Who Has the Cheapest Auto Insurance in Indianapolis?

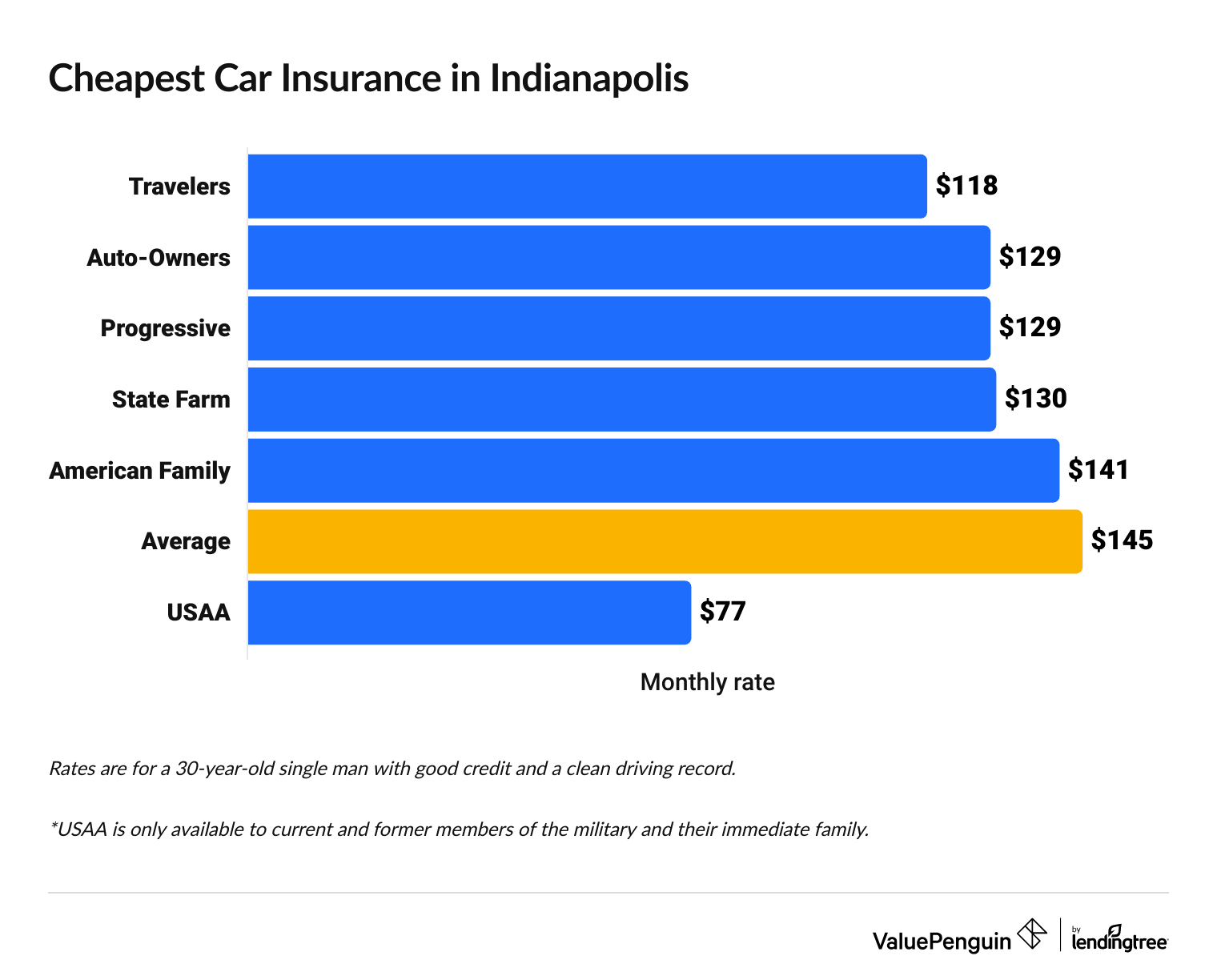

Travelers has the cheapest full coverage car insurance in Indianapolis, at $118 per month. The cheapest minimum coverage quotes are from Auto-Owners, at just $43 per month.

