Who Has The Cheapest Motorcycle Insurance In Connecticut?

Progressive has the cheapest motorcycle insurance in Connecticut, with an average cost of $19 per month.

Compare Motorcycle Insurance Quotes in Connecticut

Best cheap motorcycle insurance in Connecticut

How we chose the top companies

Cheapest motorcycle insurance in Connecticut

Progressive has the cheapest motorcycle insurance in Connecticut for most people.

The company charges an average of $19 per month for a full coverage policy.

Compare Motorcycle Insurance Quotes in Connecticut

USAA also has cheap rates, at an average of $18 per month. However, you can buy a USAA motorcycle policy only if you or an immediate family member are current or former military.

It's also important to note that Progressive handles motorcycle insurance for USAA customers. That means you're essentially getting Progressive motorcycle insurance through USAA for a slight discount.

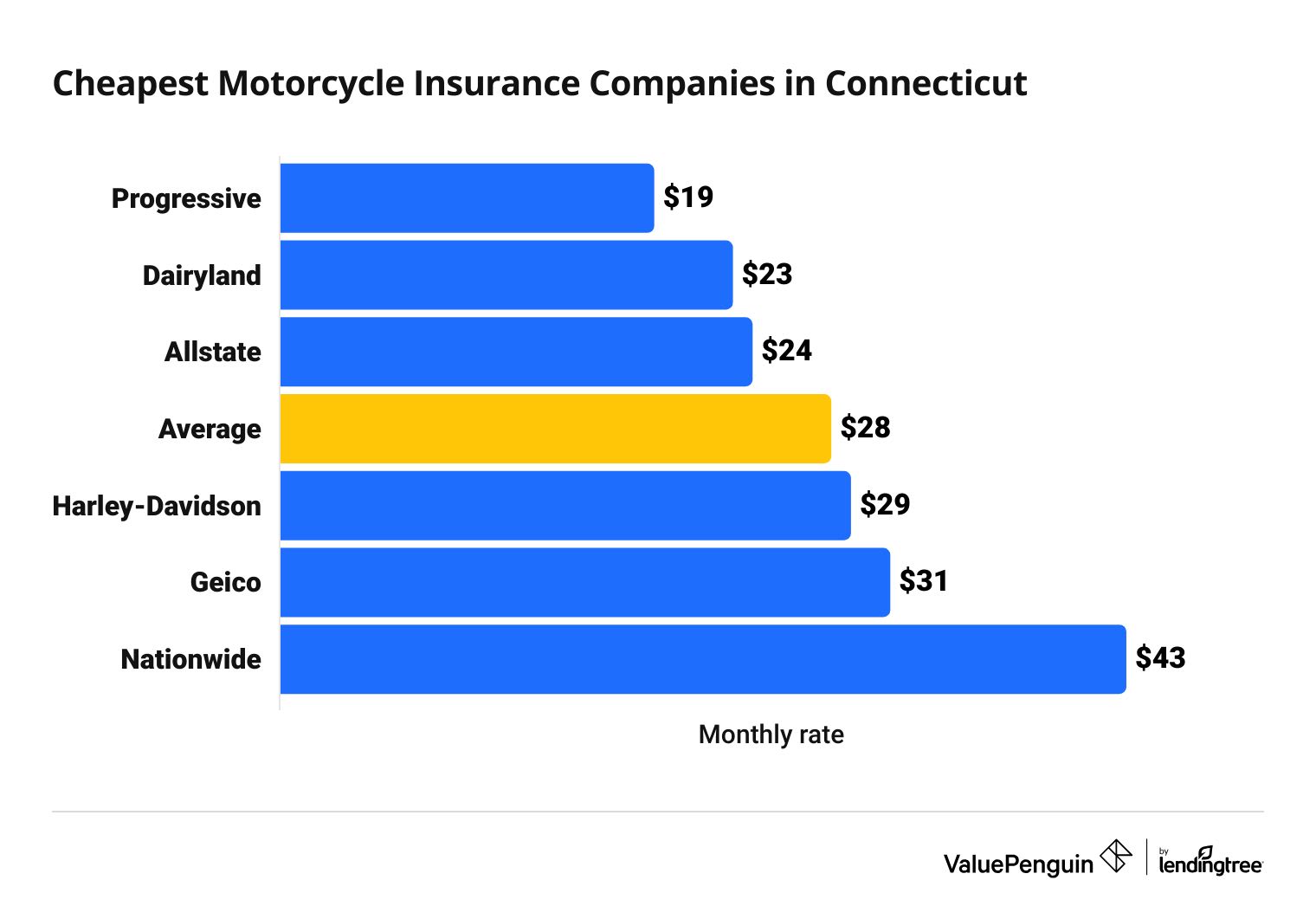

Motorcycle insurance in Connecticut costs $28 per month, on average.

