Does Medicare Cover Nursing Homes?

Medicare does not usually cover the cost of nursing home care.

Medicare will pay for some "skilled nursing facility" care if you need it. But coverage is limited, and Medicare will not pay for nursing home care.

Buying what's called long-term care insurance is the best way to cover nursing home costs. If you earn a low income, you can also get nursing home coverage through free government health insurance, called Medicaid.

Compare Medicare Plans in Your Area

Does Medicare pay for nursing home care?

Medicare does not usually pay for nursing home care.

Medicare doesn't pay for you to live in a nursing home long-term. It also doesn't cover stays where you don't need care from a doctor, and Medicare won't pay for someone to help you around the house.

Medicare Part A (hospital insurance) will cover some nursing home care costs in certain situations, such as limited coverage for when you have to stay in the hospital and some short-term care for people who need help adjusting back to regular life after a health issue.

Keep in mind you're responsible for paying part of your bills with Medicare Part A, called the deductible, copays and coinsurance. You can limit how much you'll pay with a Medicare Supplement (Medigap) plan. Plans C, D, F, G, M and N cover the full cost of skilled nursing facility care, which means you won't have to pay for your short-term stay.

Medicare Advantage plans don't typically pay for nursing home care, although they can. All Medicare Advantage plans have to offer at least the same level of coverage as Original Medicare (Parts A and B). That means you'll get some coverage for being in skilled nursing facilities with Medicare Advantage, just like you'd have with regular Medicare.

Medicare Advantage plans can also offer extra coverage like vision, dental and access to gyms and fitness programs. But Medicare Advantage plans typically don't cover nursing homes because of the high cost.

Medicare nursing home coverage

If you go to a hospital and then to a short-term skilled nursing facility, the total amount Medicare pays will depend on how much care you need. You'll pay the $1,676 Medicare Part A deductible. Then you'll have to pay a fixed amount, called a copay, for your hospital stay.

If you're in the hospital for 60 days or fewer, you won't have a copay. After 60 days, you're responsible for a $419 per day copay until day 91, when it increases to $838 per day.

Once you move to a skilled nursing facility, you'll pay nothing for the first 20 days and $210 per day up through your 100th day in the facility. You're responsible for all costs after that.

Days in skilled nursing facility | Cost you pay per day (2025) |

|---|---|

| 0-20 | $0 |

| 21-100 | Up to $210 |

| 101 or more | All costs |

Remember that Medicare only pays for short-term nursing home stays and only after a hospital stay that's at least three days long.

When you check in to a hospital or skilled nursing facility, you start what's called a benefit period. This includes your stay in the hospital and your nursing care afterward. During each benefit period, you pay the first $1,676, called your Part A deductible, before Medicare starts.

The benefit period ends 60 days after you leave the hospital or skilled nursing facility. If you go back to the hospital during this time, you won't have to pay your Part A deductible again.

How to get Medicaid to pay for nursing home care

If you'd struggle to afford a long-term care policy, you may be eligible for free government health insurance, called Medicaid. Medicaid covers some types of long-term care, such as nursing homes, home health care and assisted living facilities.

Keep in mind, not all nursing homes accept Medicaid.

It's a good idea to see if your state offers extra benefits for seniors who need financial help with long-term care.

For example, the Iowa Long-Term Care Partnership Program partners with Medicaid and private insurance companies. The program can help you get into a nursing home through Medicaid even if you don't meet some of the more difficult eligibility requirements.