Compare Car Insurance Rates in Indianapolis

Best cheap car insurance companies in Indianapolis

How we chose the top companies

Cheapest car insurance in Indianapolis: Travelers

Travelers has the most affordable rates for full coverage in Indianapolis. A policy from Travelers costs $118 per month, which is 18% cheaper than the city average.

The average cost of full coverage car insurance in Indianapolis is $145 per month.

Auto-Owners and State Farm are also worth considering. They each have excellent customer service and an average price of around $130, or $12 more per month than Travelers.

Compare Car Insurance Rates in Indianapolis

Cheapest full coverage quotes in Indianapolis

Company | Monthly rate | |

|---|---|---|

| Travelers | $118 | |

| Auto-Owners | $129 | |

| Progressive | $129 | |

| State Farm | $130 | |

| American Family | $141 |

*USAA is only available to current and former military members and their families.

Full coverage from Allstate, the most expensive company, costs $221 per month. That's nearly twice as much as Travelers. That's why it's important to shop around to find the best cheap car insurance for you.

Cheapest liability insurance quotes in Indianapolis: Auto-Owners

Auto-Owners has the cheapest car insurance quotes in Indianapolis, with an average rate of $43 per month for minimum coverage.

That's 23% cheaper than the citywide average. The average cost of car insurance in Indianapolis is $56 per month for minimum coverage.

Cheap minimum coverage car insurance in Indianapolis

Company | Monthly rate |

|---|---|

| Auto-Owners | $43 |

| Travelers | $49 |

| American Family | $49 |

| State Farm | $50 |

| Progressive | $55 |

*USAA is only available to current and former military members and their families.

A liability-only policy in Indiana costs $48 per month on average across the state, but people living in Indianapolis pay 17% more. Residents of large cities often pay more for auto insurance because of things like more traffic and higher rates of auto theft.

Cheap quotes for teen drivers in Indianapolis: Progressive and Travelers

Progressive and Travelers have the best rates for young drivers in Indianapolis.

The cheapest quotes for minimum coverage in Indy come from Progressive, where a policy costs an average of $139 per month for an 18-year-old driver.

Travelers has the cheapest full coverage rates for teens, with an average price of $344 per month. That's 16% cheaper than the city average, and $46 per month less than Auto-Owners.

USAA offers even cheaper rates for young drivers that are enlisted in the military or have a family member that has served.

Monthly car insurance quotes for Indianapolis teens

Company | Liability only | Full coverage |

|---|---|---|

| Progressive | $139 | $391 |

| Travelers | $148 | $344 |

| Auto-Owners | $153 | $371 |

| State Farm | $171 | $412 |

| Geico | $172 | $440 |

*USAA is only available to current and former military members and their families.

Teen drivers pay more for car insurance because they have less practice and tend to take more risks behind the wheel, which means they're more likely to file a car insurance claim.

In Indianapolis, an 18-year-old driver can expect to spend three times as much for car insurance compared to a 30-year-old driver.

Save money by sharing your policy

The best way for teen drivers to find affordable car insurance is to share a policy with their parents or another older adult. Having a joint policy is usually much cheaper than the cost of two separate policies.

Teens can also reduce their insurance rates by qualifying for a good-grades discount or taking an extra driver safety course.

Cheapest car insurance after a speeding ticket: Auto-Owners

Auto-Owners has the most affordable coverage after a speeding ticket, at $129 per month for full coverage. That's 26% less than the city average for a speeding ticket .

Cheapest car insurance after a speeding ticket

Company | Monthly rate |

|---|---|

| Auto-Owners | $129 |

| State Farm | $142 |

| Travelers | $149 |

| American Family | $161 |

| Progressive | $166 |

*USAA is only available to current and former military members and their families.

