Cheapest Car Insurance Quotes in Montana (2026)

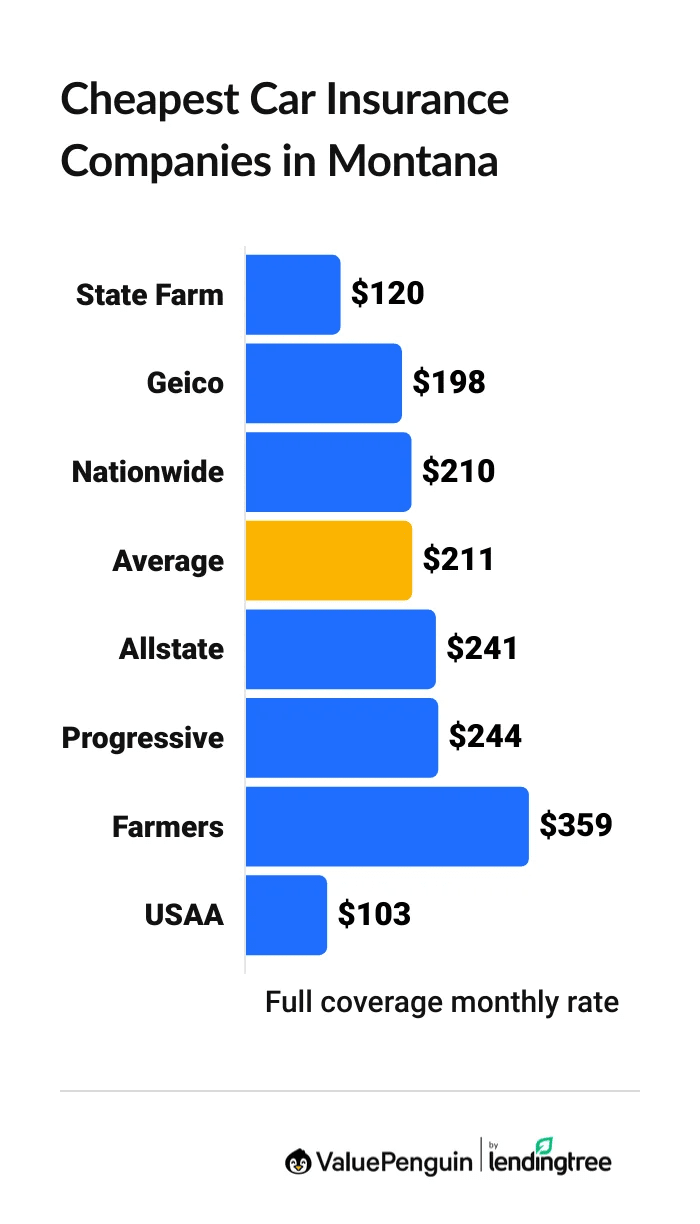

State Farm has the best cheap car insurance in Montana, at $120 per month for full coverage. That's 43% less than the state average of $211 per month.

Find Cheap Car Insurance Quotes in Montana

Best cheap Montana car insurance

Best and cheapest car insurance in Montana

- Cheapest full coverage: State Farm, $120/mo

- Cheapest minimum liability: State Farm, $25/mo

- Cheapest for young drivers: State Farm, $83/mo

- Cheapest after a ticket: State Farm, $127/mo

- Cheapest after an accident: State Farm, $120/mo

- Cheapest for teens after a ticket: State Farm, $92/mo

- Cheapest after a DUI: State Farm, $247/mo

- Cheapest for poor credit: Geico, $283/mo

State Farm has the best combination of great service and cheap quotes in Montana.

Drivers with military ties may find even cheaper rates from USAA. It also has a reputation for excellent customer service.

Cheapest auto insurance in MT: State Farm

State Farm has the best cheap full coverage insurance quotes in Montana.

