What Are the Best Medicare Supplement (Medigap) Plans in Texas for 2026?

Blue Cross Blue Shield (BCBS) has the best Medicare Supplement (Medigap) plans in Texas.

Compare Medicare Plans in Your Area

The company has affordable Medigap Plan G rates, at $166 per month, on average. Plus, BCBS of TX has a strong reputation for customer satisfaction. If you want a cheaper option, Cigna's Plan N is the cheapest in Texas.

Cigna will be rebranding its Medicare business to HealthSpring in 2026. That means you'll see HealthSpring instead of Cigna when you shop for Medigap plans.

Keep in mind, this change won't affect your coverage or plan details.

What's the best Medicare Supplement company in Texas?

Overall, Blue Cross Blue Shield (BCBS) is the best Medicare Supplement company in Texas.

The company has the best combination of cheap rates and good customer service. Plus, you can save more money on your BCBS Medigap policy by choosing a "Select Plan" that limits you to a network of doctors and hospitals, similar to an HMO (health maintenance organization).

Cigna has the cheapest quotes for Medigap Plan N, which has coverage that's nearly as good as Plan G. Cigna also has the cheapest rates for Plan G in Texas, but it gets significantly more complaints than an average company its size.

Top Medicare Supplement companies in Texas

Company |

Customer satisfaction (out of 5.0)

| Plan G rate | |

|---|---|---|---|

| Mutual of Omaha | $182 | ||

| BCBS of Texas | $166 | ||

| Aetna | $200 | ||

| AARP/UHC | $177 | ||

Compare Medicare Plans in Your Area

Medigap Plan G and Plan F are the most popular options in Texas, making up about 9 in 10 active Medicare Supplement plans. These two plans also have the most coverage. But Plan F is only available if you were eligible for Medicare before Jan. 1, 2020. Plan G is the best option for broad coverage for people who are new to Medicare and is the most popular option in Texas.

Best overall: Blue Cross Blue Shield (BCBS)

-

Editor rating

- *Plan G: $55

-

* Plan F: $68

- Plan N: $133

- Plan G: $166

- Plan F: $231

- Plan A: $292

*High-deductible plan

Blue Cross Blue Shield of Texas offers a strong combination of affordable rates and good customer service. The company gets far fewer complaints than an average company its size, which suggests customers are generally happy with their plans.

It's a good idea to choose a company with a strong reputation for customer satisfaction because you'll be less likely to run into delays when you file a claim.

Blue Cross Blue Shield of Texas has about average rates for Medigap Plan G, which offers the best coverage of any Medicare Supplement plan for new enrollees. But the company charges high prices for the next two most popular choices, Plan F and Plan N.

Consider Cigna if you want the cheapest average Plan N rates in Texas and you don't mind the company's poor reputation for customer satisfaction. State Farm offers a solid balance between affordable coverage and good service for Plan N policies.

Blue Cross Blue Shield lets you save 10% on your Medigap policy if you live with a spouse or civil partner or if you've lived with up to three adults over the age of 60 for the past year. The other people in your home don't need to have a BCBS Medigap policy for you to get this discount.

You may also be able to get a discount if you had Blue Cross Blue Shield health insurance through work or HealthCare.gov within a year of buying a BCBS Medigap policy. That means you could save up to 7% on your Blue Cross Blue Shield policy if you had a regular health plan through BCBS immediately before you retired.

Blue Cross Blue Shield of Texas also offers several coverage extras to its Medicare Supplement customers, including free routine hearing exams, discounted hearing aids, vision coverage, a 24/7 nurse line and discounts on gym memberships.

Best for customer service: Mutual of Omaha

-

Editor rating

- *Plan G: $48

- Plan N: $138

- Plan G: $182

- Plan A: $183

- Plan F: $250

*High-deductible plan

Mutual of Omaha has the best customer service of any large Medigap company in Texas. The company has high customer satisfaction ratings and good extra benefits but expensive average rates.

Mutual of Omaha gets the fewest customer complaints of any major company in Texas when it comes to Medicare Supplement plans. That makes it a good choice if customer satisfaction and an easy claims filing experience are high priorities for you. Choosing a company that gets few complaints may mean you'll have an easier time getting your claim approved and processed.

