Cheapest Car Insurance Quotes in Colorado (2026)

Geico has the best cheap car insurance in Colorado, at $196 per month for full coverage. That's $76 per month less than the state average.

Find Cheap Auto Insurance Quotes in Colorado

Best cheap car insurance in Colorado

Best and cheapest car insurance in Colorado

- Cheapest full coverage: Geico, $196/mo

- Cheapest minimum liability: Geico, $66/mo

- Cheapest for young drivers: Geico, $195/mo

- Cheapest after a ticket: State Farm, $252/mo

- Cheapest after an accident: State Farm, $270/mo

- Cheapest for teens after a ticket: Geico, $248/mo

- Cheapest after a DUI: Geico, $348/mo

- Cheapest for poor credit: Geico, $288/mo

Monthly rates based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

State Farm, Geico and Auto-Owners all have reliable customer service and cheaper-than-average rates. Progressive also has cheap rates, but its customer service isn't great.

State Farm and Geico offer online quotes, so you can quickly find the best rates for you.

Cheapest car insurance quotes in Colorado: Geico

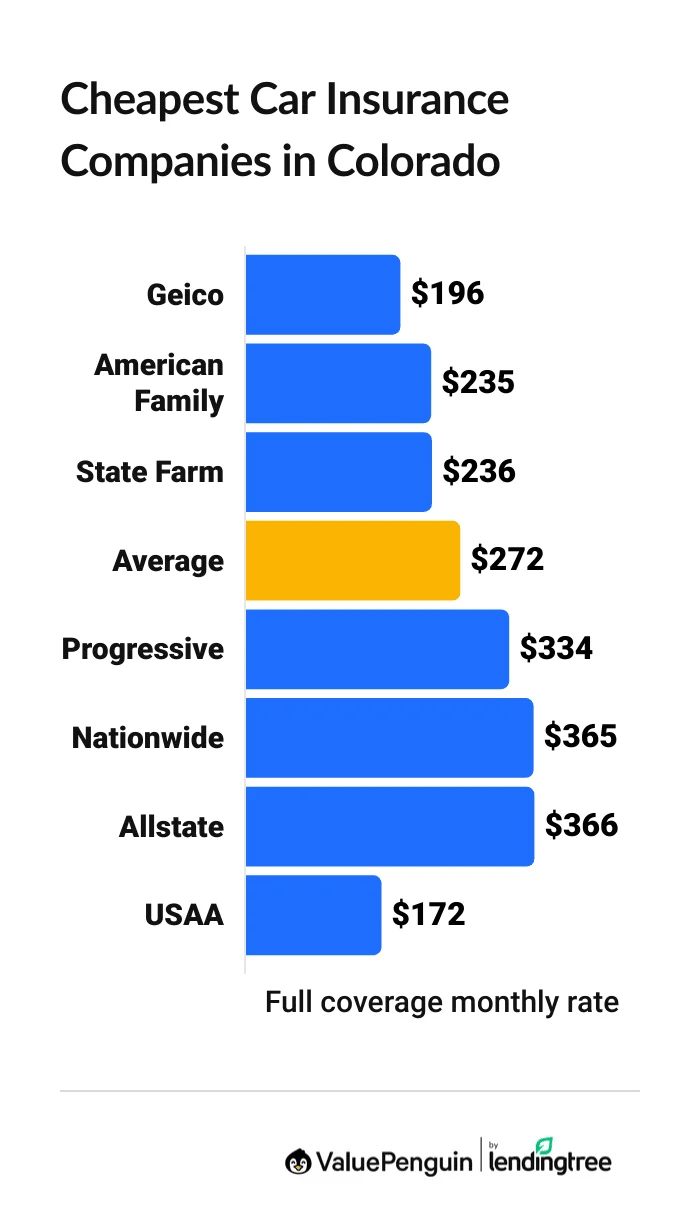

Geico and USAA have the cheapest full coverage car insurance in Colorado.

Find Cheap Auto Insurance Quotes in Colorado

- Geico has the cheapest rates for most Colorado drivers, at $196 per month for full coverage. That's 28% cheaper than the Colorado average.

- American Family and State Farm also have affordable full coverage rates, each at around $235 per month, with better customer service than Geico. You should compare quotes from both companies, as either could have the cheapest rate for you.

- If you or someone in your family is a military member or veteran, you should also get a quote from USAA. Full coverage from USAA costs an average of $172 per month, which is the cheapest rate in Colorado overall. However, only drivers with military ties can get insurance from USAA.

Cheapest full coverage car insurance in Colorado

Company | Monthly rate | |

|---|---|---|

| Geico | $196 | |

| American Family | $235 | |

| State Farm | $236 | |

| Progressive | $334 | |

| Nationwide | $365 |

*USAA is only available to current and former military members and their families.

Data-powered research on Colorado car insurance

Data-powered research on CO car insurance |

|---|

Cheapest liability insurance in Colorado: Geico

Geico has the best cheap liability insurance in Colorado, at $66 per month.