Find Cheap Car Insurance Quotes in Montana

- State Farm is the best choice for most Montana drivers because it offers a combination of cheap rates and great customer service. At $120 per month, full coverage from State Farm costs $78 per month less than the second-cheapest company, Geico.

- USAA is an excellent choice for drivers with military ties, at $103 per month. It's even cheaper than State Farm, but USAA insurance is only available to military members, veterans and some of their family members.

Best cheap full coverage car insurance in Montana

Company | Monthly rate | |

|---|---|---|

| State Farm | $120 | |

| Geico | $198 | |

| Nationwide | $210 | |

| Allstate | $241 | |

| Progressive | $244 |

*USAA is only available to current and former military members and their families.

Data-powered research on Montana car insurance

Data-powered research on MT car insurance |

|---|

Cheapest liability insurance quotes in Montana: State Farm

State Farm has the cheapest minimum liability car insurance in Montana.

At $25 per month, coverage from State Farm is less than half the state average.

Military members, veterans and their families can also find cheap quotes at USAA. The company's average monthly rate is $21 per month.

Cheap minimum coverage MT auto insurance quotes

Company | Monthly rate | |

|---|---|---|

| State Farm | State Farm | $25 |

| Geico | Geico | $36 |

| Progressive | Progressive | $59 |

| Nationwide | Nationwide | $67 |

| Farmers | Farmers | $73 |

*USAA is only available to current and former military members and their families.

Find Cheap Car Insurance Quotes in Montana

Best cheap auto insurance in Montana for teens: State Farm

State Farm has the cheapest quotes in Montana for young drivers.

State Farm charges only $83 per month for minimum liability coverage for 18-year-old drivers in Montana. That's around half the state average.

State Farm also has the best prices for full coverage, at $335 per month.

Cheapest Montana auto insurance quotes for young drivers

Company | Liability only | Full coverage |

|---|---|---|

| State Farm | $83 | $335 |

| Geico | $119 | $638 |

| Progressive | $159 | $700 |

| Allstate | $174 | $463 |

| Nationwide | $246 | $587 |

*USAA is only available to current and former military members and their families.

On average, an 18-year-old driver in Montana pays $160 per month for minimum liability coverage. That's triple the cost for 30-year-old drivers.

Insurance companies charge teen drivers more because younger people statistically get in more accidents and file more insurance claims compared to older drivers.

The easiest, most effective way for most teen drivers to lower their car insurance rates is to share a policy with an older adult, like a parent or sibling.

Many companies also have discounts geared toward young drivers. For example, State Farm offers the Steer Clear Program, where young drivers can save by taking online courses and practicing with a mentor.

Cheapest MT auto insurance quotes after a speeding ticket: State Farm

State Farm has the cheapest quotes for drivers in Montana with a recent speeding ticket. A full coverage policy from State Farm costs $127 per month after a single ticket. That's less than half the cost of the Montana state average.

Company | Monthly rate |

|---|---|

| State Farm | $127 |

| Geico | $255 |

| Allstate | $255 |

| Nationwide | $300 |

| Progressive | $324 |

*USAA is only available to current and former military members and their families.

On average, Montana drivers can expect their insurance to go up by 27% after a single speeding ticket.

In Montana, your insurance rates will usually go up for three years after a ticket or accident. Insurance companies typically charge higher rates for drivers with speeding tickets because they tend to be more likely to cause accidents in the future.

Affordable insurance in Montana after an accident: State Farm

State Farm has the cheapest quotes in Montana for drivers with an at-fault accident on their record. A full coverage policy from State Farm costs just $120 per month after an accident, which is $190 per month less than the state average.

Company | Monthly rate |

|---|---|

| State Farm | $120 |

| Geico | $339 |

| Nationwide | $360 |

| Allstate | $362 |

| Progressive | $364 |

*USAA is only available to current and former military members and their families.

On average, insurance quotes in Montana go up by 47% after an accident.

Don't start shopping for a new policy right after an accident. Your rates with your current company won't go up until your policy renews. However, any quotes you get will probably be higher than what you're currently paying, because they'll factor in your accident.

