What Are the Best Medicare Supplement Plans in Florida? (2026)

Florida Blue has the best overall Medicare Supplement plans in Florida, including the best Medigap Plan G.

Compare Medicare Plans in Your Area

Best and cheapest Medicare Supplement in Florida

What's the best Medicare Supplement company in Florida?

Florida Blue, AARP/UnitedHealthcare and United American are the best Medicare Supplement companies in Florida.

Company |

Customer satisfaction

| Monthly cost of Plan G | |

|---|---|---|---|

| Florida Blue | $258 | ||

| Mutual of Omaha | $270 | ||

| United American | $243 | ||

| AARP/UHC | $243 | ||

| Aetna | $298 | ||

Rates are based on a 65-year-old woman who does not smoke buying Medigap Plan G during the initial Medigap open enrollment period.

Compare Medicare Plans in Your Area

- Florida Blue is the best overall choice for Medicare Supplement (Medigap) plans in Florida because of its high customer satisfaction and ability to lock in your rates and avoid price increases because of your age.

- Mutual of Omaha has excellent customer satisfaction, too. However, the company's rates are higher than Florida Blue's prices, so it's not usually the best option. Mutual of Omaha is an affordable option for the high-deductible version of Plan G, though, which isn't available from Florida Blue.

- United American is a great choice if you want Plan N because it has the cheapest rates of any major Medigap company in Florida and good customer service.

- AARP/UnitedHealthcare is a great overall choice, with satisfied customers and lots of included extras such as a gym membership, 24/7 nurse line and discounts on hearing, dental and vision. The downside is that rates can increase quickly as you age.

- Aetna has middle-of-the-road customer satisfaction, but you can usually find a cheaper rate with another company.

- USAA tends to have high rates for Medigap plans, and its customer service isn't as good as that of other major companies. But getting a Medigap plan from USAA could help you simplify your bills if you already have USAA's home and auto insurance.

- Transamerica has average rates for some of its Medigap plans, but the company has poor customer satisfaction. You can probably find a better rate and better service with another company.

- Humana isn't usually a good choice for Florida Medicare Supplement. The company has more than three times as many complaints as an average company its size. Humana is one of the few major companies offering high-deductible versions of Plans F and G, but the poor service usually isn't worth the risk.

Cigna is changing its name to HealthSpring in 2026. Cigna isn't a major Medigap company in Florida, but it does sell plans. If you have a Cigna plan, you'll see your paperwork start to change to HealthSpring. You won't need to do anything to keep your coverage.

Best overall: Florida Blue

| ValuePenguin rating | |

| Customer service |

Plan |

Rate

| Is it cheap? |

|---|---|---|

| Plan F | $294 | 3% less than avg. |

| Plan G | $258 | 2% more than avg. |

| Plan N | $213 | 5% more than avg. |

Florida Blue, part of Blue Cross Blue Shield, sells Medicare Supplement plans that give you good coverage and can help you save money in the long run.

-

Can limit cost increases as you age: With all Florida Blue plans, you can lock in your rate at age 65 so your costs won't increase

because of your age.

This is called the Same Age Forever program.

Florida Blue Medigap Plan G costs an average of $258 per month at age 65, which is 2% more expensive than average. But if you lock in this rate now, you'll be paying much less than average in your later years.

-

Great customer satisfaction: Florida Blue Medigap plans have received

very few customer complaints.

This means that customers are generally happy with their plans. Florida Blue's performance has also been consistent, with a low rate of complaints for the past few years.

-

Limited perks and discounts: The downside of Florida Blue is that plans don't include extra benefits like you can get with AARP/UHC.

For example, with Florida Blue, you'll have to pay extra to get the SilverSneakers fitness program, while AARP/UnitedHealthcare includes a fitness program for free with all Medicare plans. Plus, Florida Blue doesn't have many discounts. You can save by signing up for automatic payments, but the company doesn't advertise a household discount or other ways to save.

Best for extra perks: AARP/UnitedHealthcare (AARP/UHC)

| ValuePenguin rating | |

| Customer service |

Plan |

Rate

| Is it cheap? |

|---|---|---|

| Plan F | $298 | 2% less than avg. |

| Plan G | $243 | 4% less than avg. |

| Plan N | $208 | 3% more than avg. |

AARP/UnitedHealthcare Medicare Supplement plans have low rates at age 65, good customer satisfaction and helpful perks.

