Average Household Cost of Food

Want to know if you spend more or less on food than the average U.S. household? In our guide, we show the average cost that the typical... Read More

Find Cheap Motorcycle Insurance Quotes in Your Area

Understand how motorcycle insurance can protect you and your ride.

Collision coverage

Collision coverage pays for damage to your bike if you hit another vehicle or object.

Comprehensive coverage

Comprehensive coverage pays to fix or replace your bike after vandalism, theft or damage by an "act of God," like hail.

Bodily injury liability

Bodily injury protection pays for the medical bills of other drivers and passengers if you cause an accident.

Property damage liability

Property damage liability covers any damage you cause to someone else's vehicle or property.

Find the best motorcycle insurance in your state.

The average cost of motorcycle insurance is $33 per month, or $399 per year, for full coverage. Three main factors affect rates: where you live, the amount of coverage you need and your riding history.

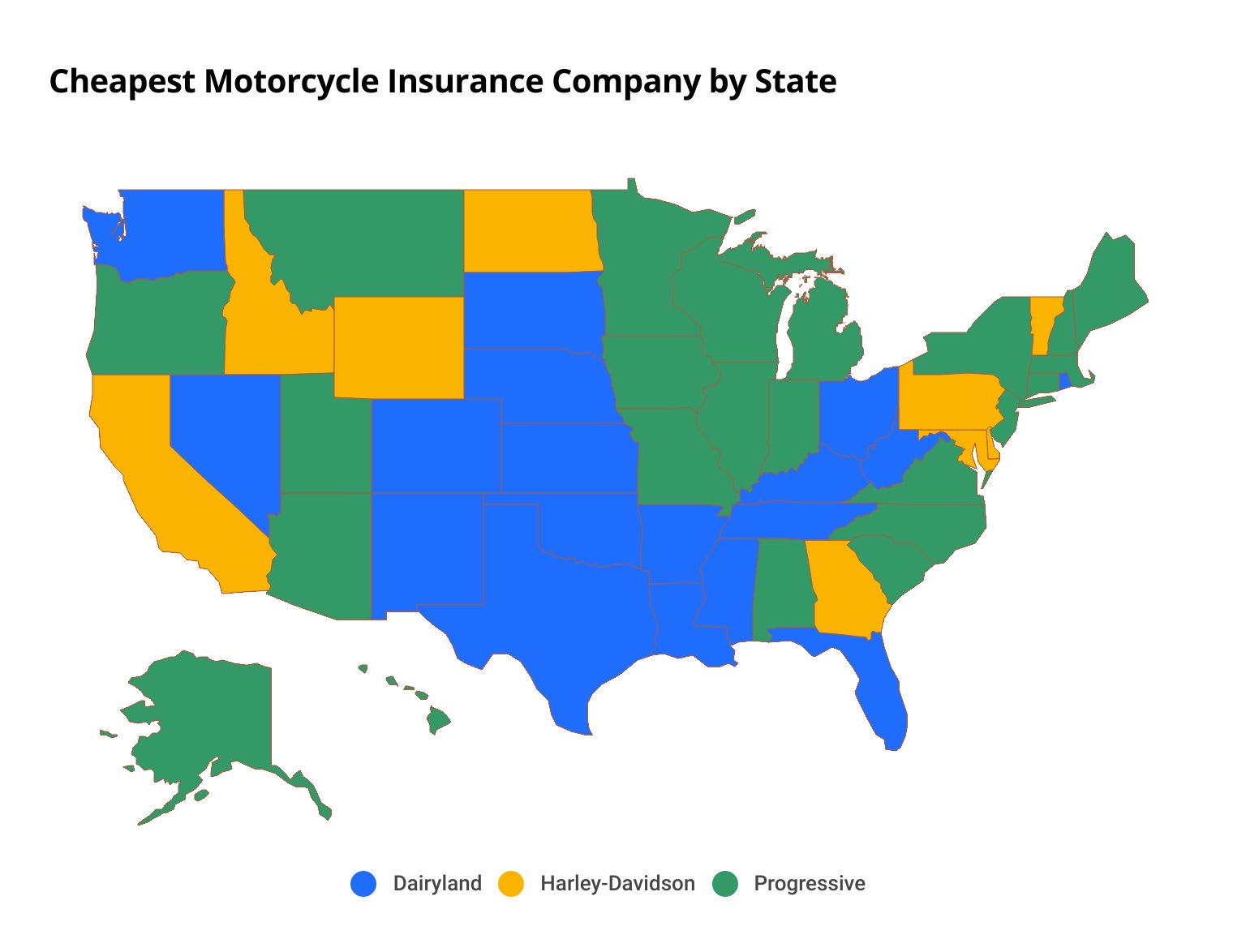

The cheapest motorcycle insurance companies are typically Dairyland, Progressive and Harley-Davidson.

However, rates vary by state. So the cheapest company near you could differ from the best option nationally. That's why comparing quotes from multiple companies is important when shopping for motorcycle insurance.

No single motorcycle insurance company is best for every rider. Major companies like Progressive and Geico offer standard motorcycle insurance, with discounts for bundling your auto and homeowners insurance. On the other hand, specialty companies like Dairyland and Harley-Davidson provide more extensive coverage to dedicated riders.

The best way to find cheap motorcycle insurance is by comparing quotes from multiple companies. You should also look for discounts. Many companies offer savings for bundling your motorcycle and auto insurance, making automatic payments or taking a motorcycle safety course.

You can get the cheapest motorcycle insurance rates by buying the minimum coverage required in your state. Most states only require a small amount of liability coverage for bodily injury and property damage. However, you won't have any coverage for your bike if you cause a crash. This may not be the best choice if you can't afford to replace your bike after an accident.

Every state has its own laws, but it's generally harder to insure your bike if you don't have a valid motorcycle license or endorsement. Most insurance companies require your license info. Companies that don't may treat you as a riskier customer and charge you more for coverage.

Want to know if you spend more or less on food than the average U.S. household? In our guide, we show the average cost that the typical... Read More

Geico has the best cheap car insurance in Hawaii at $30 per month for minimum coverage. Geico's average rate is 40% cheaper than... Read More

Mercury has the cheapest homeowners insurance in California, with an average price of $971 per year. That's 40% less than the state average... Read More

Auto insurance is only required in Alaska in certain cities where vehicle registration is mandatory. When insurance is needed, the minimum... Read More

Geico has the cheapest car insurance quotes in Alaska, charging $46 per month for minimum liability coverage. The cheapest full coverage... Read More

The minimum liability requirements to drive legally in South Dakota are 25/50/25 for the main types of liability coverage and 25/50 for... Read More

Erie has the cheapest car insurance rates in West Virginia for full coverage, at $113 per month. It's also the cheapest choice for minimum... Read More

Pennsylvania's Assigned Risk Plan is an option of last resort for high-risk drivers. Insurance through PA ARP will satisfy the state's... Read More

Progressive has the best cheap car insurance in Nebraska, at just $32 per month for minimum coverage. The cheapest full coverage comes from... Read More

To find the average cost of motorcycle insurance and the cheapest companies, ValuePenguin collected quotes across all 50 states in the U.S. Rates are for a 45-year-old single man who owns a 2018 Honda CMX500 Rebel.

Quotes are for a full coverage policy, which includes higher liability limits than state requirements along with comprehensive and collision coverage.