eRenterPlan Insurance Review: Rates and Coverage

eRenterPlan offers limited coverage at expensive rates — most renters can find better coverage elsewhere.

Find Cheap Renters Insurance Quotes in Your Area

eRenterPlan is a renters insurance policy that may be offered to you by your property manager when you sign a new lease. eRenterPlan can make it easy to get coverage, but you'll probably get a cheaper rate and better coverage with another company.

Pros and cons

Pros

-

Covers high-risk dog breeds

-

Lets you share a policy with roommates

Cons

-

Expensive rates

-

Poor customer service

-

Doesn't offer high coverage limits

Alternatives to eRenterPlan

How does eRenterPlan work?

eRenterPlan partners with landlords to help sell renters insurance to their tenants.

Compare eRenterPlan to other renters insurance companies | |

|---|---|

| Read review | |

| Read review | |

| Read review | |

That means you can only buy a policy from eRenterPlan if your landlord or property manager works with the company. Your property manager may have a partnership with eRenterPlan because it's an easy way for them to make sure their tenants are covered.

However, just because your landlord partners with eRenterPlan doesn't mean you have to get your coverage there.

Other major companies offer many of the same features as eRenterPlan. However, other companies also have higher coverage limits that give you better protection.

When you buy a policy from eRenterPlan, you're actually, being covered by one of three partner companies:

- American Modern Insurance Group

- American National Insurance Co.

- Markel Corp.

The company that underwrites your policy will be your point of contact if you ever need to file a claim. These companies generally have low customer satisfaction, which means that you might have a difficult claim experience.

