The Best Cheap Motorcycle Insurance in Michigan

Progressive has the cheapest motorcycle insurance in Michigan, with an average cost of $22 per month.

Find Cheap Motorcycle Insurance Quotes in Michigan

Best cheap motorcycle insurance in MI

How we chose the top companies

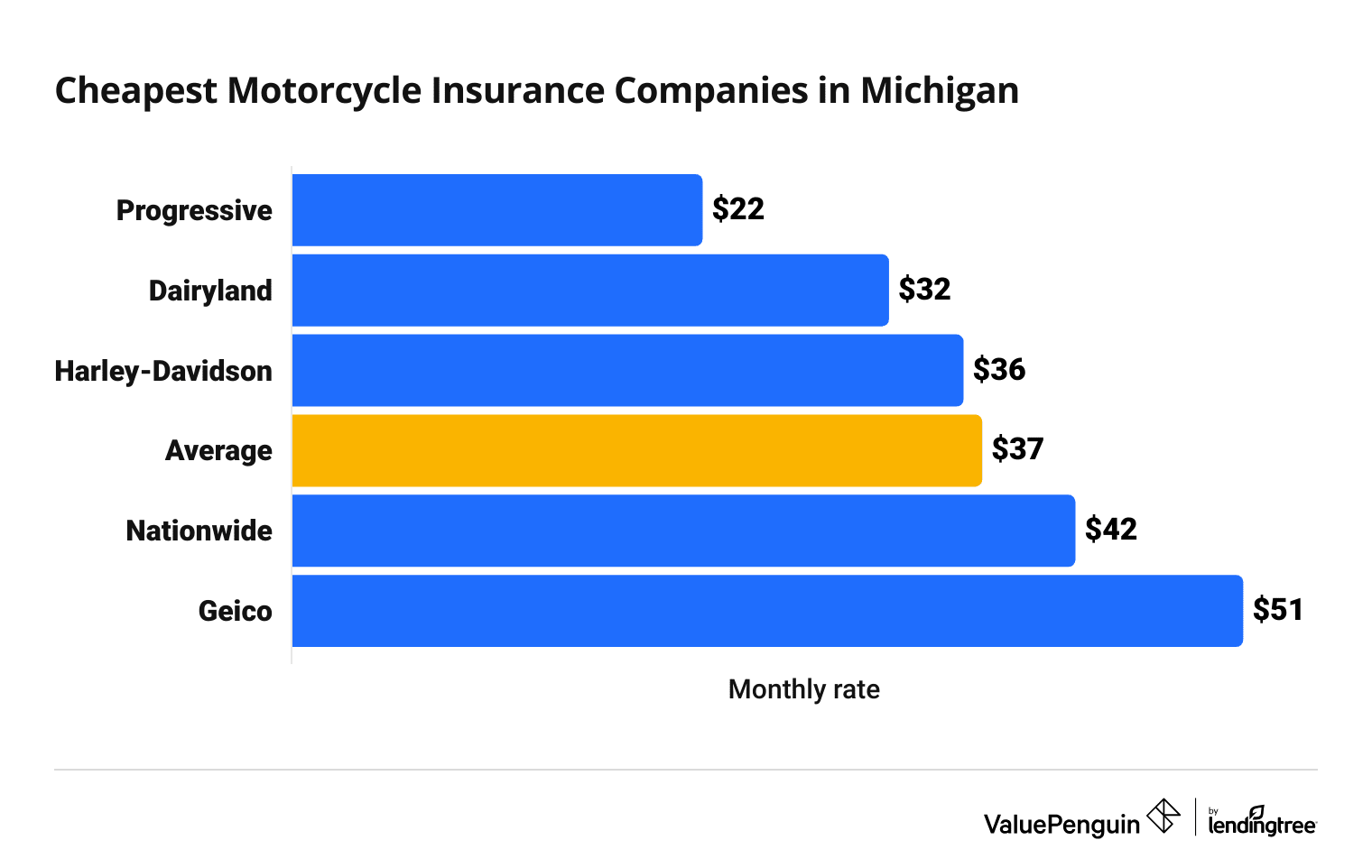

Cheapest motorcycle insurance companies in Michigan

The average cost of motorcycle insurance in Michigan is $37 per month.

Progressive has the cheapest full coverage motorcycle insurance in Michigan. At $22 per month, a policy from Progressive is 41% cheaper than the state average.

