The Best and Cheapest Homeowners Insurance Companies in Maryland (2026)

State Farm is the best cheap homeowners insurance company in Maryland. A State Farm policy costs $984 per year on average.

Find Cheap Home Insurance Quotes in Maryland

Best Cheap Home Insurance in Maryland

Our experts collected thousands of quotes across hundreds of ZIP codes for 10 top Maryland homeowners insurance companies.

To find the best cheap home insurance in Maryland, we compared quotes, coverage, discounts and customer satisfaction.

The cheapest home insurance quotes in MD

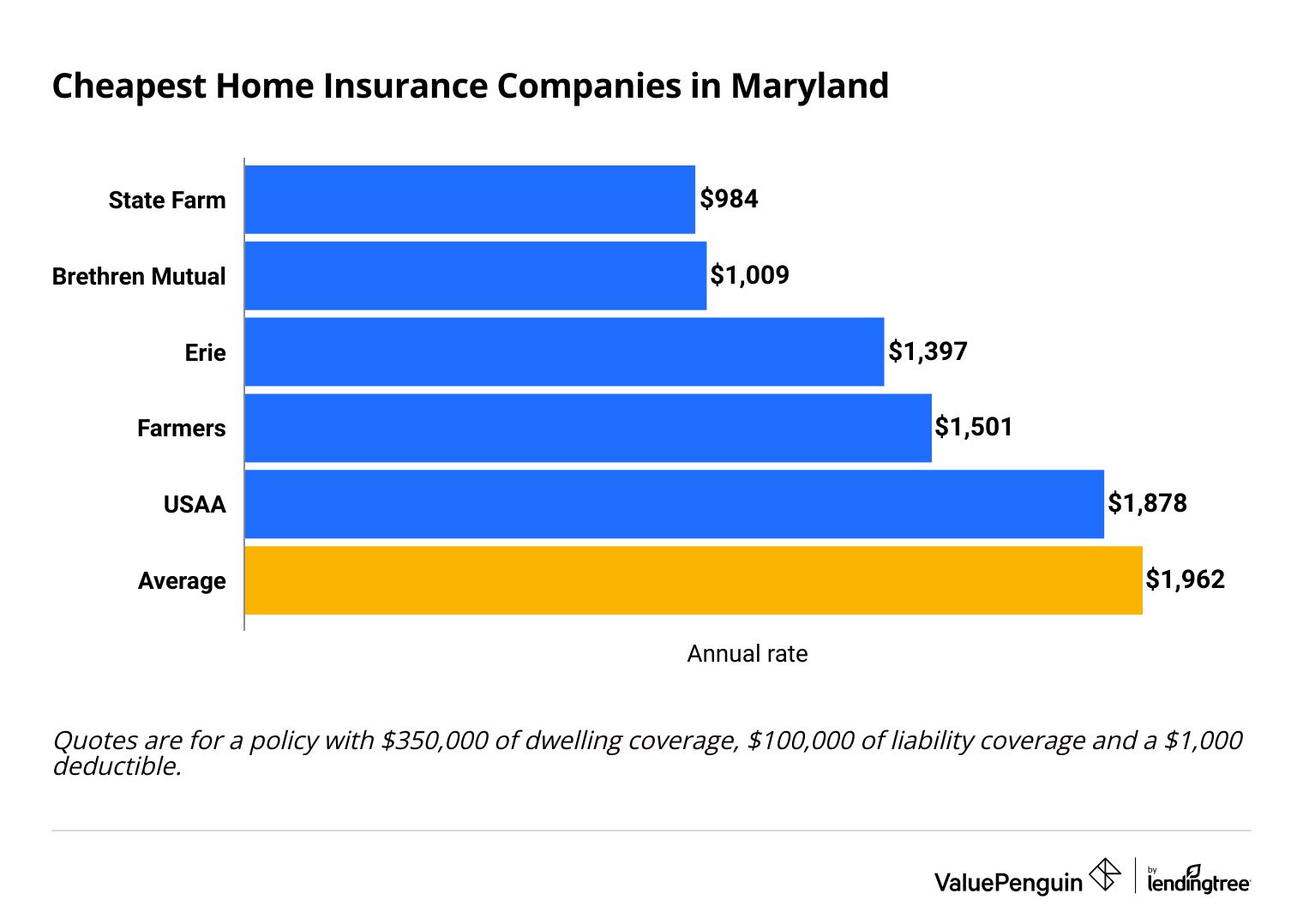

State Farm has the cheapest homeowners insurance in Maryland.

