Mobile Home Renters Insurance

Mobile home renters insurance costs between $18 and $26 per month, depending on how much coverage you need.

Find Cheap Renters Insurance Quotes in Your Area

American Family and Farmers usually offer online renters insurance quotes for mobile homes, but most other companies require you to speak with an agent to get a quote.

Renters insurance for mobile homes works the same way as any other renters insurance policy, protecting all of your belongings at a low monthly rate.

What does mobile home renters insurance cover?

Standard renters insurance coverage is the same whether someone rents a single-family house or a mobile home. A renters insurance policy can cover renters living in almost any type of home, including a manufactured home.

Mobile home renters insurance typically includes:

-

Personal property coverage, which helps pay to repair or replace your things in the event of a covered loss, like a fire, tornado or theft.

Mobile homes tend to be small, but you might be surprised by the total value of what you own. Remember, personal property protection covers furniture, electronics, jewelry and other expensive items.

-

Personal liability protection, which covers damage that you and family members, including pets, might be responsible for, like medical bills if a guest or worker is accidentally hurt in your home or damage to someone else’s personal property.

-

Loss of use coverage, also known as additional living expenses, pays for you to live somewhere else if your mobile home becomes uninhabitable.

For example, if a tornado destroys your manufactured home, you would need to find a place to stay, alter your transportation to work and possibly go out to eat if you're staying in a hotel without a kitchen.

- Medical payments, which covers medical-related expenses of others who are hurt in your home or on your property, regardless of whose fault it is.

How to insure a mobile home in transit

A mobile home renters insurance policy does not cover any belongings damaged while a home is being moved.

If the mobile home you rent is going to be moved, you should first remove all of your belongings. Remember, mobile homes don’t have an engine and can’t be driven.

Motorhomes and RVs have motors and require a different insurance policy entirely.

Cost of renters insurance for mobile homes

The average cost of renters insurance for mobile homes is about $26 per month.

That's more expensive than the typical cost of renters insurance for an apartment or single-family home, which is is $18 per month.

Find Cheap Renters Insurance Quotes in Your Area

Most renters insurance companies do not provide online quotes for mobile homes.

Only two companies — American Family and Farmers — occasionally provide online quotes for mobile homes.

