Private Flood Insurance: Companies, Costs, and Coverage

Private flood insurance is an alternative to the government-backed National Flood Insurance Program (NFIP).

A private flood insurance policy can be a better deal than an NFIP policy because it can cover more expensive homes, provide better coverage, and give you cheaper rates.

The downside is that private flood insurance can be risky because insurance companies can increase your rates or drop you, while rates through the government are more stable.

Find Cheap Homeowners Insurance Quotes in Your Area

On this page

What is private flood insurance?

Private flood insurance policies are usually more flexible and can give you better protection than NFIP flood insurance through the government.

- A private flood insurance policy will pay for flood damage to your home and belongings.

- The insurance is through a private company instead of the government. If you file a claim for flood damage, the insurance company will use their own money to pay, rather than using government funds.

- Because policies aren't through the government, they don't have to follow the government's coverage rules. This means private flood insurance policies can be customized to meet your coverage needs.

Flood insurance vs. home insurance

Your home insurance policy won't cover damage caused by flooding.

| Flood insurance will pay for damage to your home caused by storms, hurricanes, overflowing rivers, or heavy rain. | |

| Home insurance covers water damage such as if a pipe bursts in your house. |

How much does private flood insurance cost?

Private flood insurance costs an average of $1,170 per year or $98 per month.

MAPFRE and Zurich are the most affordable flood insurance companies, costing about $450 to $550 per year for private flood insurance.

Private flood insurance companies

Find Cheap Homeowners Insurance Quotes in Your Area

Is private flood insurance cheaper than an NFIP policy?

Many people will pay less for a private flood insurance policy than for an NFIP flood insurance policy that's backed by the government.

That's because each insurance company sets their own rates for private flood insurance. So you can save by shopping around for the company that gives you the best rates.

- If you live in an area that has a low or medium risk of flooding, private flood insurance is usually cheaper than a flood insurance policy from the government.

- If you live in an area that has a high risk of flooding, all types of flood insurance can be expensive because you're more likely to need to file a claim to repair damages. For these areas, check to see if private insurance or a government policy will be a better deal for your home.

On average, the cost of a private flood insurance policy is $352 more per year than the cost of federal flood insurance that's through FEMA (Federal Emergency Management Agency).

But private flood insurance also provides more coverage and is used for more expensive homes. So even though average rates are higher, you might not pay more to get an insurance policy for your home.

Comparing private flood insurance vs. NFIP

How is private flood insurance similar to NFIP flood insurance?

Private flood insurance | NFIP government flood insurance | |

|---|---|---|

| Bought through a private company | ||

| Can be used for a mortgage |

Both types of flood insurance are sold by private companies. The difference is that an NFIP policy is a government insurance policy with an insurance company doing the paperwork, such as sending policy documents and processing claims. But a private flood insurance policy is entirely from the company.

Both types of policies can meet your mortgage requirements. If your mortgage company requires you to have flood insurance because your home is in an area that could flood, you can use either private flood insurance or government flood insurance to meet the requirement. Before 2019, you couldn't use private flood insurance to meet these requirements.

How is private flood insurance better than an NFIP flood insurance?

Private flood insurance can be better than a government flood insurance policy because it's affordable, gives you more coverage, has flexible options and may pay claims faster.

Private flood insurance | NFIP government flood insurance | |

|---|---|---|

| Rates | ||

| Coverage | ||

| Waiting period | ||

| Payouts after a claim |

Pros of private flood insurance

Find Cheap Homeowners Insurance Quotes in Your Area

Why private flood insurance might be worse that NFIP flood insurance

Private flood insurance can be riskier than a government flood insurance policy because your rates could go up, you could lose coverage, and you'll have to be careful to buy a policy from a good company.

