Who Has The Cheapest Auto Insurance Quotes in Portland, OR?

State Farm has the cheapest full coverage insurance in Portland, at $142 per month. | ||

Country Financial has the cheapest rates for Portland teens, at $183 per month for liability-only coverage. | ||

Progressive has the cheapest quotes after a DUI in Portland, at $228 per month for full coverage. |

State Farm has the cheapest full coverage insurance in Portland, at $142 per month. | ||

Progressive has the cheapest quotes after a DUI in Portland, at $228 per month. |

Compare Car Insurance Rates in Portland, OR

Best cheap car insurance companies in Portland

How we chose the top companies

Best and cheapest car insurance in Portland, Oregon

- Cheapest full coverage: State Farm, $142/mo

- Cheapest minimum liability: State Farm, $79/mo

- Cheapest for young drivers: Country Financial, $183/mo

- Cheapest after a ticket: State Farm, $153/mo

- Cheapest after an accident: State Farm, $142/mo

- Cheapest for teens after a ticket: Country Financial, $243/mo

- Cheapest after a DUI: Progressive, $228/mo

- Cheapest for poor credit: Country Financial, $307/mo

Cheapest car insurance in Portland, OR: State Farm

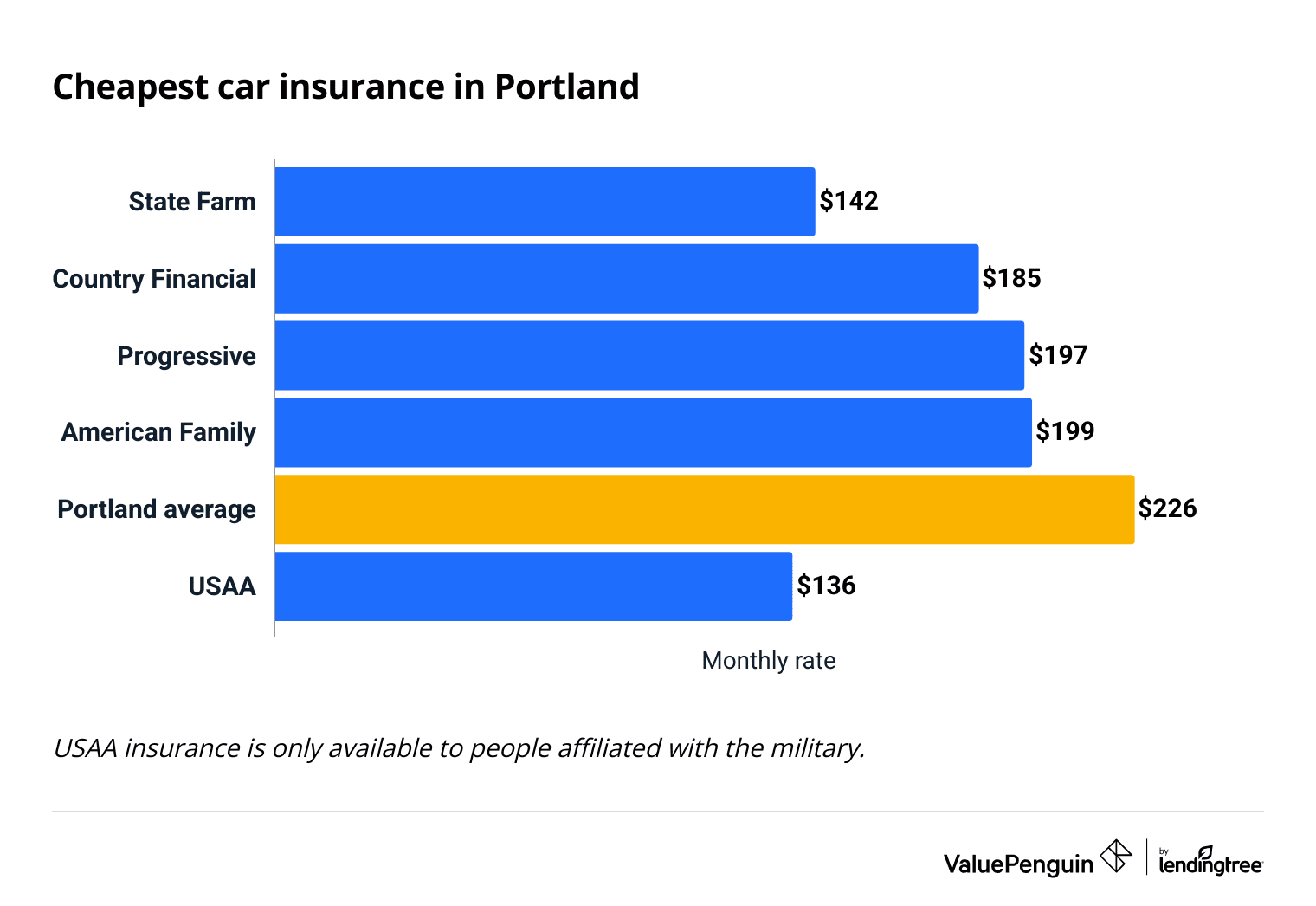

State Farm offers an average rate of $142 per month for full coverage car insurance, which is 37% cheaper than the average rate in Portland.

Drivers with military ties should also take a look at USAA. Its rates are even cheaper than State Farm's, and it's one of the best-rated insurance companies in the country. But you can only get it if you've served in the military or had a parent or spouse who has.

Compare Car Insurance Rates in Portland, OR

Cheapest full coverage car insurance in Portland

Company | Monthly rate | |

|---|---|---|

| State Farm | $142 | |

| Country Financial | $185 | |

| Progressive | $197 | |

| American Family | $199 | |

| Travelers | $231 |

*USAA is only available to current and former military members and their families.

Cheapest liability insurance quotes in Portland: State Farm

State Farm has the lowest price for car insurance in Portland, at $79 per month for liability-only coverage.

That's one-third less than the average car insurance quote across the top companies in Portland, and $10 per month cheaper than Progressive, which has the second-best price overall.

Remember that minimum coverage is the cheapest policy you can buy, so it doesn't provide much protection. People who drive a lot or own a newer or more valuable car should consider upping their coverage beyond the minimum.

Best cheap minimum coverage car insurance rates in Portland, OR

