Cheapest Car Insurance Quotes in New Hampshire (2026)

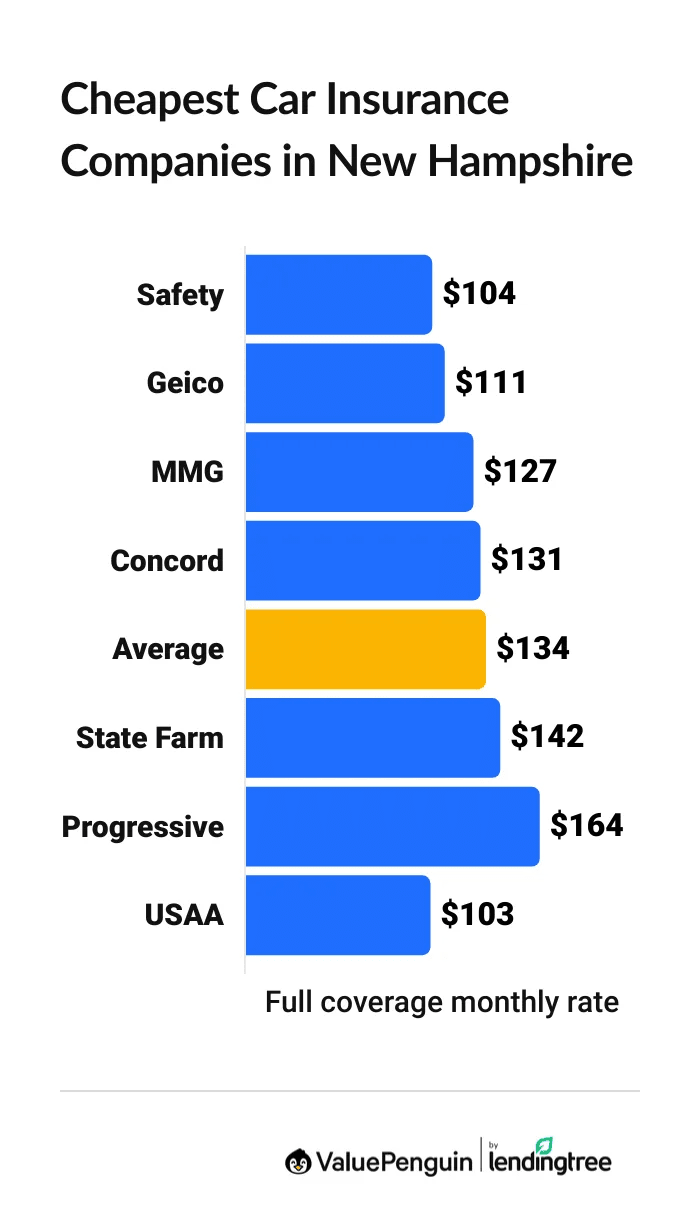

Safety has the cheapest car insurance in New Hampshire, at $104 per month for full coverage. This is $30 per month cheaper than the statewide average.

Find Cheap Auto Insurance Quotes in New Hampshire

Best cheap auto insurance in NH

Best and cheapest car insurance in New Hampshire

- Cheapest full coverage: Safety, $104/mo

- Cheapest minimum liability: Safety, $37/mo

- Cheapest for young drivers: Concord, $122/mo

- Cheapest after a ticket: Safety, $104/mo

- Cheapest after an accident: State Farm, $160/mo

- Cheapest for teens after a ticket: Safety, $147/mo

- Cheapest after a DUI: Progressive, $192/mo

- Cheapest for poor credit: Geico, $163/mo

Monthly rates based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

Cheapest car insurance in NH: Safety

Safety and Geico have the cheapest full coverage car insurance in New Hampshire.

Find Cheap Auto Insurance Quotes in New Hampshire

- Safety has the cheapest full coverage rates in NH, at $104 per month. That's $30 per month cheaper than the New Hampshire average. However, Safety doesn't offer online quotes, which means you'll have to speak with an agent to compare rates.

