Compare Honda Insurance Costs by Model

The average cost to insure a Honda is $255 per month. Car insurance rates range from $203 per month for a Honda Fit to $301 per month for a... Read More

Compare life insurance quotes and find the best rates for a policy.

Life insurance can help protect your family financially if anything happens to you, but it’s important to make sure you’re not overpaying for the coverage you need.

Life insurance is a planning tool that provides financial protection for your dependents.

The asset provides a tax-free lump sum of money which is paid to your dependent after your death. Typically, life insurance is bought so that your dependents would be able to sustain payments for bills, college tuition or other after-life expenses.

Key components of life insurance policies are:

Every individual has a different financial situation and therefore will require different life insurance needs.

When calculating your needs you should consider what the life insurance will be used for and why you may need life insurance in general.

If you are young and do not have any dependents then buying life insurance may not be a necessary purchase at this point in your life. On the other hand, if you are starting a family in which the financial livelihood of the family relies on your salary, then you may want to consider purchasing some life insurance coverage and calculate your future needs.

When beginning to calculate how much life insurance you need, you should start by adding up your current and future financial obligations. This can include obligations such as:

After you have figured out your obligations, you can add up your current assets such as savings and college funds. Finally, by subtracting your current assets from the obligations you will arrive at a target amount for how much life insurance you will need. It is important to note that this is a rough estimate for coverage and it may be useful to purchase slightly more life insurance to compensate for unexpected financial situations that your dependents might face.

Life insurance companies will typically offer two different types of life insurance: term life insurance and permanent life insurance.

A term policy will last for a set period of time before expiring while permanent plans stay in effect for your entire life. Furthermore, some permanent life insurance policies will have a cash value component that will grow as you make premium payments.

Term life insurance | Permanent life insurance | |

|---|---|---|

| Period of coverage | Specified term, usually one to 30 years | Lifelong |

| Cash value | No | Yes |

| Average monthly premium | Cheap | Expensive |

Depending on your situation and what the purpose of your life insurance is, the type of life insurance that you need will change.

For example, if you are looking for a cheap policy to cover future financial obligations like college tuition, then choosing a term life insurance policy with a death benefit that matches the total tuition may be the best option. On the other hand, say you have Type 1 diabetes and have had problems with getting approved for life insurance. In this case, a permanent policy like guaranteed acceptance life insurance may be a better option for coverage.

