Best & Cheapest Car Insurance Quotes in Chicago

State Farm has the cheapest car insurance in Chicago, with an average price of $46 per month for minimum coverage and $106 per month for full coverage.

Find Cheap Auto Insurance Quotes in Chicago, IL

Best cheap car insurance companies in Chicago, IL

How we chose the top companies

Best and cheapest car insurance in Illinois

- Cheapest full coverage: Travelers, $138/mo

- Cheapest minimum liability: Country Financial, $61/mo

- Cheapest for young drivers: Country Financial, $154/mo

- Cheapest after a ticket: Travelers, $177/mo

- Cheapest after an accident: State Farm, $193/mo

- Cheapest for teens after a ticket: Country Financial, $209/mo

- Cheapest after a DUI: Travelers, $206/mo

- Cheapest for poor credit: Travelers, $213/mo

Monthly rates are based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

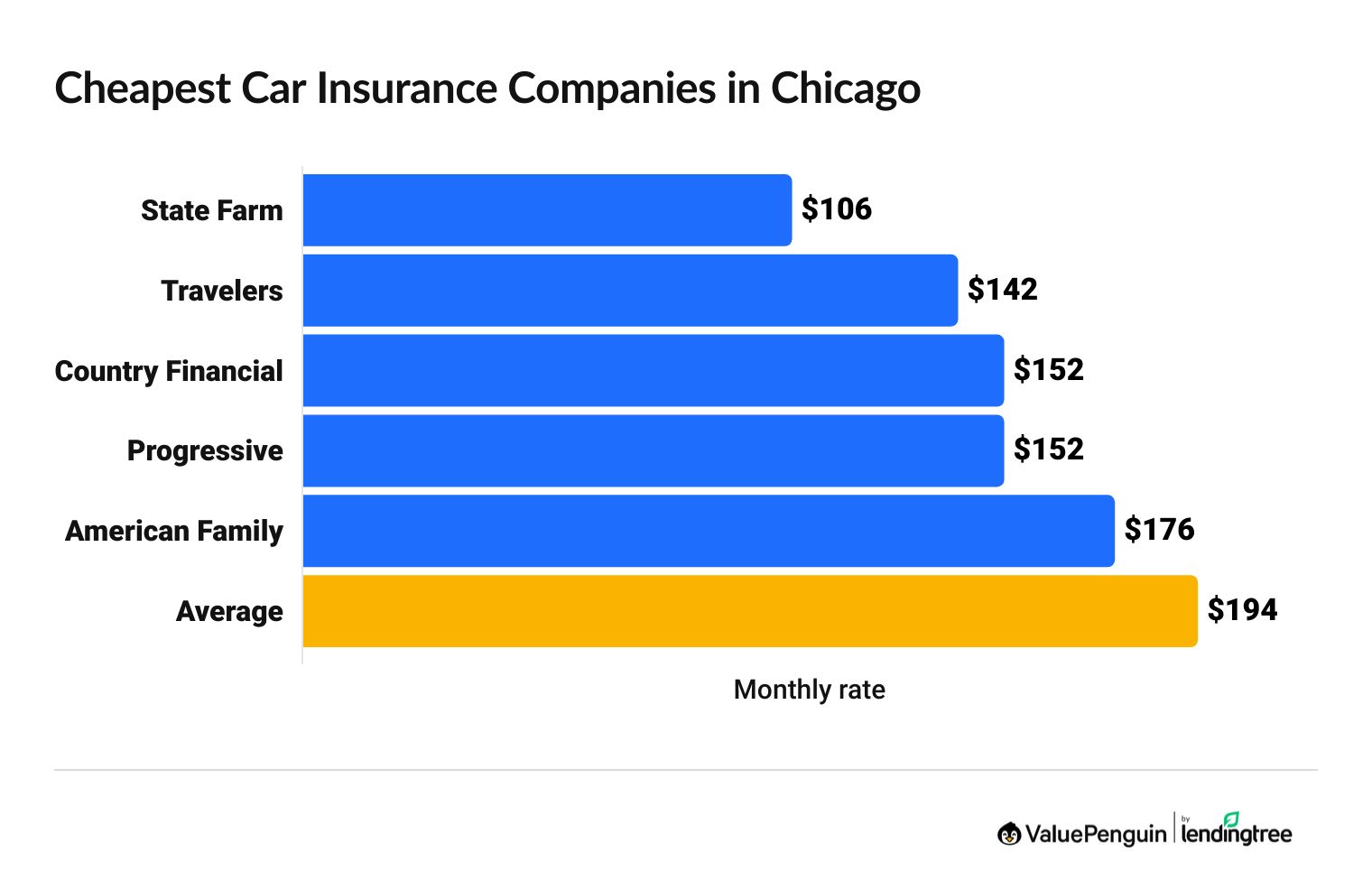

Cheapest car insurance in Chicago: State Farm

State Farm has the cheapest full coverage policy, with an average price of $106 per month.

That's 46% cheaper than the city average of $194.

Chicago is the largest city in Illinois and the third biggest city in the country, which is why the city’s car insurance rates tend to be higher than the state average. Insurance rates in Chicago are $50 per month more expensive than the state average.

Find Cheap Auto Insurance Quotes in Chicago

Cheapest full-coverage car insurance in Chicago

Company | Monthly rate | |

|---|---|---|

| State Farm | $106 | |

| Travelers | $142 | |

| Country Financial | $152 | |

| Progressive | $152 | |

| American Family | $176 |

*USAA is only available to current and former military members and their families.

Cheapest liability insurance quotes in Chicago: State Farm

State Farm also has the cheapest car insurance in Chicago, with an average rate of $46 per month.

Country Financial, Travelers and Progressive also have rates cheaper than the city average of $81 per month.

Cheapest liability insurance quotes in Chicago

Company | Monthly rate | |

|---|---|---|

| State Farm | $46 | |

| Country Financial | $57 | |

| Travelers | $63 | |

| Progressive | $65 | |

| American Family | $69 |

