Cheapest Auto Insurance Quotes in North Carolina (2026)

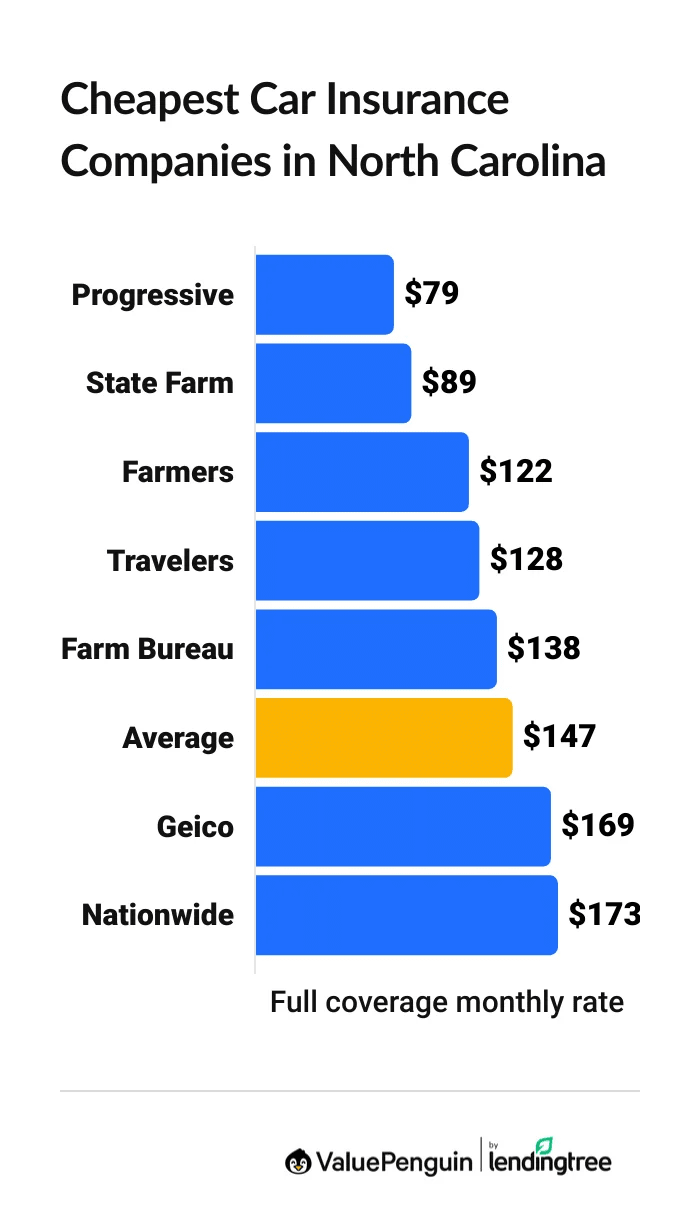

Progressive has the cheapest full coverage car insurance in North Carolina, at $79 per month. That's $68 per month less than the state average.

Find Cheap Auto Insurance Quotes in North Carolina

Best cheap car insurance in North Carolina

Best and cheapest car insurance in North Carolina

- Cheapest full coverage: Progressive, $79/mo

- Cheapest minimum liability: State Farm, $41/mo

- Cheapest for young drivers: State Farm, $82/mo

- Cheapest after a ticket: Progressive, $103/mo

- Cheapest after an accident: Progressive, $122/mo

- Cheapest for teens after a ticket: State Farm, $95/mo

- Cheapest after a DUI: Progressive, $290/mo

- Cheapest for poor credit: Progressive, $79/mo

Monthly rates are based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

State Farm offers the best mix of affordable rates and reliable customer service. Although Progressive has cheaper rates for many drivers, its customer service isn't as good.

Cheapest full coverage car insurance in NC: Progressive

Progressive and State Farm have the cheapest full coverage insurance in North Carolina.

Find Cheap Auto Insurance Quotes in North Carolina

- State Farm is the best choice for many North Carolina drivers. Full coverage insurance from State Farm is $89 per month. While that's $10 per month more than Progressive, State Farm's excellent customer service may be worth the extra cost — especially if you're in an accident in the future.