That's $18 per month cheaper than the Colorado state average of $84. Progressive, American Family and State Farm also offer rates less than $80 per month for liability insurance. They all have better customer service than Geico, too.

Best cheap liability car insurance in CO

Company | Monthly rate |

|---|---|

| Geico | $66 |

| Progressive | $74 |

| State Farm | $74 |

| American Family | $74 |

| Nationwide | $111 |

*USAA is only available to current and former military members and their families.

Find Cheap Auto Insurance Quotes in Colorado

Cheap Colorado insurance rates for teens: Geico

Geico has the cheapest car insurance for young drivers in Colorado.

Liability-only car insurance from Geico costs $195 per month for an 18-year-old driver. That's $128 per month less than the Colorado average.

Geico's full coverage insurance costs $506 per month, which is $376 per month cheaper than the state average.

Colorado auto insurance quotes for teens

Company | Liability only | Full coverage |

|---|---|---|

| Geico | $195 | $506 |

| American Family | $235 | $669 |

| State Farm | $254 | $674 |

| Progressive | $344 | $1,216 |

| Allstate | $387 | $737 |

*USAA is only available to current and former military members and their families.

Minimum coverage in Colorado costs an average of $286 per month for an 18-year-old driver. That's $202 more per month than a 30-year-old driver pays for the same coverage.

The best way for young drivers to save on car insurance is by sharing a policy with their parents. This is typically much cheaper than buying two separate policies.

You can also lower your rates with discounts geared toward young drivers. For example, companies including State Farm, American Family and Geico offer a good student discount to full-time students with a certain GPA or standardized test score.

Cheap Colorado auto insurance after a speeding ticket: State Farm

State Farm has the cheapest quotes for drivers with a recent speeding ticket. A full coverage policy from State Farm costs around $252 per month. That's $91 per month cheaper than the state average.

Cheapest car insurance in CO after a speeding ticket

Company | Monthly rate |

|---|---|

| State Farm | $252 |

| Geico | $275 |

| American Family | $276 |

| Allstate | $405 |

| Progressive | $451 |

*USAA is only available to current and former military members and their families.

On average, full coverage rates go up by $71 per month in Colorado after one speeding ticket.

That's because insurance companies believe drivers who speed are more likely to cause an accident in the future. Additionally, having an accident while speeding results in worse injuries and greater damage, making it more expensive for the insurance company.

Cheapest insurance in Colorado after an accident: State Farm

State Farm has the cheapest full coverage insurance after an accident. Full coverage from State Farm costs $270 per month, which is 36% less than the state average.

The next-cheapest company, American Family, costs $79 more per month than State Farm.

Best car insurance rates in Colorado after an accident

Company | Monthly rate |

|---|---|

| State Farm | $270 |

| American Family | $349 |

| Geico | $381 |

| Progressive | $494 |

| Allstate | $568 |

*USAA is only available to current and former military members and their families.

Car insurance rates in Colorado go up by an average of 55% after an accident. That's an average increase of $149 per month for full coverage insurance.

There are a number of ways you can lower your insurance rates after an accident.

- Compare rates from multiple companies. The difference between the cheapest and most expensive company in Colorado after an accident is $426 per month. This means you could save a lot of money just by shopping around for the best rate.

- Take advantage of discounts. You can typically save quite a bit by bundling your auto insurance with a home or renters policy. Many companies also offer safe driving programs, which track your driving with a phone app or plug-in device. These programs allow you to earn a large discount by practicing safe driving habits, such as driving the speed limit or avoiding driving at night.

- Get rid of any coverage you don't need. For example, if you own an older car that doesn't have financing, you can consider canceling your comprehensive and collision coverage. These coverages can be costly, but without them, your insurance won't pay for damage to your vehicle after an accident.

Cheapest quotes in CO for teens after a ticket or accident: Geico

Geico has the cheapest quotes for teens with a recent speeding ticket on their records. Liability-only coverage from State Farm costs around $248 per month for an 18-year-old with a traffic ticket. That's $82 per month cheaper than the state average.

State Farm is the cheapest option for young drivers after an accident. At $308 per month for liability coverage, State Farm is $97 per month cheaper than the state average.

Cheap insurance in Colorado for teens with a ticket or accident

Company | Ticket | Accident |

|---|---|---|

| Geico | $248 | $351 |

| American Family | $255 | $345 |

| State Farm | $280 | $308 |

| Progressive | $374 | $396 |

| Allstate | $447 | $708 |

*USAA is only available to current and former military members and their families.

Young drivers with a ticket or accident typically pay more for car insurance than those with a clean record. Colorado quotes increase by around 15% for young drivers after a speeding ticket and 42% after an accident.

Don't rush to switch car insurance companies right after a ticket or accident.

Your insurance typically won't go up until your policy renews. As such, you should start comparing quotes a few weeks before your current policy expires.

Cheap auto insurance in Colorado after a DUI: Geico

Geico has the cheapest quotes in Colorado for drivers with a recent DUI. Full coverage from Geico costs an average of $348 per month. That's less than the average rate after a DUI in Colorado by $133 per month.