eRenterPlan costs

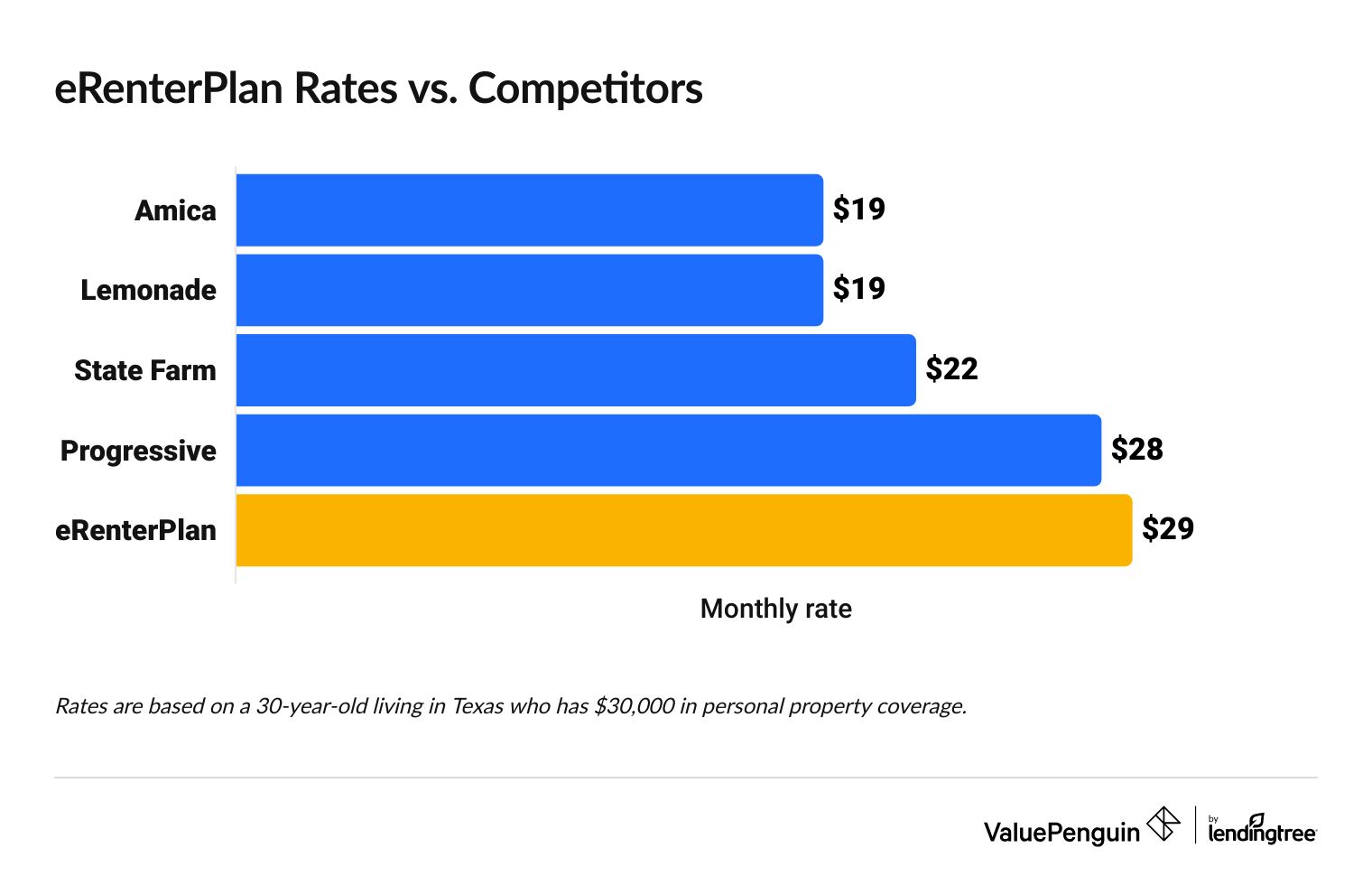

eRenterPlan renters insurance costs $29 per month, on average.

It doesn't make sense for most people to buy a policy from eRenterPlan when you can get similar or better coverage at a cheaper rate with another company.

The company advertises that rates usually start between $15 to $20 per month, but rates depend on where you live, how old you are, how much coverage you need and if you've ever filed a claim before.

Find Cheap Renters Insurance Quotes in Your Area

eRenterPlan's rates are higher than most other major renters insurance companies. Plus, the company doesn't have any discounts except for paying quarterly, semi-annually or annually instead of monthly.

eRenterPlan insurance rates vs. competitors

Company | Average monthly rate | |

|---|---|---|

| Amica | $19 | |

| Lemonade | $19 | |

| State Farm | $22 | |

| Progressive | $28 | |

| Assurant | $29 | |

Rates are for a 30-year-old living in Texas who has $30,000 in personal property coverage.

eRenterPlan renters insurance policy coverage and discounts

eRenterPlan has standard coverage like personal property, liability and medical payments.

The company also has a few helpful add-ons, but its discounts are lacking.

eRenterPlan coverage

A basic eRenterPlan policy includes some extra coverage above and beyond what normal policies have. However, the company doesn't let you adjust your coverage as much as its competitors do.

Pros

- If your stuff is damaged or stolen, you'll get the full cost to replace it rather than a lower cost based on how old or worn it is. Many insurers factor wear and tear into your settlement or charge you extra for replacement cost coverage, but with eRenterPlan, replacement cost is standard.

- eRenterPlan gives you a high level of additional living expenses (ALE) coverage, which pays for expenses like a hotel room or moving expenses if you can't stay in your apartment after a claim. You'll automatically have the same level of coverage you have for your stuff. Most renters insurance companies only offer additional living expenses at a lower limit.

- You can add up to four roommates to a policy without paying more, although it isn't always a good idea to share a policy with roommates.

- eRenterPlan covers dog bites regardless of breed, which could be useful for some dog owners.

Cons

- You can only insure your belongings for up to $50,000. If you need more coverage, eRenterPlan isn't a good option.

- Personal liability coverage is limited to $100,000. Medical payments coverage is set at $1,000, so you can't purchase more or less.

