Best Cheap Health Insurance in North Carolina for 2026

Blue Cross NC is the best health insurance company in North Carolina. Its cheapest plan costs $584 per month before discounts.

Find Cheap Health Insurance Quotes in North Carolina

Best and cheapest health insurance in North Carolina

Cheapest health insurance companies in NC

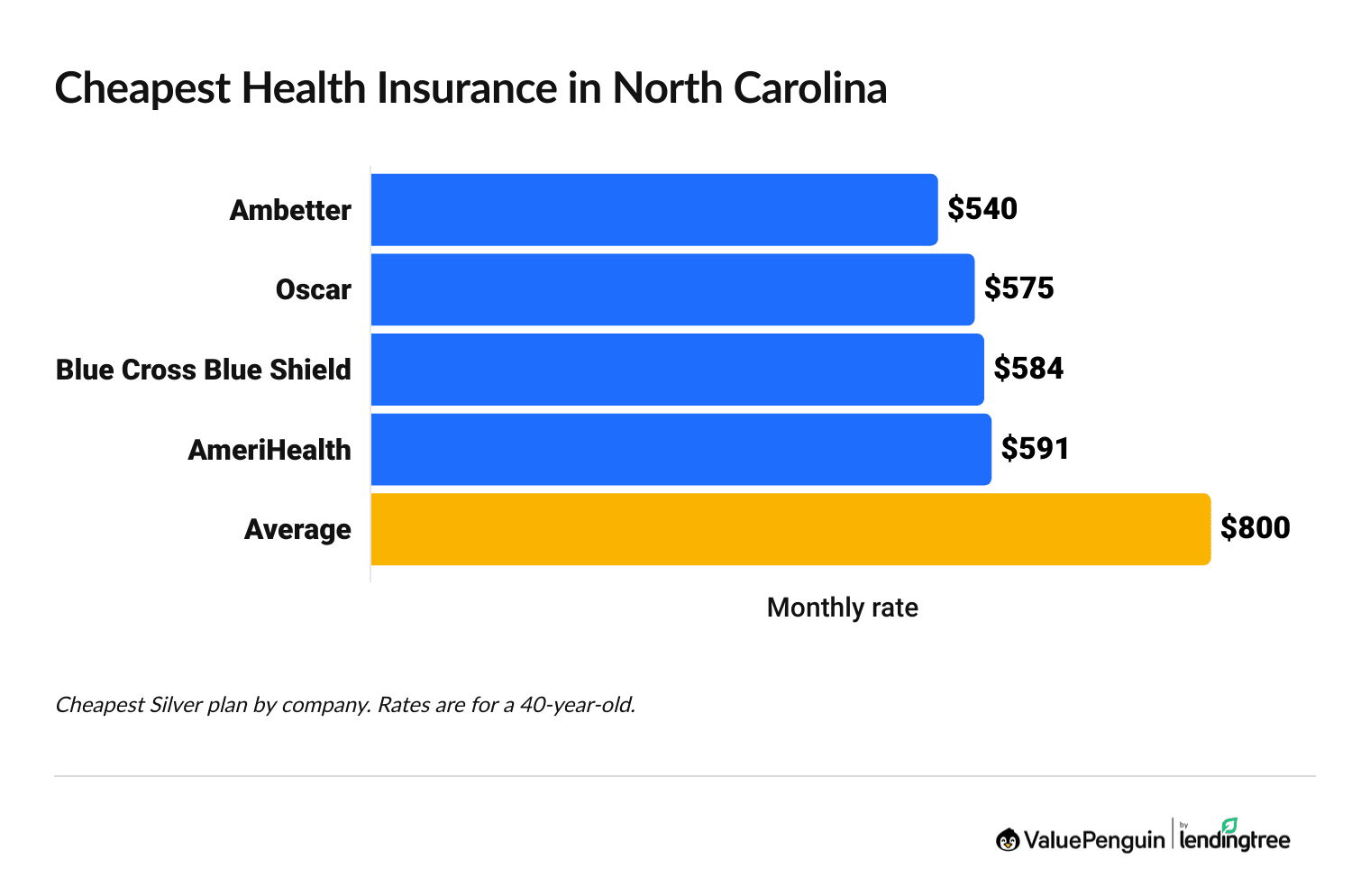

Ambetter, Oscar and Blue Cross Blue Shield have the cheapest health insurance plans in North Carolina, with Silver plan rates starting at $540 per month before discounts.