Average nursing home costs

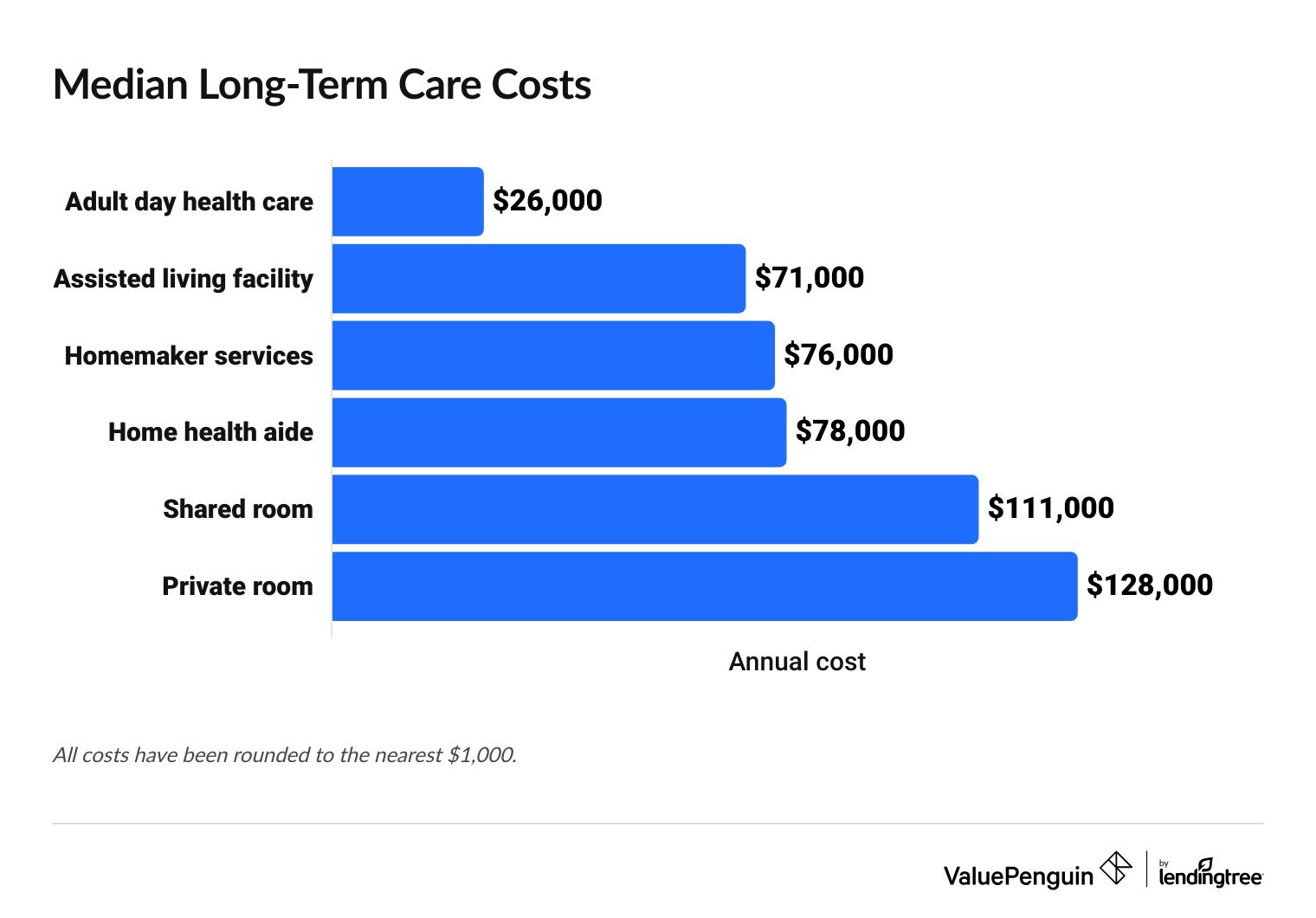

A typical shared room in a nursing home costs about $111,000 per year, according to Genworth Financial.

That jumps to roughly $128,000 per year for a private room. How much you pay for nursing home care depends, in part, on where you live. For example, a midlevel shared nursing home room in Alaska costs about $364,000 per year. In Missouri, the same room would cost just $76,000 per year.

If you can't afford the high cost of a nursing home, you should consider a cheaper alternative like an assisted living facility, which usually costs about $71,000 per year. Adult day care is even cheaper, at about $26,000 per year. Keep in mind, an adult day care center is not a nursing home, and it does not offer overnight stays or round-the-clock care.