*USAA is only available to current and former military members and their families.

Find Cheap Auto Insurance Quotes in Chicago

Cheapest auto insurance for young drivers: State Farm

State Farm offers the cheapest full-coverage quotes for young drivers in Chicago, at $324 a month.

Country Financial has the next cheapest policy, with an average quote of $369 per month, which is $45 more than State Farm.

Monthly car insurance rates for young drivers

Company | Liability only | Full coverage |

|---|---|---|

| State Farm | $148 | $324 |

| Country Financial | $147 | $369 |

| Travelers | $201 | $428 |

| Progressive | $207 | $594 |

| Geico | $245 | $603 |

Since young and inexperienced drivers are more likely to be involved in car accidents, it’s no surprise that companies charge a much higher rate to offset the risk.

In fact, 18-year-old drivers can expect to pay three to four times more than the average 30-year-old in Chicago. This makes it crucial for young drivers to do as much research as possible to ensure that they get the best rates.

Young drivers should consider combining insurance plans with their parents. The cost of a combined policy will be cheaper than if you get two separate policies.

There are other ways to save money if your income is low or if these rates are out of your desired price range. One of the most important actions you can take is to look at other companies outside of this list.

A measure that all drivers should take is to look for discounts. Most insurance companies offer discounts, some of which you may currently qualify for:

Good student

Having a good academic record or achieving a certain GPA

Car safety

Installing safety, security or anti-theft devices, such as anti-lock brakes or cameras

Safe driver

Taking a defensive driving course or not getting into an accident for a certain amount of time

New car

If your car is newer than a certain age or you are the first owner of a car

Cheapest car insurance after a speeding ticket: State Farm

State Farm has the lowest rates for drivers with a speeding ticket in Chicago, with an average cost of $114 per month for full coverage. That's less than half the price of the city average.