Find Cheap Motorcycle Insurance Quotes in Michigan

Motorcycle insurance in Michigan is 16% more expensive than the typical cost across the country, which is around $32 per month.

Cheapest motorcycle insurance companies in Michigan

Company | Monthly rate | ||

|---|---|---|---|

| Progressive | $22 | ||

| Dairyland | $32 | ||

| Harley-Davidson Insurance | $36 | ||

| Nationwide | $42 | ||

| Geico | $51 | ||

Best for most people: Progressive

-

Editor's rating

-

Cost: $22/month

Overview

Pros/cons

Progressive has great prices, useful coverage options and reliable service for Michigan riders.

Overview

Progressive has great prices, useful coverage options and reliable service for Michigan riders.

Pros/cons

Pros:

-

Cheapest quotes in Michigan

-

Base policies have extra coverage

-

Reliable customer service

Cons:

-

No rental reimbursement or trailer coverage

Progressive has great prices, useful coverage options and reliable service for Michigan riders.

Pros:

-

Cheapest quotes in Michigan

-

Base policies have extra coverage

-

Reliable customer service

Cons:

-

No rental reimbursement or trailer coverage

Michigan riders pay around $22 per month for a full coverage policy from Progressive. That's $15 per month cheaper than the Michigan state average.

In addition, Progressive's base policy includes replacement cost coverage for motorcycle parts and $3,000 of custom parts protection. Most motorcycle insurance companies charge extra for these protections, but they're free for Progressive customers.

Progressive also offers a disappearing deductible. Every year you go without an accident, your motorcycle deductible decreases by 25%. This can lead to major savings if you ever get in an accident.

Progressive customers are usually happy with the service the company provides. It only gets one-third as many complaints compared to a typical company of its size, according to the National Association of Insurance Commissioners (NAIC).

However, Progressive doesn't offer rental reimbursement. So if you're in an accident, you'll have to pay for a rental vehicle while your bike is in the shop.

Best for commuters: Harley-Davidson

-

Editor's rating

-

Cost: $36/month

Overview

Pros/cons

Harley-Davidson is a good choice for riders who commute by motorcycle.

Overview

Harley-Davidson is a good choice for riders who commute by motorcycle.

Pros/cons

Pros:

-

Good coverage options for motorcycle commuters

-

Cheaper-than-average rates

Cons:

-

Poor customer service

Harley-Davidson is a good choice for riders who commute by motorcycle.

Pros:

-

Good coverage options for motorcycle commuters

-

Cheaper-than-average rates

Cons:

-

Poor customer service

Harley-Davidson offers roadside assistance and rental reimbursement as optional coverages, which help daily riders stay on the road.

- Roadside assistance offers help if you have battery issues, a flat tire or mechanical problems, as well as 24/7 towing.

- Rental reimbursement pays for a rental vehicle while your motorcycle is in the shop after an accident.

Full coverage from Harley-Davidson costs around $36 per month in Michigan, which is $1 cheaper than average. However, it's still $14 per month more than coverage from Progressive.

Harley-Davidson doesn't have a strong customer service reputation. The company gets about two-thirds more complaints than a typical company its size, according to the NAIC. That means it could take Harley-Davidson customers longer to fix their bikes after an accident.

Best for veterans: USAA

-

Editor's rating

-

Cost: $21/month

Overview

Pros/cons

USAA provides an extra discount on Progressive for military service members.

Overview

USAA provides an extra discount on Progressive for military service members.

Pros/cons

Pros:

-

Cheapest quotes for military members

-

Basic policy includes replacement cost coverage

-

Excellent customer service

Cons:

-

Only available to military members, veterans and their families

USAA provides an extra discount on Progressive for military service members.

Pros:

-

Cheapest quotes for military members

-

Basic policy includes replacement cost coverage

-

Excellent customer service

Cons:

-

Only available to military members, veterans and their families

USAA doesn't sell its own motorcycle insurance. Instead, it partners with Progressive to offer its members excellent coverage at a discounted rate. But you must be a military member, veteran or family member to get the discount.

USAA members get a 5% discount on Progressive motorcycle insurance rates. That brings the cost of a full coverage Progressive policy down to about $21 per month.

In addition, motorcycle insurance from Progressive includes replacement cost coverage and $3,000 of custom parts coverage. Most other companies charge extra for these coverages.