Most affordable CO car insurance after a DUI

Company | Monthly rate |

|---|---|

| Geico | $348 |

| Progressive | $403 |

| American Family | $411 |

| Allstate | $487 |

| State Farm | $498 |

*USAA is only available to current and former military members and their families.

A DUI is a serious driving offense, so it's common to see a large rate increase afterward. On average, car insurance companies in Colorado raise rates by 77% after a DUI. That's an average increase of $210 per month for a full coverage policy.

Best car insurance in CO for drivers with poor credit: Geico

Geico has the lowest quotes for Colorado drivers with poor credit, at around $288 per month. That's $261 per month cheaper than the average price of other top companies in Colorado.

Inexpensive car insurance in Colorado if you have poor credit

Company | Monthly rate |

|---|---|

| Geico | $288 |

| American Family | $400 |

| Nationwide | $554 |

| Progressive | $565 |

| Allstate | $615 |

*USAA is only available to current and former military members and their families.

A poor credit score doesn't mean you're a bad driver. However, insurance companies see it as a sign that you're more likely to file a claim. As a result, drivers in Colorado with poor credit pay $277 per month more for full coverage than drivers with a good credit score.

Average car insurance cost in Colorado by city

Aurora, a suburb of Denver, is the most expensive city for car insurance in Colorado.

Full coverage quotes in Aurora cost an average of $307 per month. That could be because Aurora has more property crime than an average Colorado town.

Clifton, a small desert town near Grand Junction, has the cheapest rates in Colorado, at $200 per month.

Colorado average car insurance rates by city

City | Monthly rate | % from average |

|---|---|---|

| Acres Green | $277 | 2% |

| Agate | $290 | 7% |

| Aguilar | $263 | -3% |

| Air Force Academy | $277 | 2% |

| Akron | $272 | 0% |

Location is just one factor that affects auto insurance quotes. Rates are typically more expensive in areas that have more car accidents and thefts or severe weather.

Rates are also usually more expensive in big cities. Car insurance in Denver, the state capital and the biggest city in Colorado, is 11% more expensive than the state average.

Colorado auto insurance minimums

All drivers in Colorado must have liability insurance to pay for damage caused in an accident. Policies must have limits of at least 25/50/15.

- Bodily injury liability: $25,000 per person and $50,000 per accident

- Property damage liability: $15,000 per accident

Colorado drivers can buy more coverage than the state requirement. Options include coverage for uninsured motorists, medical payments, collision and comprehensive.

What's the best car insurance coverage for Colorado drivers?

Full coverage insurance is the best choice for most Colorado drivers.

Frequently asked questions

What's the cheapest car insurance in Colorado?

How much is a full coverage insurance policy in Colorado?

The average cost of full coverage auto insurance in Colorado is $272 per month. That's 31% more expensive than the average rate in the United States. This is largely because Colorado has severe weather that can damage cars, and many more car thefts than other states, according to the FBI.

How much is car insurance in Fort Collins, CO?

Fort Collins car insurance costs an average of $236 per month for a full coverage policy. That's 13% less than the state average. In comparison, car insurance in Colorado Springs costs around $286 per month.

Does Colorado have high car insurance rates?

Yes, Colorado car insurance rates are high compared to the rest of the country. Colorado is the 19th-most expensive state for full coverage. Colorado car insurance quotes are expensive because of the state's extreme weather conditions, high auto theft rates and fast-growing population that puts residents at greater risk for accidents.

Who has the best auto insurance in Colorado?

The top insurance companies in Colorado are USAA and State Farm. These companies consistently get positive reviews for their claims processes and have reputations for dependable customer service.

Methodology

ValuePenguin experts collected thousands of quotes from all ZIP codes across Colorado. Rates are for a 30-year-old single man with good credit and no prior insurance claims. He owns a 2018 Honda Civic EX.

Full coverage insurance includes comprehensive and collision coverage and higher liability coverage limits than state minimums.

- Bodily injury liability: $50,000 per person; $100,000 per accident

- Property damage liability: $50,000 per accident

- Uninsured or underinsured motorist bodily injury: $50,000 per person; $100,000 per accident

- Comprehensive and collision: $500 deductible

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used for comparative purposes only. Your own quotes may be different.

Lead Writer

Matt Timmons is a Lead Writer on the insurance team at ValuePenguin, where he writes in-depth and timely pieces helping find the right coverage for them.

He's covered insurance at ValuePenguin since 2018, specializing in auto and home insurance, as well as life insurance. He's paid special attention to the EV insurance market, where prices are much higher than for gas cars.

Before he started writing about personal finance, Matt wrote about professional skills and online tools at an e-learning company.

How insurance helped Matt

During freshman orientation in college, Matt's iPod was stolen off his table while he was eating lunch. Luckily, he'd bought a college insurance plan the day before and he had money to buy a replacement before classes started.

Expertise

- Auto insurance

- Home insurance

- Insurance rate analysis

- Life insurance

Referenced by

- CNBC

- Miami Herald

- Yahoo! Finance

Education

- BA, Wesleyan University

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.