Cheapest Auto Insurance Quotes in Vermont (2026)

Co-Op has the best cheap car insurance in Vermont, at $83 per month for full coverage. That's $45 per month cheaper than the state average.

Find Cheap Auto Insurance Quotes in Vermont

Best cheap Vermont car insurance

Best and cheapest car insurance in Vermont

- Cheapest full coverage: Co-Op, $83/mo

- Cheapest minimum liability: Co-Op, $19/mo

- Cheapest for young drivers: Co-Op, $40/mo

- Cheapest after a ticket: State Farm, $97/mo

- Cheapest after an accident: State Farm, $105/mo

- Cheapest for teens after a ticket: Co-Op, $48/mo

- Cheapest after a DUI: Co-Op, $121/mo

- Cheapest for poor credit: Co-Op, $168/mo

Monthly rates based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

Co-Op has the cheapest rates in Vermont and an approach that works through agents for a more personal touch. But it's a smaller company with a mixed customer service reputation and fewer online tools.

State Farm also has a mix of great customer service and cheap rates. It's much cheaper than most other companies in Vermont, and you can easily compare rates online.

Cheapest Vermont auto insurance: Co-Op

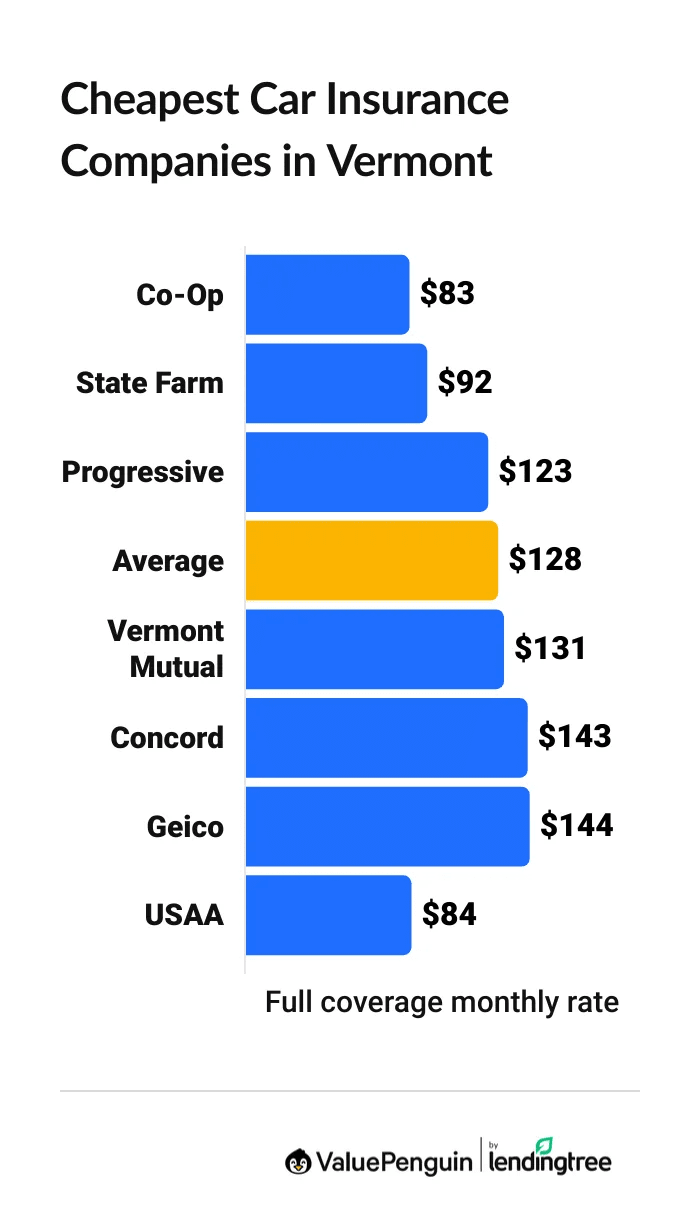

Co-Op and USAA have the most affordable full coverage car insurance in Vermont.

