Who Has The Cheapest Motorcycle Insurance In West Virginia?

Dairyland is the cheapest motorcycle insurance company in West Virginia, at $18 per month for full coverage.

Find Cheap Motorcycle Insurance Quotes in West Virginia

Best cheap motorcycle insurance in West Virginia

How we chose the top companies

Cheapest motorcycle insurance in West Virginia

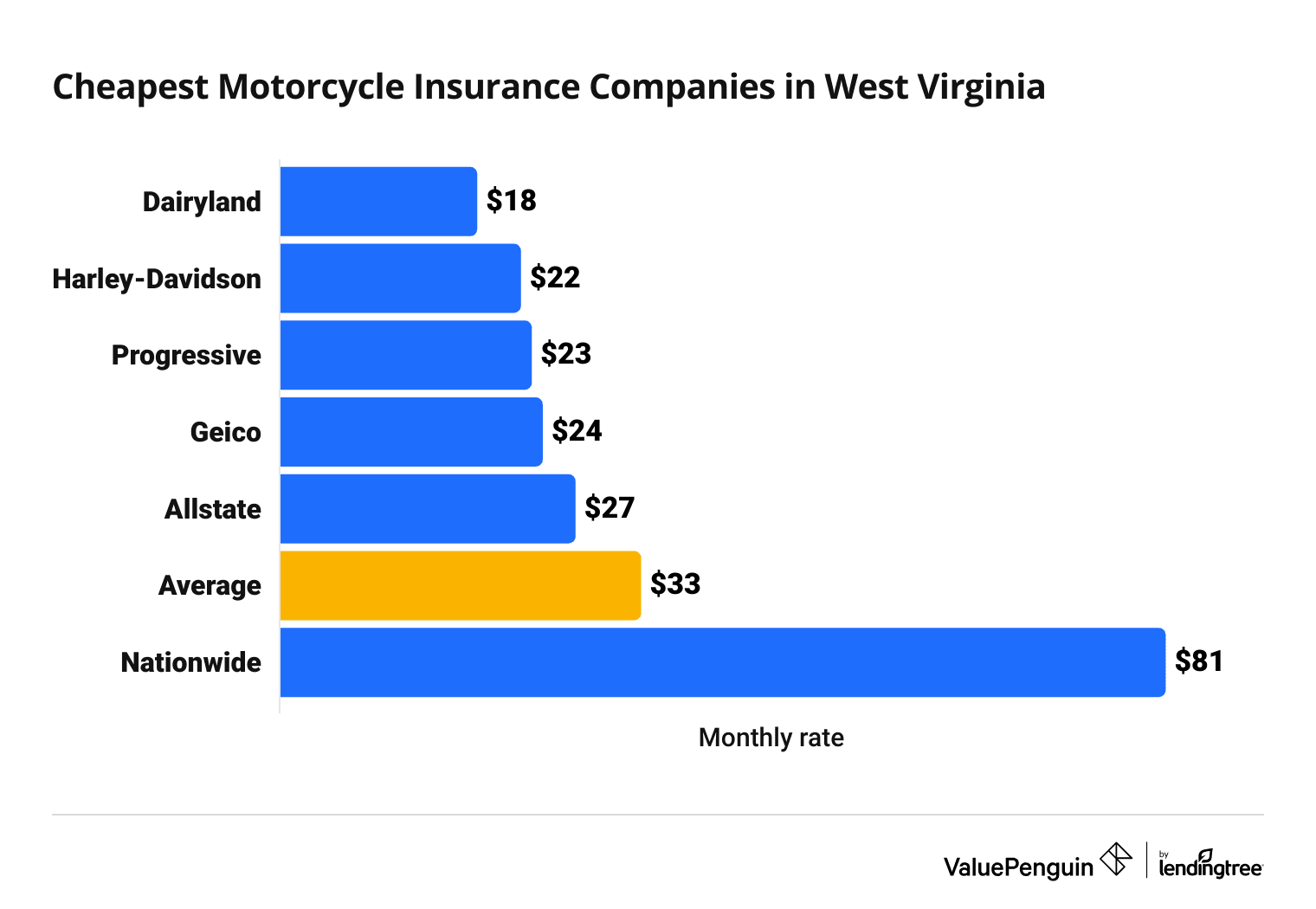

The cheapest motorcycle insurance company in West Virginia is Dairyland, at $18 per month for full coverage.