- Progressive has the cheapest full coverage rates, at $79 per month. That's $68 per month less than the North Carolina average.

Cheap full coverage car insurance quotes in NC

Company | Monthly rate | |

|---|---|---|

| Progressive | $79 | |

| State Farm | $89 | |

| Farmers | $122 | |

| Travelers | $128 | |

| Farm Bureau | $138 |

Data-powered research on North Carolina car insurance

Data-powered research on NC car insurance |

|---|

Cheapest liability insurance in NC: State Farm

State Farm has the cheapest minimum liability insurance in North Carolina, at around $41 per month.

That's $19 per month less than the statewide average of $60 per month.

Cheapest NC liability insurance rates

Company | Monthly rate |

|---|---|

| State Farm | $41 |

| Progressive | $44 |

| Travelers | $56 |

| Farm Bureau | $57 |

| Nationwide | $59 |

Find Cheap Auto Insurance Quotes in North Carolina

Cheapest car insurance in NC for new drivers: State Farm and Progressive

State Farm has the cheapest minimum liability rates in North Carolina for new drivers. A minimum liability policy from State Farm costs $82 per month for an 18-year-old driver, on average. That's $44 per month less than the North Carolina average.

Progressive has the cheapest full coverage for young drivers in NC, at an average of $158 per month. That's nearly half the state average.

If you need full coverage insurance, you should also compare quotes from State Farm. While it's more expensive than Progressive, at $172 per month on average, it has much better customer service reviews. State Farm's great service could be helpful if you're in a crash.

Cheap NC auto insurance for new drivers

Company | Liability only | Full coverage |

|---|---|---|

| State Farm | $82 | $172 |

| Progressive | $92 | $158 |

| Geico | $106 | $300 |

| Travelers | $123 | $269 |

| Nationwide | $125 | $355 |

It's illegal for insurance companies to use your age to set your car insurance rates in North Carolina. However, companies can consider your driving experience.

New drivers typically pay much more for insurance than experienced drivers.

An 18-year-old driver in North Carolina who got their license at 16 pays more than twice as much for car insurance as a 30-year-old with more than a decade of driving experience. That's because new drivers are more likely to cause an accident.

Young drivers in North Carolina can get the cheapest rates by sharing a policy with their parents.

Cheap NC car insurance after a speeding ticket: Progressive

Progressive has the cheapest car insurance in NC for drivers with a recent speeding ticket. Full coverage costs $103 per month with Progressive, which is half the state average.

State Farm has better customer service reviews than Progressive, so it could be a better option for many drivers. State Farm is slightly more expensive, but at $116 per month, it's still much cheaper than average.

Best auto insurance quotes in NC after a ticket

Company | Monthly rate |

|---|---|

| Progressive | $103 |

| State Farm | $116 |

| Farmers | $162 |

| Farm Bureau | $182 |

| Travelers | $197 |

A speeding ticket raises rates by around 39% in North Carolina. That's an average of $57 per month more than drivers with clean records pay for full coverage insurance.

However, the amount your car insurance will go up depends on how fast you were driving.

Your rates may go up much more if you get a ticket for going more than 10 mph over the speed limit, according to North Carolina's Safe Driver Incentive Plan.

Best cheap auto insurance in NC after an accident: Progressive

Progressive is the cheapest insurance company for North Carolina drivers who have caused an accident. Full coverage insurance from Progressive costs just $122 per month after an accident, which is less than half the North Carolina average.

North Carolina drivers should also compare quotes from State Farm after a crash. At $137 per month, State Farm is only a bit more expensive than Progressive. But State Farm's great customer service could be worth the extra cost, especially if you're in another accident in the future.

Most affordable car insurance in NC after an accident

Company | Monthly rate |

|---|---|

| Progressive | $122 |

| State Farm | $137 |

| Farmers | $191 |

| Farm Bureau | $216 |

| Travelers | $229 |

The cost of car insurance in North Carolina goes up by an average of 69% after an at-fault accident. That's an average increase of $101 per month for a full coverage policy.

Best for new drivers in NC with a ticket or an accident: State Farm

State Farm has the cheapest auto insurance quotes for new drivers with either a ticket or an accident on their driving record.