Find Cheap Health Insurance Quotes in North Carolina

Affordable health insurance in North Carolina

Company |

Cost

| |

|---|---|---|

| Ambetter | $540-$804 | |

| Oscar | $575-$868 | |

| BCBS of NC | $584-$941 | |

| AmeriHealth | $591-$753 | |

- Ambetter has the most affordable Silver plans in North Carolina, with rates starting at $540 per month. The company has the most affordable quotes for about 2 in 5 North Carolinians. Plus, Ambetter has a good 3 out of 5-star rating from HealthCare.gov.

- Blue Cross Blue Shield (BCBS) has affordable quotes, with Silver plans starting at $584 per month. Plus, it's the best-rated company in North Carolina.

- BCBS has the cheapest plans for roughly 2 in 5people in NC, including residents of Raleigh and Durham. Where you live sets your plan options, and rates differ depending on your county.

Aetna will leave the North Carolina health marketplace at the end of 2025. Aetna customers will have to get coverage through a new company during the state's open enrollment period, which runs from Nov. 1 to Jan. 15.

Consider Blue Cross Blue Shield if you're going to lose your medical insurance at the end of the year. The company has affordable rates, a large network of doctors and a reputation for good customer service.

Best health insurance companies in North Carolina

Blue Cross Blue Shield has the best health insurance in North Carolina for individuals and families, with Silver plans starting at $584 per month.

- High ratings and wide selection of doctors: Blue Cross Blue Shield (BCBS) has 4 out of 5 stars from ValuePenguin editors because of its good customer service and coverage. BCBS also has a large network of doctors, making it easy to get medical care in NC.

- Widely accepted: Most doctors and hospitals take BCBS insurance, and you'll have flexibility about where you can get medical care. Roughly 3 out of 5 North Carolina residents have Blue Cross Blue Shield.

- Top-quality medical care: All BCBS plans in NC have a strong 4 out of 5 overall star rating from HealthCare.gov. These plans also have an excellent 5 out of 5-star rating for member experience.

Find Cheap Health Insurance Quotes in North Carolina

Best-rated health insurance companies in NC

Company |

ACA rating

|

VP rating

|

|---|---|---|

| BCBS of NC | ||

| UnitedHealthcare | ||

| Ambetter | ||

| Cigna | ||

| AmeriHealth |

UnitedHealthcare in North Carolina: Proceed with caution

UnitedHealthcare recently lost a class action lawsuit with the North Carolina Department of Insurance because the company failed to adequately pay for out-of-network services.

Although UnitedHealthcare is widely available and well-rated, it's not a good choice for most people in North Carolina. The company has the most expensive health insurance plans in the state, with Silver plans starting at $745 per month.

Plus, UnitedHealthcare is in the middle of several other class-action lawsuits including one related to its Optum Rx pharmacy line of business and another relating to its use of AI tools to handle health insurance claims.

How much is health insurance in NC?

The average cost of health insurance in North Carolina is $800 per month if you pay full price or possibly about $182 per month if you're eligible for discounts based on your income.