A single speeding ticket will raise your car insurance rates in Indianapolis by around $28 per month. Rates increase much more after an at-fault accident ($72 per month) or a DUI ($102 per month).

Cheapest car insurance after an accident: Auto-Owners

Auto-Owners has the cheapest full coverage rates in Indianapolis after an at-fault accident, with an average of $158 per month. That's 44% cheaper than the city average.

State Farm is also worth considering if you prefer to buy your policy online, as Auto-Owners only sells coverage through independent agents. State Farm costs only $5 more per month than Auto-Owners, on average, and they both have excellent customer service.

Cheapest car insurance after an accident

Company | Monthly rate |

|---|---|

| Auto-Owners | $158 |

| State Farm | $163 |

| Travelers | $167 |

| Progressive | $189 |

| American Family | $238 |

*USAA is only available to current and former military members and their families.

On average, auto insurance rates in Indianapolis go up by half after an at-fault accident. That works out to an average price of $188 per month.

However, not all insurance companies will raise your rates by the same amount after an accident. Auto-Owners only raises rates by 23% after a single at-fault accident, while rates from American Family jump by 70%.

Cheapest quotes for teen drivers with traffic violations: Progressive

Progressive has the most affordable quotes for teen drivers with incidents on their records.

A minimum coverage policy from Progressive costs $146 per month for an 18-year-old driver in Indianapolis after a single speeding ticket, which is 28% cheaper than the average price.

Progressive also has the best prices for a teen after a crash, at $156 per month. That's about $100 less than the city average of $255 per month.

Teens with a bad driving record should also compare quotes from Auto-Owners, which tends to offer low rates to young drivers.

Monthly minimum coverage quotes for young drivers after an incident

Company | Ticket | Accident |

|---|---|---|

| Progressive | $146 | $156 |

| Auto-Owners | $159 | $203 |

| Travelers | $183 | $217 |

| State Farm | $188 | $222 |

| Geico | $192 | $250 |

*USAA is only available to current and former military members and their families.

Indianapolis teens with a bad driving record usually pay more for car insurance than those with clean records. On average, insurance companies raise minimum coverage rates by 21% after a single speeding ticket and 53% after an at-fault accident.

Car insurance companies usually charge more after a ticket or an accident because people who have filed one claim are more likely to file another in the future. Fortunately, your rate will go back down over time.

Cheapest car insurance in Indianapolis after a DUI: Progressive

Progressive has the best rates for Indianapolis drivers with a DUI. A full coverage policy from Progressive costs $150 per month — 39% less than the city average.

Cheapest car insurance after a DUI

Company | Monthly rate |

|---|---|

| Progressive | $150 |

| Travelers | $172 |

| State Farm | $243 |

| American Family | $266 |

| Allstate | $290 |

*USAA is only available to current and former military members and their families.

A DUI on your record will cause full coverage rates to increase by an average of 70% in Indianapolis, from $145 per month before you receive a citation to $246 per month afterward.

Cheapest car insurance for drivers with poor credit: Travelers

Travelers has the cheapest rates for Indianapolis drivers with poor credit. At $196 per month for full coverage, Traveler's rates are 35% cheaper than the city average.

Cheapest car insurance for poor credit

Company | Monthly rate |

|---|---|

| Travelers | $196 |

| Progressive | $211 |

| American Family | $254 |

| Geico | $276 |

| Allstate | $306 |

*USAA is only available to current and former military members and their families.

Drivers in Indianapolis with bad credit scores pay more than twice as much for car insurance compared to people with good credit. That's a difference of $154 per month for full coverage insurance.

Your credit score is determined by your ability to drive safely. But insurance companies charge drivers with poor credit more for insurance because they have found those drivers are more likely to make a claim in the future, making them more expensive to cover.

Average car insurance cost in Indianapolis, by ZIP code

The cheapest area for car insurance in Indianapolis is the part of the city near Carmel, ZIP code 46280.

