Aetna Medicare Supplement Review: Cheap Plans but Many Complaints

Aetna is a bad choice for most Medicare Supplement (Medigap) plan options because of its average rates and poor customer service.

Compare Medicare Plans in Your Area

Aetna has average prices and poor customer service. However, it has a few good deals, such as its Plan N and high-deductible Plan G. In addition, Aetna is made up of several different companies, some of which have rates that are much cheaper than the national average.

That means a Medicare Supplement plan from Aetna can be a good deal depending on which plan you buy and which Aetna subsidiary you buy it from.

Pros and cons

Pros

Cheap Plan N

Cheap High-Deductible Plan G

Available in most states

Cons

Expensive Medigap Plan F

Bad customer service

Doesn't sell all Medigap plans

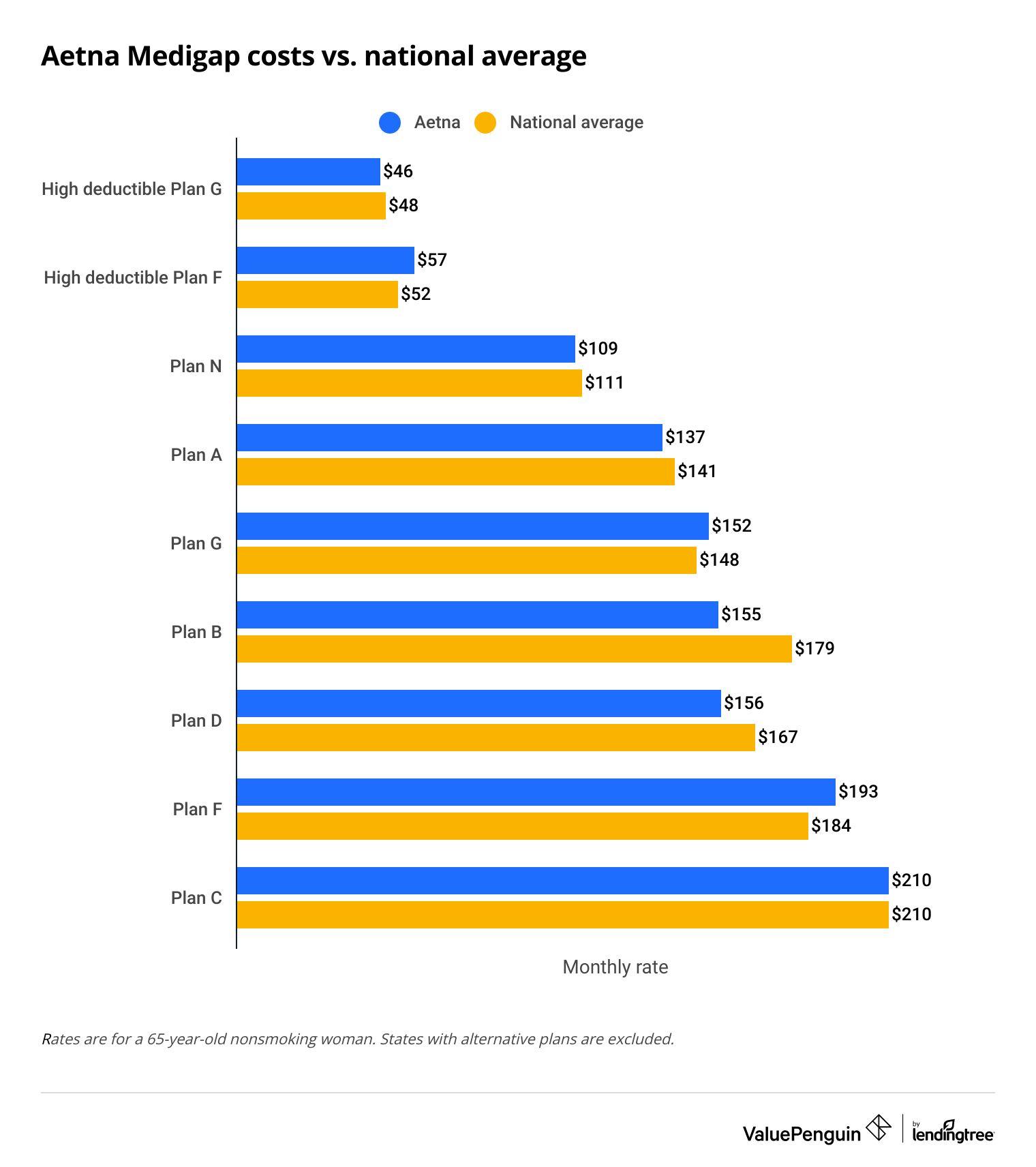

How much does an Aetna Medigap plan cost?

Aetna's Plan G costs $152 per month on average for a 65-year-old woman who doesn't smoke.

That's $4 per month more expensive than the national average. Medigap Plan G offers the best Medigap coverage for new enrollees. Plan F has slightly better coverage, but you can only buy it if you became eligible for Medicare before Jan. 1, 2020.

Aetna also is expensive for Plan F. However, it's a good choice for Plan N because of its cheap rates. Plan N from Aetna costs $109 per month, slightly less than the national average.

Compare Medicare Plans in Your Area

Aetna sells Medicare Supplement plans under four different company names.

- Aetna Health Insurance Company

- Continental Life Insurance Company of Brentwood, Tennessee

- Aetna Health and Life Insurance Company

- American Continental Insurance Company

Between these four subsidiaries, rates can differ dramatically. For example, Plan G from American Continental Insurance Company costs just $137 per month. In contrast, the same plan costs $164 per month from Continental Life Insurance Company of Brentwood.