Instead, wait until you get your renewal offer in the mail. It should come a few weeks to one month before your policy expires. That gives you plenty of time to compare quotes and find the best accident rates for you.

Best Montana auto insurance rates for teens after a ticket or accident: State Farm

State Farm has the cheapest rates for teen drivers after a speeding ticket or accident. At State Farm, young drivers pay around $92 per month for minimum coverage insurance after a ticket, and $83 after an accident. That's about half the average cost in Montana.

Company | Ticket | Accident |

|---|---|---|

| State Farm | $92 | $83 |

| Geico | $139 | $160 |

| Progressive | $173 | $184 |

| Allstate | $189 | $290 |

| Nationwide | $266 | $269 |

*USAA is only available to current and former military members and their families.

Teen drivers can save money after a speeding ticket by getting as many discounts as possible. Many insurance companies offer discounts to young drivers for taking a driver safety course or having a high GPA in high school or college.

Cheap auto insurance companies in Montana after a DUI: State Farm

State Farm has the most affordable insurance quotes for Montana drivers with a DUI. At $247 per month, full coverage from State Farm costs about one-third less than the state average.

Company | Monthly rate |

|---|---|

| State Farm | $247 |

| Progressive | $287 |

| Allstate | $328 |

| Farmers | $469 |

| Nationwide | $483 |

*USAA is only available to current and former military members and their families.

Driving under the influence is a serious offense, and car insurance companies almost always increase your rates after you get a DUI. The average cost of a full coverage policy after one DUI in Montana is $378 per month. That's $168 per month more than drivers with a clean record pay for the same coverage.

Montana drivers with a DUI may need SR-22 insurance.

Insurance companies typically charge a one-time fee between $15 and $50 to file an SR-22 form on your behalf. That's on top of any increase in your insurance rates. It also means the DMV will know right away if your policy ends, so don't accidentally let your policy expire — if that happens, your car registration will lapse and you could lose your license.

Cheapest Montana car insurance rates for drivers with poor credit: Geico

Geico has the best car insurance rates for Montana drivers with poor credit. At $283 per month, Geico is $115 per month cheaper than the Montana state average.

Company | Monthly rate |

|---|---|

| Geico | $283 |

| Nationwide | $334 |

| Allstate | $357 |

| Progressive | $386 |

| Farmers | $588 |

*USAA is only available to current and former military members and their families.

Montana drivers with poor credit pay close to twice as much for full coverage as those with good credit scores. That's because insurance companies believe drivers with a poor credit score are more likely to make a claim in the future.

Best car insurance in Montana

USAA has the best car insurance in Montana because it offers an excellent combination of great customer service and cheap rates.

USAA earned the highest score on J.D. Power's customer satisfaction study and has top financial stability marks. However, only military members, veterans and their families can buy USAA car insurance.

State Farm is the best choice for drivers who aren't eligible for USAA. It also has reliable customer service and cheap rates for most drivers.

Top Montana car insurance companies

Company |

Editor's rating

|

JD Power

|

AM Best

|

|---|---|---|---|

| USAA | 735 | A++ | |

| State Farm | 650 | A++ | |

| Nationwide | 645 | A | |

| Farmers | 622 | A | |

| Geico | 645 | A++ |

Average cost of auto insurance in Montana by city

Bonner-West Riverside, a suburb of Missoula, has the cheapest car insurance rates in the state.

The average cost of car insurance in Bonner-West Riverside, near Missoula, is $180 per month for a full coverage policy.

Drivers in Lodge Grass, in the Crow Indian Reservation, pay the highest rates in the state at $229 per month.

Average Montana car insurance rates by city

City | Monthly rate | % from average |

|---|---|---|

| Absarokee | $212 | 1% |

| Acton | $210 | 0% |

| Alberton | $194 | -8% |

| Alder | $193 | -9% |

| Alzada | $211 | 0% |

Where you live can affect the cost of your car insurance as much as your driving habits. However, insurance rates in Montana don't vary much by town or city. The difference in price between the cheapest and most expensive cities is only $49 per month.

