Allstate Insurance Reviews: Auto and Motorcycle

Allstate's expensive car insurance quotes and difficult claims process make it a poor choice for most people.

Find Cheap Auto Insurance Quotes in Your Area

Is Allstate a good insurance company?

Allstate auto insurance isn't a great choice for most people. Its car and motorcycle insurance are typically very expensive. Even though it offers many discounts, it's unlikely you'll save enough to make Allstate the best choice for you.

In addition, Allstate's customer service reviews aren't great, especially when it comes to its claims process.

The main reason you should consider Allstate is if you're looking to bundle your auto and home insurance policies. Its home insurance is usually affordable, and some people find it easier to have all of their insurance policies with one company.

| Price | |

| Coverage | |

| Customer service | |

| Unique value |

Pros and cons of Allstate auto insurance

Pros

Lots of discounts

Helpful coverage add-ons to protect your car

Good for bundling with home insurance

Cons

Expensive rates

Poor claims experience

Allstate car insurance review

Allstate auto insurance isn't the best choice for most people.

Its expensive rates and poor claims service mean you can probably find cheaper, more reliable coverage elsewhere.

However, it may be worthwhile to compare rates from Allstate if you plan to bundle your auto and home insurance. Its affordable home insurance rates and bundling discount of up to 25% may offset Allstate's high car insurance rates.