Find Cheap Health Insurance Quotes in North Carolina

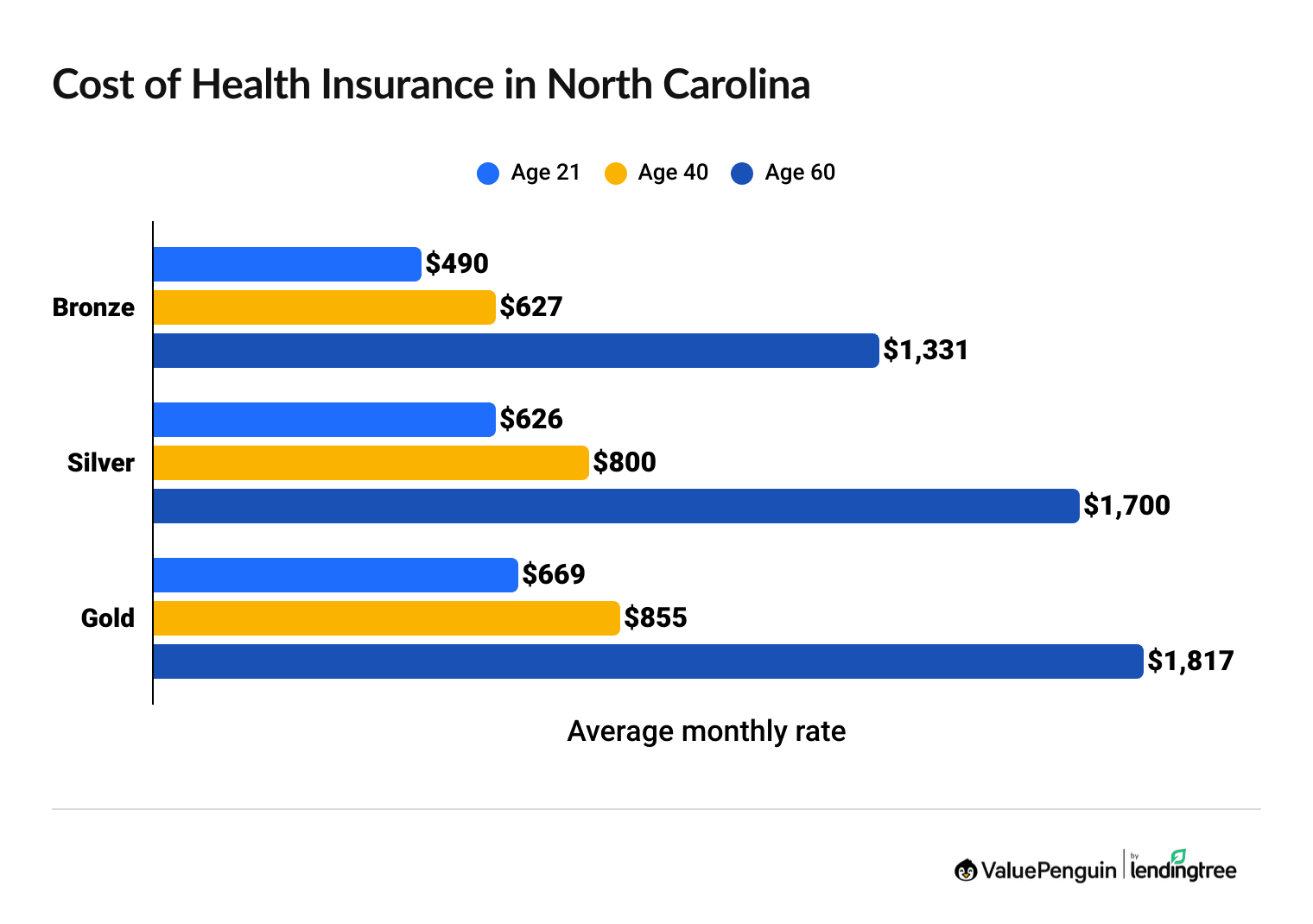

Your health insurance costs will depend on the level of coverage you choose, your age and your income.

- Plans with less coverage usually have cheaper rates. Bronze and Catastrophic plans can save you money each month, but you'll have to pay a larger portion of your medical bills. That's why the best level of coverage for you depends how much medical care you expect to need.

- Seniors pay high rates for medical insurance in NC and everywhere else in America. Health insurance rates increase as you get older because insurance companies expect that you'll need more medical care as you age. In North Carolina, rates increase steeply after age 40. A 60-year-old pays more than twice as much as a 40-year-old for a Silver plan.

- PPO plans are the most expensive. The type of plan you choose affects how easy it is to see specialists and whether you can see a doctor who's not in the plan's network. A PPO plan is the most flexible, but on average they cost roughly 8% more than the overall NC state average.

Health insurance discount changes in North Carolina for 2026

Medical insurance costs $800 per month in North Carolina, or a projected amount of $182 per month, on average, after discounts, called subsdies, which is more than twice what you'd pay for discounted coverage in 2025, on average.

The average cost of health insurance after subsidies are projected to go from about $86 per month in 2025 to $182 per month in 2026. That's because the amount of discounts available to shoppers is getting smaller in 2026.