Of the four, Aetna Health and Life Insurance Company has the lowest prices for most plan types. Its Plan F costs just $171 per month and its Plan N costs $95 per month on average.

Your age, gender, where you live and whether you smoke will all impact your Medigap quotes.

Aetna vs. average Medigap rates

Plan | Aetna monthly rate | National monthly rate |

|---|---|---|

| Plan *G | $46 | $48 |

| Plan *F | $57 | $52 |

| Plan N | $109 | $111 |

| Plan A | $137 | $141 |

| Plan G | $152 | $148 |

Average monthly cost for a 65-year-old woman who doesn't smoke. *High-deductible plans F and G.

Compare Medicare Plans in Your Area

Aetna Medicare Supplement vs. competitors

Aetna has middle-of-the-road prices compared to most of its major competitors. It's slightly cheaper than companies like Blue Cross Blue Shield (BCBS) and Mutual of Omaha.

However, Aetna charges more for Plan G than AARP/UnitedHealthcare and Cigna.

Mutual of Omaha Medicare Supplement Plan G rates vs. competitors

Company | Age 65 rate | Age 75 rate | Age 85 rate |

|---|---|---|---|

| AARP/UHC | $142 | $186 | $226 |

| Cigna | $148 | $184 | $250 |

| Aetna | $152 | $193 | $252 |

| Blue Cross Blue Shield | $155 | $214 | $262 |

| Mutual of Omaha | $156 | $186 | $243 |

| Humana | $165 | $209 | $272 |

Average rates are monthly and for a woman who does not smoke.

If a smooth claims process is important to you, consider AARP/UnitedHealthcare.

It gets 46% fewer customer complaints compared to an average Medigap company of the same size. In addition, AARP/UHC has significantly cheaper rates than Aetna.

Aetna Medicare Supplement plan choices

Aetna sells Medigap Plans A, B, C, D, N, F and G . The only plans it doesn't sell are K, L and M.

Medicare Supplement Plans F, G and N make up most of the Medigap plans sold nationwide. These plans are popular because they offer the most coverage.

All three plans will pay for many of the costs that you'd normally have to pay under Medicare, such as your Medicare Part A and B coinsurance, the first three pints of blood during a transfusion, hospice care, skilled nursing facilities and emergency care while traveling outside the country.

Aetna Medicare Supplement coverage by plan

Plan F | Plan G | Plan N | |

|---|---|---|---|

| Part A coinsurance | |||

| Part B coinsurance | |||

| Blood (3 pints) | |||

| Hospice care | |||

| Skilled nursing facility | |||

| Part A deductible | |||

| Part B deductible | |||

| Part B excess charges | |||

| Foreign travel emergency | 80% | 80% | 80% |

However, only Plan F will pay for your $240 per year Medicare Part B deductible . Even though Plan F offers better coverage, it's not always the better deal.

On average, an Aetna Plan G policy costs $492 per year less than a Plan F policy. That means you could pay the Part B deductible and still save $252 annually by going with Plan G.

Plan N has the same coverage as Plan G with a few exceptions. Plan N has a $20 copay when you visit the doctor and a $50 copay for emergency care.

Plan N also doesn't cover the difference between what your doctor charges and what Medicare will pay for, called an excess charge.

Only 2% of doctors are allowed to make excess charges.

Medicare Supplement High-Deductible Plan G

Aetna has cheap high-deductible Plan G policies. These plans offer the same coverage as a regular Plan G policy. However, you must pay $2,800 before your policy starts paying anything for care.

A high deductible Plan G usually isn't a good idea because you'll only save $1,272 per year on average with the plan's lower rate. That means you'd have to go several years without needing significant medical care for it to save you money. However, this plan may make sense for some healthy individuals who also have some money saved up.

Customer reviews and complaints

Aetna gets 20% more complaints than an average Medigap company its size.

That could mean you'll have a difficult time getting your claims processed if you have an Aetna Medigap plan.

Aetna does a better job on other measures of customer satisfaction. It's ranked about average on JD Power's 2023 Medicare Advantage customer satisfaction survey. This survey may reflect the quality of the company's customer service more broadly even though it doesn't look directly at Aetna's Medigap plans.

In addition, Aetna has an A+ rating from the Better Business Bureau (BBB). This means that Aetna makes a strong effort to resolve customer complaints.

Frequently asked questions

Are Aetna Medicare Supplement insurance plans good?

Aetna Medicare Supplement (Medigap) plans have average prices and poor customer service. Because Medigap coverage doesn't change by company, consider a plan from a company that has cheaper prices and fewer complaints, like AARP/UnitedHealthcare.

Does Aetna Medigap Plan G cover silver sneakers?

Insurance companies can't offer Silver Sneakers with Medigap policies in most states because of the way Medigap coverage works. However, many Aetna Medicare Advantage plans include Silver Sneakers.

Is Aetna Medicare or Medicaid?

Aetna sells Medicare Advantage and Medicare Supplement plans. It also manages low-income health insurance plans funded by the government, called Medicaid, in some states. If you are 65 or older and you have a low income, you may dual-qualify for both Medicare and Medicaid.

Sources and methodology

Average rates are for a 65-year-old woman who doesn't smoke unless otherwise noted.

Sources include Medicare.gov, Aetna, the Better Business Bureau, J.D. Power and the National Association of Insurance Commissioners.

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.