Montana car insurance requirements

Montana requires drivers to have a minimum amount of liability insurance coverage to avoid penalties, which is sometimes written as 25/50/20.

- Bodily injury liability (BI): $25,000 per person and $50,000 per accident

- Property damage liability (PD): $20,000 per accident

Montana doesn’t require uninsured motorist coverage. However, insurance companies must offer it as part of liability coverage. Drivers have the option of declining uninsured motorist coverage.

What's the best car insurance coverage for Montana drivers?

Most drivers should consider buying a full coverage auto insurance policy rather than minimum coverage.

That's because minimum coverage has low liability limits and no comprehensive or collision coverage. That means you won't have any protection for your own car and will usually end up paying more if you cause an accident.

For example, if you cause a serious accident with a brand-new car, $20,000 of property damage liability probably won't be enough to replace the other driver's vehicle. So if you have minimum liability coverage, you'll need to pay the difference yourself, as well as the cost of fixing your own car.

In addition to liability coverage, full coverage policies pay for your car’s damage in accidents you cause, along with things outside of your control, like hail and vandalism.

Lenders typically require you to have a full coverage policy with collision and comprehensive coverage if you have a car loan or lease. You should also consider adding these coverages if your car is less than eight years old or worth more than $5,000.

Frequently asked questions

What is the cheapest auto insurance in Montana?

In 2026 State Farm has the cheapest auto insurance in Montana. The company charges an average of $120 per month for a full coverage policy and $25 per month for a minimum liability policy. Those are around half the state averages of $211 and $52 per month.

Consider Geico if you have a poor credit score.

How much is car insurance in Montana?

The average cost of car insurance in Montana is $211 per month for full coverage — $3 per month more than the national average. That's partially because Montana has much higher rate of alcohol-related driving deaths than the national average.

What is the best car insurance in Montana?

USAA is the best-rated car insurance company in Montana due to its cheap rates and excellent customer service. However, only military members, veterans and their families can get USAA car insurance. State Farm is the best choice for drivers who aren't eligible for USAA.

How much is car insurance in Billings, MT?

A full coverage policy costs $209 per month in Billings, which is $2 per month less than the Montana state average. In comparison, car insurance in Missoula, MT costs an average of $182 per month, and people living in Bozeman pay an average of $192 per month.

What car insurance is required in Montana?

Drivers in Montana must buy insurance with at least 25/50/20 of liability coverage. That means you'll need $25,000 of bodily injury liability coverage per person and $50,000 per accident, along with $20,000 of property damage liability coverage per accident.

Methodology

ValuePenguin experts collected thousands of quotes from cities across Montana for the state's largest insurance companies. Quotes are for a 30-year-old man with good credit who owns a 2018 Honda Civic EX.

Quotes are for a full coverage policy with comprehensive and collision and liability limits higher than state minimums.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $50,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision: $500 deductible

Rate data for this study was collected from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used for comparative purposes only. Your own quotes will differ.

Lead Writer

Matt Timmons is a Lead Writer on the insurance team at ValuePenguin, where he writes in-depth and timely pieces helping find the right coverage for them.

He's covered insurance at ValuePenguin since 2018, specializing in auto and home insurance, as well as life insurance. He's paid special attention to the EV insurance market, where prices are much higher than for gas cars.

Before he started writing about personal finance, Matt wrote about professional skills and online tools at an e-learning company.

How insurance helped Matt

During freshman orientation in college, Matt's iPod was stolen off his table while he was eating lunch. Luckily, he'd bought a college insurance plan the day before and he had money to buy a replacement before classes started.

Expertise

- Auto insurance

- Home insurance

- Insurance rate analysis

- Life insurance

Referenced by

- CNBC

- Miami Herald

- Yahoo! Finance

Education

- BA, Wesleyan University

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.