Between 2021 and 2025, you could take advantage of higher discounts called "expanded subsidies" when you bought health insurance through HealthCare.gov. These better discounts won't be available in 2026, although you can still get smaller subsidies.

Health insurance rates in North Carolina after subsidies (2025 vs. 2026)

Income | 2025 rate | 2026 rate | Difference |

|---|---|---|---|

| $30,000 | $49 | $155 | 216% |

| $40,000 | $154 | $287 | 86% |

| $50,000 | $283 | $415 | 47% |

| $60,000 | $423 | $498 | 18% |

| $70,000 | $496 | $638 | 29% |

Average cost after subsidies for a single 40-year-old with a Benchmark Silver plan.

- Who can get subsidies? To get discounted health insurance, you have to earn between $15,650 and $62,600 as an individual ($32,150 to $128,600 for a family of four). The size of your discount depends on how much you make: the lower your income, the larger your subsidy.

- How do subsidies work? You can use your subsidy to buy any Bronze, Silver or Gold plan available on HealthCare.gov. After you enter your annual income, the website automatically shows you how much each plan costs with the subsidy applied. You can choose to pay a discounted rate every month, or you can pay full price and get the subsidy in a lump sum when you file your taxes.

- How much do you save? ValuePenguin's subsidy calculator can give you an idea of how much you can expect to pay for coverage after discounts.