Cheapest motorcycle insurance companies in CT

Company | Monthly rate | ||

|---|---|---|---|

| Progressive | $19 | ||

| Dairyland | $23 | ||

| Allstate | $24 | ||

| Harley-Davidson Insurance | $29 | ||

| Geico | $31 | ||

| Nationwide | $43 | ||

Best motorcycle insurance in Connecticut: Progressive

-

Editor's rating

-

Cost: $19/month

Overview

Pros/Cons

Progressive has the best motorcycle insurance in Connecticut because of its cheap rates, many coverage options and strong customer service.

Overview

Progressive has the best motorcycle insurance in Connecticut because of its cheap rates, many coverage options and strong customer service.

Pros/Cons

Pros:

-

Cheap rates

-

Many coverage extras and discounts

-

Good customer service

Cons:

-

No rental reimbursement coverage

Progressive has the best motorcycle insurance in Connecticut because of its cheap rates, many coverage options and strong customer service.

Pros:

-

Cheap rates

-

Many coverage extras and discounts

-

Good customer service

Cons:

-

No rental reimbursement coverage

Progressive has the cheapest motorcycle insurance in Connecticut for most people. The company charges an average of $19 per month for a full coverage policy. That's significantly cheaper than the statewide average of $28 per month.

All Progressive motorcycle insurance policies come standard with replacement cost coverage, for which many companies charge extra. Further, all policies come with $3,000 of equipment coverage.

Progressive lets you save with a range of discounts. Plus, the company has a good reputation for customer service, getting significantly fewer complaints than an average company its size.

Best motorcycle insurance in CT for bundling: Allstate

-

Editor's rating

-

Cost: $24/month

Overview

Pros/Cons

Allstate offers a generous bundling discount for Connecticut motorcycle riders who also have a home or auto policy with the company.

Overview

Allstate offers a generous bundling discount for Connecticut motorcycle riders who also have a home or auto policy with the company.

Pros/Cons

Pros:

-

Good bundling discount

-

Affordable rates

-

Many coverage extras and discounts

-

Fewer complaints than average

Cons:

-

Doesn't have the cheapest rates

Allstate offers a generous bundling discount for Connecticut motorcycle riders who also have a home or auto policy with the company.

Pros:

-

Good bundling discount

-

Affordable rates

-

Many coverage extras and discounts

-

Fewer complaints than average

Cons:

-

Doesn't have the cheapest rates

Allstate has the best motorcycle insurance bundling discount in Connecticut. Consider Allstate if you already have an Allstate auto, home or renters insurance policy.

In addition to its generous bundling discount, Allstate also has affordable rates. The company charges an average of $24 per month. That's cheaper than the statewide monthly average of $28.

Allstate also offers many coverage extras. You can get gap insurance, roadside assistance and rental reimbursement. These options make Allstate a good option if you want the flexibility to personalize your coverage.

Best motorcycle insurance in CT for touring and commuting: Harley-Davidson

-

Editor's rating

-

Cost: $29/month

Overview

Pros/Cons

Harley-Davidson has the best coverage for Connecticut riders who rely on their bike for road trips or daily use.

Overview

Harley-Davidson has the best coverage for Connecticut riders who rely on their bike for road trips or daily use.

Pros/Cons

Pros:

-

Roadside assistance available

-

Vacation rental coverage

-

Many discount options

Cons:

-

Average rates are on the higher side

-

Doesn't offer home or auto insurance

Harley-Davidson has the best coverage for Connecticut riders who rely on their bike for road trips or daily use.

Pros:

-

Roadside assistance available

-

Vacation rental coverage

-

Many discount options

Cons:

-

Average rates are on the higher side

-

Doesn't offer home or auto insurance

Harley-Davidson is the best choice for Connecticut motorcycle riders who use their bikes to commute or go on road trips. The company offers roadside assistance coverage, which may come in handy if you're traveling long distances from home. Plus, you can get your normal level of coverage for a rented motorcycle.

Harley-Davidson charges slightly higher than average rates, at an average of $29 per month. However, you can save on your monthly rate by taking advantage of one or more of the company's many discounts — these include discounts for homeowners, completing a safety course and going a certain amount of time without filing a claim.