- Geico has the cheapest online quotes in New Hampshire, at $111 per month for a full coverage policy. While that's $7 per month more than a Safety policy, Geico doesn’t have the best customer service reviews.

- State Farm may be worth the extra expense if you value good customer service and prefer to manage your policy online. State Farm rates are typically more expensive.

Cheapest full coverage car insurance in New Hampshire

Company | Monthly rate | |

|---|---|---|

| Safety | $104 | |

| Geico | $111 | |

| MMG | $127 |

| Concord | $131 |

| State Farm | $142 |

*USAA is only available to current and former military members and their families.

Data-powered research on New Hampshire car insurance

Data-powered research on NH car insurance |

|---|

Cheapest liability-only NH auto insurance: Safety

Safety has the cheapest minimum liability car insurance in New Hampshire.

A liability-only policy from Safety costs $37 per month, which is $17 per month less than the state average. The second-cheapest company, MMG, charges $46 per month.

Cheap minimum liability car insurance quotes in NH

Company | Monthly rate |

|---|---|

| Safety | $37 |

| MMG | $46 |

| Geico | $48 |

| Concord | $57 |

| State Farm | $60 |

*USAA is only available to current and former military members and their families.

Find Cheap Auto Insurance Quotes in New Hampshire

Veterans and military families can also find affordable car insurance at USAA. Minimum liability coverage from USAA costs $37 per month. USAA also has a strong customer service reputation, but it's only available to military members, veterans and some of their family members.

Best NH car insurance rates for teens: Concord

Concord has the cheapest quotes for young drivers in New Hampshire.

The average cost of a liability-only policy from Concord is $122 per month, which is around one quarter less than the state average. MMG has the best full coverage quotes for teen drivers, at just $229 per month. That's $163 per month less than the New Hampshire average.

Cheap New Hampshire auto insurance for young drivers

Company | Liability only | Full coverage |

|---|---|---|

| Concord | $122 | $254 |

| MMG | $122 | $229 |

| Geico | $126 | $302 |

| Safety | $147 | $422 |

| Allstate | $179 | $344 |

*USAA is only available to current and former military members and their families.

In New Hampshire, young drivers pay nearly three times as much for car insurance as older drivers. That's because they tend to get in more accidents. This makes them more expensive to insure because companies may have to pay out more money from claims.

The best way for New Hampshire teens to lower their car insurance rates is by sharing a policy with their parents or an older relative. A shared policy is usually much cheaper than two separate policies, and you can qualify for a multi-car discount.

Young drivers should also try to qualify for as many discounts as possible. For example, many companies offer a discount for getting good grades in school, taking a defensive driving course or bundling your home or renters insurance.

Cheapest car insurance for NH drivers with a speeding ticket: Safety

Safety has the best cheap auto insurance for New Hampshire drivers with a single speeding ticket. At $104 per month, full coverage from Safety costs $63 per month less than the state average.

Affordable car insurance in NH after a ticket

Company | Monthly rate |

|---|---|

| Safety | $104 |

| State Farm | $142 |

| Geico | $155 |

| Concord | $177 |

| MMG | $181 |

*USAA is only available to current and former military members and their families.

New Hampshire drivers pay 25% more for car insurance after a single speeding ticket. That's an average increase of $33 per month for a full coverage policy.

Some companies won’t raise rates on your first minor traffic violation ticket if you have what’s called accident forgiveness.

Cheapest quotes for NH drivers after an accident: State Farm

State Farm offers the cheapest quotes for New Hampshire drivers with an at-fault accident in their driving history. A full coverage policy from State Farm costs $160 per month, which is nearly one quarter less than the New Hampshire average.

Cheap New Hampshire auto insurance quotes after a crash

Company | Monthly rate |

|---|---|

| State Farm | $160 |

| MMG | $190 |

| Concord | $201 |

| Safety | $206 |

| Geico | $224 |

*USAA is only available to current and former military members and their families.

An at-fault accident in New Hampshire increases auto insurance quotes by an average of $77 per month.

