How Much Does Earthquake Insurance Cost in California?

Find Cheap Homeowners Insurance Quotes in California

California homeowners need earthquake insurance if they want full protection, as damage from earthquakes is not covered by homeowners insurance. Earthquake insurance costs an average of $3.54 per thousand dollars of coverage in California. This translates into an annual rate of $1,770 for a single-family home with a $500,000 replacement cost.

However, depending on which insurer you choose, coverage can cost as little as 10 cents per thousand dollars of coverage or as much as $15 per thousand dollars of coverage.

Earthquake insurance rates in California by city

Earthquakes cause an estimated $14.7 billion worth of damage annually in the U.S.; $9.6 billion of that is just in the state of California. Between 2010 and 2015, the U.S. Geological Survey recorded 1,545 earthquakes in the state of California that registered at or above a magnitude 3.

Earthquake quotes vary by location. The closer your house is to a fault line in California, the higher your rate, reflecting the greater probability of earthquake damage and the resulting higher cost to protect your assets.

Cost of CA earthquake insurance per thousand dollars of coverage

City | Average coverage rate | Average annual cost for $500,000 of coverage | |

|---|---|---|---|

| Alameda | $6.47 | $3,233 | |

| Big Bear Lake | $3.41 | $1,704 | |

| Burbank | $4.21 | $2,104 | |

| Calexico | $5.82 | $2,912 | |

| Chula Vista | $3.04 | $1,518 |

Los Angeles

Residents in the Los Angeles neighborhoods of Echo Park, Silver Lake and El Sereno tend to see cheaper rates for earthquake coverage. Residents in Mar Vista, Culver City and West Los Angeles typically pay higher rates for the same coverage.

With the San Andreas tectonic zone and hundreds of smaller active faults, the county is estimated to have a 60% chance of an earthquake with a magnitude of at least 6.7 in the next three decades, according to the U.S. Geological Survey.

San Diego

The cost of protection against earthquakes ranges from $2.90 to $3.09 per thousand dollars of coverage in San Diego. For $758,000 of dwelling coverage — the median home price in San Diego — the annual rate is estimated to be between $2,199 and $2,342.

Home to over 1.4 million residents — and the Rose Canyon, Elsinore and San Jacinto fault lines — the city (and San Diego County) also has an 18% chance of a magnitude 6.7 or greater earthquake in the next 30 years, according to the Earthquake Engineering Research Institute. The organization estimates that 45% of residential buildings would be damaged by an earthquake of this magnitude.

San Francisco

Insuring a single-family house in San Francisco against earthquakes could cost anywhere from $4.08 to $4.58 per thousand dollars of coverage. The Mission neighborhood ranks on the cheaper end, while Nob Hill residents tend to see rates on the higher end of the range.

Assuming coverage for a median home price of $1.3 million, rates could be close to $6,000 a year.

With the San Andreas and Hayward faults running through the greater Bay Area, the U.S. Geological Survey estimates that there's a 72% chance that an earthquake of at least a 6.7 magnitude will strike in the next 30 years.

How much do earthquake insurance costs vary by insurer?