There, the average price for full coverage is $135 per month.

The most expensive area is the Martindale-Brightwood neighborhood , where the typical price is $168 per month.

Depending on where you live in Indianapolis, average full coverage rates can differ by up to $33 per month. This is because insurance companies consider population density, crime rates, the percentage of uninsured drivers and traffic rates when determining your insurance costs.

Full coverage quotes by Indianapolis ZIP code

ZIP | Monthly rate | % from average |

|---|---|---|

| 46201 | $165 | 8% |

| 46202 | $161 | 5% |

| 46203 | $161 | 5% |

| 46204 | $159 | 4% |

| 46205 | $164 | 7% |

What is the best car insurance coverage in Indianapolis, IN?

Full coverage is the best type of policy for most drivers in Indianapolis.

A full coverage policy includes collision and comprehensive coverages.

- Collision coverage pays for repairs to your car after you crash into another car or a stationary object, no matter who is responsible.

- Comprehensive coverage pays for damage to your car caused by noncollision accidents, like storms or theft, along with collisions with animals.

All car insurance policies include liability coverage, which pays for damage you cause to other people and objects. For example, if you accidentally rear-end someone in traffic, liability coverage would pay for their medical bills and any damage to their car.

Low rates make minimum coverage attractive to many drivers. In Indianapolis, a minimum coverage policy costs $89 less per month than full coverage insurance.

However, minimum coverage doesn't pay for any damage to your own vehicle after an accident, which means you'll have to pay for the cost of any repairs to your car. For that reason, we recommend full coverage insurance to most drivers, especially those with a car that's less than 10 years old or worth more than $5,000.

Frequently asked questions

Who has the cheapest car insurance quotes in Indianapolis, IN?

Auto-Owners has the cheapest minimum coverage car insurance in Indianapolis, at $43 per month. Drivers who need full coverage insurance can find the best rates withTravelers, which has an average rate of$118 per month.

How much is full coverage car insurance in Indianapolis, IN?

The average cost of full coverage insurance in Indianapolis is $145 per month, which is 12% more expensive than the Indiana state average. Travelers has the cheapest full coverage quotes, with an average rate of $118 per month.

What car insurance is required in Indianapolis?

In the state of Indiana, drivers must have $25,000 of bodily injury liability per person and $50,000 per accident, along with $25,000 of property damage liability per accident. This is sometimes referred to as 25/50/25.

Methodology

To find the best cheap car insurance companies in Indianapolis, ValuePenguin gathered and analyzed quotes from nine of the largest companies in Indiana. Rates are for a 30-year-old single man with a good credit score and clean record who drives a 2015 Honda Civic EX.

Full coverage quotes include collision and comprehensive coverage, along with higher liability limits than the Indiana state requirement.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Medical payments coverage: $10,000

- Property damage liability: $25,000 per accident

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision deductible: $500 deductible

Quadrant Information Services provided ValuePenguin with the rate data used in this analysis. Rates were publicly sourced from insurer filings. Your own quotes will likely differ based on your personal information; the quotes in this study are intended solely for comparative purposes.

Lead Writer

Matt Timmons is a Lead Writer on the insurance team at ValuePenguin, where he writes in-depth and timely pieces helping find the right coverage for them.

He's covered insurance at ValuePenguin since 2018, specializing in auto and home insurance, as well as life insurance. He's paid special attention to the EV insurance market, where prices are much higher than for gas cars.

Before he started writing about personal finance, Matt wrote about professional skills and online tools at an e-learning company.

How insurance helped Matt

During freshman orientation in college, Matt's iPod was stolen off his table while he was eating lunch. Luckily, he'd bought a college insurance plan the day before and he had money to buy a replacement before classes started.

Expertise

- Auto insurance

- Home insurance

- Insurance rate analysis

- Life insurance

Referenced by

- CNBC

- Miami Herald

- Yahoo! Finance

Education

- BA, Wesleyan University

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.