Mutual of Omaha also stands out for its extra discounts and benefits.

- Health service discounts: The Mutually Well program gives you discounts on health services like massage therapy and acupuncture. The free app lets you create and track health goals. You can also buy a discounted gym membership.

- Hearing benefits: Amplifon Hearing gives you discounts on hearing tests and hearing aids. You also get a 60-day trial period on any hearing aids you buy through the program.

- Vision benefits: If you use a doctor that partners with EyeMed Vision, you can pay just $50 on an eye exam and 40% on glasses frames (up to $140 off).

The main downside to Mutual of Omaha is its high rates. The company charges about $20 per month more than the Texas state average for a Medigap Plan G policy, on average.

Paying a little more every month for better customer service may be worthwhile if you prefer having an easier time when it comes to filing a claim over getting the cheapest rate.

Cheapest Plan N: Cigna (HealthSpring)

-

Editor rating

- *Plan G: $59

- Plan N: $104

- Plan A: $141

- Plan G: $143

- Plan F: $235

*High-deductible plan

In Texas, it costs $104 per month, on average, for Medigap Plan N from Cigna.

That's about 13% cheaper than the average cost for Plan N in Texas and the cheapest option in the state from a major Medigap company.

Cigna is changing its name to HealthSpring for its Medicare businesses starting in 2026.

Medigap Plan N is a good choice for budget-conscious shoppers. The plan's coverage is nearly as good as Plan G's. But you'll have some extra costs you have to pay when you get medical care. For example, you'll pay up to a $20 copay for doctor's office visits.

While Cigna offers a good price on Plan N, there is a trade-off between cost and quality. Cigna gets far more complaints about its Medicare Supplement policies than an average company its size.

While Cigna has the cheapest Plan N in Texas, its customer satisfaction is rated worse than other big companies. Plan N coverage is only $8 more per month from State Farm, and State Farm's customer service record is much better. For most people, it's probably a good idea to spend a bit more for better service.

How much does a Medigap plan cost in Texas?