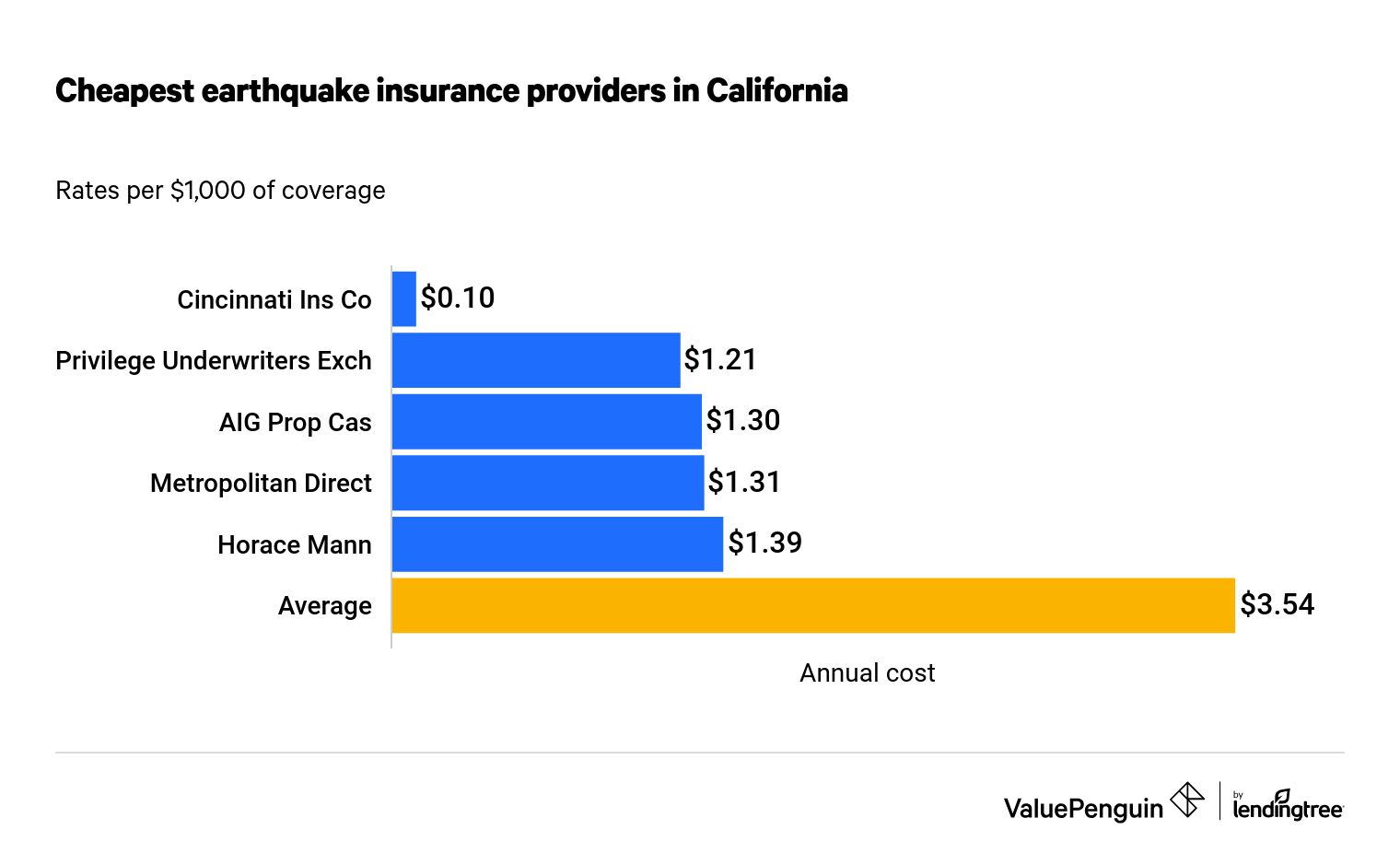

The average cost by earthquake insurer ranges from 10 cents to $15 per thousand dollars of coverage for a single-family house in California. Estimated annual rates range from $50 to $7,500 for coverage limits of $500,000, illustrating the importance of comparing quotes.

The graph below ranks companies based on their coverage cost per thousand dollars, starting with the most affordable. The quote you get may vary based on the characteristics of your house, including its foundation, number of stories and year built. This graph also does not include carriers like Allstate, State Farm or USAA, which refer to the California Earthquake Authority to determine rates.

The companies with the three lowest earthquake insurance rates are Cincinnati Insurance Co., Privilege Underwriters Exchange and AIG, with average rates ranging from 10 cents to $1.30 per thousand dollars of coverage.

On the other hand, the three companies charging the highest rates are Aegis Security, American Modern and Pacific Specialty. These insurers quoted rates that are 16 to 150 times higher than the rates from the cheapest competitors. For these pricier carriers, rates are fairly consistent and are not greatly affected by whether a homeowner lives in a low-risk or a high-risk area for tremors.

CEA earthquake insurance policies

The California Earthquake Authority (CEA) is one of the world’s largest providers of residential earthquake insurance. A publicly managed not-for-profit entity, it partners with insurers to help Californians manage their earthquake-related risks and losses.

The CEA offers two policies for earthquake insurance: Homeowners Choice and Standard Homeowners. The biggest difference between the two policies is that the Homeowners Choice policy does not automatically include personal property or loss of use coverage. Homeowners Choice policies are usually cheaper, but we generally recommend getting the Standard Homeowners policy. Unless you are confident you could replace your personal property and you have a place to stay after an earthquake, paying for loss of use and personal property coverage is worth it.

Coverage | Explanation | Included in Standard Homeowners? | Included in Homeowners Choice? | Coverage limits for both policies |

|---|---|---|---|---|

| Dwelling coverage | Covers earthquake damage to the structure of your home and attached structures like a garage | Yes | Yes | Matches homeowners insurance policy limits |

| Personal property coverage | Covers earthquake damage to your belongings | Yes | No; optional add-on | Maximum of $200,000 |

| Loss of use | Covers the costs of staying elsewhere if an earthquake renders your home uninhabitable | Yes | No; optional add-on | Up to $100,000 |

| Building code upgrades | Covers the cost of repairs to ensure they comply with the current building code | Yes | Yes | $10,000 automatically included; maximum of $30,000 |

| Emergency repairs | Covers urgent repairs needed to forestall further damage, such as broken windows or glass | Yes | Yes | Maximum is 5% of homeowners and personal property limit |

| Breakables | Covers certain categories of breakables, such as crystal, china and glassware | No; optional add-on | No; optional add-on | None listed |

| Exterior masonry veneer | Covers repairs to certain kinds of exterior masonry, such as brick or stone | No; optional add-on | No; optional add-on | None listed |

Deductibles for earthquake insurance

Your deductible will work slightly differently depending on whether you have a Standard Homeowners policy or a Homeowners Choice policy. If you have a Standard Homeowners policy, your insurance company will only subtract the cost of one deductible — the dwelling coverage deductible — from your claim payment.