- Great discounts and perks: Unlike many other companies, AARP/UHC Medigap plans give you discounts on vision care, dental and hearing aids. Plus, you get free gym memberships and a 24/7 nurse line.

- Few complaints: In Florida, AARP/UnitedHealthcare gets about 25% fewer complaints compared to an average company its size. That means most customers tend to be satisfied with the service they get from AARP/UHC, and you're less likely to have problems with your coverage.

- Popular: UHC is also the most popular Medigap company in Florida, with more than half of all policies. This means you'll have the stability of a large company to give you peace of mind as you age. And with Medigap, claim approvals are based on the government's decision through Original Medicare. So you won't run the risk of having to fight your insurance company about claim denials.

-

Costs start low, but increase quickly: In Florida, Medigap Plan G from AARP/UHC costs an average of $243 per month at age 65, which is cheap compared to many other companies.

But rates can increase quickly, making it one of the more expensive companies when you get older. By age 80, rates average $390 per month, which is 11% higher than average.

Best affordable coverage with Plan N: United American

| ValuePenguin rating | Not rated |

| Customer service |

Plan |

Rate

| Is it cheap? |

|---|---|---|

| Plan F | $279 | 8% less than avg. |

| Plan G | $243 | 4% less than avg. |

| Plan N | $192 | 5% less than avg. |

Plan N from United American is the best affordable Medicare Supplement Plan in Florida, making it a great choice if you're on a budget.

- Low overall rates: United American has the cheapest Plan N in Florida, among major insurance companies in the state, at an average rate of $192 per month. That's about 5% less than the average rate for Plan N in Florida, which is $203 per month.

- Good customer satisfaction: United American's Medigap plans get about 73% fewer complaints than an average company. This means that customers are generally happy with their plans and don't face many hassles with their coverage.

- No online quotes: To buy a policy, you'll need to work with a United American agent. For some people, it's helpful to have an agent as a way to ask questions to someone who lives nearby. But United American Medigap isn't a good choice if you would rather shop for coverage online.

- Perks aren't advertised: United American doesn't advertise perks like a fitness plan, nurse line or discounts on health products. The company might still offer them, but you have to talk to an agent to learn more.

Which Medigap plan should you choose?

- Plan G is the best coverage for most people new to Medicare. It pays for nearly all of your medical costs except for the $283 Medicare Part B deductible.

- Plan F is the most popular Medicare Supplement plan in Florida, making up more than half of all active plans in the state. It has great coverage. However, it's not available if you're new to Medicare, and it often isn't as good of a deal as Plan G.

- Plan N is the best choice for affordable coverage. You'll save about $51 per month compared to Plan G, which adds up to about $612 per year. The trade-off is that you'll have extra medical costs, such as a $20 fee for some doctor visits.

How much does a Medigap plan cost in Florida?