Allstate auto insurance quotes

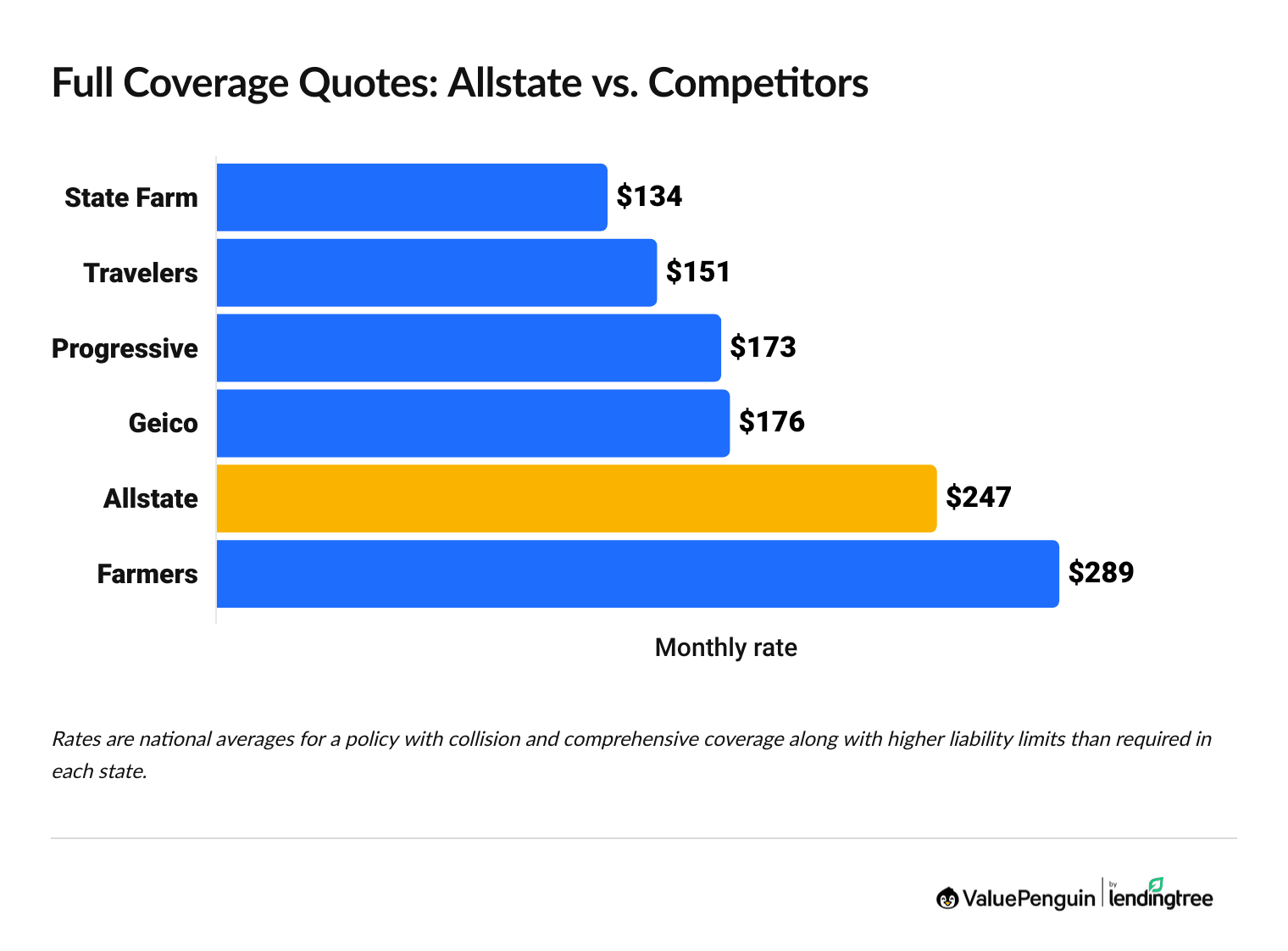

Full coverage insurance from Allstate costs an average of $247 per month.

That makes Allstate one of the most expensive major car insurance companies. In addition, Allstate has the highest full coverage quotes in 22 states.

If you're shopping for the cheapest rates, you should compare quotes from State Farm and Travelers instead.

Find Cheap Auto Insurance Quotes in Your Area

Allstate's liability-only insurance is also expensive, at around $112 per month. That's $69 per month more expensive than average.

Allstate car insurance quotes vs. competitors

Full coverage

Company | Monthly rate | |

|---|---|---|

| State Farm | $134 | |

| Travelers | $151 | |

| Progressive | $173 | |

| Geico | $176 | |

| Allstate | $247 | |

| Farmers | $289 |

Liability-only

Company | Monthly rate | |

|---|---|---|

| State Farm | $55 | |

| Geico | $66 | |

| Travelers | $66 | |

| Progressive | $67 | |

| Allstate | $112 | |

| Farmers | $114 |

Allstate's car insurance rates also tend to be expensive for teens and people with a bad driving record.

Allstate insurance discounts

Allstate offers a lot of discounts to help lower your car insurance rates. These include its safe driving program, Drivewise, and pay-per-mile program, Milewise.

However, its list of discounts is comparable to other major companies, such as State Farm or Progressive.

Even if you can get most of its discounts, Allstate’s rates are so high that you probably won’t save enough for it to be your cheapest option.

Allstate discounts list

- Anti-lock break discount

- Anti-theft discount

- Automatic payment discount

- Bundling discount

- Early signing discount

- New car discount

- Paperless discount

- Paid-in-full discount

- Responsible payer discount

- Safe driving discount

- Smart student discount

Allstate Drivewise

Safe drivers can also save money by signing up for the Allstate Drivewise program.

You'll automatically get a 10% discount when you sign up for Drivewise. Then, Allstate uses an app to track your driving habits. This includes your speed, the time of day you drive, braking time and whether you use your phone while driving.

If you practice safe driving habits, you can earn a discount of up to 40%. However, if you have bad habits, your rates could go up.

Allstate Drivewise isn't available in Alaska or California.

Allstate Milewise

Allstate Milewise is a great option for people who work from home, retirees, students who live close to school and other people who don't drive often.

Milewise uses the number of miles you drive each day along with a base rate to determine how much you pay for car insurance. This is called pay-per-mile insurance.

The base rate is based on your personal info and driving record, similar to traditional car insurance. This is added to the per-mile rate, which is usually a few cents per mile.