Private flood insurance | NFIP government flood insurance | |

|---|---|---|

| Consistent rates | ||

| Coverage stability | ||

| Availability | ||

| Financial strength | ||

| Switching | ||

| Popular |

Cons of private flood insurance

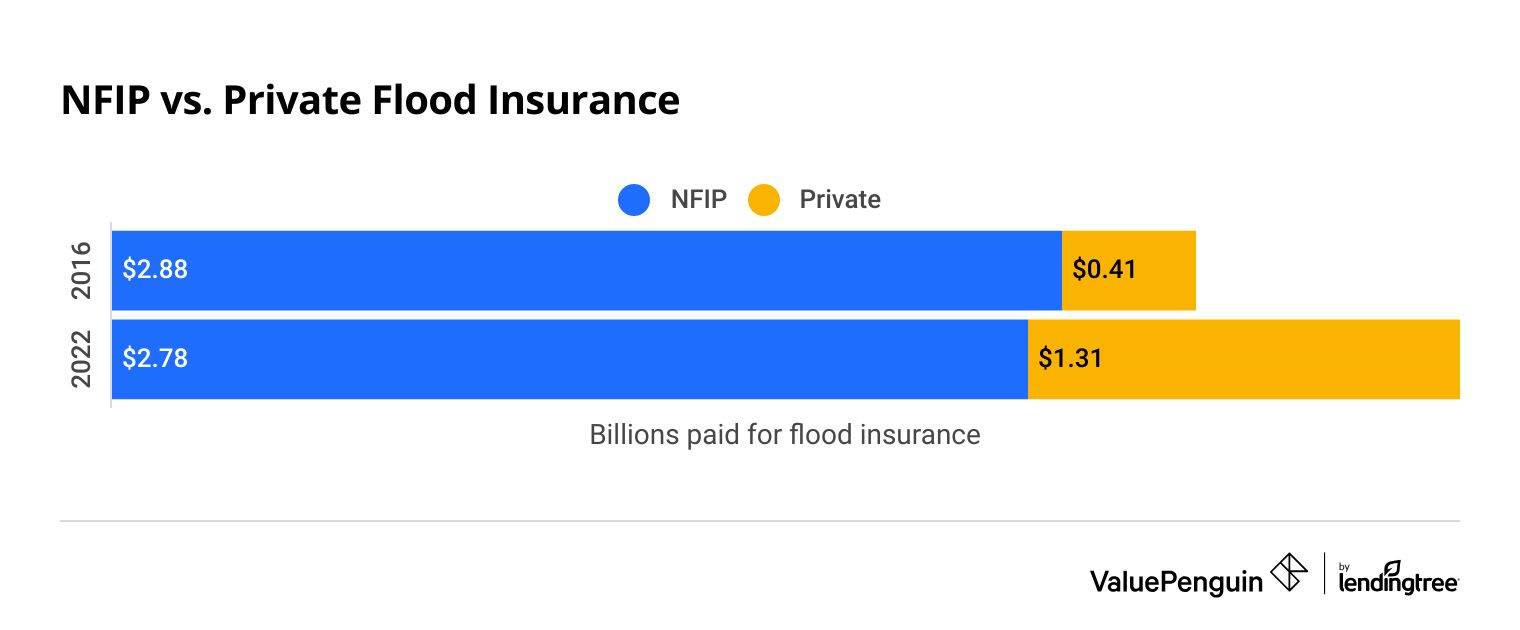

NFIP vs. Private flood insurance policies

NFIP | Private | |

|---|---|---|

| 2016 | $2.88 B | $0.41 B |

| 2022 | $2.78 B | $1.31 B |

Billions paid for flood insurance, called direct premiums written (DPW)

The private flood insurance market has grown by $900 million in the six years between 2016 and 2022. But it makes up less than one-third of all flood insurance policies.

NFIP flood insurance policies through the government earned $100 million less in premiums during the same timeframe.

Frequently asked questions

Should you get private flood insurance?

Private flood insurance is good if you have an expensive home or want cheaper rates than a government policy through the National Flood Insurance Program. But it can be riskier because a government flood insurance policy has more safeguards. For example, you're guaranteed to get a policy, and your rates won't go up if the insurance company decides your home is risky or if you file a claim.

What are the disadvantages of private flood insurance?

Getting private flood insurance can be more time-consuming because you'll have to shop around to compare companies and rates. It's also riskier because insurance companies can choose to change their rates or drop your coverage. Plus, you might not be able to get private flood insurance if you recently had a flood or live in a mobile home.

What's the largest private flood insurance company?

Geico, Zurich, and AXA SA are the three largest private flood insurance companies. Together they make up about a third of the market.

Methodology and sources

Average rates for private flood insurance are based on nationwide data from S&P Global for the 2023 plan year. Rates are an average of what policyholders currently pay and are not standardized based on property values.

Market share data is also from S&P Global. Rates for government flood insurance policies are from FEMA.

Additional sources include:

- Congressional Research Service (CRS)

- FloodSmart.gov

About the Author

Analyst

Stephanie Guinan is an Analyst for ValuePenguin/LendingTree. She specializes in simplifying complex insurance topics for consumers.

She’s also worked as an award-winning data journalist and content marketing writer. Stephanie’s work has been cited by Wall Street Journal, New York Times, Rolling Stone and more.

Expertise

- Health insurance and Medicare

- Home and auto insurance

- Crunching numbers

Referenced by

- Wall Street Journal

- New York Times

- Rolling Stone

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.