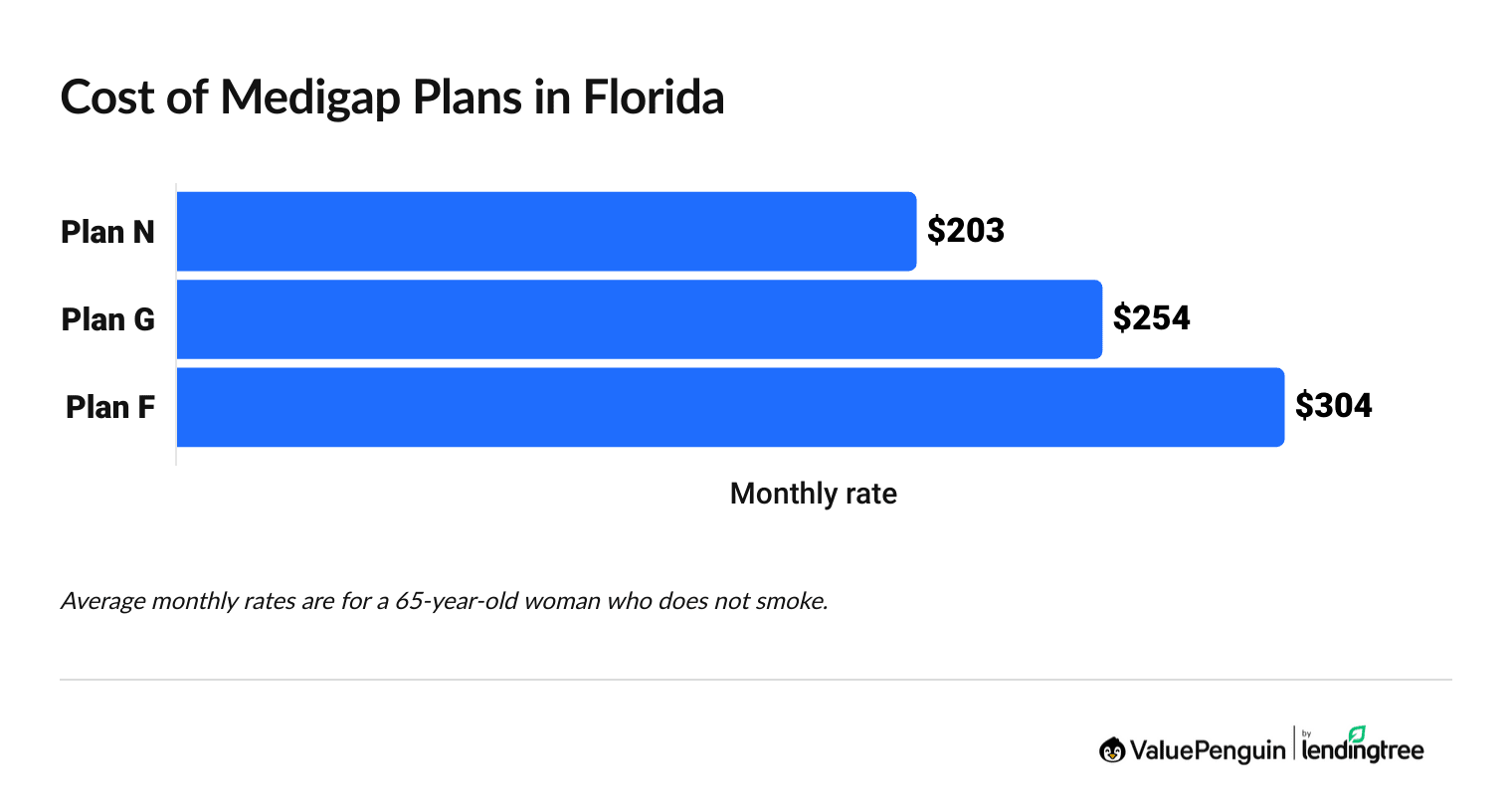

The average cost of Medicare Supplement in Florida at age 65 is between $203 and $304 per month, based on the most popular plans.

Compare Medicare Plans in Your Area

The best way to save on a Medicare Supplement plan is to sign up when you are first eligible. During your initial enrollment period, health insurance companies can't use your health history to charge you higher rates. They also can't deny your application to get coverage.

Florida Medicare Supplement plan costs

Medigap plan | Monthly cost | % of FL market |

|---|---|---|

| F | $304 | 51% |

| G | $254 | 24% |

| N | $203 | 10% |

Total percentage of enrollment may not equal 100% because of rounding.

Popular Medicare Supplement plans in Florida

- Plan F costs an average of $304 per month in Florida, making it one of the most expensive Medicare Supplement plans. But it also has the best coverage. More than half the Medigap plans in FL are Plan F. However, Plan F is only available if you were eligible for Medicare before 2020.

- Plan G costs an average of $254 per month in Florida, and its coverage is almost as good as Plan F. Plan G is available to everyone eligible for Medicare, and it's the second most popular option in Florida. Nearly 1 in 4 Medigap plans in Florida are Plan G.

- Plan N costs an average of $203 per month in Florida, making it a good way to save money and still get extensive coverage. Plan N makes up around 10% of Florida's Medicare Supplement plans. Its coverage is almost as good as Plan G, but you will pay more for your medical care, including copays when you go to the doctor.

Medigap vs. Medicare Advantage in Florida

Medicare Advantage plans are popular in Florida, but Medigap plans can often give you better coverage. It's important to know the difference so you can choose the best plan for you.