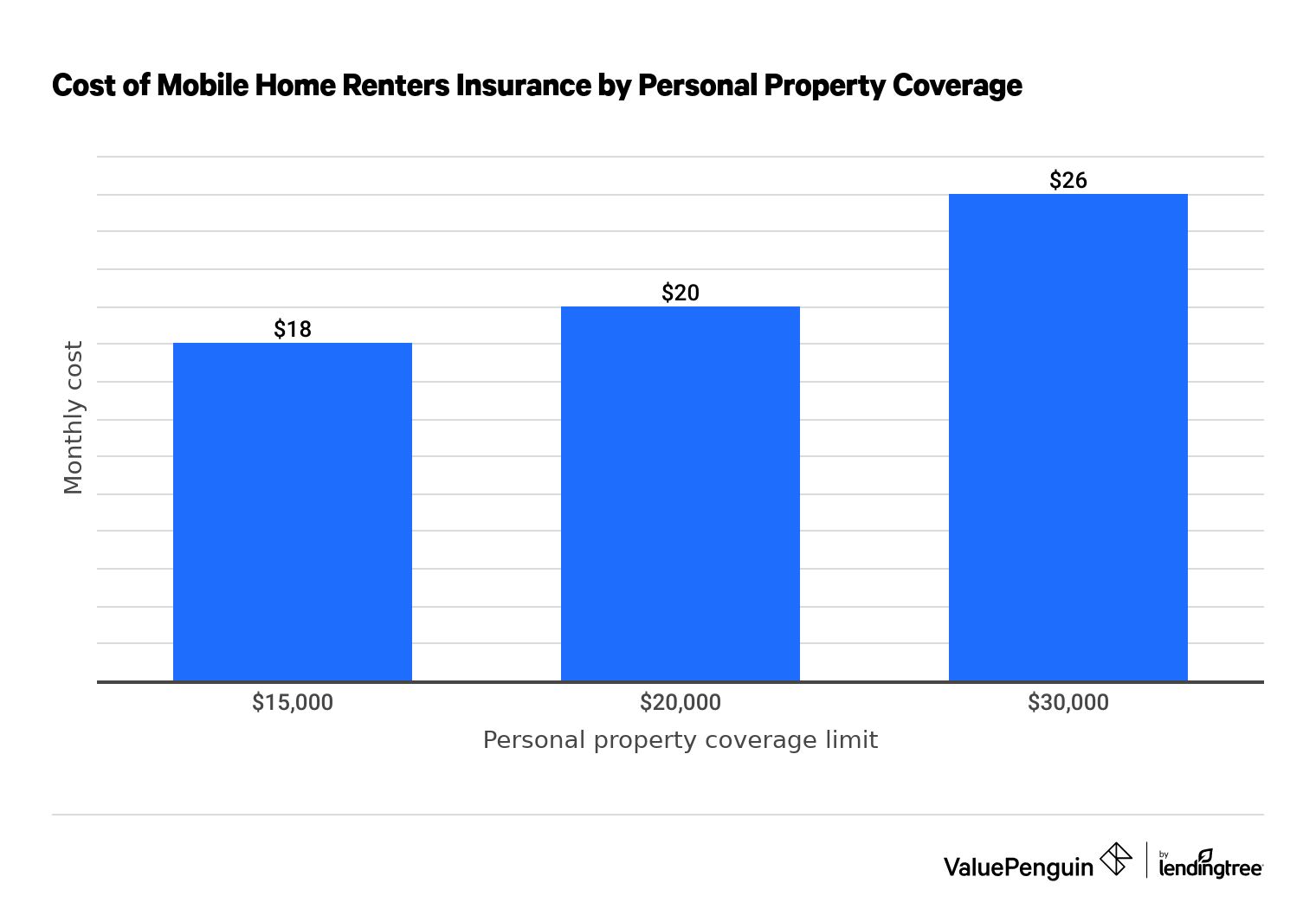

Mobile home renters quotes by personal property coverage

Coverage amount | Monthly rate |

|---|---|

| $15,000 | $18 |

| $20,000 | $20 |

| $30,000 | $26 |

Quotes are based on a 30-year-old renter who lives in Texas.

Some companies will give you a quote based on your address, but they don't let you specify that you're renting a mobile home.

It's important that you're up front with your insurance company about the type of home you're renting. If you need to file a claim in the future, your insurance company could deny it if your policy is for a traditional single family home.

It doesn’t matter if you’re renting a traditional mobile home, a double-wide or any other variation of a manufactured home — you’ll probably need to call an agent when shopping for a policy to get a quote.

Insuring a mobile home in a trailer park vs. private property

Generally, insuring a rented mobile home on someone’s private property costs the same as insuring one in a trailer park designed specifically for numerous mobile homes. The renters insurance policy for each one is identical.

However, you might choose different coverage limits for your policy depending on where the mobile home is located. Mobile home insurance policies generally include $100,000 in liability coverage, but you can get as much as $500,000.

For example, if your manufactured home is on a remote private property, you might not need as much liability protection as someone who lives in a mobile home park close to others. That's because it's less likely that someone will be injured in or around your home.

Mobile home renters who live in a community also need to make sure they understand their responsibilities as a tenant. For instance, some parks provide landscaping and other maintenance services, like shoveling snow. In other cases, those tasks are the resident's responsibility — which could mean you're responsible for any injuries that occur outside the home if you don't take care of the property.

Florida mobile home renters insurance

Florida is a popular destination for retirees, and many choose to buy or rent manufactured homes there in an effort to keep costs low. Mobile home tenants should strongly consider buying renters insurance in Florida because it can help replace your things if they're damaged by a fire, vandalism or other covered event.

Mobile homes are prone to wind damage during a hurricane or major storm.