Median long-term care costs

Type of care | Average cost per year |

|---|---|

| Adult day health care | $26,000 |

| Assisted living facility | $71,000 |

| Homemaker services | $76,000 |

| Home health aide | $78,000 |

| Shared room | $111,000 |

| Private room | $128,000 |

All figures have been rounded to the nearest $1,000.

Medicare doesn't typically pay for services that offer help around the house, such as Visiting Angels. But it will pay for some at-home health services.

For example, Medicare will pay for occupational and physical therapy at your house if your doctor decides you need them.

Does Medicare pay for assisted living?

No, Medicare does not normally cover the cost of assisted living facilities or home health care unless you have a Medicare Institutional Special Needs Plan (I-SNP). These Medicare Advantage plans include extra benefits for people who need to stay in a care facility for 90 days or more.

Medicare Institutional Special Needs Plans are relatively uncommon. Only 2% of people with Medicare Special Needs Plans have this type of coverage.

The Program of All-Inclusive Care for the Elderly (PACE) is a Medicare program that helps people with major health care needs avoid long-term nursing home care. If you join PACE, you'll have a team of doctors and nurses to plan your care. The program covers some long-term care services like adult day primary care, at-home care and transportation to and from doctor's appointments.

Most people who have PACE qualify for both Medicare and Medicaid. But you can join even if you only have one program, or if you don't have either.

Medicare and long-term care

Medicare does not normally cover long-term care, such as nursing home stays, assisted living facilities or home health care.

To get coverage for long-term care, the best option is to buy long-term care insurance. This coverage pays for most of the costs you'll face when you go to a nursing home.

Buying a long-term care policy before you need it is a good idea. That's because companies generally charge higher rates as you get older. At a certain point, many companies may refuse to sell you a policy altogether.

Frequently asked questions

Does Medicare pay for nursing homes?

No, Medicare does not normally pay for nursing homes. Medicare offers limited coverage for skilled nursing facility stays, but you need your doctor's approval to get this benefit.

To pay for a nursing home, you should buy a long-term care insurance policy or sign up for Medicaid if you earn a low income.

How much does a nursing home cost?

A midlevel shared room in a nursing home typically costs about $111,000 per year. Keep in mind that the price you pay will depend on factors like where you live, the type of room you rent and the level of care you need.

How much does Medicare pay for nursing home care?

Medicare pays the full cost for your first 20 days at a skilled nursing facility after you've met your $1,676 Medicare Part A deductible. From days 21 to 100, you're responsible for a roughly $210 per day copay, and coverage ends on day 101.

Sources

Sources include the Centers for Medicare & Medicaid Services (CMS), KFF, the Department of Health and Human Services Administration on Aging, the Department of Veterans Affairs (VA), the Iowa Long-Term Care Partnership Program and Medicare.gov.

About the Author

Senior Writer

Talon Abernathy is a ValuePenguin Senior Writer who specializes in health insurance, Medicare and Medicaid. He's also contributed to other insurance verticals including home, renters, auto, motorcycle and flood insurance.

Talon came to ValuePenguin in 2023. Since his arrival, he's helped to expand the site's health insurance-related content offerings. He enjoys helping readers understand the ins and outs of America's all too complicated health insurance landscape.

Before coming to ValuePenguin, Talon worked as a freelance writer. His prior work has touched on a broad range of personal finance-related topics including credit-building strategies, small business incorporation tactics and creative ways to save for retirement.

Insurance tip

In many parts of the country, you can qualify for a free Silver health insurance plan if you meet certain income requirements. Government subsidies in the form of premium tax credits and cost-sharing reductions may mean you'll pay nothing for coverage.

Expertise

- Health insurance

- Medicare and Medicaid

- Flood insurance

- Homeowners insurance

- Renters insurance

- Auto and motorcycle insurance

Referenced by

- The Miami Herald

- Money.com

- MSN

- Nasdaq

- The Sacramento Bee

- Yahoo! Finance

Education

- BA, University of Washington

- Certificate in Copyediting, UC San Diego

Credentials

- Licensed Life & Disability Insurance Agent

- Licensed Property & Casualty Insurance Agent

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.