Cheapest Car Insurance in Oregon (2026)

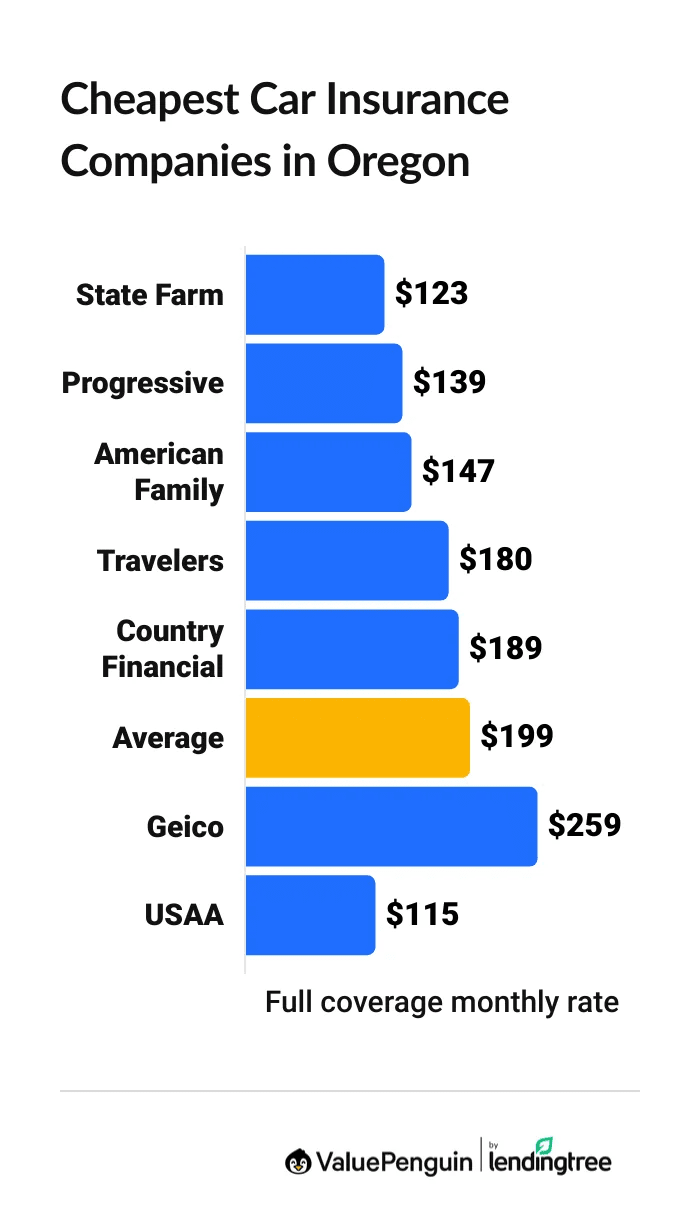

State Farm has the best cheap car insurance in Oregon, at $123 per month for full coverage. That's $76 per month less than the state average.

Find Cheap Auto Insurance Quotes in Oregon

Best cheap auto insurance in Oregon

Best and cheapest car insurance in Oregon

- Cheapest full coverage: State Farm, $123/mo

- Cheapest minimum liability: State Farm, $59/mo

- Cheapest for young drivers: Country Financial, $164/mo

- Cheapest after a ticket: State Farm, $132/mo

- Cheapest after an accident: State Farm, $123/mo

- Cheapest for teens after a ticket: State Farm, $206/mo

- Cheapest after a DUI: Progressive, $160/mo

- Cheapest for poor credit: Progressive, $218/mo

Monthly rates are based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

State Farm offers the best mix of cheap rates and great customer service in Oregon. American Family is also a good choice. It has reliable customer service but is typically more expensive than State Farm.

Country Financial has cheap rates for young drivers. Minimum coverage at Country Financial is the cheapest for Oregon teen drivers. But Country Financial doesn’t have the best reviews. State Farm is the second cheapest and has reliable service.

Cheapest Oregon auto insurance rates: State Farm

State Farm has the cheapest full coverage car insurance in Oregon.

Find Cheap Auto Insurance Quotes in Oregon

State Farm is a great choice for most Oregon drivers because it offers a mix of cheap rates and reliable service. At an average of $123 per month, full coverage from State Farm is $76 per month less than the state average.

Best cheap full coverage car insurance in Oregon

Company | Monthly rate | |

|---|---|---|

| State Farm | $123 | |

| Progressive | $139 | |

| American Family | $147 | |

| Travelers | $180 | |

| Country Financial | $189 |

USAA is only available to current and former military members and their families.

Data-powered research on Oregon car insurance

Cheap car insurance in Oregon for liability-only: State Farm

State Farm has the cheapest liability-only auto insurance in Oregon, at $59 per month.

That's $35 per month less than the Oregon state average, which is $95 per month.

Cheapest Oregon minimum car insurance quotes

Company | Monthly rate |

|---|---|

| State Farm | $59 |

| Progressive | $60 |

| American Family | $64 |

| Travelers | $81 |

| Country Financial | $90 |

USAA is only available to current and former military members and their families.

