What Is Medicare Supplement Plan G?

Medicare Supplement Plan G is the best overall Medigap plan for most people.

Compare Medicare Plans in Your Area

- Coverage: Medicare Plan G has the best coverage for new Medicare enrollees. Plan F has slightly better coverage, but it's usually a worse deal overall because of its expensive monthly cost.

- Popular: Medicare Supplement Plan G is also the most popular Medigap plan because it pays for almost all of the costs you're responsible for with Original Medicare (Parts A and B).

- Cost: Plan G costs $180 per month, on average, which is more expensive than most Medigap plan choices. But the extra cost can be worth it since Plan G will pay for nearly all of your medical costs, except your Part B deductible.

What is Medicare Supplement Plan G?

Medicare Supplement Plan G has the best coverage at the best price among Medigap plans.

Medigap Plan G covers most of the costs you're responsible for paying with Original Medicare (Parts A and B). For example, you have to pay $1,736 before Medicare Part A (hospital coverage) starts. Plan G covers your Part A deductible, so your coverage begins immediately.

There are 10 Medicare Supplement plans. Each plan has a letter. Plan G is the most popular plan overall, Medigap Plan F is the second most popular plan type and Plan N is third. These plans offer better coverage than the seven other types.

Most popular Medigap plans

- Plan G: 39% of all Medigap plans sold

- Plan F: 36% of all Medigap plans sold

- Plan N: 10% of all Medigap plans sold

Medigap Plan F offers slightly more coverage than Plan G because it also pays for your $283 per year Medicare Part B deductible. However, Plan F costs an average of $480 per year more than Plan G, which makes it a worse option for most people.

Also, you can only get Plan F if you were eligible for Medicare before 2020.

To buy Medicare Plan G, you need to already have Original Medicare, which refers to Medicare Part A (hospital stays) and Medicare Part B (doctor visits).

If you have a Medicare Advantage plan, you can't buy any Medigap policy, including Plan G.

What does Medicare Plan G cover?

Medigap Plan G covers most of the costs you're responsible for paying with Original Medicare (Parts A and B).

When you go to the doctor or the hospital, Original Medicare will typically pay part of the bill. But you may still have some costs to pay yourself.

Medicare Plan G helps with those costs. After Medicare Part A or B has paid its portion of your medical bills, Plan G covers some or all of the rest.

Example: Plan G coverage for a hospital stay

Imagine you get sick with a bad case of the flu, and you have to be admitted to the hospital. Without Medigap Plan G, you will have to pay your $1,736 Part A deductible before Medicare starts to pay. And if you are hospitalized for more than 60 days, you pay $434 per day in what's called coinsurance.

But if you have Medicare Supplement Plan G, you wouldn't pay anything yourself. Plan G pays for your deductible and Part A coinsurance. That means you don't have to pay anything out of pocket for your hospital stay.

Remember that Plan G is what's called a supplemental insurance plan. It's not your main insurance coverage. While Medigap plans reduce or eliminate what you have to pay, Original Medicare still pays for most of your medical costs.

Medicare Plan G coverage

Plan G has the same coverage no matter which company you buy it from. That's because Medigap plans have to cover the exact same services by law.

Medicare Plan G benefits | Coverage |

|---|---|

| Medicare Part A coinsurance | |

| Medicare Part B coinsurance | |

| Blood (three pints) | |

| Part A hospice care coinsurance | |

| Skilled nursing facility coinsurance | |

| Part A deductible | |

| Part B deductible | |

| Part B excess charges | |

| Foreign travel emergency | 80% |

Medicare Plan G does not cover your Medicare Part B deductible, which is $283 for 2026. Each year, you have to pay for doctor visits and other non-hospital medical services until you have reached the deductible.

Then Medicare will cover about 80% of the cost of doctor visits and other medical services that don't require an overnight stay, which is called outpatient care. Plan G pays for the remaining 20% of your bill, so you don't have to pay anything but the $283 annual deductible.

How much does Medicare Supplement Plan G cost?

Medicare Plan G costs $180 per month, on average, for a 65-year-old woman who does not smoke. You'll often see a range of prices for Medicare Supplement policies because each insurance company sets rates differently. Your exact price for Plan G also depends on your health, age and gender, as well as where you live.

There is a high-deductible version of Plan G available. This plan has a much lower monthly rate, just $52 per month, on average. But you're responsible for the first $2,950 of your medical costs before coverage starts. Then the plan pays for everything.