Don't rush to switch car insurance companies right after your accident. Your rates won't go up until your current policy needs to be renewed. But any quotes you get will factor in your accident, so they'll usually be more expensive than what you're currently paying.

Instead, wait for your insurance company to send your renewal offer, which usually comes a few weeks to a month before your policy expires. Then, you should shop around for multiple quotes to find the best price for you.

Cheapest NH insurance for teens with a ticket or accident: Safety and MMG

Safety is the cheapest company for young drivers in New Hampshire with a speeding ticket on their records.

A minimum liability policy from Safety costs $147 per month for an 18-year-old with one speeding ticket. That's 44% less than the New Hampshire state average.

Teens with a recent accident on their records pay around $181 per month for a liability-only policy from MMG, which is 20% less than the state average.

Best auto insurance in NH for teens after a ticket or crash

Company | Ticket | Accident |

|---|---|---|

| Safety | $147 | $203 |

| Geico | $154 | $195 |

| Concord | $165 | $192 |

| MMG | $172 | $181 |

| State Farm | $210 | $218 |

*USAA is only available to current and former military members and their families.

In New Hampshire, teens with a speeding ticket pay 19% more for car insurance than those with clean records. And an at-fault accident will raise your rates by around 42%. That's less than the typical increase for older drivers because young drivers are considered high risk to begin with.

Cheap auto insurance quotes in NH after a DUI: Progressive

Progressive has the most affordable car insurance in New Hampshire after a DUI. A full coverage policy from Progressive costs $192 per month after a DUI, which is $39 per month cheaper than the statewide average.

Affordable New Hampshire car insurance rates after a DUI

Company | Monthly rate |

|---|---|

| Progressive | $192 |

| MMG | $215 |

| Safety | $230 |

| Concord | $231 |

| Allstate | $239 |

*USAA is only available to current and former military members and their families.

New Hampshire drivers can expect their rates to go up by around 73% after a DUI. That's an increase of $97 per month for full coverage insurance, on average.

Cheapest car insurance for drivers with poor credit: Geico

Geico has the best car insurance quotes in New Hampshire for drivers with poor credit. With an average price of $163 per month for full coverage, a policy from Geico is $111 per month cheaper than the state average.

Affordable auto insurance quotes in NH with bad credit

Company | Monthly rate |

|---|---|

| Geico | $163 |

| Safety | $176 |

| Concord | $191 |

| Allstate | $256 |

| Progressive | $269 |

*USAA is only available to current and former military members and their families.

New Hampshire drivers with poor credit pay more than twice as much for full coverage than drivers with good credit. This is because insurance companies believe drivers with bad credit are more likely to file claims in the future.

You can improve your credit score by paying your bills on time and limiting the number of new cards or credit lines you apply for. While these actions won't affect your car insurance rates right away, a better credit score could mean lower rates when your policy renews.

Best car insurance in NH

USAA has excellent service and low rates in New Hampshire.

However, USAA is only available to people affiliated with the military and their immediate family.

State Farm has strong customer service, making it a great option if you’re comfortable with higher-than-average rates.

Top car insurance companies in NH

Company |

Editor's rating

|

J.D. Power

|

AM Best

|

|---|---|---|---|

| USAA | 735 | A++ | |

| State Farm | 650 | A++ | |

| MMG | A | ||

| Concord | A+ | ||

| Safety | 617 | A |

New Hampshire car insurance rates by city

Keene, a city in southwestern New Hampshire, has the cheapest car insurance quotes in the state.

Drivers in Keene pay an average of $133 per month for a full coverage policy.

Manchester, located just north of Boston, has the most expensive car insurance in New Hampshire, at $176 per month. As the largest city in the state, Manchester has more traffic and higher auto theft rates than many other cities in New Hampshire. This makes car insurance more expensive because traffic and theft both lead to more claims.

Average full coverage quotes in New Hampshire by city

City | Monthly rate | % from average |

|---|---|---|

Alton Bay | $146 | 9% |

| Antrim | $147 | 10% |

Ashland | $139 | 4% |

Ashuelot | $138 | 3% |

Barnstead | $148 | 11% |

Do I need car insurance in New Hampshire?