Company | Monthly rate |

|---|---|

| State Farm | $79 |

| Progressive | $89 |

| Country Financial | $98 |

| American Family | $109 |

| Travelers | $123 |

*USAA is only available to current and former military members and their families.

Compare Car Insurance Rates in Portland, OR

Cheapest car insurance for young drivers: Country Financial

Country Financial has the best rates for 18-year-olds in Portland, with an average price of $183 per month for a minimum coverage policy.

Country also has the best rates for a full coverage policy, at $370 per month.

Teenagers typically pay much higher prices for car insurance than older adults, as they're less experienced behind the wheel and get in crashes more often.

Best car insurance for young drivers in Portland

Company | Liability only | Full coverage |

|---|---|---|

| Country Financial | $183 | $370 |

| State Farm | $234 | $426 |

| Geico | $293 | $572 |

| Travelers | $339 | $655 |

| American Family | $414 | $778 |

*USAA is only available to current and former military members and their families.

The best way for a teen to save on insurance is to share a policy with their parents or an older adult. Also, many insurers offer discounts such as a good student discount.

Cheapest car insurance for people with a speeding ticket: State Farm

State Farm has the best prices for drivers with a speeding ticket in Portland. It offers an average rate of $153 per month for full coverage after one speeding ticket, which is around half the average cost across all insurance companies. It's also $84 per month less than the second-best option, American Family.

Cheapest car insurance after a speeding ticket

Company | Monthly rate |

|---|---|

| State Farm | $153 |

| American Family | $237 |

| Country Financial | $244 |

| Progressive | $252 |

| Travelers | $298 |

*USAA is only available to current and former military members and their families.

Companies have found drivers with recent speeding tickets are more likely to get in a crash or make a claim, so you pay more for coverage after getting one.

Cheapest car insurance in Portland after an accident: State Farm

State Farm has the best rates for drivers after an at-fault crash in Portland, with an average of just $142 per month for full coverage. That's less than half the average rate across all insurance companies.

Cheapest car insurance after an accident

Company | Monthly rate |

|---|---|

| State Farm | $142 |

| Country Financial | $275 |

| Progressive | $284 |

| American Family | $329 |

| Travelers | $337 |

*USAA is only available to current and former military members and their families.

