Cheap Car Insurance Quotes in Michigan 2026

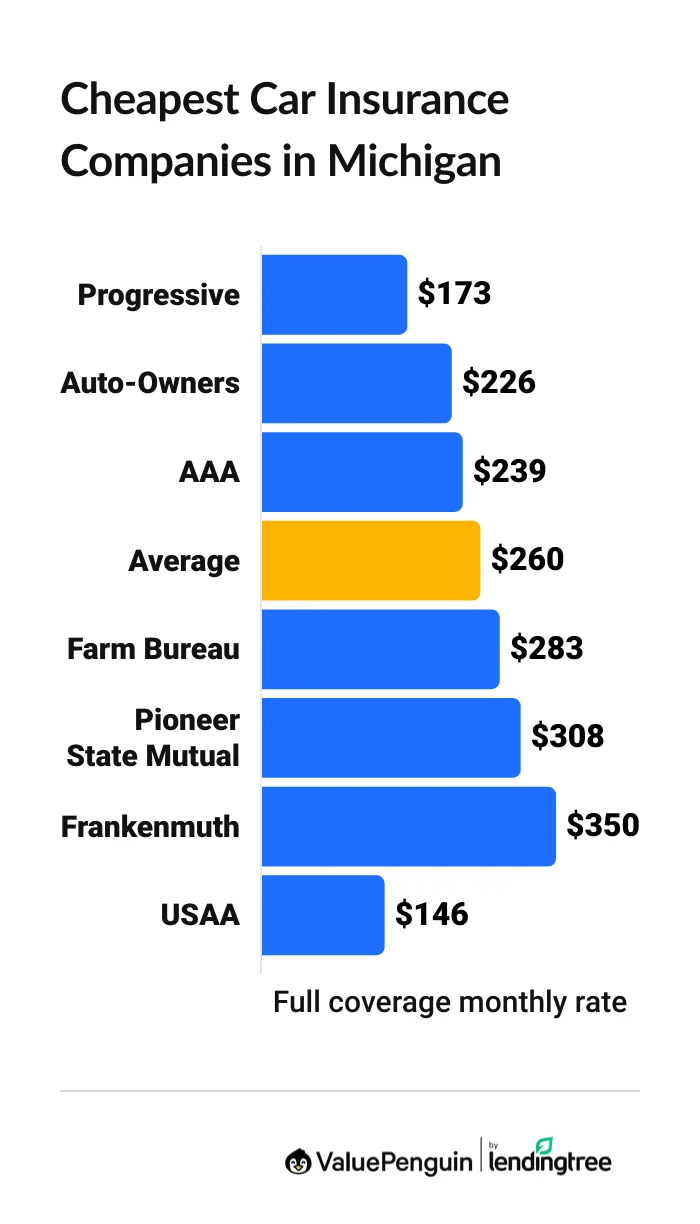

Progressive has the cheapest full coverage auto insurance in Michigan. At $173 per month, Progressive is $87 per month cheaper than the state average.

Find Cheap Car Insurance Quotes in Michigan

Best cheap auto insurance in Michigan

Best and cheapest car insurance in Michigan

- Cheapest full coverage: Progressive, $173/mo

- Cheapest minimum liability: AAA, $70/mo

- Cheapest for young drivers: Auto-Owners, $107/mo

- Cheapest after a ticket: Progressive, $223/mo

- Cheapest after an accident: Auto-Owners, $266/mo

- Cheapest for teens after a ticket: Auto-Owners, $133/mo

- Cheapest after a DUI: Progressive, $209/mo

Monthly rates are based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

Auto-Owners has the best mix of affordable rates and great customer service in Michigan. But Auto-Owners doesn't offer online quotes, so you need to contact an agent to compare rates.

Progressive has the cheapest online quotes in Michigan. You can quickly compare rates and buy a policy on the company's website. However, Progressive's customer service isn't as good as Auto-Owners' customer support.