Allstate Milewise is currently available in only 21 states.

Allstate auto insurance coverage

Allstate offers a handful of common yet helpful car insurance coverage add-ons to increase your protection. Allstate sets itself apart from its competitors with its vehicle protection plans, which help pay for repairs and other wear and tear not covered by your vehicle warranty.

Allstate car insurance coverage add-ons

Allstate's new car replacement pays to replace your car with a brand new model if it's totaled in an accident. This coverage is available only for cars up to two model years old.

Ride-share insurance helps bridge the gap between the coverage provided by your rideshare company and your personal car insurance policy.

Roadside assistance helps cover the cost of towing, flat tire replacement, gas and oil delivery and other services if you're stranded on the side of the road.

Rental reimbursement helps cover the cost of a rental car while your car is in the shop after a crash.

When you add accident forgiveness to your Allstate policy, your rates won't go up after your first accident, even if it was your fault.

With Allstate's deductible rewards program, you'll get $100 off your collision deductible as soon as you sign up. Then, you can earn an additional $100 savings each year you avoid getting into an accident. The maximum savings is $500 off your collision deductible.

For example, say your deductible is $1,000 and you sign up for deductible rewards. If you get in an accident two years later, you would have to pay only $800.

Other companies call this a vanishing deductible or disappearing deductible.

Allstate rewards you with a safe driving bonus every six months you avoid accidents. This bonus is applied to your insurance bill.

Gap insurance pays the difference between the amount you owe on your car loan or lease and its current value if it's totaled in an accident.

Allstate's gap insurance is offered under its vehicle protection plans.

Allstate offers a number of vehicle protection plans that can help cover the cost of regular car maintenance and wear and tear.

Some of Allstate's protection plan options include:

- Extended Vehicle Care, which pays for mechanical breakdowns that aren't covered by the manufacturer's warranty.

- Complete Protection, which covers everything from dents or dings to missing keys.

- Tire and Wheel Protection, which pays to fix or replace ties and wheels and covers the cost to mount and balance new tires.