USAA and Progressive both have excellent customer service. That means riders can count on their insurer to get them back on the road quickly after an accident. Keep in mind that USAA motorcycle insurance policies are managed by Progressive, so you'll call Progressive if you need to make a claim or manage your policy — not USAA.

Michigan motorcycle insurance: Costs by city

Detroit has the most expensive motorcycle insurance in Michigan, at $47 per month for a full coverage policy.

Lansing, where full coverage costs around $31 per month, has the cheapest rates among the state's largest cities.

Average cost of motorcycle insurance in Michigan by city

City | Monthly cost | % from average |

|---|---|---|

| Ann Arbor | $37 | 2% |

| Battle Creek | $34 | -7% |

| Bay City | $35 | -4% |

| Birmingham | $37 | 0% |

| Brown City | $35 | -5% |

Full coverage motorcycle insurance rates vary by $16 per month across the largest cities in Michigan.

Cities with more traffic and higher crime rates — like Detroit, Dearborn and Southfield — tend to have higher rates. That's because insurance companies believe riders in these cities are more likely to make a claim in the future.

Michigan motorcycle insurance requirements

You must buy an insurance policy to ride a motorcycle in Michigan legally. Your policy needs to have a minimum amount of liability coverage, sometimes written as 50/100/10.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $10,000 per accident

However, you don't need to worry about hitting these limits. Insurance companies don't sell policies that don't meet the legal minimum, so any policy you buy will include enough coverage.

Unlike with standard auto insurance, Michigan doesn't require riders to have personal injury protection (PIP). In fact, PIP isn't an option for motorcycle riders in Michigan.

Insurance companies must offer medical payments coverage, though. This coverage pays your medical bills up to your chosen limit after an accident. But, unlike PIP, it doesn't cover lost wages.

Frequently asked questions

How much is motorcycle insurance in Michigan?

The average cost of full coverage motorcycle insurance in Michigan is $37 per month. Riders can find cheaper rates from Progressive, Dairyland and Harley-Davidson.

What is the cheapest motorcycle insurance in Michigan?

Progressive has the cheapest motorcycle insurance quotes in Michigan, at $22 per month for a full coverage policy. That's 41% cheaper than average and $10 per month cheaper than the second-most affordable option, Dairyland.

Do you need motorcycle insurance in Michigan?

Motorcycle insurance is required in Michigan. Riders must have a minimum of $50,000 of bodily injury liability per person and $100,000 per accident. You must also have $10,000 of property damage coverage per accident.

Is motorcycle insurance expensive in Michigan?

Yes, motorcycle insurance in Michigan can be expensive. Full coverage insurance in Michigan costs around $37 per month. That's 16% more expensive than the national average of $32 per month.

Methodology

ValuePenguin gathered over 200 motorcycle insurance quotes from the largest cities across Michigan to determine the state's average coverage cost. All quotes are for a 45-year-old single man who owns a 2018 Honda CMX500 Rebel.

Rates are for a full coverage policy with higher liability limits than the state requirement and comprehensive and collision coverage.

- Bodily injury liability coverage: $50,000 per person and $100,000 per accident

- Property damage liability coverage: $25,000 per accident

- Collision coverage: $500 deductible

- Comprehensive coverage: $500 deductible

- All other coverages: Not included

To determine ValuePenguin editor's ratings, we consider customer service scores, coverage options, cost and the overall value a company provides its customers.

The ValuePenguin team has a combined total of more than 50 years' experience in the property and casualty insurance industry.

Lead Writer

Matt Timmons is a Lead Writer on the insurance team at ValuePenguin, where he writes in-depth and timely pieces helping find the right coverage for them.

He's covered insurance at ValuePenguin since 2018, specializing in auto and home insurance, as well as life insurance. He's paid special attention to the EV insurance market, where prices are much higher than for gas cars.

Before he started writing about personal finance, Matt wrote about professional skills and online tools at an e-learning company.

How insurance helped Matt

During freshman orientation in college, Matt's iPod was stolen off his table while he was eating lunch. Luckily, he'd bought a college insurance plan the day before and he had money to buy a replacement before classes started.

Expertise

- Auto insurance

- Home insurance

- Insurance rate analysis

- Life insurance

Referenced by

- CNBC

- Miami Herald

- Yahoo! Finance

Education

- BA, Wesleyan University

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.