Average cost of medical insurance by NC county

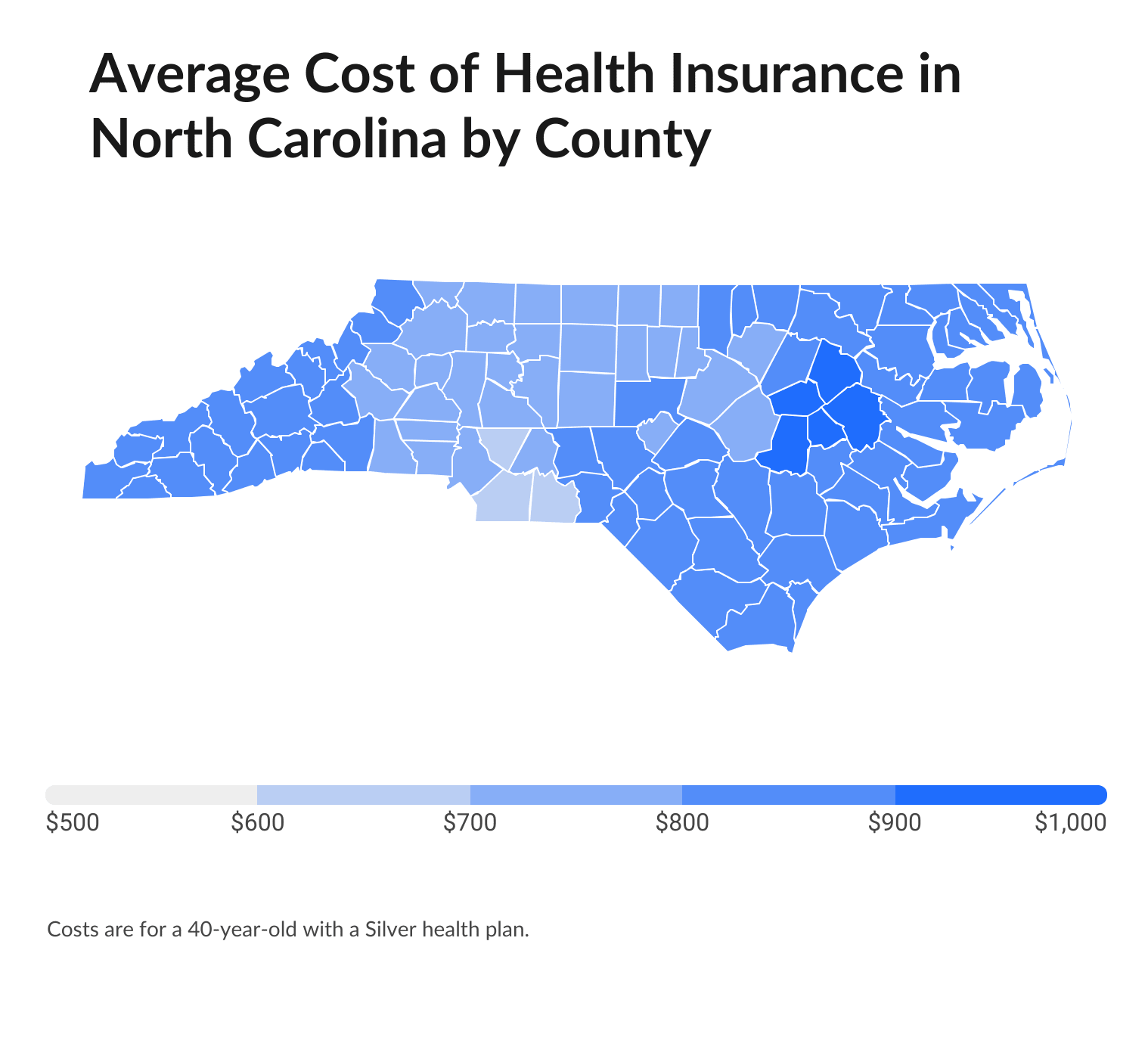

Cabarrus and Union Counties have the cheapest health insurance quotes in North Carolina, at $689 per month, on average.

Average health insurance costs in North Carolina can differ by hundreds of dollars per month depending on where you live. That's because plans are offered at the county level, so some parts of North Carolina have more coverage options than other areas.

Factors such as local health care costs and the overall health of your community can also influence the medical insurance rates in your county.

Average Silver health insurance rates by NC county

NC county | Monthly rate |

|---|---|

| Alamance | $767 |

| Alexander | $761 |

| Alleghany | $768 |

| Anson | $698 |

| Ashe | $809 |

Monthly rates for a 40-year-old who's not eligible for subsidies.

Cheap North Carolina health insurance plans by city

Oscar has the cheapest health insurance in Charlotte, at $575 per month for a Silver plan.

In Raleigh, Blue Cross and Blue Shield of NC has the most affordable health insurance, at $584 per month. Ambetter has the cheapest quotes in Greensboro and Winston-Salem.

Cheapest health insurance plans by NC county

County | Cheapest plan | Monthly rates |

|---|---|---|

| Alamance | BCBS of NC Home Silver Preferred | $603 |

| Alexander | Ambetter Clear Silver | $596 |

| Alleghany | Ambetter Clear Silver | $677 |

| Anson | Oscar Silver Simple PCP Saver | $575 |

| Ashe | AmeriHealth Silver Essential | $731 |

Cheapest Silver plan with rates for a 40-year-old

Ambetter is the cheapest health insurance company in roughly half of all North Carolina counties, with 41% of the state's population. That makes it the best deal for many people.

Best health insurance by level of coverage

The best health insurance plan for you will depend on your income level and how much health care you need. The more medical care you need, the higher the tier you should choose.

Gold plans: Best if you need expensive medical care

| Gold plans pay for about 80% of your medical care. |

The average cost of a Gold health insurance plan is $855 per month in NC.

This high cost is worth it if you need expensive medical care. The plans will help you save overall because they have lower deductibles, coinsurance and copays.

Gold plans are typically the best health insurance option if you expect to have large medical bills, such as for surgery, childbirth or managing a chronic condition.

Silver plans: Best for most people

| Silver plans pay for about 70% of your medical care. |

The average cost of a Silver plan is $800 per month in NC, if you pay full price.

It's the most popular tier of coverage, with about half of NC shoppers buying a Silver plan.

Silver plans are a good choice for most people because they balance the monthly cost of a plan and how much you spend on medical care. You get more coverage than you would with a Bronze plan, but you'll likely have lower monthly rates than with a Gold plan.

Bronze: Best if you're young and healthy

| Bronze plans pay for about 60% of your medical care. |

A Bronze plan costs an average of $627 per month, on average.

Bronze health insurance plans have low monthly rates, but you also have to pay the most for your medical care. That's because these plans have the highest deductibles and out-of-pocket limits.