Allstate motorcycle insurance review

Allstate motorcycle insurance quotes

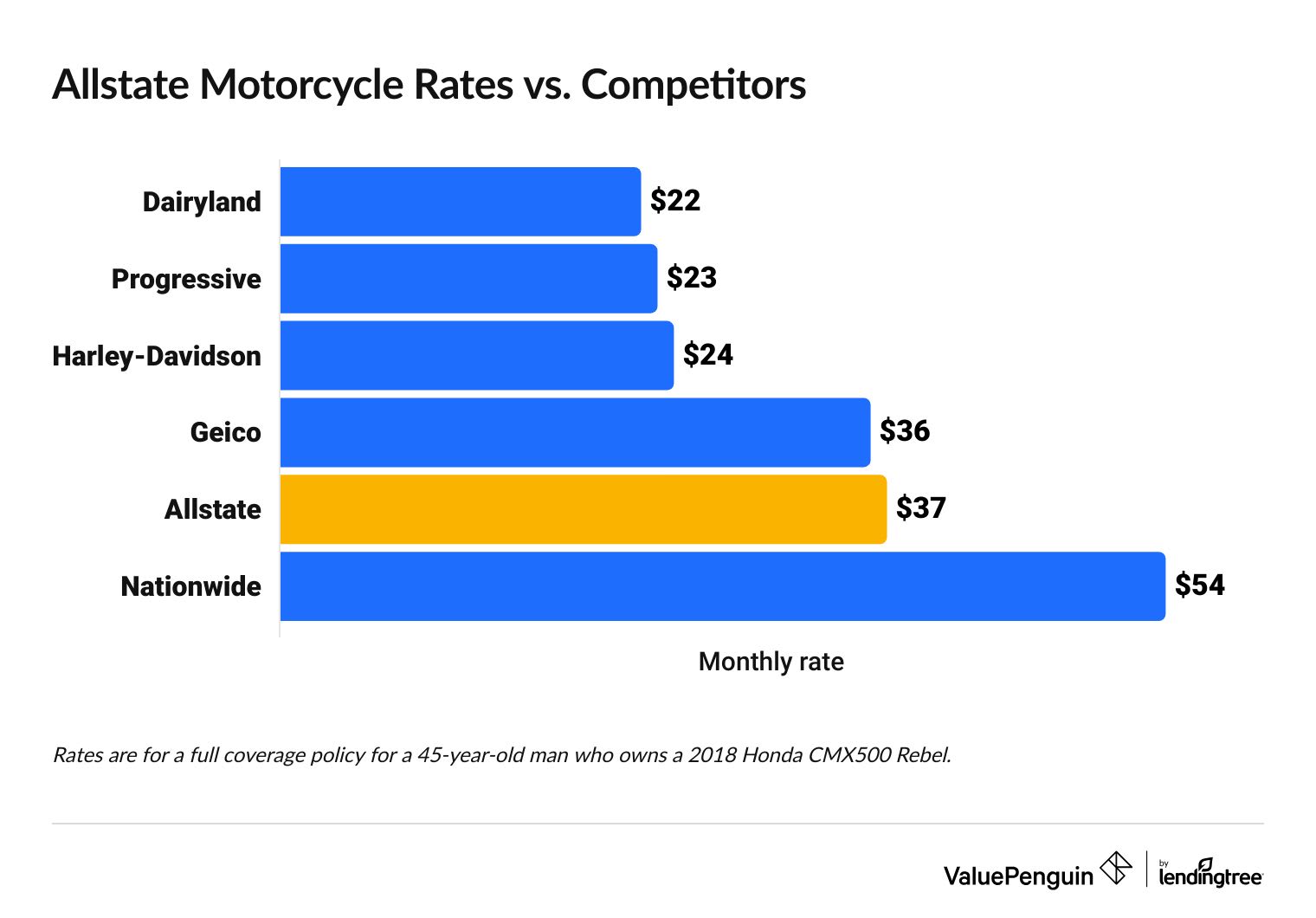

Motorcycle insurance from Allstate costs an average of $37 per month for a full coverage policy.

That's $4 per month more than the national average, and $15 per month more than the cheapest company, Dairyland.

Find Cheap Motorcycle Insurance Quotes in Your Area

Allstate motorcycle insurance rates vs. competitors

Company | Monthly rate | |

|---|---|---|

| Dairyland | $22 | |

| Progressive | $23 | |

| Harley-Davidson | $24 | |

| Geico | $36 | |

| Allstate | $37 | |

| Nationwide | $54 |

Allstate motorcycle insurance discounts

Allstate offers lots of discounts to help lower your motorcycle insurance bill, and some are very easy to get. For example, you'll earn a policy transfer discount just for switching your motorcycle insurance to Allstate from another company.

Switch your motorcycle insurance to Allstate from another company and automatically earn a discount.

Sign up for a motorcycle policy with Allstate at least seven days before your policy expires with your current insurance company to earn a discount.

Sign up for automatic payments to get a discount of up to 5%.

Earn a discount when you have multiple insurance policies with Allstate, including motorcycle, home, renters, auto, life and business insurance.

Save money when you insure more than one motorcycle with Allstate.

Earn a discount if you've gone five years or longer without an at-fault accident or major traffic ticket.

Get a discount if you belong to a motorcycle club, including:

- American Motorcycle Association

- Gold Wing Touring Association

- Harley Owners Group

- Honda Riders Club of America

- Motorcycle Safety Foundation

- Road Riders Association

Earn a discount if you've completed a voluntary motorcycle safety course within the last three years.

Save money when you pay your annual motorcycle insurance balance in full.

Allstate insurance motorcycle coverages

Allstate offers lots of ways for riders to personalize their protection.