By contrast, people with a Homeowners Choice policy have a separate deductible for personal property coverage. This personal property deductible is only required if you don't meet your dwelling coverage deductible limit. If the earthquake damage is so major that you end up paying your dwelling coverage deductible in full, then your personal property deductible will be waived, and both dwelling coverage and personal property coverage will kick in.

CEA earthquake insurance for mobile home owners, condo owners and renters

- Condo insurance in California does not typically cover earthquakes, so owners must get extra insurance to protect their property against damage. CEA offers condo owners the same coverages as homeowners, with the addition of loss assessment coverage. Loss assessment coverage helps you pay an assessment required by your homeowners association that covers earthquake-related repairs.

- Mobile home insurance policies do not typically include earthquake coverage either. CEA earthquake insurance for both circumstances functions similarly to that of a fixed, stand-alone home, with the same standard coverages available: dwelling, personal property, loss of use, building code upgrade, emergency repairs and breakables.

- CEA coverage options for renters are more limited than for homeowners because structural damage is usually the responsibility of the landlord. Earthquake insurance for renters does not include dwelling or building code upgrade coverages, but it does include personal property, loss of use and emergency repairs coverages. Breakables coverage is also available for renters who want to protect glassware and other fragile home goods. You are only responsible for a personal property deductible since the other coverages kick in without a deductible.

You can buy California Earthquake Authority policies through the CEA’s member insurance companies. Participating insurers include some of California's major homeowners insurance providers, like State Farm, Allstate and USAA.

Frequently asked questions

How much earthquake insurance should I buy?

Earthquake insurance costs are based on the value of your home. You should insure your home based on its replacement cost, which should be listed on your homeowners insurance policy.

What is the deductible on an earthquake insurance policy?

The deductible on an earthquake insurance policy varies by company but is usually between 10% and 20%.

What is the California Earthquake Authority (CEA)?

The California Earthquake Authority (CEA) is one of the largest providers of residential earthquake insurance in the world. The CEA is a publicly managed not-for-profit entity that partners with some of California's top insurers to help residents manage their earthquake-related risks and losses.

Does car insurance cover earthquake damage?

Your auto insurance covers earthquake damage if you have comprehensive coverage, which covers damage to your car that isn't a result of a collision.

Is there earthquake insurance for renters?

There are earthquake policies available for renters. Since renters insurance does not cover earthquake damage, it's recommended that renters buy a separate policy to protect their personal property and help reimburse costs if their home becomes uninhabitable due to earthquake damage.

Does earthquake insurance cover tsunamis?

Whether the damage from a tsunami is covered by your earthquake insurance depends on the direct cause of the damage. If the tsunami triggers mudslides that damage your home and belongings, your earthquake insurance may cover the damage. However, any damage done by floodwater would require a separate flood insurance policy.

Methodology

We studied sample earthquake quotes submitted by insurance companies to the California Department of Insurance. The sample included 57 companies, and actual rate samples were submitted by 35 carriers. Twenty-two carriers were excluded because they did not provide actual rates and referenced the California Earthquake Authority for rates calculations, or their earthquake insurance was underwritten by another company included in our list. Rates that were substantially higher than the majority of the quotes provided were excluded.

Rates are listed per thousand dollars of coverage. To determine your rate estimate, take the amount of coverage you need, divide it by a thousand and multiply it by the estimated rate. For example, if you need $800,000 of coverage, calculate: $800,000 / $1,000 for $800, multiplied by the study average coverage rate of $3.54, for an estimated $2,832 annual rate. The actual rate you'll pay may differ and depend on where your house is located and what kind of house it is.

Earthquake statistics were gathered from the Federal Emergency Management Agency (FEMA), the U.S. Geological Survey and the California Earthquake Authority.

Senior Writer

Lindsay Bishop is a Senior Writer at ValuePenguin, where she educates readers about home, auto, renters, flood and motorcycle insurance.

Lindsay began her career in the insurance and financial industry in 2010. She was a licensed auto, home, life and health insurance agent and held Series 6 and 63 financial licenses.

After a hiatus from the financial sector, Lindsay returned to the industry as a content writer for ValuePenguin in 2021. She enjoys having the opportunity to help readers make smart decisions about their insurance so they can be prepared for anything life throws their way.

When Lindsay isn't writing about insurance, you can find her spending time with family, enjoying the outdoors on Sunday long runs or riding her Peloton.

How insurance helped Lindsay

As a homeowner for 15 years located in South Carolina, Lindsay has plenty of experience navigating the coastal insurance market and managing the claims process. That includes successfully negotiating a full roof replacement claim.

Expertise

- Home insurance

- Car insurance

- Flood insurance

- Renters insurance

- Motorcycle insurance

Referenced by

- CNBC

- Yahoo Finance

- Miami Herald

Education

- BS/BA Economics, University of Nevada Las Vegas

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.