Bronze plans are often the best deal if you're healthy and only go to the doctor a few times per year. But if you have an unexpected illness, medical care can be expensive before the plan's full benefits kick in. Before choosing a Bronze plan, make sure you have enough savings to cover the plan's full deductible in case you have a medical emergency.

Cheap or free health insurance in NC if you have a low income

If you're struggling to afford insurance in North Carolina, you have a few options. If you have a very low income, Medicaid could help you get health care for free or very cheap. If you can't get on Medicaid, a Silver plan can be a good option because it lets you get extra discounts when you make less.

Silver plans: Best if you have a low income but don't qualify for Medicaid

| Silver plans will pay 73% to 94% of your medical costs if you have a low income. |

You'll get extra savings on your medical costs if you choose a Silver plan and make less than about $39,125 per year as a single person or $80,375 per year as a family of four.

If you qualify for cost-sharing reductions (CSRs), you'll get better deductibles, coinsurance and copays so that you pay less when you go to the doctor.

Medicaid: Free health insurance if you have a low income

If you have a low income, North Carolina Medicaid gives you health coverage that's free or very low cost.

To qualify for Medicaid, you have to make less than about $22,000 per year as a single person or $44,000 as a family of four. You may be able to make more and still qualify if you are under 19, are pregnant or have a disability.

North Carolina's Medicaid division helps you find out which companies have Medicaid plans in your county.

- The best Medicaid plan in NC for most people is a standard plan. This will cover health costs such as doctor visits, lab tests, hospital care, prescriptions, vision care and mental health. Many standard plans also offer extra perks like a phone plan, access to kids' programs, rides to doctor appointments and more.

- In NC, a tailored Medicaid plan is the best choice for specialized treatment such as if you're getting care for substance use or a developmental disability. These plans cover costs such as long-term rehabilitation services, in-home care and community support like help finding a job.

Are health insurance rates going up in North Carolina?

Health insurance costs rose by an average of 17% between 2025 and 2026.Silver plans had the largest average increase, at 21%. Bronze plans rose by 17%, on average, and Gold plans increased by an average of 15% year on year. The cost of a Silver health plan in North Carolina rose by 26% between 2022 and 2026.

Bronze

Silver

Gold

Year | Cost | Change |

|---|---|---|

| 2022 | $456 | N/A |

| 2023 | $508 | 11% |

| 2024 | $513 | 1% |

| 2025 | $536 | 4% |

| 2026 | $627 | 17% |

Monthly costs are for a 40-year-old. Expanded Bronze plans are included in 2024, 2025 and 2026 averages, when they're offered.

Why is health insurance expensive in NC in 2026?

An increase in the cost of health care, including the cost for medications, is the main cause of rising health insurance rates.

The popularity of GLP-1 drugs, especially, has put pressure on insurance companies. When more people take an expensive medication like Ozempic or Wegovy, health insurance companies need to raise rates to make sure they have enough money to pay for the drugs.

Another cause of higher rates in 2026 is changes to the discounts you can get from HealthCare.gov and state marketplaces. These discounts, called subsidies, are based on your income. Since 2021, people who have low incomes have gotten bigger discounts. These "enhanced" subsidies expire at the end of 2025.

The cost of health insurance is going up, in part, because healthier people are choosing to not get marketplace health insurance due to rising costs. Because the people who still have ACA plans are in worse health, on average, than the people leaving, health insurance companies are raising rates.

How to afford health insurance if your rates go up

- Review your options. If rates for your current plan are going up for 2026, look at the other companies and plans in your area. Getting quotes from multiple companies doesn't lock you into anything; it just lets you compare plans. You might find an option that's cheaper but still gives you the coverage you need.

- Think about your coverage. If you don't go to the doctor often, you could drop down to a Bronze plan to save money each month. Just remember that you have to pay for more of your medical bills, so make sure you have money in the bank. You can get an HSA with Bronze plans now, and that could help you save for medical bills. If you use your medical insurance often though, stick with a higher-tier plan.

- Take advantage of changes in income. If you've recently had a change in income, especially if you make less, check if you can get discounts. Even if the discounts are lower in 2026, they'll still help you save money.

- See if you can get Medicaid. If your income is below about $22,000 per year as a single person or $44,000 as a family of four, you can probably get Medicaid. Medicaid gives you coverage for free or very cheap.