It charges $984 per year for $350,000 of coverage to repair or rebuild your home after a covered loss, called dwelling coverage. That's roughly half the Maryland state average of $1,962 per year.

Find Cheap Homeowners Insurance Quotes in Your Area

Comparing home insurance quotes can save you thousands of dollars each year.

The cheapest homeowners insurance company in Maryland, State Farm, charges less than one-third what the most expensive company, Chubb, does. That amounts to a savings of $2,172 per year.

Cheap annual home insurance quotes in MD

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $720 | ||

| Brethren Mutual | $726 | |

| Farmers | $940 | ||

| Erie | $970 | ||

| Allstate | $1,368 | ||

$200,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $720 | ||

| Brethren Mutual | $726 | |

| Farmers | $940 | ||

| Erie | $970 | ||

| Allstate | $1,368 | ||

$350,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $984 | ||

| Brethren Mutual | $1,009 | |

| Erie | $1,397 | ||

| Farmers | $1,501 | ||

| USAA | $1,878 | ||

$500,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $1,312 | ||

| Brethren Mutual | $1,448 | |

| Erie | $1,905 | ||

| Farmers | $2,168 | ||

| USAA | $2,313 | ||

$1 million

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $2,278 | ||

| Brethren Mutual | $2,942 | |

| Erie | $3,621 | ||

| USAA | $3,706 | ||

| Farmers | $4,354 | ||

Common natural disasters in Maryland

Maryland residents are vulnerable to powerful storms, floods and blizzards. Most standard home insurance policies will cover damage caused by snow, ice and windstorms. However, you should consider hurricane insurance if you live in a high-risk, coastal area.

You may need a flood insurance policy if you live next to a large body of water.

Best homeowners insurance in MD for most people: State Farm

-

Editor's rating

- Cost: $$984/yr

State Farm has the cheapest home insurance quotes in Maryland.

Pros:

-

Cheap rates

-

Strong customer service

-

Large network of local agents

-

Good bundling discount

Cons:

-

Few coverage extras and discounts

State Farm homeowners insurance costs roughly half the Maryland state average. You'll pay $984 per year on average for $350,000 of dwelling coverage. State Farm also has the lowest rates for $200,000, $500,000 and $1 million of coverage in Maryland.

State Farm also has good customer service. It gets fewer complaints compared to an average company of the same size, according to the National Association of Insurance Commissioners (NAIC). State Farm also scored above average on a recent J.D. Power survey on satisfaction among homeowners insurance customers.

However, State Farm offers relatively few coverage add-ons. That said, you can take advantage of a few options including guaranteed replacement cost and higher limits for personal property such as jewelry, fine art and expensive electronics.

State Farm offers relatively few discounts for homeowners compared to other top companies. But it has one of the best home-auto bundle discounts among home insurance companies in Maryland.

Best homeowners insurance in Maryland for customer satisfaction: Erie

-

Editor's rating

- Cost: $1,397/yr

Erie gets significantly fewer complaints than an average insurance company of the same size.

Pros:

-

Excellent customer service

-

Cheap prices

-

Strong coverage

-

Good home-auto bundling discount

Cons:

-

No online quotes

-

Few discounts

Erie gets 62% fewer complaints than an average insurance company of the same size.

Erie ranked first among major home insurance companies for customer satisfaction, according to a recent J.D. Power survey. It's important to choose a home insurance company that has a reputation for good customer service.