Cheapest car insurance in Michigan: Progressive

Progressive has the cheapest full coverage car insurance in Michigan for most people.

Find Cheap Car Insurance Quotes in Michigan

Full coverage from Progressive costs $173 per month on average, which is 34% cheaper than the state average.

USAA offers even cheaper auto insurance quotes to members of the military, veterans and their families. USAA's full coverage policy costs $146 per month, which is $27 less per month than Progressive.

Cheapest full coverage insurance in Michigan

Company | Monthly rate | |

|---|---|---|

| Progressive | $173 | |

| Auto-Owners | $226 | |

| AAA | $239 | |

| Farm Bureau | $283 | |

| Pioneer State Mutual | $308 |

USAA is only available to current and former military members and their families.

Data-powered research on Michigan car insurance

Data-powered research on MI car insurance |

|---|

Cheapest liability car insurance quotes in Michigan: AAA

AAA has the cheapest minimum coverage auto insurance in Michigan.

A policy from AAA costs around $70 per month. That's $20 per month less than the Michigan state average, which is $90 per month.

Auto-Owners and Progressive also have liability-only insurance for a little more than $70 per month. But Auto-Owners has better customer service scores than Progressive.

Best cheap Michigan auto insurance

Company | Monthly rate |

|---|---|

| AAA | $70 |

| Auto-Owners | $71 |

| Progressive | $72 |

| Farm Bureau | $89 |

| Pioneer State Mutual | $90 |

USAA is only available to current and former military members and their families.

Find Cheap Car Insurance Quotes in Michigan

Cheapest auto insurance in MI for young drivers: Auto-Owners

Auto-Owners has the most affordable car insurance for Michigan teens.

Auto-Owners insurance costs an average of $107 per month for a teen buying minimum coverage. That's $93 per month cheaper than the state average.

Auto-Owners also has the cheapest full coverage rates for teens, at $361 per month for an 18-year-old.

Young drivers can find even cheaper rates at USAA, where a minimum coverage policy costs just $78 per month. But USAA is only available to military members, veterans and their immediate families.

Best Michigan car insurance rates for teens

Company | Liability only | Full coverage |

|---|---|---|

| Auto-Owners | $107 | $361 |

| AAA | $137 | $492 |

| Farm Bureau | $145 | $462 |

| Pioneer State Mutual | $159 | $542 |

| Frankenmuth | $223 | $646 |

USAA is only available to current and former military members and their families.

In Michigan, 18-year-old drivers pay about twice as much for minimum coverage car insurance as older drivers.

Insurance companies charge teens more for insurance because they have less driving experience and are more likely to get in an accident.

The best way for young drivers to pay less for car insurance is to join their family's insurance plan. Also, many companies offer car insurance discounts for taking driver safety classes or having good grades.

Cheapest MI car insurance after a speeding ticket: Progressive

Progressive has the cheapest car insurance quotes in Michigan for drivers with a recent speeding ticket. A full coverage policy from Progressive costs $223 per month, which is $82 per month less than the state average.

Company | Monthly rate |

|---|---|

| Progressive | $223 |

| Auto-Owners | $266 |

| Farm Bureau | $283 |

| AAA | $283 |

| Pioneer State Mutual | $333 |

USAA is only available to current and former military members and their families.

A single speeding ticket increases insurance quotes for Michigan drivers by $46 per month for full coverage insurance, on average.

Cheapest Michigan car insurance after an accident: Auto-Owners

Auto-Owners has the cheapest quotes for Michigan drivers with an accident on their record. Full coverage from Auto-Owners costs $266 per month, which is $67 per month less than the state average.

Company | Monthly rate |

|---|---|

| Auto-Owners | $266 |

| Progressive | $271 |

| AAA | $338 |

| Farm Bureau | $346 |

| Pioneer State Mutual | $369 |

USAA is only available to current and former military members and their families.

In Michigan, an at-fault accident raises rates by an average of 28%, or $73 per month for full coverage.