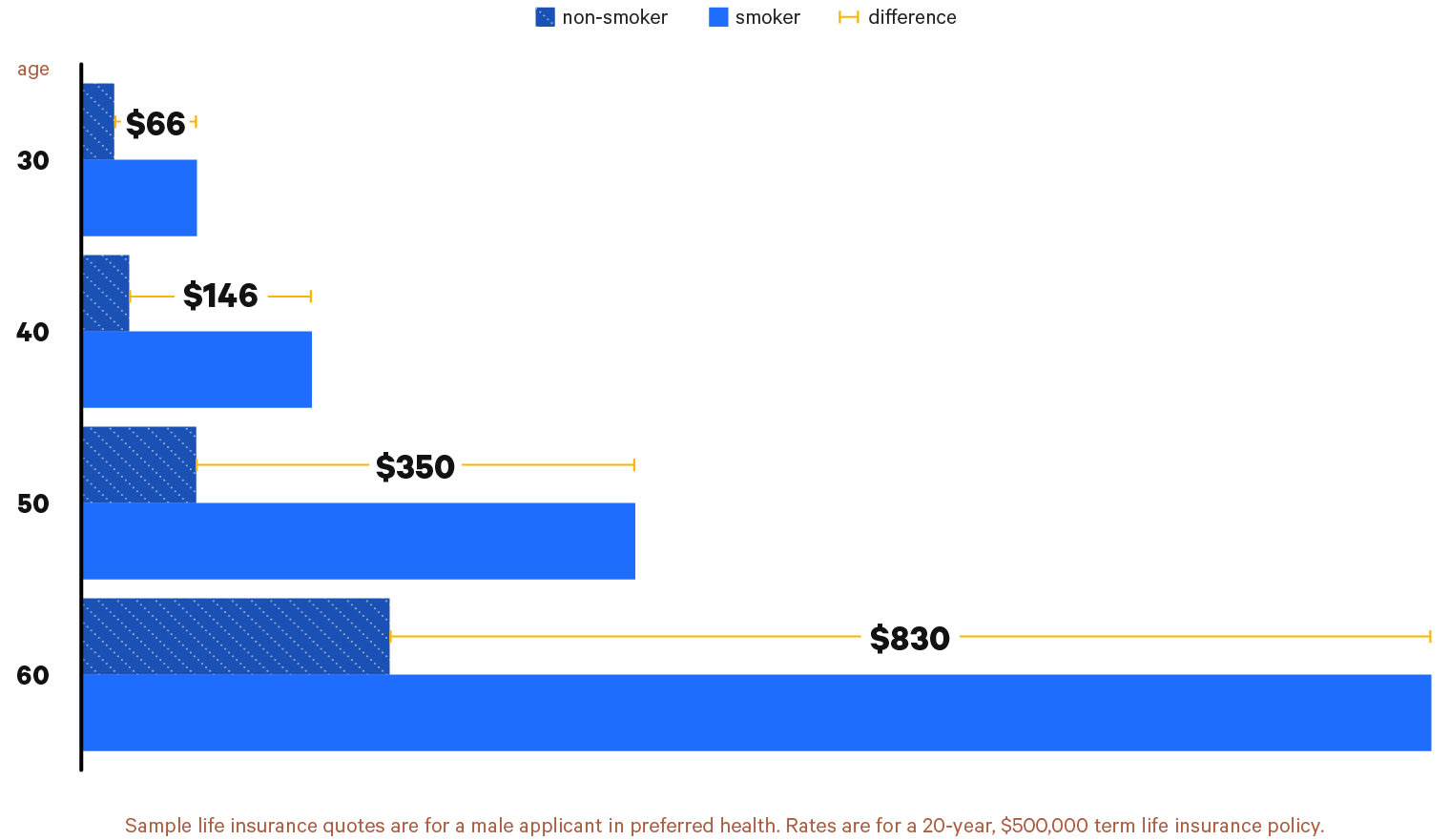

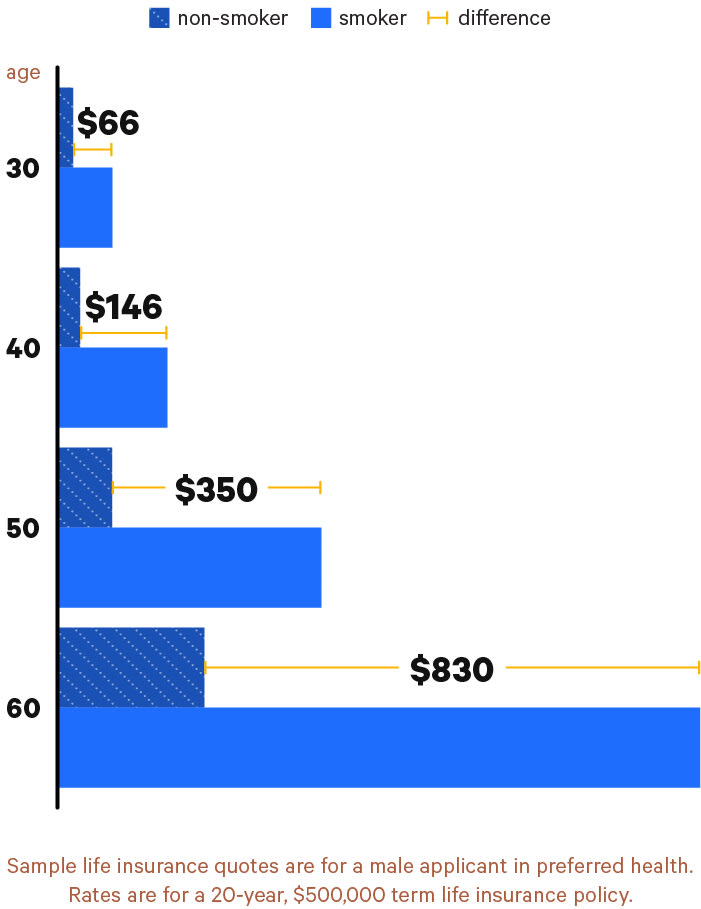

The cost of your life insurance policy will be dependent on a variety of factors including your health, age, occupation and if you smoke. However, the largest determinant will be if you are a smoker.

Smokers will have an average cost of life insurance that is 306% higher when compared to a nonsmoker.

Find Cheap Life Insurance Quotes in Your Area

When searching for the best cheap life insurance we would recommend getting life insurance quotes from as many insurers as possible. To aid you in this process we have provided detailed reviews of some of the best life insurance companies in the industry.

You will notice that many life insurance providers will have favorable underwriting requirements for certain individuals. For example, if you smoke you may find that Northwestern Mutual will have some of the best smoker life insurance rates available. Additionally, some insurers will specialize in certain products such as Mutual of Omaha which has one of the cheapest guaranteed whole life insurance products in the industry.

The average cost to insure a Honda is $255 per month. Car insurance rates range from $203 per month for a Honda Fit to $301 per month for a... Read More

Mopeds must be registered with the South Carolina DMV to ride on public roads, but insurance is not required.... Read More

Scooters, mopeds and electric bicycles are regulated differently from motorcycles in North Carolina. Whether you'll need insurance, a... Read More

Policyholders can file an auto insurance claim after an accident to request reimbursement for damage. You should always read your policy or... Read More

The average annual cost of flood insurance in Massachusetts is $1,078 per year for a policy from the National Flood Insurance Program with... Read More

On average, flood insurance costs $1,261 per year in Pennsylvania. Costs will be different depending on where you live and how your home is... Read More

Flood insurance costs $883 per year in Georgia, on average. As a Georgia homeowner, you'll need to buy flood insurance if your home is in a... Read More

Your home insurance rate may go up after you file a claim. It depends on the type of claim, your claims history and an assessment of your... Read More

In Indiana, mopeds, scooters and other personal mobility devices are regulated differently than motorcycles. Here's what you need to know... Read More

The average price of full coverage insurance for a 2022 Subaru WRX is $224 per month. But drivers looking for the cheapest rates should... Read More

Scooters, mopeds and other personal mobility tools are subject to different laws than motorcycles. Some require a license and insurance,... Read More

Your health insurance might cover abortions. But coverage depends on why you need an abortion, the state you live in and the type of health... Read More