Companies that have fewer complaints typically have smoother claims processes. The last thing you need when you're trying to repair your home is another headache.

Erie has the third-cheapest rates among Maryland home insurance companies. It charges $1,397 per year for $350,000 of dwelling coverage on average. That's roughly one-third less than the Maryland state average.

You can get an Erie quote only by talking to a local agent. This means you can't get a quote online, although some customers prefer the personalized service offered by an agent.

Best homeowners insurance in Maryland for extra coverage and discounts: American Family

-

Editor's rating

- Cost: $2,060/yr

American Family offers a range of coverage extras that you can use to customize your policy.

Pros:

-

Many extra coverage options

-

Few complaints

-

Plenty of discounts available

Cons:

-

Above average rates

You can modify your American Family home insurance policy with 16 different coverage add-ons.

American Family lets you customize your homeowners policy with a wide range of coverage options.

American Family coverage extras

- Flash flood

- Roof damage

- Service line

- Vacant home

- Vacation home

- Home renovation

- Equipment breakdown

- Hidden water damage

- Home business

- Short-term rental

- Credit monitoring

- Identity protection

- Senior living protection

- Itemized personal property

- Matching undamaged siding

- Sewer back-up, septic back-up and sump overflow

American Family also has good customer service. It gets roughly one-third fewer complaints compared to an average company of the same size.

However, American Family is not one of the cheapest home insurance companies in Maryland. At $2,060 per year for $350,000 of dwelling coverage, American Family's home insurance costs slightly more than the Maryland state average.

You can lower your monthly rate by taking advantage of one or more of American Family's many available discounts. These include discounts for renovated and new homes . It also offers a good home-auto insurance bundle discount.

Average cost of home insurance in Maryland

Home insurance costs $1,962 per year in Maryland for $350,000 dwelling coverage on average.

That's 9% less than the national average of $2,151 per year.

Average cost of home insurance in MD

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $1,383 |

| $350,000 | $1,962 |

| $500,000 | $2,690 |

| $1,000,000 | $5,096 |

Maryland has the 24th most expensive homeowners insurance nationwide.

Cost of Maryland home insurance by city

West Ocean City has the most expensive home insurance rates in Maryland. It costs $3,129 per year on average.

Chevy Chase Village has the cheapest homeowner's coverage in Maryland at $1,524 per year on average. That means the same level of coverage in Chevy Chase Village costs roughly half of what you'd pay in West Ocean City.

Insurance rates can differ significantly depending on where you live, because some cities are more likely to experience natural disasters. West Ocean City's location on the coast makes it vulnerable to storms and wind damage.

Other factors like crime rates and the cost to rebuild your house can also influence rates.

City | Annual rate | % from avg |

|---|---|---|

| Abell | $2,079 | 6% |

| Aberdeen | $1,882 | -4% |

| Aberdeen Proving Ground | $1,905 | -3% |

| Abingdon | $1,874 | -5% |

| Accident | $1,897 | -3% |

Rates are for a policy with $350,000 of dwelling coverage.

The best home insurance companies in Maryland

Erie, USAA and State Farm offer the best customer service among homeowners insurance companies in Maryland.

You can buy USAA only if you or a family member are current or former military.

Company |

Rating

|

Complaints

|

|---|---|---|

| Erie | Low | |

| State Farm | Average | |

| Brethren Mutual | Low | |

| Nationwide | Low | |

| American Family | Average |

Natural disasters in Maryland

Maryland residents may be at risk for hurricanes, blizzards and floods.

A standard homeowners insurance policy won't cover flood damage. If you live in an area at risk of flooding, consider getting a separate flood policy.

Your mortgage company may require that you get flood damage if you live in an area deemed high risk by FEMA. However, you should consider flood coverage even if you own your home outright. According to FEMA, a single inch of flood water causes $25,000 of damage on average.

Your home insurance will cover normal wind damage. But policies may limit coverage for hurricanes or other powerful windstorms. If you live in a hurricane-prone area, consider getting extra coverage to protect against this hazard, called hurricane coverage.