Cheapest car insurance in Chicago after a speeding ticket

Company | Monthly rate |

|---|---|

| State Farm | $114 |

| Travelers | $182 |

| Country Financial | $202 |

| Progressive | $203 |

| American Family | $209 |

On average, a speeding ticket will raise the price of insurance in Chicago by 29%.

Cheapest car insurance for drivers with prior accidents: State Farm

State Farm has by far the lowest rates for Chicago drivers after an at-fault accident. Its average cost of $124 per month for full coverage is 39% cheaper than the second-cheapest major company.

Cheapest car insurance after accidents

Company | Accident rate |

|---|---|

| State Farm | $124 |

| Travelers | $203 |

| Country Financial | $228 |

| Progressive | $242 |

| American Family | $266 |

Accidents will have one of the biggest effects on your auto insurance rates. If you have a history of accidents, your insurance company will probably increase prices, as it sees you as a higher risk. Certain companies in Chicago increase insurance costs by only 7%, while others raise them by more than 85%.

In the event that you are involved in an accident, you will not only see a base price increase but also could lose certain discounts. A driver with a clean driving history can consider investing in accident forgiveness. It can protect you from the egregious price hikes that come with getting into an accident. However, the accident will still be on your record.

Cheapest Chicago car insurance after a DUI: State Farm

State Farm has the cheapest rates for Chicago drivers after a DUI conviction, with an average of $114 per month for full coverage. That's a monthly savings of $57.

Cheapest car insurance in Chicago after a DUI

Company | Monthly rate |

|---|---|

| State Farm | $114 |

| Progressive | $171 |

| Travelers | $214 |

| Country Financial | $239 |

| American Family | $317 |

A DUI is one of the most serious offenses you can commit. On average, a DUI raises the price of a car insurance policy by 57% in Chicago.

Cheapest car insurance for Chicago drivers with poor credit: Travelers

Travelers is the cheapest option for car insurance for Chicago drivers with bad credit. The company's rate of $220 per month for full coverage edges out the second-cheapest option, State Farm.

Cheapest car insurance quotes for poor credit

Company | Monthly rate |

|---|---|

| Travelers | $220 |

| State Farm | $229 |

| Country Financial | $232 |

| Progressive | $253 |

| American Family | $304 |

In Chicago, you'll pay an average of 71% more if you have bad credit.

Your credit score doesn't have anything to do with your ability to drive. However, insurance companies say drivers with poor credit tend to file more claims and are more expensive to cover.

Cheapest car insurance for married drivers: State Farm

State Farm has the lowest rates in Chicago for married drivers, with an average of $106 per month, despite not giving a discount to married drivers. Progressive gives the biggest discount to married drivers, at 16%.

Cheapest car insurance for married drivers in Chicago

Company | Monthly rate |

|---|---|

| State Farm | $106 |

| Progressive | $127 |

| Country Financial | $131 |

| Travelers | $143 |

| American Family | $176 |

In Chicago, married drivers pay 6% less for full coverage. Married drivers are statistically less likely to get into an accident and thus pay lower rates.

Best car insurance company in Chicago by customer service

USAA has the top-rated customer service in Chicago.

The company gets a low rate of complaints and sits atop J.D. Power's claims satisfaction survey. However, USAA is only available to military members, veterans and their families.

If you are not eligible for USAA, State Farm is another good company in Chicago.

Best car insurance companies in Chicago, IL

Company |

Editor's rating

|

|---|---|

| State Farm | |

| USAA | |

| Geico | |

| American Family | |

| Farmers | |

| Travelers | |

| Allstate | |

| Country Financial | |

| Progressive |

Price and customer service are equally important when it comes to determining which insurance company you should buy a policy from. Nothing builds trust more than seeing a company put in the work to make sure that the claims process is smooth and all your questions are answered.

How car insurance costs change by neighborhood in Chicago

Drivers in Chicago's Lakeview neighborhood pay the least for car insurance in the city, while drivers in West Englewood pay the most.

Where you live in the city can impact your rates, with factors like crime and uninsured drivers raising the price of a policy. In Chicago, the difference between the cheapest and most expensive ZIP codes is $68 per month.