- The company offers higher coverage limits for jewelry but not for other valuables like bicycles, musical instruments or electronics.

- eRenterPlan doesn't let you add coverage for an at-home business. If you run a business out of your apartment, you should choose another company so you can get proper coverage.

eRenterPlan also offers a few optional coverage add-ons that renters can use to customize their policy.

Coverage | Description | Monthly cost |

|---|---|---|

| Bed bug remediation | Covers up to $750 to get rid of bed bugs and replace your infested stuff | $1.50 |

| Identity recovery | Offers up to $15,000 to cover costs resulting from identity theft | $1.50 |

| Pet damage liability | Covers up to $500 of damage to your apartment caused by your pet | $1.50 |

| Jewelry coverage | Increases jewelry coverage to $2,500 or $5,000 | $2 to $5 |

| Water backup | Covers up to $40,000 of damage due to water backup from drains or pipes | $1.00 |

| Unemployment | Pays $500 or $1,000 toward your rent for two months if you lose your job | $12.50 |

eRenterPlan discounts

eRenterPlan doesn't have good discounts. The only savings you can get are for paying in larger amounts instead of monthly.

Discount | Savings |

|---|---|

| Quarterly payments | $20/year |

| Semi-annual payments | $25/year |

| Annual payments | $30/year |

eRenterPlan customer reviews and ratings

The companies that work with eRenterPlan have poor customer service and a high level of complaints.

eRenterPlan renters insurance comes from three different companies: American Modern Insurance Group, American National Insurance Co. and Markel Corp. When you file a claim, you won't be making a claim with eRenterPlan but rather with one of these three insurers.

None of these companies gets good customer service reviews. More people than average file complaints about these companies, which is often a sign that the service is poor.

eRenterPlan ratings

Company |

NAIC

|

AM Best

|

|---|---|---|

| American Modern Insurance Group | 54% more complaints than average | A+ (superior) |

| American National Insurance Co. | 81% more complaints than average | A (excellent) |

| Markel Corp. | 317% more complaints than average | A (excellent) |

You can't pick which company your eRenterPlan policy comes from, which means you have no control over the level of service you get. While all the companies get more complaints than average, Markel's customer service is particularly poor. That means eRenterPolicy customers who get a policy from Markel will probably have a more difficult claim experience than those whose policies come from American Modern or American National.

However, all three of eRenterPlan's partners have good financial stability ratings from AM Best. This means they have the financial strength to pay claims, even if a lot of people file claims at once.

Frequently asked questions

Is eRenterPlan a good renters insurance option?

eRenterPlan can be an easy way to get renters insurance because your landlord may offer you a policy. However, eRenterPlan is usually expensive compared to other companies and offers fewer coverage options and discounts. You can probably get a cheaper policy with better coverage from another company.

How much is renters insurance through eRenterPlan?

Renters insurance from eRenterPlan costs $29 per month, on average. Your rate depends on where you live, how old you are, what coverage limits you need and if you've filed any renters insurance claims in the past.

Does ERenterPlan have auto insurance?

eRenterPlan only sells renters insurance. If you have a car, it's probably a better idea to get your renters insurance from a company that also sells car insurance. That way, you can get a discount for

How do I cancel my eRenterPlan policy?

The fastest way to cancel your coverage with eRenterPlan is to log into the company's site and cancel it there. You can also call the customer service line at 888-512-4204.

Methodology

ValuePenguin gathered quotes from eRenterPlan and other renters insurance companies from 25 of the largest cities across Texas. Not every company was available in every ZIP code. Quotes are for a 30-year-old single woman who has not filed any renters insurance claims and has the following coverage limits:

- $30,000 of personal property coverage

- $100,000 of personal liability

- $1,000 of medical payments to guests

- $500 deductible

Quotes for other companies in Texas include $9,000 in additional living expense coverage, while eRenterPlan automatically includes additional living expense coverage up to the personal property limit.

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.