Obamacare health insurance in NC

All health insurance plans from HealthCare.gov, no matter the plan tier, are required to cover at least 10 essential health situations.

- Doctor visits

- Preventive and chronic disease care

- Emergency care

- Laboratory services

- Hospital care

- Pregnancy, maternity and newborn care

- Mental health and substance use services

- Prescription medications

- Rehabilitation care and devices

- Pediatric services

Every plan, no matter what level of coverage it offers, has coverage for at least these 10 situations. The difference in the plans comes in how you and your insurance company split medical bills. Higher-tier plans pay for more of your health care costs, while lower-tier plans mean you have to pay more of your bills.

Average cost of health insurance by family size

Health insurance for a family of four costs an average of $2,559 per month in North Carolina.

Family size | Average monthly cost |

|---|---|

| Individual | $800 |

| Individual and child | $1,280 |

| Couple | $1,601 |

| Family of three | $2,080 |

| Family of four | $2,559 |

Averages based on a Silver plan for 40-year-old adults and children who are under age 15.

In North Carolina, each child that you add to a Silver medical insurance plan adds an average of $479 per month. Children are typically cheaper to insure than adults because it's less likely that they will have serious medical issues. It costs about $800 to add an adult to a Silver plan.

Average cost of health insurance by plan type

You can choose between several different types of insurance plans in North Carolina. The most common options are HMOs and PPOs.

Type | Cost |

|---|---|

| HMO | $800 |

| PPO | $863 |

| EPO | $654 |

| POS | $729 |

Monthly costs are for a 40-year-old with a Silver plan.

- PPO plans give you flexibility. You can use any doctor and still have some coverage, and you don't need a referral to go to a specialist. If you can afford one, a PPO is the best option.

- HMOs are affordable, but they also require you to use certain doctors and get referrals to see specialists.

- EPO and POS plans are less common, but they are cheaper than HMOs or PPOs in North Carolina. EPO plans are similar to HMOs in that they restrict you to a doctor network. But you don't need a referral to see a specialist within the network.

- POS plans let you use in-network and out-of-network doctors, but you'll pay more if you go out of network, just like with a PPO. But with a POS plan, you have to have a primary care doctor and be referred to specialists.

Short-term health insurance in North Carolina

In January 2025, the Trump administration repealed a rule that would've limited the length of a short-term health plan to just three months. That means North Carolina health insurance companies can now sell short-term plans that last for up to 364 days.

You can get a short-term health insurance plan any time of the year. That makes them a good option if you need coverage outside of open enrollment (Nov. 1 to Jan. 15) and you don't qualify to enroll at a different time with a special enrollment period.

Pros of short-term health insurance in NC

Cons of short-term health insurance in NC

Health insurance enrollment by income level in North Carolina

Lower health insurance discounts for 2026 will more heavily affect people who make less money.

People who earn a below average income are more likely to get health insurance through HealthCare.gov than other groups. In 2025, roughly two-thirds of all North Carolina residents with marketplace coverage earned about $30,000 per year or less.

Enrollment by income

Income | % of total enrollment |

|---|---|

| Less than $15,060 | 1% |

| $15,060 to $20,783 | 17% |

| $20,784 to $22,590 | 29% |

| $22,591 to $30,120 | 19% |

| $30,121 to $37,650 | 11% |

Enrollment in 2025 marketplace plans made during the 2024-2025 Open Enrollment period. Total may not be 100% due to rounding

Frequently asked questions

What is the average cost of health insurance in North Carolina?

For 2026, the average cost of health insurance in North Carolina is $800 per month for a 40-year-old buying a Silver plan. You may be able to lower your monthly rate with subsidies, and you could lower your health care costs with cost-sharing reductions. Eligibility for both is based on income and family size.

Is $200 a month expensive for health insurance in NC?

A health insurance plan that costs $200 per month is not expensive in North Carolina. That's one-quarter the average cost of health insurance in North Carolina. Keep in mind, most people who get rate discounts, called subsidies, pay just under $200 per month in North Carolina.

Will ACA subsidies go away in North Carolina in 2026?