Full coverage quotes in Chicago by ZIP code

ZIP code | Neighborhood | Average monthly cost | Difference from average |

|---|---|---|---|

| 60018 | Rosemont | $170 | -12% |

| 60601 | New Eastside | $166 | -14% |

| 60602 | Loop | $166 | -14% |

| 60603 | Grant Park | $172 | -11% |

| 60604 | South Loop | $173 | -11% |

Minimum auto insurance requirements in Illinois

Almost all of the 50 states have a minimum amount of coverage all drivers are required to hold to be able to legally drive. In Illinois, the amount of coverage you need to carry is higher than in most other states but overall is still a small amount of car insurance to adequately protect you.

Coverage type | Amount required |

|---|---|

| Bodily injury liability | $25,000 per person / $50,000 per accident |

| Property damage liability | $20,000 per person |

| Uninsured motorist bodily injury liability | $25,000 per person / $50,000 per accident |

What's the best car insurance coverage in Chicago?

Just meeting the minimum requirements might be tempting considering that insurance rates are higher in Chicago than in most areas of Illinois. However, simply getting the bare necessity may not be the best choice for your situation.

A full coverage policy includes comprehensive and collision coverage on top of the state's minimum liability requirements.

- Most drivers in Illinois have comprehensive insurance. Comprehensive coverage protects you from damage caused by events that are completely out of your control, like storms and vandalism.

- Collision coverage is what you rely on when you crash into another car or object. Most car accidents will fall under collision coverage.

Comprehensive and collision coverage are meant to protect your car in nearly any situation. You should get a full coverage policy if you are leasing or financing your vehicle, your car is less than 10 years old or your car is worth more than $5,000. Otherwise, you’ll often be spending more on insurance than your vehicle is worth.

Frequently asked questions

How much is car insurance in Chicago?

Minimum coverage car insurance in Chicago costs an average of $81 per month, while full coverage is $194 per month. Those rates are around 34% higher than the

Who's the cheapest car insurance company in Chicago?

State Farm offers the cheapest car insurance rates in Chicago. The company's average minimum coverage rate is $46 per month and its full coverage rate is $106 per month.

What's the best car insurance company in Chicago?

USAA and State Farm are the best-rated car insurance companies in Chicago. Both have a good combination of reliable customer service, coverage options and low prices. USAA, however, is only available to current and former military members and some members of military families.

Methodology

ValuePenguin collected quotes from top insurance companies across Chicago. Unless otherwise stated, quotes are for a 30-year-old man with a 2015 Honda Civic EX, good credit and a clean driving record.

Minimum coverage rates match the state minimums in Illinois, while full coverage policies include more liability coverage, plus comprehensive and collision.

Coverage type | Coverage limits |

|---|---|

| Bodily injury liability | $50,000 per person / $100,000 per accident |

| Property damage liability | $50,000 per accident |

| Uninsured/underinsured motorist bodily injury liability | $50,000 per person / $100,000 per accident |

| Uninsured/underinsured motorist property damage | $50,000 per accident |

| Comprehensive and collision | $500 deductible |

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.

About the Author

Lead Writer

Matt Timmons is a Lead Writer on the insurance team at ValuePenguin, where he writes in-depth and timely pieces helping find the right coverage for them.

He's covered insurance at ValuePenguin since 2018, specializing in auto and home insurance, as well as life insurance. He's paid special attention to the EV insurance market, where prices are much higher than for gas cars.

Before he started writing about personal finance, Matt wrote about professional skills and online tools at an e-learning company.

How insurance helped Matt

During freshman orientation in college, Matt's iPod was stolen off his table while he was eating lunch. Luckily, he'd bought a college insurance plan the day before and he had money to buy a replacement before classes started.

Expertise

- Auto insurance

- Home insurance

- Insurance rate analysis

- Life insurance

Referenced by

- CNBC

- Miami Herald

- Yahoo! Finance

Education

- BA, Wesleyan University

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.