Causing an accident has a major effect on your insurance rates because companies have found that drivers who have been at fault in one crash are more likely to be at fault again in the future.

Cheapest insurance in Portland for teens with a ticket or accident: Country Financial or State Farm

Country Financial has the cheapest car insurance for teens with a recent speeding ticket, while State Farm has the best prices after a crash.

After a speeding ticket, minimum coverage from Country Financial costs $243 per month for an 18-year-old. That's half the price of the city average. State Farm is also fairly affordable, at $254 per month.

After an at-fault crash, minimum coverage from State Farm costs just $234 per month — 44% cheaper than average in Portland.

Best cheap minimum coverage for teens with a bad record

Company | Ticket | Accident |

|---|---|---|

| Country Financial | $243 | $274 |

| State Farm | $254 | $234 |

| Geico | $383 | $506 |

| Progressive | $411 | $419 |

| Travelers | $419 | $492 |

*USAA is only available to current and former military members and their families.

Cheapest car insurance for drivers with a DUI: Progressive

Progressive has the best rates in Portland for a driver with a DUI. There, you may find rates around $228 per month for full coverage. That's a 43% discount compared to the average rate citywide.

Cheapest car insurance for Portland drivers with a DUI

Company | Monthly rate |

|---|---|

| Progressive | $228 |

| State Farm | $298 |

| Travelers | $353 |

| American Family | $370 |

| Allstate | $438 |

*USAA is only available to current and former military members and their families.

If you have a DUI conviction, one of the most serious driving offenses, you're likely to see a big increase in car insurance rates. On average, a Portland driver with one DUI will pay $390 per month for a full coverage policy — that's 72% more than a driver with a clean record.

Drivers with DUIs on their record in Oregon may also need an SR-22 form.

Cheapest car insurance for drivers with poor credit: Country Financial

In Portland, Country Financial has the best insurance in Portland for drivers with bad credit. Its average rate is $307 per month for full coverage, which is 29% cheaper than the city average.

Your credit score isn't based on your driving skills, but having bad credit can still make your insurance rates go up. It can sometimes be a challenge to get car insurance with bad credit.

Cheapest car insurance for poor credit

Company | Monthly rate |

|---|---|

| Country Financial | $307 |

| Progressive | $337 |

| American Family | $349 |

| Geico | $390 |

| Travelers | $424 |

*USAA is only available to current and former military members and their families.

Average car insurance cost in Portland, by neighborhood

Powellhurst is the most expensive neighborhood in Portland for car insurance, at $258 per month for full coverage.

That's $61 per month more expensive than the cheapest part of the Portland area — in the nearby towns of King City and Tigard.

Where you live impacts your car insurance rates. For example, if you live in an area with low crime rates, you might pay less. If the roads in your neighborhood are poorly maintained (leading to more accidents), you might pay more.

ZIP | Monthly rate | % from average |

|---|---|---|

| 97201 | $205 | -8% |

| 97202 | $219 | -1% |

| 97203 | $228 | 3% |

| 97204 | $221 | -1% |

| 97205 | $213 | -4% |

Methodology

To determine the best rates in Portland, ValuePenguin collected quotes from the largest insurance companies in Oregon. Rates are for a 30-year-old man with good credit who drives a 2015 Honda Civic EX.

Full coverage quotes include the following limits:

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Personal injury protection (PIP): $15,000

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision: $500 deductible

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only. Your own quotes may be different.

Lead Writer

Matt Timmons is a Lead Writer on the insurance team at ValuePenguin, where he writes in-depth and timely pieces helping find the right coverage for them.

He's covered insurance at ValuePenguin since 2018, specializing in auto and home insurance, as well as life insurance. He's paid special attention to the EV insurance market, where prices are much higher than for gas cars.

Before he started writing about personal finance, Matt wrote about professional skills and online tools at an e-learning company.

How insurance helped Matt

During freshman orientation in college, Matt's iPod was stolen off his table while he was eating lunch. Luckily, he'd bought a college insurance plan the day before and he had money to buy a replacement before classes started.

Expertise

- Auto insurance

- Home insurance

- Insurance rate analysis

- Life insurance

Referenced by

- CNBC

- Miami Herald

- Yahoo! Finance

Education

- BA, Wesleyan University

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.