If you have full coverage motorcycle insurance, Allstate automatically includes $1,000 of coverage for custom parts, like a custom seat or saddlebags. And its trailer coverage makes it a great choice for people who travel with their bikes often.

This coverage pays for damage to your trailer and motorcycle after a crash, a rollover, vandalism and other types of damage.

Allstate offers two different roadside assistance plans:

- Allstate's basic motorcycle roadside assistance helps pay for towing and labor if your bike breaks down on the side of the road or you're in an accident.

- Allstate's stand-alone roadside assistance, called Roadside Advantage, comes with extra coverage. It includes tire and wheel replacement, which pays for a new tire or wheel if you're stuck on the side of the road with a flat. It also comes with trip interruption coverage, which pays up to $1,500 in extra expenses if your bike breaks down while you're on vacation or a road trip. This roadside assistance package costs $89 for the first year, and $105 per year afterward.

This coverage pays to replace your bike with a brand new model if it's totaled in an accident. To get this coverage, your bike must be newer than 2 years old and you must have collision and comprehensive coverage.

Allstate customers can add up to $30,000 of coverage for custom parts and accessories, like a custom stereo, handlebars or fairings.

If you have a loan or lease on your motorcycle, gap insurance pays the difference between your balance on the bike and its current value if it's totaled in an accident.

With the first accident waiver, your rates won't go up after your first at-fault accident. To get this coverage, you must:

- Not have any recent at-fault accidents in any type of vehicle

- Not be charged with a major traffic violation along with the accident

- Have had your Allstate motorcycle insurance policy for at least four years

This package will help cover the cost of a funeral if you're killed in an accident while riding your bike. It will also pay you a lump sum if you're dismembered in a serious accident.

Allstate car insurance customer service reviews

It can be hard to predict what type of customer service you'll get from Allstate.

While the company gets fewer customer complaints than expected, it earned a poor score on J.D. Power's claims satisfaction survey. That means Allstate may take longer than normal to fix your car after a crash, and you could end up spending more on repairs.

Allstate insurance ratings

- Car insurance complaints: 30% fewer than expected

- J.D. Power claims satisfaction survey: 16th out of 22

- AM Best financial strength rating: A+

On a positive note, Allstate earned an A+ or "Superior" financial strength rating. This means Allstate shouldn't have a problem paying customer claims, even in difficult situations like a major catastrophe.

Frequently asked questions

How much is Allstate car insurance?

Allstate charges an average of $247 per month for full coverage car insurance. Liability-only car insurance from Allstate costs $112 per month, on average.

Is Allstate cheaper than Geico?

No, Allstate isn't cheaper than Geico. A full coverage policy from Allstate costs around $247 per month, while Geico charges $176 per month, on average.

Is Allstate better than State Farm?

State Farm is almost always a better choice than Allstate. State Farm has some of the most affordable car insurance in the country, along with reliable customer service.

On the other hand, Allstate's rates are usually very expensive, and its customer service isn't great. Even if you qualify for most of Allstate's discounts, it's unlikely you'll save enough to beat State Farm's low rates.

Methodology

To compare Allstate's auto insurance prices, ValuePenguin gathered rates from ZIP codes across all 50 states in the U.S and Washington, D.C. Rates are for a 30-year-old single man with a good credit score and clean driving record who owns a 2015 Honda Civic EX.

Full coverage quotes are for a policy with higher liability limits than the state requirement, along with comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist coverage: $50,000 per person and $100,000 per accident

- Personal injury protection or medical payments coverage: State requirement

- Comprehensive and collision deductibles: $500

To compare Allstate's motorcycle insurance rates, ValuePenguin collected thousands of quotes from all 50 states and seven major companies. Quotes are for a 45-year-old single man who owns a 2018 Honda CMX500 Rebel.

Quotes are for a full coverage policy, including higher liability limits than the state requirement and comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Uninsured and underinsured motorist property damage: $25,000 per accident

- Medical payments: $5,000

- Comprehensive and collision deductible: $500

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.