Find Cheap Auto Insurance Quotes in Oregon

Cheap Oregon auto insurance for young drivers: Country Financial

Country Financial has the cheapest car insurance in Oregon for teen drivers.

A minimum coverage policy from Country Financial costs $164 per month for an 18-year-old driver. That's $130 less than the average rate for young drivers in Oregon, which is $293 per month.

Country Financial also has the cheapest full coverage rates for Oregon teens. At $357 per month, full coverage from Country Financial is 42% less than the Oregon average.

Cheapest auto insurance in Oregon for teens

Company | Liability only | Full coverage |

|---|---|---|

| Country Financial | $164 | $357 |

| State Farm | $191 | $384 |

| Travelers | $221 | $515 |

| Geico | $234 | $543 |

| Progressive | $244 | $556 |

USAA is only available to current and former military members and their families.

In Oregon, 18-year-old drivers pay more than triple the price 30-year-olds pay for car insurance. Young drivers usually pay more for insurance than adults because they're more likely to cause an accident.

If you've already compared car insurance from multiple companies and still need to get your rate down, there are a few things you can try.

Consider sharing a policy with your parents. A combined insurance policy will increase your parents' rates, but it can save you a lot compared to buying a separate policy.

Look for discounts. Most insurance companies have discounts geared toward young drivers.

For example, State Farm's Steer Clear program offers a discount for young drivers who complete online courses and practice driving with a mentor.

Cheap Oregon car insurance after a ticket: State Farm

State Farm has the most affordable car insurance rates in Oregon for drivers with a speeding ticket. Full coverage from State Farm costs around $132 per month. That's about half the state average, and $43 per month less than the second-cheapest option, American Family.

Low-cost car insurance in Oregon for drivers with a ticket

Company | Monthly rate |

|---|---|

| State Farm | $132 |

| American Family | $175 |

| Progressive | $176 |

| Travelers | $231 |

| Country Financial | $247 |

USAA is only available to current and former military members and their families.

In Oregon, a single speeding ticket increases insurance rates by 29%. That's an average increase of $58 per month for a full coverage policy.

Cheapest car insurance in OR after an accident: State Farm

State Farm has the best full coverage quotes after an accident, averaging $123 per month. That's $185 per month less than the Oregon state average.

Best auto insurance companies in Oregon after an accident

Company | Monthly rate |

|---|---|

| State Farm | $123 |

| Progressive | $196 |

| American Family | $252 |

| Travelers | $259 |

| Country Financial | $272 |

USAA is only available to current and former military members and their families.

Average quotes for a full coverage policy go up by about $106 a month after an at-fault accident in Oregon.

Don't worry about switching car insurance companies right after your accident. Your rates won't go up until your current policy renews. However, any quotes you get will consider your accident, so they'll probably be higher than what you currently pay.

Instead, wait until your insurance company sends your renewal offer, which is usually a few weeks to a month before your policy expires. Then, you should shop around for quotes from multiple companies to find the best rate for you.

Cheapest OR insurance for teens with a ticket or accident: State Farm

State Farm has the best rates for young Oregon drivers with a speeding ticket. Minimum coverage auto insurance from State Farm costs $206 per month for an 18-year-old with one ticket, which is $160 cheaper than the statewide average.

The cheapest coverage for teens who have an accident on their record also comes from State Farm, at $191, which is less than half the average in Oregon.

Cheap quotes for Oregon teens after a ticket or accident

Company | Ticket | Accident |

|---|---|---|

| State Farm | $206 | $191 |

| Country Financial | $216 | $242 |

| Progressive | $249 | $257 |

| Travelers | $274 | $320 |

| American Family | $289 | $397 |

USAA is only available to current and former military members and their families.

An 18-year-old driver with a speeding ticket pays 25% more for car insurance than a young driver with a clean record in Oregon. Teen rates go up by 39% in Oregon after an at-fault accident.

Cheap car insurance in Oregon after a DUI: Progressive

Progressive offers the cheapest quotes for Oregon drivers with a DUI. At $160 per month, full coverage from Progressive costs less than half the Oregon average after a DUI.

Best Oregon car insurance quotes after a DUI

Company | Monthly rate |

|---|---|

| Progressive | $160 |

| State Farm | $250 |

| Travelers | $271 |

| American Family | $271 |

| Allstate | $414 |

USAA is only available to current and former military members and their families.

Oregon drivers with a DUI pay an average of 89% more for a full coverage policy than drivers with a clean record.

In addition, drivers may have to get SR-22 insurance in Oregon after a DUI. Insurance companies typically charge between $15 and $50 to file an SR-22 form on your behalf. That's on top of any increase to your car insurance rates.

Cheapest Oregon auto insurance for drivers with poor credit: Progressive

Progressive offers the best rates for Oregon drivers with a low credit score or no credit history. A full coverage policy from Progressive costs $218 per month, which is $167 per month cheaper than the state average.

Best car insurance in Oregon for poor credit

Company | Monthly rate |

|---|---|

| Progressive | $218 |

| American Family | $249 |

| Country Financial | $305 |

| Travelers | $322 |

| Geico | $383 |

USAA is only available to current and former military members and their families.