Find Cheap Auto Insurance Quotes in Vermont

- Co-Op charges an average of $83 per month for full coverage, which is 35% cheaper than the Vermont average.

- State Farm is another cheap option, at $92 per month, and it gives you the backing of a national company.

- USAA is also a great choice for Vermont drivers with military ties, at $84 per month. However, only military members, veterans and some of their family members can buy insurance from USAA.

Best cheap full coverage auto insurance in VT

Company | Monthly rate | |

|---|---|---|

| Co-Op | $83 |

| State Farm | $92 | |

| Progressive | $123 | |

| Vermont Mutual | $131 |

| Concord | $143 |

*USAA is available only to current and former military members and their families.

Data-powered research on Vermont car insurance

Cheapest liability-only car insurance in VT: Co-Op

Co-Op has the cheapest minimum liability insurance in Vermont, at only $19 per month.

That's $21 per month less than the Vermont average for a liability-only policy, which is $40 per month.

Best minimum liability auto insurance rates in Vermont

Company | Monthly rate |

|---|---|

| Co-Op | $19 |

| State Farm | $27 |

| Allstate | $42 |

| Vermont Mutual | $42 |

| Progressive | $46 |

*USAA is available only to current and former military members and their families.

Find Cheap Auto Insurance Quotes in Vermont

USAA also offers cheap rates to drivers with military ties, at just $24 per month. However, only active-duty military members, veterans and their families can get car insurance from USAA.

Cheap car insurance in Vermont for teens: Co-Op

Co-Op has the cheapest rates for young drivers in Vermont.

A minimum liability policy from Co-Op costs $40 per month for an 18-year-old driver. That's $69 per month less than the Vermont average for teens. Co-Op also has the cheapest full coverage quotes for young drivers in Vermont, at $163 per month.

Teens who are eligible for USAA can get affordable rates and military specific coverage. Minimum liability coverage from USAA costs just $61 per month, while full coverage costs around $200 per month.

Best insurance companies in Vermont for teens

Company | Liability only | Full coverage |

|---|---|---|

| Co-Op | $40 | $163 |

| Allstate | $84 | $530 |

| State Farm | $88 | $284 |

| Vermont Mutual | $95 | $308 |

| Concord | $100 | $265 |

*USAA is available only to current and former military members and their families.

In Vermont, 18-year-old drivers pay close to three times as much for car insurance as 30-year-old drivers. That's because young drivers typically have only a few years of driving experience, which means they're more likely to make a mistake and cause a crash.

The best way for younger drivers to save money on their insurance is by sharing a policy with a parent or older relative. A shared policy typically costs much less than two separate policies, and you can qualify for a multicar discount.

In addition, many insurance companies have discounts geared toward young drivers. For example, State Farm's Steer Clear program offers a discount to young drivers who complete online safety courses and practice driving with an older mentor.

Cheapest VT car insurance after a speeding ticket: State Farm

State Farm has the best quotes for Vermont drivers with a recent speeding ticket. A full coverage policy costs $97 per month, which is 37% less than the state average.

Company | Monthly rate |

|---|---|

| State Farm | $97 |

| Co-Op | $100 |

| Progressive | $159 |

| Vermont Mutual | $163 |

| Nationwide | $175 |

*USAA is available only to current and former military members and their families.

Vermont drivers can expect rates to go up by 21% after a single speeding ticket. That's an average increase of $27 per month for a full coverage policy.

Cheapest insurance in Vermont after an accident: State Farm

State Farm offers the cheapest full coverage car insurance quotes in Vermont after an at-fault accident. Its average rate is $105 per month, which is close to half the state average of $195 per month.

Company | Monthly rate |

|---|---|

| State Farm | $105 |

| Co-Op | $111 |

| Vermont Mutual | $163 |

| Progressive | $185 |

| Concord | $217 |

*USAA is available only to current and former military members and their families.

Drivers in Vermont pay $67 more per month for full coverage after an accident than drivers with a clean record. That's an average increase of 52%.

You don't have to worry about switching car insurance companies right after your crash. Your rates won't go up until your current policy expires. But any quotes you get will include your accident, so they'll probably be more expensive than your current rates.