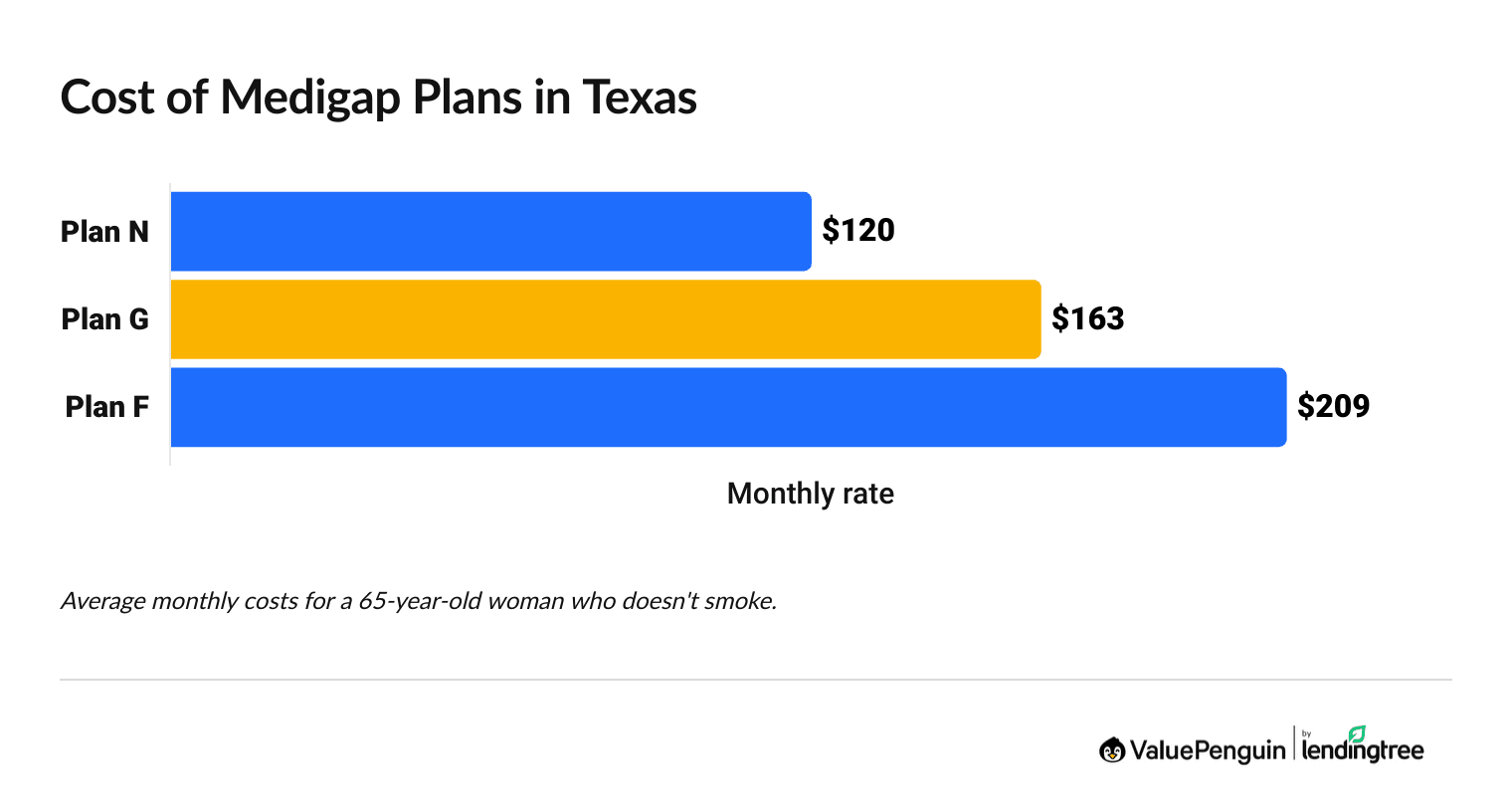

The most popular Medigap plans in Texas cost between $120 and $209 per month, on average.

The most popular plans in Texas are G, F and N. Together, they make up over 95% of all Medigap plans in Texas. On average, Plan N costs an average of $120 per month, Plan G costs $163 per month and Plan F costs $209 per month.

Compare Medicare Plans in Your Area

How much you pay for coverage depends on several factors, such as the plan you choose, your age and whether you use tobacco products.

What influences the cost you pay for Medigap in TX

- The plan letter you choose

- Your age when you first sign up

- Your gender

- Where you live

- Your current health and medical history history

- Whether or not you use tobacco products.

Texas Medicare Supplement plan costs

Medigap plan | Monthly cost | Percentage of TX enrollment |

|---|---|---|

| G | $163 | 53.6% |

| F | $209 | 34.5% |

| N | $120 | 7.6% |

| A | $158 | less than 1% |

| C | $219 | less than 1% |

Average monthly rates for a 65-year-old woman who does not smoke.

How age affects Medigap rates in Texas

In Texas, insurance companies can use your age to set your Medicare Supplement rate.

For example, you'll pay an average of one third more for a Medigap Plan G when you're 75 compared to when you're 65. From 75 to 85, the cost of a Plan G policy jumps by about 40%.

It's important to buy a plan during the six months around your 65th birthday, called an open enrollment period. If you wait to buy a plan, you'll likely pay more. That's because companies can consider your health history when setting rates and approving coverage after the Medigap open enrollment period.

Not all insurance companies use age to set Medigap prices in Texas. To avoid higher rates as you get older, look in your policy documents or ask your broker or agent to make sure your plan is "community rated," like the plans from BCBS of Texas. You might pay a little more at first, but your monthly rate won't go up as much when you get older.

Medicare resources in Texas

The state of Texas offers several resources to help you choose the right Medigap plan. These programs could also help you find out if you're eligible for help with your Medicare costs.

- In Texas, the State Health Insurance Assistance Program (SHIP) is also called the Texas Health Information, Counseling and Advocacy Program. Its resources are free, and you can speak with someone by phone or in one of the Texas offices.