Don't rush to switch insurance companies right after an accident.

Your rates won't go up until your policy renews. You should get a letter or email beforehand with your new rates. That's a good time to start shopping around for quotes.

Cheapest for young drivers after a ticket or accident: Auto-Owners

Auto-Owners is the cheapest option for young drivers in Michigan who have a recent speeding ticket or accident.

The company's rates average $133 per month for minimum coverage after either an at-fault accident or a speeding ticket.

Cheap insurance in Michigan for teens with a ticket or accident

Company | Ticket | Accident |

|---|---|---|

| Auto-Owners | $133 | $133 |

| Farm Bureau | $145 | $178 |

| AAA | $151 | $172 |

| Pioneer State Mutual | $176 | $196 |

| Frankenmuth | $254 | $320 |

USAA is only available to current and former military members and their families.

After a speeding ticket, young drivers in Michigan pay an average of $38 more per month for minimum coverage car insurance. An accident raises rates by an average of $56 per month.

Cheapest MI auto insurance quotes after a DUI: Progressive

Progressive has the cheapest Michigan car insurance quotes for drivers with a DUI. Full coverage rates from Progressive average $209 per month. A policy from Progressive costs 70% less than the Michigan average.

Inexpensive auto insurance in Michigan after a DUI

Company | Monthly rate |

|---|---|

| Progressive | $209 |

| Auto-Owners | $482 |

| AAA | $577 |

| Pioneer State Mutual | $589 |

| Farm Bureau | $693 |

USAA is only available to current and former military members and their families.

In Michigan, having a DUI on your record can cause your car insurance rates to more than double. To get the cheapest car insurance, choose a company with low rates and look for discounts for things like taking a defensive driving class.

Best car insurance in Michigan

State Farm and Farm Bureau are the best car insurance companies for customer service in Michigan for most drivers.

Each company earned a good score on J.D. Power's customer satisfaction survey and a rating of 4.5 stars from ValuePenguin editors.

USAA has the highest customer satisfaction scores overall. However, not everyone can buy car insurance from USAA. You must be a military member, veteran or military family member to qualify.

Top-rated insurance companies in Michigan

Company |

Editor's rating

|

J.D. Power

|

AM Best

|

|---|---|---|---|

| USAA | 735 | A++ | |

| State Farm | 650 | A++ | |

| Farm Bureau | 645 | A | |

| Auto-Owners | 638 | A+ | |

| Frankenmuth | A |

AAA and Auto-Owners are also highly rated options in Michigan and are available to everyone. Both have strong customer service reputations.

Average Michigan car insurance rates by city

Shoreham has the cheapest car insurance quotes in Michigan, while Hamtramck has the highest rates in the state.

Where you live can impact your auto insurance rates. In Michigan, rates vary widely from city to city. The difference between the most and least expensive places is $476 per month for a full coverage policy.

Drivers living in Hamtramck, a city in the Detroit metro, pay an average of $683 per month for full coverage insurance. People in Shoreham, on Lake Michigan near St. Joseph, pay an average of $206 per month for the same coverage. Residents of Flint pay $391 per month, while people in Ann Arbor pay $233 per month.

Michigan auto insurance quotes by city

City | Monthly rate | % from average |

|---|---|---|

| Acme | $250 | -4% |

| Addison | $256 | -1% |

| Adrian | $244 | -6% |

| Afton | $261 | 1% |

| Ahmeek | $257 | -1% |

Michigan car insurance requirements

Michigan has the highest required car insurance limits in the country.

Michigan drivers must have a large amount of personal injury protection (PIP) along with the standard liability coverages that most states require.

Personal injury protection (PIP) pays for injuries to you or your passengers in an accident. It also helps replace lost income while you recover, no matter who is at fault.

In Michigan, you must have car insurance liability limits of 50/100/10.