Medicare Advantage plans bundle Medicare Parts A and B together. They usually include prescription drug coverage and come with extra perks, like dental, vision and hearing coverage. Most people in Florida who are on Medicare have a Medicare Advantage plan.

Medigap plans are supplemental insurance plans that help pay your medical costs after Original Medicare has paid its share. Medigap plans aren't as popular as Medicare Advantage plans in Florida, but they pay for a larger share of your health care bills. This helps you avoid unpredictable medical expenses as you get older and your needs change.

You can't be enrolled in a bundled Medicare Advantage plan and a Medigap plan at the same time. If you have complex medical needs, it's usually a better idea to buy a Medicare Supplement plan instead of a Medicare Advantage plan. It's typically more expensive each month, but you'll pay for less of your health care and usually save money overall.

Frequently asked questions

Which Medigap plan is best in Florida?

The best Medicare Supplement plan in Florida is Plan G from Florida Blue, which costs $258 per month, on average. It has great customer satisfaction, and you can lock in your rate so your costs won't go up as you age. The best affordable option is Plan N from United American, which costs an average of $192 per month at age 65.

What is the average cost of a Medigap plan in Florida?

A Medicare Supplement plan in Florida usually costs between $203 and $304 per month, based on the most popular plans in the state. But your rate will depend on what plan you choose and how old you are when you buy the plan. You'll get the best rates if you sign up as soon as you are eligible for Medicare.

Are Medicare Supplement plans in Florida expensive?

Yes, Medicare Supplement is more expensive in Florida than in most other states. Plan G costs an average of $254 per month in Florida, which is $74 more per month than the national average of $180 per month.

Methodology and sources

The cost for Medicare Supplement plans in Florida is based on comprehensive actuarial data for all private insurers. Only companies with more than about 1% of plans in the state, according to the National Association of Insurance Commissioners (NAIC), were reviewed.

Unless otherwise noted, average rates are for a 65-year-old woman who does not smoke and who signed up for a Medigap plan when she was first eligible.

Enrollment data is based on AHIP's report on the state of Medicare Supplement coverage and data from the NAIC.

Additional sources include NAIC's customer complaint index, Medicare.gov and KFF's report on Medicare Advantage enrollment.

ValuePenguin's picks for the best companies are based on affordability, customer complaints, unique features and research about potential risks. The customer satisfaction rating is a one-to-five score based on the NAIC complaint index for each company's Medicare Supplement product. Higher scores mean better customer service and fewer complaints.

Satisfaction score | Customer complaints adjusted for company size |

|---|---|

| 5.0 (top rating) | At least 75% fewer complaints than typical |

| 4.5 | 50% to 74% fewer complaints than typical |

| 4.0 | 25% to 49% fewer complaints than typical |

| 3.5 | 6% to 24% fewer complaints than typical |

| 3.0 | 5% fewer to 5% more complaints than typical |

| 2.5 | 6% to 49% more complaints than typical |

| 2.0 | 50% to 99% more complaints than typical |

| 1.5 | 100% to 249% more complaints than typical |

| 1.0 | At least 250% more complaints than typical |

About the Author

Insurance Writer

Cate Deventer is a ValuePenguin writer who specializes in health insurance, Medicare, auto and home insurance. She's been a licensed insurance agent since 2011.

She started her insurance career working as a customer service agent for State Farm. She later moved to an independent agency, where she worked with several insurance companies and hundreds of clients. She quoted policies, filed claims and answered insurance questions. In 2021, she pivoted her career and began writing about insurance for Bankrate. She moved to ValuePenguin in 2023 and began writing about health insurance and Medicare.

Cate has a passion for helping readers choose insurance to fit their needs. She enjoys knowing that her research and knowledge help people choose insurance products that make a positive difference in their lives.

How insurance helped Cate

Cate used her health insurance knowledge to navigate a surgery in 2023. Understanding how her policy worked let her focus on recovery instead of worrying about bills.

Expertise

- Health insurance

- Medicare & Medicaid

- Auto insurance

- Home insurance

- Life insurance

Credentials

- Licensed Life, Accident & Health Insurance Agent

- Licensed Property & Casualty Insurance Agent

Referenced by

- CBS

- NBC

- Wall Street Journal

Education

- BA, Theatre, Purdue University

- BA, English, Indiana University

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.