Harley-Davidson doesn't offer auto or home insurance. That means you can't bundle coverage through Harley-Davidson, making it a poor option if you prefer the cost savings and efficiency of dealing with a single company.

Connecticut motorcycle insurance cost by city

Bridgeport and New Haven have more expensive motorcycle insurance quotes than other large Connecticut cities.

Riders in Bridgeport and New Haven pay an average of $39 per month for full coverage.

The cheapest rates are in Bristol (a suburban city outside of Hartford) and Torrington (in the northwest section of the state). Riders in Bristol these locales pay an average of $23 per month for full coverage.

Average motorcycle insurance cost in CT by city

City | Monthly cost | % from average |

|---|---|---|

| Bridgeport | $39 | 40% |

| Bristol | $23 | -17% |

| Danbury | $25 | -12% |

| East Hartford | $25 | -13% |

| Fairfield | $30 | 5% |

Full coverage rates in Connecticut differ by up to $16 per month across the 25 largest cities in the state. Riders in larger cities typically pay more for insurance than those in smaller towns. That's because cities typically have higher crime and accident rates, which lead to more insurance claims.

CT motorcycle insurance laws

Connecticut motorcycle owners need a minimum amount of insurance to legally drive their motorcycle. The requirements include bodily injury liability and property damage liability coverage, along with uninsured motorist coverage.

- Bodily injury liability: $25,000 per person and $50,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist coverage: $25,000 per person and $50,000 per accident

Most riders should get more coverage than just the minimum requirements. A major accident can often lead to expensive medical bills, sometimes more than the $25,000 limit.

Plus, the legally required coverage doesn't protect your own bike. As such, it's a good idea to have comprehensive and collision coverage if you can't afford to replace your bike after an accident.

Frequently asked questions

What's the cheapest motorcycle insurance in Connecticut?

Progressive has the cheapest average full coverage motorcycle insurance rates in Connecticut, at $19 per month. That's $9 per month cheaper than the statewide average.

USAA has slightly cheaper rates, at an average cost of $18 per month. However, you can only buy a USAA policy if you or a family member are current or former military.

How much does motorcycle insurance cost in Connecticut?

Motorcycle insurance in Connecticut costs an average of $28 per month. That's slightly cheaper than the national average of $33 per month.

Does CT require motorcycle insurance?

Yes, Connecticut riders must have at least $25,000 of bodily injury liability coverage and $50,000 per accident, along with matching uninsured and underinsured motorist limits. Plus, you need to have $25,000 of property damage liability per accident.

Methodology

To find the best cheap motorcycle insurance in Connecticut, ValuePenguin collected 175 quotes from the largest cities across CT. Rates are for a 45-year-old single man who owns a 2018 Honda CMX500 Rebel.

Quotes are for a full coverage policy, which includes higher liability limits than the state requirement, along with comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person; $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person; $100,000 per accident

- Uninsured and underinsured motorist property damage: $25,000 per accident

- Medical payments: $5,000

- Comprehensive and collision deductible: $500

The ValuePenguin team has a combined total of more than 50 years' experience in the property and casualty insurance industry.

Senior Writer

Talon Abernathy is a ValuePenguin Senior Writer who specializes in health insurance, Medicare and Medicaid. He's also contributed to other insurance verticals including home, renters, auto, motorcycle and flood insurance.

Talon came to ValuePenguin in 2023. Since his arrival, he's helped to expand the site's health insurance-related content offerings. He enjoys helping readers understand the ins and outs of America's all too complicated health insurance landscape.

Before coming to ValuePenguin, Talon worked as a freelance writer. His prior work has touched on a broad range of personal finance-related topics including credit-building strategies, small business incorporation tactics and creative ways to save for retirement.

Insurance tip

In many parts of the country, you can qualify for a free Silver health insurance plan if you meet certain income requirements. Government subsidies in the form of premium tax credits and cost-sharing reductions may mean you'll pay nothing for coverage.

Expertise

- Health insurance

- Medicare and Medicaid

- Flood insurance

- Homeowners insurance

- Renters insurance

- Auto and motorcycle insurance

Referenced by

- The Miami Herald

- Money.com

- MSN

- Nasdaq

- The Sacramento Bee

- Yahoo! Finance

Education

- BA, University of Washington

- Certificate in Copyediting, UC San Diego

Credentials

- Licensed Life & Disability Insurance Agent

- Licensed Property & Casualty Insurance Agent

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.