No, ACA subsidies won't go away in North Carolina in 2026. But extra pandemic-era subsidies are expiring at the end of 2025. That means North Carolina residents who rely on subsidies can expect the cost of their coverage to increase sharply in the coming year.

What is the largest health insurance company in North Carolina?

Blue Cross Blue Shield of North Carolina is the largest health insurance company in the state, accounting for more than 60% of all active health insurance plans. Blue Cross Blue Shield is usually cheap and has good customer satisfaction in North Carolina. Plus, it is accepted by most doctors and medical offices, which gives you flexibility to choose your health care locations.

What's the average cost of self-insured health insurance in North Carolina?

The cost to self-insure your employees in North Carolina will depend on factors like the size of your business and the average age and medical needs of your employees. It's usually more straightforward to use a traditional insurance company to manage your company's group coverage plan.

How do I get marketplace health insurance in NC?

In North Carolina, you can get marketplace medical insurance through HealthCare.gov. You can buy a plan during open enrollment, from Nov. 1 through Jan. 15. Or you can sign up midyear if you qualify for special circumstances. The best cheap option is usually a Silver plan, which gives you good coverage at a low rate.

Methodology

North Carolina health insurance rate data for 2026 is from the Centers for Medicare & Medicaid Services (CMS). ValuePenguin used the CMS public use files (PUFs) to find average rates for different plan tiers, geographic locations and family sizes.

Rates

Rates are based on a 40-year-old with a Silver plan, unless otherwise noted. Rates for Bronze plans include regular and Expanded Bronze plans for 2024, 2025 and 2026, when the plans are available. Your costs and plan options will vary; plans aren't always available in all parts of a state or county.

Subsidies

Rates after subsidies are estimates for a 40-year-old with a Benchmark Silver plan and are based on how subsidies were structured before 2021. Prices are calculated using KFF's rates for full-price Benchmark plans, federal poverty levels (FPLs), IRS rules about premium tax credits and Congressional reports about expanded tax credits. The total cost in the state uses calculated rates by income, which are weighted using CMS data on the incomes of those who purchased plans during last year's open enrollment. The median was used for each income range. Unknown incomes were excluded from the calculations. Incomes of 100% of the federal poverty line and 500% of the federal poverty line were assumed for enrollees who earn less than 100% FPL and more than 500% FPL, respectively. Information about state subsidies, when available, was sourced from state marketplaces.

Ratings

ValuePenguin's experts rank companies based on cost, coverage options, customer satisfaction and unique value. Ratings are out of 100 possible points. ACA ratings show how the company performs in North Carolina for medical care, member experience and plan administration. This 2026 plan quality data from CMS is based on data from last year. Ratings are not available for new plans or plans with low enrollment.

More sources

Enrollment trends, including plan selections by tier and enrollment by income, are from CMS data for the 2025 open enrollment period.

Other sources include S&P Global Capital IQ and the National Association of Insurance Commissioners (NAIC).

About the Author

Former Senior Writer

Talon Abernathy is a former ValuePenguin Senior Writer who specialized in health insurance, Medicare and Medicaid. He also contributed to other insurance verticals including home, renters, auto, motorcycle and flood insurance.

Talon came to ValuePenguin in 2023. Since his arrival, he's helped to expand the site's health insurance-related content offerings. He enjoys helping readers understand the ins and outs of America's all too complicated health insurance landscape.

Before coming to ValuePenguin, Talon worked as a freelance writer. His prior work has touched on a broad range of personal finance-related topics including credit-building strategies, small business incorporation tactics and creative ways to save for retirement.

Insurance tip

In many parts of the country, you can qualify for a free Silver health insurance plan if you meet certain income requirements. Government subsidies in the form of premium tax credits and cost-sharing reductions may mean you'll pay nothing for coverage.

Expertise

- Health insurance

- Medicare and Medicaid

- Flood insurance

- Homeowners insurance

- Renters insurance

- Auto and motorcycle insurance

Referenced by

- The Miami Herald

- Money.com

- MSN

- Nasdaq

- The Sacramento Bee

- Yahoo! Finance

Education

- BA, University of Washington

- Certificate in Copyediting, UC San Diego

Credentials

- Licensed Life & Disability Insurance Agent

- Licensed Property & Casualty Insurance Agent

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.