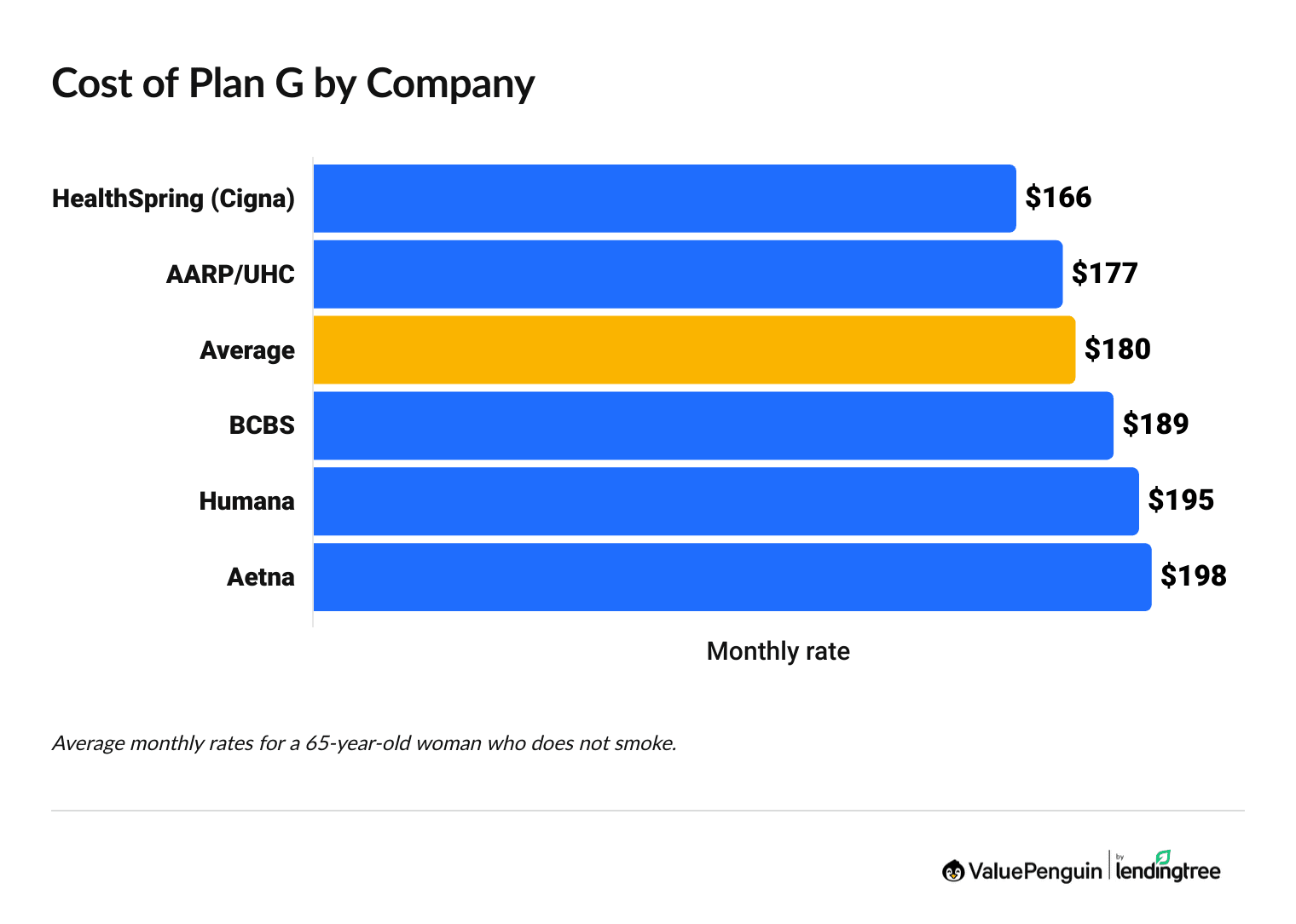

Plan G costs by company

AARP/UnitedHealthcare is the only national Medigap company to have both cheaper-than-average rates for Plan G and a good reputation for service.

Compare Medicare Plans in Your Area

Average cost of Plan G from different insurance companies

Company | Plan G rate | |

|---|---|---|

| HealthSpring (Cigna) | $166 | |

| AARP/UHC | $177 | |

| BCBS | $189 | |

| Humana | $195 | |

Average monthly rates are for a 65-year-old woman who doesn't smoke.

Medicare Plan G pros and cons

Pros

Cons

How to buy Medigap Plan G

The best way to buy Medigap Plan G is to compare quotes from companies in your area.