Oregon drivers with a bad credit score pay 94% more for car insurance than those with good credit. That's because insurance companies believe that drivers with bad credit are more likely to file claims.

Best auto insurance in Oregon: USAA

USAA has the best car insurance in Oregon because it offers great customer service and affordable quotes.

However, USAA car insurance is only available to current and former military members and their families.

State Farm is the best option for drivers who can't get USAA. It has reliable customer service and some of the lowest rates in Oregon.

Top car insurance companies in Oregon

Company |

Editor's rating

|

J.D. Power

|

AM Best

|

|---|---|---|---|

| USAA | 735 | A++ | |

| State Farm | 650 | A++ | |

| American Family | 640 | A | |

| Farmers | 622 | A | |

| Travelers | 613 | A++ |

Average car insurance cost in Oregon by city

Baker City, a very small city crowned by five national forests, has the cheapest car insurance in Oregon.

Drivers in Baker City pay an average of $203 per month for full coverage insurance.

Maywood Park, a Portland suburb, has the most expensive average rate in the state, at $310 per month. That's because urban areas tend to have more car thefts.

Oregon car insurance rates by city

City | Monthly rate | % from average |

|---|---|---|

| Adams | $215 | 8% |

| Adel | $224 | 13% |

| Adrian | $221 | 11% |

| Agness | $209 | 5% |

| Albany | $207 | 4% |

Oregon auto insurance minimum requirements

Drivers in Oregon must have a minimum amount of liability insurance to drive legally, which is sometimes written as 25/50/20.

Oregon also requires matching uninsured motorist bodily injury limits, as well as personal injury protection (PIP). Oregon is unique in that it isn’t a no-fault state, but it requires personal injury protection insurance.

- Bodily injury liability: $25,000 per person and $50,000 per accident

- Property damage liability: $20,000

- Uninsured motorist bodily injury: $25,000 per person and $50,000 per accident

- Personal injury protection (PIP): $15,000

What's the best car insurance coverage in Oregon?

Most drivers in Oregon should consider a full coverage policy, along with higher liability limits than the state requires.

Full coverage car insurance includes liability coverage as well as comprehensive and collision coverages. Both of these coverage types are typically required with a car loan or lease.

- Collision coverage pays for damage to your own car when you're in an accident, even if it's your fault.

- Comprehensive coverage pays for damage caused by events beyond your control, like hail or theft.

Higher liability limits give you more protection if you cause an accident so that you don't have to pay out of your own pocket for the repairs and injuries you cause.

For example, if you crash into and total a brand-new car, $20,000 of property damage liability coverage probably won't be enough to fully replace it. If you only have minimum liability insurance, you'll have to pay the remainder out of pocket.

Just because you have a full coverage policy doesn't mean your insurance will cover every expense associated with an accident.

For example, your car insurance company won't pay for a rental car unless you add rental car reimbursement to your policy. Make sure you look at all of the coverage options available when shopping for insurance, so you can add any protection that's important to you.

Frequently asked questions

Who has the cheapest car insurance rates in Oregon?

State Farm has the cheapest car insurance rates in Oregon in 2026. Full coverage from State Farm costs around $123 per month, which is about 38% cheaper than the state average. State Farm also has the cheapest liability-only coverage in Oregon, at an average of $59 per month.

How much is the average car insurance per month in Oregon?

The average cost of car insurance in Oregon is $199 per month for a full coverage policy. That's $9 per month less than the U.S. average. This is despite the fact that Oregon has higher car theft rates than many other states, according to the FBI.

How much is car insurance in Salem, Oregon?

The average cost of car insurance in Salem is $250 per month for a full coverage policy. That's 25% more expensive than the Oregon state average. In comparison, auto insurance in Portland costs $281 per month, on average.

Methodology

To find the best cheap insurance in Oregon, ValuePenguin collected thousands of rates from ZIP codes across Oregon for the state's largest insurance companies. Rates are for a 30-year-old man with good credit who owns a 2018 Honda Civic EX.

Full coverage quotes include the following limits:

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Personal injury protection (PIP): $15,000

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision: $500 deductible

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used for comparative purposes only. Your own quotes may be different.

About the Author

Senior Writer

Jenn Jones is a Senior Writer at LendingTree where she covers auto, home, renters and motorcycle insurance topics.

Previously an editor for USA TODAY Blueprint and a finance manager at World Car dealerships, she has more than a decade of experience in the world of personal finance and a deep interest in sharing knowledge that empowers others. She’s also served as a freelance translator, copy editor, writer and researcher. She graduated from the University of Virginia with a B.S. in commerce and a B.A. in Chinese language and literature.

How insurance helped Jenn

Jenn first came to appreciate pet insurance when annual checkups for her cat and dog totaled more than $700.

Expertise

- Auto insurance

- Renters insurance

- Condo insurance

- Home insurance

Referenced by

- USA TODAY

- MSN

- F&I Magazine

- Automotive News

Education

- BS, Commerce, University of Virginia

- BA, Chinese Language and Literature, University of Virginia

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.