Minimum liability coverage from State Farm costs $95 per month for an 18-year-old driver with a recent speeding ticket. That's $52 per month cheaper than the North Carolina average.

State Farm also has the most affordable quotes for new drivers after an at-fault accident. At $104 per month, minimum coverage from State Farm is $62 per month less than the statewide average.

Cheap insurance in NC for new drivers with a ticket or accident

Company | Ticket | Accident |

|---|---|---|

| State Farm | $95 | $104 |

| Progressive | $105 | $115 |

| Geico | $118 | $178 |

| Nationwide | $143 | $157 |

| Farmers | $144 | $157 |

New drivers can expect to pay 17% more for insurance after getting a single speeding ticket, and 32% more after causing a crash.

Cheap North Carolina auto insurance after a DUI: Progressive

Progressive has the most affordable car insurance in NC for drivers with a recent DUI. Full coverage from Progressive costs $290 per month, which is less than half the North Carolina state average after a DUI.

Cheapest car insurance rates in North Carolina after a DUI

Company | Monthly rate |

|---|---|

| Progressive | $290 |

| State Farm | $325 |

| Farmers | $457 |

| Travelers | $478 |

| Geico | $593 |

North Carolina drivers with a DUI pay four times more for car insurance than drivers with clean driving records, on average. That's because insurance companies believe drivers with DUIs are more likely to cause an accident in the future.

Cheap auto insurance in NC for drivers with poor credit: Progressive

Progressive has the cheapest full coverage quotes for NC drivers with poor credit, averaging $79 per month. That's significantly less than half the North Carolina average of $248 per month. It's also $43 per month less than the second-cheapest option, Farmers.

Best rates for car insurance in NC with bad credit

Company | Monthly rate |

|---|---|

| Progressive | $79 |

| Farmers | $122 |

| Nationwide | $173 |

| Travelers | $174 |

| Farm Bureau | $197 |

On average, North Carolina drivers with bad credit pay $102 more per month for full coverage insurance than those with good credit. Insurance companies believe drivers with lower credit scores tend to file more insurance claims, so companies often charge more to make up the extra costs.

Best car insurance in NC

State Farm has the best car insurance in North Carolina because of its good customer support, coverage options and affordable rates.

Farm Bureau also offers reliable customer service, but it's typically more expensive than State Farm.

Top insurance companies in North Carolina

Company |

Editor's rating

|

J.D. Power

|

AM Best

|

|---|---|---|---|

| State Farm | 650 | A++ | |

| Farm Bureau | 645 | A | |

| Nationwide | 645 | A | |

| Farmers | 622 | A | |

| Travelers | 613 | A++ |

Average North Carolina car insurance rates by city

Carolina Shores, a coastal town near the South Carolina border, has the cheapest auto insurance in NC.

Full coverage in Carolina Shores costs just $125 per month.

Newell, a community just outside of Charlotte, has the most expensive car insurance rates in North Carolina. Full coverage in Newell costs around $190 per month.

Full coverage NC car insurance quotes by city

City | Monthly rate | % from average |

|---|---|---|

| Aberdeen | $141 | -4% |

| Advance | $134 | -9% |

| Ahoskie | $151 | 3% |

| Alamance | $145 | -1% |

| Albemarle | $141 | -4% |

The average cost of full coverage car insurance in North Carolina is $147 per month. But rates can differ by up to $65 per month from one city to the next.

Large cities with more traffic and higher crime rates typically have more expensive car insurance quotes.

For example, Charlotte, the largest city in North Carolina, has some of the highest rates in the state, at $166 per month. That's because the added traffic and higher theft rates in big cities mean drivers there are more likely to get in accidents or have their cars stolen.

Cheap car insurance in NC by driver type

State Farm and Progressive have the cheapest car insurance for most North Carolina drivers.

Driver type | Cheapest company |

Monthly cost

|

|---|---|---|

| Cheapest liability-only | State Farm | $41 (31% savings) |

| Cheapest for a safe driver | Progressive | $79 (46% savings) |

| Cheapest for poor credit | Progressive | $79 (68% savings) |

| Cheapest for teens | State Farm | $82 (35% savings) |

| Cheapest after a ticket | Progressive | $103 (49% savings) |

| Cheapest after an accident | Progressive | $122 (51% savings) |

| Cheapest after a DUI | Progressive | $290 (51% savings) |

North Carolina car insurance requirements

As of July 1, 2025, you are required to have at least 50/100/50 of liability insurance to drive legally in North Carolina.