Maryland commonly experiences freezing temperatures and snowstorms in the winter. Fortunately, most standard home insurance plans will cover damage caused by snow and ice. However, you need to take standard precautions to protect your home. For example, your home insurance policy typically won't pay for damage caused by snow that blew in through an open window.

Tips to save money on your Maryland home insurance policy

You could save hundreds or even thousands of dollars a year on homeowners insurance by comparing quotes.

The difference between the cheapest and most expensive homeowners insurance in Maryland is $2,172 per year for $350,000 of dwelling coverage. It's important to remember that more expensive rates don't mean better service or coverage. State Farm has the cheapest rates in Maryland and some of the best customer service.

Taking advantage of discounts can save you hundreds of dollars each year. Most home insurance companies offer at least a few discounts. Common discounts include price breaks for bundling different lines of insurance, switching companies or going a certain amount of time without filing a claim.

You can lower your monthly rate by increasing the amount of money you need to pay before your insurance kicks in, called a deductible. It's important to make sure that you have enough money in your savings account to easily pay your deductible.

Surging home insurance prices in Maryland

Home insurance prices are up 47.0% in Maryland over the last six years.

Maryland homeowners have recently seen their home insurance rates go up significantly, with an average increase of 13.3% in 2023 and 10.5% in 2024.

Home insurance rates at Farmers more than doubled (up 123.5%) over the past six years. This was a substantially larger increase than the next highest company, Nationwide, at 67.3%.

Home insurance rate change data was compiled using RateWatch from S&P Global, which uses information from the National Association of Insurance Commissioners (NAIC).

Frequently asked questions

What's the best homeowners insurance in Maryland?

State Farm has the best homeowners insurance in Maryland. It offers a good combination of low rates and strong customer service.

Who has the best car and homeowners insurance in MD?

State Farm is the best company for car and homeowners insurance in Maryland. In addition to its low homeowners insurance quotes, State Farm has competitive auto rates and a good home-auto bundle.

What is the average cost of homeowners insurance in Maryland?

The average cost of homeowners insurance in Maryland is $1,962 per year. That's about 9% or $188 below the national average of $2,151 per year.

Methodology

ValuePenguin collected quotes from the largest home insurance companies in Maryland across hundreds of ZIP codes. Rates are for a 45-year-old married man with no history of insurance claims.

Quotes include the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. Quadrant's rates were taken from public filings and should only be used for comparative purposes.

Home insurance ratings were created using complaint data from the National Association of Insurance Commissioners (NAIC), the J.D. Power customer satisfaction survey and ValuePenguin's ratings.

Senior Writer

Talon Abernathy is a ValuePenguin Senior Writer who specializes in health insurance, Medicare and Medicaid. He's also contributed to other insurance verticals including home, renters, auto, motorcycle and flood insurance.

Talon came to ValuePenguin in 2023. Since his arrival, he's helped to expand the site's health insurance-related content offerings. He enjoys helping readers understand the ins and outs of America's all too complicated health insurance landscape.

Before coming to ValuePenguin, Talon worked as a freelance writer. His prior work has touched on a broad range of personal finance-related topics including credit-building strategies, small business incorporation tactics and creative ways to save for retirement.

Insurance tip

In many parts of the country, you can qualify for a free Silver health insurance plan if you meet certain income requirements. Government subsidies in the form of premium tax credits and cost-sharing reductions may mean you'll pay nothing for coverage.

Expertise

- Health insurance

- Medicare and Medicaid

- Flood insurance

- Homeowners insurance

- Renters insurance

- Auto and motorcycle insurance

Referenced by

- The Miami Herald

- Money.com

- MSN

- Nasdaq

- The Sacramento Bee

- Yahoo! Finance

Education

- BA, University of Washington

- Certificate in Copyediting, UC San Diego

Credentials

- Licensed Life & Disability Insurance Agent

- Licensed Property & Casualty Insurance Agent

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.