In Florida, your insurance is required to cover wind damage as a result of a hurricane, but flooding is almost never covered by renters insurance.

If your rented mobile home is located by the coast, a lake, a river or an area that typically floods after a big storm, you may want to buy a separate flood insurance policy.

Insuring a mobile home in California

The cost of mobile home renters insurance in California is much less than homeowners insurance. Renters of manufactured homes need to make sure they understand what their policy does — and does not — cover.

For example, some mobile home insurance policies exclude damage from wildfires, which might be a serious risk to your manufactured home, depending on where it is located.

Wildfires are an important issue for California residents to consider, since it has more wildfires than any other state. If a mobile home renters policy doesn’t cover wildfires, insurance companies typically offer wildfire coverage for an extra fee. In addition to damage caused by a fire, wildfire coverage also commonly includes loss of use coverage if a renter has to evacuate their residence.

Mobile home renters in California should also consider buying a separate earthquake insurance policy if they live near a fault line.

Renters insurance for mobile homes in Texas

Mobile home renters in Texas may need to buy extra coverage, depending on where they live.

Renters who live in Houston, Galveston, Corpus Christi or other coastal areas should consider buying a separate flood insurance policy to protect their belongings from weather-related flooding. Most basic renters insurance policies don't cover flooding.

In addition, Texans may need separate windstorm coverage. If your mobile home is located near the coast or in an area with regular tornadoes, your renters insurance policy may exclude wind, hail and hurricanes from your policy. That means if your things are damaged due to a windstorm or hurricane, your insurance policy wouldn't help you replace your stuff.

Frequently asked questions

What does mobile home renters insurance cover?

Most mobile home renters insurance has the same basic coverage as a standard renters policy, including personal property coverage, personal liability protection, loss of use coverage and medical payments coverage. Most companies also offer more protection at an extra cost, like coverage for valuable jewelry or sports equipment.

How much does mobile home renters insurance cost?

Mobile home renters insurance costs around $20 per month for $20,000 of personal property coverage. However, your insurance rate varies depending on where you live, how much coverage you need and your insurance history.

How much is renters insurance for a mobile home in Texas?

The cost of renters insurance for a mobile home in Texas depends on the amount of coverage you need. A policy with $15,000 of personal property coverage costs around $18 per month, while $30,000 of coverage costs $26 per month, on average.

Methodology

To find the average cost of mobile home renters insurance, we compared quotes for mobile homes in 10 cities across the state of Texas. Quotes were gathered from Midvale, an American Family Insurance partner, and Farmers, which were the only two companies that offered online quotes for mobile home renters in Texas.

Rates are for a 30-year-old single man who lives alone and has no history of insurance claims. We compared quotes for three levels of personal property coverage: $15,000, $20,000 and $30,000. All other coverage limits remained the same.

Coverage | Limit |

|---|---|

| Personal liability coverage | $100,000 |

| Medical payments coverage | $1,000 |

| Deductible | $500 |

About the Author

Senior Writer

Lindsay Bishop is a Senior Writer at ValuePenguin, where she educates readers about home, auto, renters, flood and motorcycle insurance.

Lindsay began her career in the insurance and financial industry in 2010. She was a licensed auto, home, life and health insurance agent and held Series 6 and 63 financial licenses.

After a hiatus from the financial sector, Lindsay returned to the industry as a content writer for ValuePenguin in 2021. She enjoys having the opportunity to help readers make smart decisions about their insurance so they can be prepared for anything life throws their way.

When Lindsay isn't writing about insurance, you can find her spending time with family, enjoying the outdoors on Sunday long runs or riding her Peloton.

How insurance helped Lindsay

As a homeowner for 15 years located in South Carolina, Lindsay has plenty of experience navigating the coastal insurance market and managing the claims process. That includes successfully negotiating a full roof replacement claim.

Expertise

- Home insurance

- Car insurance

- Flood insurance

- Renters insurance

- Motorcycle insurance

Referenced by

- CNBC

- Yahoo Finance

- Miami Herald

Education

- BS/BA Economics, University of Nevada Las Vegas

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.