You also need to have matching uninsured and underinsured motorist coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $50,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Uninsured and underinsured motorist property damage: $50,000 per accident

Drivers with minimum coverage won't have to do anything. Your insurance company will automatically raise your limits to meet the new legal requirements. But you should expect your rates to go up since you'll have more coverage.

What's the best car insurance to get in North Carolina?

Full coverage is the best car insurance in NC if you can afford it.

Full coverage car insurance in North Carolina costs $87 per month more than minimum liability coverage. That's because it comes with coverage that pays for many types of damage to your car, called comprehensive and collision coverage.

If you have a loan or lease on your car, your lender will require you to have full coverage insurance. You should also consider full coverage if you have a car that's worth more than $5,000 or less than 8 years old, or if you don't have enough money to repair or replace your car on your own.

You only need to have minimum liability to drive legally, but it's usually not the best choice. That's because minimum coverage is often not enough to pay for an expensive accident. And it doesn't offer any protection for your vehicle.

Frequently asked questions

Who has the cheapest auto insurance in NC?

In 2026, Progressive has the cheapest full coverage auto insurance in North Carolina, at $79 per month. That's 46% cheaper than the state average.

State Farm has the cheapest minimum liability quotes, at $41 per month.

How much is the average cost of car insurance in NC?

The average cost of auto insurance in North Carolina is $60 per month for a minimum liability policy. Full coverage costs $147 per month, on average.

What is the minimum car insurance in NC?

Minimum car insurance in North Carolina needs to have $50,000 of bodily injury liability coverage per person and $100,000 per accident, which pays for other people's injuries. It also includes $50,000 of property damage liability, to pay to repair anything you damage. You must also have matching uninsured and underinsured motorist coverage.

How much is auto insurance in Raleigh, NC?

Car insurance in Raleigh costs an average of $148 per month for full coverage. That's only 1% more than the North Carolina state average. In comparison, drivers in Charlotte pay $166 per month for full coverage.

Why is car insurance so cheap in North Carolina?

North Carolina car insurance rates are cheaper than in other parts of the country in part because the state has lower car theft rates than the national average. Many North Carolina drivers also live in rural areas, which tend to have less traffic congestion and fewer accidents. However, people living in bigger cities like Charlotte or Raleigh may pay more for car insurance.

Methodology

To find the best cheap car insurance in NC, ValuePenguin collected thousands of rates from ZIP codes across North Carolina from the state's largest insurance companies. Quotes are for a 30-year-old man with a 2018 Honda Civic EX who has good credit.

Full coverage rates include liability coverage, plus collision and comprehensive coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $50,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Uninsured and underinsured motorist property damage: $50,000 per accident

- Comprehensive and collision: $500 deductible

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used for comparative purposes only. Your own quotes may be different.

Senior Writer

Lindsay Bishop is a Senior Writer at ValuePenguin, where she educates readers about home, auto, renters, flood and motorcycle insurance.

Lindsay began her career in the insurance and financial industry in 2010. She was a licensed auto, home, life and health insurance agent and held Series 6 and 63 financial licenses.

After a hiatus from the financial sector, Lindsay returned to the industry as a content writer for ValuePenguin in 2021. She enjoys having the opportunity to help readers make smart decisions about their insurance so they can be prepared for anything life throws their way.

When Lindsay isn't writing about insurance, you can find her spending time with family, enjoying the outdoors on Sunday long runs or riding her Peloton.

How insurance helped Lindsay

As a homeowner for 15 years located in South Carolina, Lindsay has plenty of experience navigating the coastal insurance market and managing the claims process. That includes successfully negotiating a full roof replacement claim.

Expertise

- Home insurance

- Car insurance

- Flood insurance

- Renters insurance

- Motorcycle insurance

Referenced by

- CNBC

- Yahoo Finance

- Miami Herald

Education

- BS/BA Economics, University of Nevada Las Vegas

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.