New Hampshire is the only state that doesn’t require car insurance. But, if you don’t buy car insurance, you'll have to deposit $100,000 in cash or securities with the state treasurer.

Most New Hampshire drivers choose to have car insurance, and the state has few uninsured drivers. In addition, lenders typically require you to have car insurance if you have a car loan or lease.

Drivers who buy car insurance must meet the minimum coverage requirements:

- Bodily injury liability coverage: $25,000 per person and $50,000 per accident

- Property damage liability coverage: $25,000 per accident

- Uninsured motorist bodily injury liability coverage: $25,000 per person and $50,000 per accident

- Uninsured motorist property damage liability coverage: $25,000 per accident

- Medical payments coverage: $1,000 per accident

What's the best car insurance coverage in NH?

Full coverage is the best choice for most drivers in New Hampshire.

One reason for this is because full coverage car insurance includes comprehensive and collision insurance. Collision and comprehensive insurance cover damage to your car because of a crash, theft, vandalism or a natural disaster, regardless of who's at fault.

Full coverage can also have higher liability limits than required by the state. This is important because the minimum requirement may not be high enough to cover the cost of a serious accident.

For example, if you hit and total an expensive car, it's unlikely that $25,000 with property damage liability will be enough to replace it. So if you have minimum coverage, you may end up with a big bill after a major crash.

Frequently asked questions

Is Safety better than State Farm?

Safety has cheaper rates than State Farm in New Hampshire, but State Farm has more reliable customer service.

Do I need car insurance in New Hampshire?

Car insurance is not required in New Hampshire. However, drivers who choose not to buy a policy need to deposit $100,000 in cash or securities with the state treasurer. However, most drivers prefer to get an insurance policy.

What is the cheapest car insurance in New Hampshire?

Safety has the cheapest insurance rates in New Hampshire in 2026. A full coverage policy from Safety costs $104 per month, while minimum liability coverage costs $37 per month. Both are significantly less than the New Hampshire state averages.

Is car insurance expensive in New Hampshire?

NEED NATIONAL DATA New Hampshire has the second-cheapest full coverage rates in the country. It's also the 13th-cheapest state for minimum liability insurance. This is partially because New Hampshire has fewer deadly car accidents and uninsured drivers than many other states.

How much does car insurance cost in New Hampshire?

The average cost of full coverage car insurance in New Hampshire is $134 per month, or $1,605 per year. Minimum liability coverage costs $55 per month, or $657 per year.

Methodology

ValuePenguin collected thousands of rates from ZIP codes across New Hampshire for the largest insurance companies in the state. Rates are for a 30-year-old man with good credit who owns a 2018 Honda Civic EX.

Quotes are for a full coverage policy with comprehensive and collision coverage and liability limits that are higher than the New Hampshire minimum requirement.

- $50,000 of bodily injury liability coverage per person and $100,000 per accident

- $50,000 of property damage liability

- $10,000 of medical payments coverage

- $50,000 of bodily injury uninsured motorist coverage per person and $100,000 per accident

- Collision and comprehensive coverage with a $500 deductible

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used for comparative purposes only. Your own quotes may be different.

Senior Writer

Jenn Jones is a Senior Writer at LendingTree where she covers auto, home, renters and motorcycle insurance topics.

Previously an editor for USA TODAY Blueprint and a finance manager at World Car dealerships, she has more than a decade of experience in the world of personal finance and a deep interest in sharing knowledge that empowers others. She’s also served as a freelance translator, copy editor, writer and researcher. She graduated from the University of Virginia with a B.S. in commerce and a B.A. in Chinese language and literature.

How insurance helped Jenn

Jenn first came to appreciate pet insurance when annual checkups for her cat and dog totaled more than $700.

Expertise

- Auto insurance

- Renters insurance

- Condo insurance

- Home insurance

Referenced by

- USA TODAY

- MSN

- F&I Magazine

- Automotive News

Education

- BS, Commerce, University of Virginia

- BA, Chinese Language and Literature, University of Virginia

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.