- The Texas Department of Insurance also has a list of Medicare contacts to help you find the resources you need.

- If you're applying for Medicare for the first time, you can use the U.S. Social Security Administration's website to apply online or find a Social Security office in Texas.

Frequently asked questions

What is the best Medicare Supplement (Medigap) plan in Texas?

The best Medicare Supplement plan in Texas is Plan G from Blue Cross Blue Shield of TX. Plan G offers the most coverage of any Medigap plan except Plan F, which isn't available if you're just signing up for coverage. Blue Cross Blue Shield of TX has affordable quotes for Plan G in Texas and a good reputation for customer service.

What is the average cost of a Medicare Supplement plan in Texas?

The average cost of a Medicare Supplement plan in Texas is $163 per month for a Plan G policy, which is the most popular Medigap plan type in the Lone Star State. The amount you'll pay for a Medigap policy in Texas depends on factors such as your age, gender and the plan type and company you choose.

Can you enroll in Medicare Supplement plans at any time?

You can enroll in a Medicare Supplement plan at any time, but you'll get the best rates if you buy your policy during the six months around your 65th birthday, called an open enrollment period. You only get one open enrollment period for Medicare Supplement plans, and if you wait to buy a plan outside this period, you may pay a higher rate or get denied coverage entirely, depending on your health history.

Methodology and sources

Texas Medicare Supplement rates for 2026 are based on rate data for all private insurance companies in Texas. Average rates are for a 65-year-old woman who does not smoke, unless a different age or gender is noted. Prices reflect the cost for coverage when enrollees first become eligible and do not include increased costs for health problems, unless otherwise noted.

Plan popularity data comes from America's Health Insurance Plans (AHIP). Only companies with more than 17,000 customers, according to the National Association of Insurance Commissioners (NAIC), were included in this study.

Other sources include Medicare.gov, the Texas Department of Insurance and the insurance companies featured in this review.

Each company was assigned a customer satisfaction score based on average complaint data from the NAIC. Each score is on a scale of 0.0 to 5.0, with higher scores meaning better customer service.

Satisfaction score | Customer complaints adjusted for company size |

|---|---|

| 5.0 (top rating) | Over 75% fewer complaints than typical |

| 4.5 | 50% to 74% fewer complaints than typical |

| 4.0 | 25% to 49% fewer complaints than typical |

| 3.5 | 6% to 24% fewer complaints than typical |

| 3.0 | 5% fewer to 5% more complaints than typical |

| 2.5 | 6% to 49% more complaints than typical |

| 2.0 | 50% to 99% more complaints than typical |

| 1.5 | 100% to 249% more complaints than typical |

| 1.0 | 250% or more complaints than typical |

About the Author

Former Senior Writer

Talon Abernathy is a former ValuePenguin Senior Writer who specialized in health insurance, Medicare and Medicaid. He also contributed to other insurance verticals including home, renters, auto, motorcycle and flood insurance.

Talon came to ValuePenguin in 2023. Since his arrival, he's helped to expand the site's health insurance-related content offerings. He enjoys helping readers understand the ins and outs of America's all too complicated health insurance landscape.

Before coming to ValuePenguin, Talon worked as a freelance writer. His prior work has touched on a broad range of personal finance-related topics including credit-building strategies, small business incorporation tactics and creative ways to save for retirement.

Insurance tip

In many parts of the country, you can qualify for a free Silver health insurance plan if you meet certain income requirements. Government subsidies in the form of premium tax credits and cost-sharing reductions may mean you'll pay nothing for coverage.

Expertise

- Health insurance

- Medicare and Medicaid

- Flood insurance

- Homeowners insurance

- Renters insurance

- Auto and motorcycle insurance

Referenced by

- The Miami Herald

- Money.com

- MSN

- Nasdaq

- The Sacramento Bee

- Yahoo! Finance

Education

- BA, University of Washington

- Certificate in Copyediting, UC San Diego

Credentials

- Licensed Life & Disability Insurance Agent

- Licensed Property & Casualty Insurance Agent

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.