That's around half the West Virginia state average and $4 per month cheaper than the second-cheapest company, Harley-Davidson.

Compare Motorcycle Insurance Quotes in West Virginia

The average cost of motorcycle insurance in West Virginia is $33 per month for full coverage. That's $1 per month more than the national average of $32.

Cheap full coverage motorcycle insurance quotes in West Virginia

Company | Monthly rate | ||

|---|---|---|---|

| Dairyland | $18 | ||

| Harley-Davidson | $22 | ||

| Progressive | $23 | ||

| Geico | $24 | ||

| Allstate | $27 | ||

| Nationwide | $81 | ||

Best motorcycle insurance for most people: Progressive

-

Editor's rating

-

Cost: $23/month

Overview

Pros/cons

Progressive has excellent prices and lots of useful coverage options.

Overview

Progressive has excellent prices and lots of useful coverage options.

Pros/cons

Pros:

-

Affordable motorcycle insurance rates

-

Standard policy includes extra perks

-

Good customer service

Cons:

-

No rental reimbursement or trailer coverage

Progressive has excellent prices and lots of useful coverage options.

Pros:

-

Affordable motorcycle insurance rates

-

Standard policy includes extra perks

-

Good customer service

Cons:

-

No rental reimbursement or trailer coverage

Motorcycle insurance from Progressive costs $23 per month. That's about 30% cheaper than the state average but $5 per month more expensive than the cheapest option, Dairyland.

Many people will also be able to bring their prices down even more with discounts. You can get discounts with Progressive for taking a safety course and bundling auto and homeowners insurance together, among others.

Coverage options from Progressive are outstanding, too. The company offers generous protection for your gear, as well as optional replacement cost coverage for new motorcycles.

- Full replacement cost: After an accident, Progressive will get your bike repaired to preaccident condition or better.

- Original equipment manufacturer (OEM) parts replacement: If you have OEM or custom parts on your motorcycle, Progressive will fix your bike with the same or better parts. This coverage comes standard when you get comprehensive and collision coverage.

- Accessories and custom parts and equipment (CPE): Progressive includes $3,000 to cover upgrades, custom parts and your bike accessories. Riders have the option to add up to $30,000 of additional coverage.

However, Progressive doesn't offer rental reimbursement coverage. This coverage pays for a rental vehicle while your bike is in the shop after an accident. Progressive may not be the best choice if your motorcycle is your only vehicle and you can't afford to rent a car after an accident.

Best for motorcycle commuters: Harley-Davidson

-

Editor's rating

-

Cost: $22/month

Overview

Pros/cons

Harley-Davidson has great coverage options for daily motorcycle riders.

Overview

Harley-Davidson has great coverage options for daily motorcycle riders.

Pros/cons

Pros:

-

Great coverage options

-

Affordable motorcycle insurance quotes

Cons:

-

No options to bundle with auto or home insurance

Harley-Davidson has great coverage options for daily motorcycle riders.

Pros:

-

Great coverage options

-

Affordable motorcycle insurance quotes

Cons:

-

No options to bundle with auto or home insurance

Harley-Davidson offers lots of coverage options that are extra useful for people who use a motorcycle as their primary way to get around.

- Rental reimbursement: Covers the cost of a rental bike while yours is in the shop after a crash.

- Trip interruption: Pays for a hotel or transportation costs if your bike is damaged while you are far from home.

- Vacation rental: Protects rental motorcycles with the same coverage as your own personal bike.

Rates at Harley-Davidson are the second-cheapest in West Virginia. Only Dairyland offers lower prices.

But customers aren't always satisfied with Harley-Davidson Insurance. It has about two-thirds more complaints than an average company its size, suggesting you might experience things like claim delays or rate increases.

The other drawback to Harley-Davidson Insurance is that it does not sell any other kind of insurance. If you own a car, you'll need to get a separate policy for it, and Harley doesn't sell home or renters insurance, either.

Managing multiple policies might be a hassle, and you're passing up an insurance bundle discount, too — which is one of the best ways to save on insurance.