- $50,000 in bodily injury liability coverage per person

- $100,000 in bodily injury liability coverage per accident

- $10,000 in property damage liability

You also need:

- $250,000 in personal injury protection (PIP), unless you meet certain criteria to opt out

- $1 million per accident in property protection insurance

Michigan is a no-fault state. That means your insurance pays for your medical bills without considering who caused the car accident.

Driving without insurance in Michigan is a misdemeanor, and it can come with major consequences. If you cause an accident or are pulled over, you'll have to pay a fine of $200 to $500, and could spend up to a year in jail. The court can also suspend your driver's license for up to 30 days, or until you provide proof that you have an active insurance policy.

In addition, if you cause an accident while driving without insurance, you'll have to pay for any injuries or damage you cause, which can cost thousands of dollars or more.

What's the best car insurance coverage for Michigan drivers?

Full coverage car insurance is the best choice for most Michigan drivers.

Full coverage includes liability insurance, which pays for damage you cause in a crash, along with collision and comprehensive coverage.

- Collision insurance pays to repair your car after an accident you cause.

- Comprehensive insurance pays to repair your car if it's damaged by events like weather, theft or vandalism.

If you have a loan or lease on your car, your lender typically requires you to have comprehensive and collision coverage. It's also a good idea if your car is worth more than $5,000 or is less than 8 years old.

Minimum coverage insurance is the most affordable insurance option in Michigan. It costs $170 per month less than full coverage.

However, minimum car insurance coverage doesn't include comprehensive and collision. This means it won't pay for damage you cause to your own car.

For cheaper or older cars, you might save more by getting minimum coverage and paying for repairs yourself.

Frequently asked questions

Who has the cheapest car insurance rates in Michigan?

In 2026, AAA has the cheapest car insurance quotes in Michigan, with an average rate of $70 per month for minimum coverage insurance. That's 22% cheaper than the Michigan average. If you need full coverage, Progressive has the cheapest rate, at $173 per month.

How much is car insurance in Michigan per month?

The average cost of auto insurance in Michigan is $260 per month for a full coverage policy. That makes Michigan the third-most expensive state in the U.S. for full coverage insurance. The minimum coverage you need to avoid penalties costs an average of $90 per month.

Why is car insurance so expensive in Michigan?

Car insurance in Michigan is expensive because the state requires high coverage limits. Recent laws lowered the minimum requirement for personal injury protection (PIP). However, Michigan is still the most expensive state for minimum coverage car insurance. Its rates are nearly double the national average.

What's the best insurance in Michigan?

Auto-Owners has the best car insurance for most Michigan drivers. Auto-Owners has good customer service and affordable rates. However, you can't compare quotes online.

Methodology

ValuePenguin collected thousands of rates from ZIP codes across Michigan for the largest insurance companies in the state. Quotes are for a 30-year-old man driving a 2018 Honda Civic EX with a good credit score.

Quotes are for a full coverage policy with the following coverage limits:

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $50,000 per accident

- Personal injury protection: $250,000

- Property protection insurance: $1 million per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision: $500 deductible

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These quotes were publicly sourced from insurer filings and should be used for comparative purposes only. Your own quotes may be different.

Lead Writer

Matt Timmons is a Lead Writer on the insurance team at ValuePenguin, where he writes in-depth and timely pieces helping find the right coverage for them.

He's covered insurance at ValuePenguin since 2018, specializing in auto and home insurance, as well as life insurance. He's paid special attention to the EV insurance market, where prices are much higher than for gas cars.

Before he started writing about personal finance, Matt wrote about professional skills and online tools at an e-learning company.

How insurance helped Matt

During freshman orientation in college, Matt's iPod was stolen off his table while he was eating lunch. Luckily, he'd bought a college insurance plan the day before and he had money to buy a replacement before classes started.

Expertise

- Auto insurance

- Home insurance

- Insurance rate analysis

- Life insurance

Referenced by

- CNBC

- Miami Herald

- Yahoo! Finance

Education

- BA, Wesleyan University

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.