Instead, wait until you get your renewal offer from your current company. You'll typically get this a few weeks to a month before your policy expires. Then, shop around for quotes from multiple companies to find the best rate for you.

Best VT auto insurance for teens after a speeding ticket or accident: Co-Op

Co-Op has the cheapest rates in Vermont for teens with a bad driving record.

A minimum liability policy from Co-Op costs $48 per month for an 18-year-old with one speeding ticket. That's $75 per month less than the Vermont average.

Minimum coverage from Co-Op costs $59 per month after an at-fault accident. That's $83 per month cheaper than the Vermont average for teens.

Cheap Vermont insurance for teens with a ticket or accident

Company | Ticket | Accident |

|---|---|---|

| Co-Op | $48 | $59 |

| State Farm | $94 | $103 |

| Allstate | $94 | $156 |

| Vermont Mutual | $105 | $105 |

| Concord | $128 | $149 |

*USAA is available only to current and former military members and their families.

Young drivers can expect a 13% increase in their insurance quotes after a single speeding ticket. And teens pay 30% more for insurance after an at-fault accident in Vermont. This is a smaller increase than adults typically see after a ticket or accident because teen drivers are already considered riskier on the road, even with a clean record.

Cheap car insurance rates in VT after a DUI: Co-Op

Co-Op offers the most affordable full coverage insurance for Vermont drivers with a DUI. At $121 per month, full coverage from Co-Op is less than half the state average of $259 per month.

Cheapest Vermont auto insurance quotes after a DUI

Company | Monthly rate |

|---|---|

| Co-Op | $121 |

| Progressive | $140 |

| State Farm | $196 |

| Concord | $243 |

| Allstate | $276 |

*USAA is available only to current and former military members and their families.

Car insurance rates in Vermont double after a DUI. That's because insurance companies believe drivers with a DUI are more likely to cause an accident in the future.

In addition, you may need an SR-22 insurance filing after a DUI, which proves your insurance meets the state requirements.

Best VT auto insurance for drivers with poor credit: Co-Op

Co-Op offers the cheapest quotes for Vermont drivers with a poor credit score. Full coverage from Co-Op costs an average of $168 per month, which is $72 per month cheaper than the Vermont average.

Drivers with bad credit should also compare quotes from Geico, which has a more established customer service reputation than Co-Op. Reliable customer service could be important if you're in an accident in the future.

Cheap auto insurance in Vermont for drivers with poor credit

Company | Monthly rate |

|---|---|

| Co-Op | $168 |

| Geico | $206 |

| Progressive | $213 |

| Nationwide | $220 |

| Concord | $255 |

*USAA is only available to current and former military members and their families.

Vermont drivers with bad credit pay nearly twice as much for car insurance as those with good credit. That's because car insurance companies believe these drivers are more likely to file insurance claims.

Best auto insurance in Vermont

USAA has the best auto insurance in Vermont, based on its good customer service and cheap rates.

However, only active-duty military members, veterans and some of their family members can get car insurance from USAA.

State Farm is the best choice for drivers who aren't eligible for USAA. It also has great customer support and affordable quotes for Vermont drivers.

Top insurance companies in VT

Company |

Editor's rating

|

J.D. Power

|

AM Best

|

|---|---|---|---|

| USAA | 735 | A++ | |

| State Farm | 650 | A++ | |

| Nationwide | 645 | A | |

| Concord | - | A+ | |

| Co-Op | - | NR |

Co-Op, Concord and Vermont Mutual do not have ratings from J.D. Power.

Vermont car insurance rates by city

Drivers in South Burlington have the cheapest car insurance rates in Vermont.

Full coverage in South Burlington, a suburb of Burlington, costs $120 per month, on average.

Taftsville, a historic village near Woodstock, has the highest rates, averaging $131 per month.