Best for low rates: Dairyland

-

Editor's rating

-

Cost: $18/month

Overview

Pros/cons

Dairyland is the most affordable motorcycle insurance company in West Virginia.

Overview

Dairyland is the most affordable motorcycle insurance company in West Virginia.

Pros/cons

Pros:

-

Cheapest rates in WV

-

Great customer service

Cons:

-

Can't bundle with home insurance

-

Average coverage option choices

Dairyland is the most affordable motorcycle insurance company in West Virginia.

Pros:

-

Cheapest rates in WV

-

Great customer service

Cons:

-

Can't bundle with home insurance

-

Average coverage option choices

Dairyland's prices are about half the average rate statewide and $4 cheaper per month than the second-cheapest option, Harley-Davidson.

Dairyland gets positive reviews from its customers. The company gets less than half as many customer complaints as an average insurance company its size.

Dairyland doesn't have as wide a selection of coverage options as Progressive or Harley-Davidson, but it still has some useful benefits:

- Rental reimbursement coverage pays for a rental vehicle while your bike is in the repair shop after an accident.

- Roadside assistance provides services like towing, a tire change or fuel and oil delivery if your motorcycle breaks down on the side of the road.

Additionally, Dairyland doesn't sell home or renters insurance (though it does sell auto insurance). It's not a good choice if you prefer to get all of your insurance policies from one company.

West Virginia motorcycle insurance cost by city

Morgantown, Wayne and Williamson have West Virginia's most expensive motorcycle rate among larger cities, at $36 per month for full coverage.

The city with the cheapest rate is Shepherdstown. Full coverage motorcycle insurance there costs an average of $29 per month.

Cities with better-maintained roads and lower crime rates tend to have cheaper motorcycle insurance rates, while narrow streets can lead to higher rates.

Full coverage motorcycle insurance rates by West Virginia city

City | Monthly cost | % from average |

|---|---|---|

| Beckley | $32 | -1% |

| Bluefield | $32 | -1% |

| Charleston | $35 | 7% |

| Charles Town | $31 | -4% |

| Clarksburg | $33 | 1% |

West Virginia motorcycle insurance laws

Motorcyclists in West Virginia need to have motorcycle insurance in order to ride legally. Riders need a minimum amount of liability insurance, sometimes written as 25/50/25, and matching amounts of uninsured motorist coverage.

- Bodily injury liability coverage: $25,000 per person and $50,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured motorist bodily injury: $25,000 per person and $50,000 per accident

- Uninsured motorist property damage: $25,000 per accident

Although you only need to have the minimum limits, most riders should get more coverage if they can afford it. That's because the required liability coverage doesn't protect your bike. If you can't afford to fix or replace your motorcycle after an accident, you should consider adding collision and comprehensive coverage.

Methodology

ValuePenguin collected motorcycle insurance quotes across 36 of the largest cities in West Virginia from six major motorcycle insurance companies that operate in the state. Rates are for a 45-year-old single man who owns a 2018 Honda CMX500 Rebel.

Quotes are for a full coverage policy, including higher liability limits than the state requirement and comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Uninsured and underinsured motorist property damage: $25,000 per accident

- Medical payments: $5,000

- Comprehensive and collision deductible: $500

The ValuePenguin team has a combined total of more than 50 years of experience in the property and casualty insurance industry.

Lead Writer

Matt Timmons is a Lead Writer on the insurance team at ValuePenguin, where he writes in-depth and timely pieces helping find the right coverage for them.

He's covered insurance at ValuePenguin since 2018, specializing in auto and home insurance, as well as life insurance. He's paid special attention to the EV insurance market, where prices are much higher than for gas cars.

Before he started writing about personal finance, Matt wrote about professional skills and online tools at an e-learning company.

How insurance helped Matt

During freshman orientation in college, Matt's iPod was stolen off his table while he was eating lunch. Luckily, he'd bought a college insurance plan the day before and he had money to buy a replacement before classes started.

Expertise

- Auto insurance

- Home insurance

- Insurance rate analysis

- Life insurance

Referenced by

- CNBC

- Miami Herald

- Yahoo! Finance

Education

- BA, Wesleyan University

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.