Remember, the coverage you get from Plan G will be exactly the same regardless of the company you choose. That means you should only consider rates and customer satisfaction ratings when shopping for the best Medicare Supplement Plan G policy in your area.

Getting Original Medicare is the first step to getting Plan G. Starting three months before you turn 65, you have six months to enroll in Medicare. This is called your initial enrollment period. If you're retired and getting Social Security, the government will automatically enroll you in Medicare. Remember, you have to sign up for Original Medicare and have Parts A and B before you can buy a Medigap plan.

You can get a Medicare Supplement plan starting in the first month that your Medicare Part B coverage is active. You then have six months to sign up. This is called Medigap open enrollment, and it's the best time to buy a Medigap policy, since you will get the lowest rates and can't be denied coverage.

If you miss your first window, your Medigap options might be more limited and you could pay more. After your Medigap open enrollment, health insurance companies might charge you higher rates based on your health status. You could get denied coverage entirely. And there's no guarantee that a company will sell you a Medigap policy if you miss your Medigap open enrollment window.

It's best to buy Plan G when you are first eligible for Medicare so you get the cheapest Medigap quotes. That's because insurance companies aren't allowed to charge you higher rates due to health issues or refuse to sell you a policy because of preexisting conditions during this time.

Medicare Plan G vs. Plan F

Medicare Supplement Plan F covers the Medicare Part B deductible, and Plan G does not. But you can only buy Plan F if you were eligible for Medicare before Jan. 1, 2020.

Keep in mind, Plan G and Plan F have nearly identical coverage, but Plan G typically costs much less. That makes Plan G the best overall Medigap plan for most people.

Medicare Plan G vs. Plan N

Medicare Supplement Plan N has cheaper rates than Plan G. Plan N costs on average $137 per month, which is 24% less than Plan G.

However, Plan G offers slightly more coverage than Plan N. Plan G pays for extra costs some doctors charge Medicare enrollees, called Medicare Part B excess charges. With Plan N, you could pay an extra cost of up to 15% of your total medical bill.

It's important to note that Part B excess charges aren't common. Only 2% of doctors bill excess charges, although this practice is most common among psychiatrists and plastic surgeons.

Neither Plan N nor Plan G covers the Medicare Part B deductible.

Frequently asked questions

What is Medicare Supplement Plan G?

Medigap Plan G is an add-on plan that covers most of the costs you're responsible for paying with Original Medicare (Parts A and B). Medicare Supplement Plan G is the most popular Medigap plan because it offers strong coverage at affordable rates, making it the best overall Medigap plan.

What is the average cost of Medigap plan G?

Medicare Supplement plan G costs an average of $180 in 2026. That's 13% more 2025.

Consider Medigap plan N if you want a lower monthly rate, and you don't mind paying more when you go to the doctor's office.

What is the disadvantage of Plan G?

You can't get a Medicare Advantage plan if you have Plan G or any other Medigap plan. That means you'll need to buy separate coverage for prescription drugs, vision and dental.

Methodology

ValuePenguin uses rate data for all insurance companies to calculate average Medicare Supplement rates. Rates are for a 65-year-old woman who doesn't smoke, doesn't qualify for a household discount and signed up during her initial enrollment when medical status can't be used as a rating factor. Average rates exclude Select plans and plans in states that have their own Medigap systems.

About the Author

Senior Writer

Cate Deventer is a Senior Writer who specializes in health insurance, Medicare, auto and home insurance. She's been a licensed insurance agent since 2011.

She started her insurance career working as a customer service agent for State Farm. She later moved to an independent agency, where she worked with several insurance companies and hundreds of clients. She quoted policies, filed claims and answered insurance questions. In 2021, she pivoted her career and began writing about insurance for Bankrate. She moved to ValuePenguin in 2023 and began writing about health insurance and Medicare.

Cate has a passion for helping readers choose insurance to fit their needs. She enjoys knowing that her research and knowledge help people choose insurance products that make a positive difference in their lives.

How insurance helped Cate

Cate used her health insurance knowledge to navigate a surgery in 2023. Understanding how her policy worked let her focus on recovery instead of worrying about bills.

Expertise

- Health insurance

- Medicare & Medicaid

- Auto insurance

- Home insurance

- Life insurance

Credentials

- Licensed Life, Accident & Health Insurance Agent

- Licensed Property & Casualty Insurance Agent

Referenced by

- CBS

- NBC

- Wall Street Journal

Education

- BA, Theatre, Purdue University

- BA, English, Indiana University

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.