Average full coverage insurance quotes in Vermont by city

City | Monthly rate | % from average |

|---|---|---|

| Adamant | $128 | 0% |

| Albany | $128 | 0% |

| Alburgh | $124 | -4% |

| Arlington | $127 | -1% |

| Ascutney | $126 | -1% |

Vermont car insurance requirements

Vermont requires drivers to have a minimum amount of car insurance. These minimum insurance limits, often listed as 25/50/10, pay for injuries to another driver and damage to their vehicle. They also cover your own bills if you're in an accident with a driver who doesn't have insurance or whose policy doesn't have enough coverage.

- Bodily injury liability: $25,000 per person and $50,000 per accident

- Property damage liability: $10,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Uninsured and underinsured motorist property damage: $10,000 per accident

You can also self-insure, meaning you can prove to the state you have at least $115,000 available to pay for damages or injuries you cause in a crash.

What's the best car insurance coverage for VT drivers?

Most drivers in Vermont should get full coverage car insurance.

That's because full coverage can have higher liability limits than the state requirement, as well as comprehensive and collision coverage.

Minimum coverage plans may not be enough to cover the cost of damage in an expensive accident. For example, if you crash into and total a brand new car, $10,000 of property damage liability coverage won't be enough to fully replace it. With a full coverage policy, you can have higher property damage liability limits, so you'll pay less out of pocket after a crash.

In addition, full coverage insurance includes comprehensive and collision coverage.

- Collision coverage pays for damage to your car after a crash, regardless of whose fault it is.

- Comprehensive coverage pays for other types of damage, such as damage from theft, vandalism or extreme weather.

Most lenders require you to have comprehensive and collision coverage if you have a car loan or lease. You should also consider these coverages if your car is less than 8 years old or worth more than $5,000.

Frequently asked questions

Who has the cheapest car insurance in Vermont?

Co-Op has the cheapest auto insurance in Vermont in 2026. It offers full coverage insurance for $83 per month and minimum liability insurance for $19 per month.

What is the average cost of auto insurance in Vermont?

The average cost of car insurance in Vermont is $40 per month for a minimum liability policy, and $128 per month for a full coverage policy.

Who has the best car insurance in Vermont?

USAA is the best insurance company in Vermont because of its affordable quotes and high customer service scores, but you can only sign up if you have certain military ties. State Farm is a great alternative for drivers who aren't eligible for USAA.

Is Co-Op cheaper than State Farm?

Yes, Co-Op has cheaper rates than State Farm in Vermont. Co-Op's average full coverage rate is $83 per month, compared to $92 per month for State Farm. Those are two of the cheapest options for car insurance in Vermont.

Is car insurance expensive in Vermont?

Vermont is the second-cheapest state for minimum-coverage insurance and the third-cheapest for full coverage. One reason car insurance is so cheap in Vermont is that it's one of the least-populated states in the country, which means less traffic congestion and fewer accidents. It also has a low percentage of uninsured drivers.

Methodology

ValuePenguin collected thousands of rates from ZIP codes across Vermont for the largest insurance companies in the state. Rates are for a 30-year-old man who owns a 2018 Honda Civic EX with good credit.

Rates for a full coverage policy include liability limits above the minimum, plus collision and comprehensive coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $50,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision: $500 deductible

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used for comparative purposes only. Your own quotes may be different.

About the Author

Managing Editor

Ben Breiner is the Managing Editor of ValuePenguin/LendingTree's insurance vertical. He oversees a team of writers who focus on guiding readers through the rigors of home and auto coverage. He still loves that moment when the words fall together and he can translate an intimidating topic so a reader can make the best choice.

Ben got involved in insurance in 2021 when he joined ValuePenguin. He moved up from writer to editor and watched the team grow to expand the ways it helps consumers. Before that, he spent a decade as a sportswriter for newspapers in the Southeast and Midwest.

Ben had to put off buying his first car because of high insurance rates, so he's keenly aware how the wrong policy can get in the way of your goals. He should've shopped around and looked to the experts.

Insurance tip

Always keep an eye out for insurance you can load up on at a low price. A lot more liability coverage won't break the bank and protects your hard-earned assets.

Expertise

- Car insurance

- Home insurance

- Renters insurance

Education

- BA, Economics and Journalism, University of Wisconsin-Madison

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.