Best Cheap Health Insurance in Kansas for 2026

Blue Cross Blue Shield (BCBS) has the best health insurance in Kansas. Silver plans from BCBS start at $634 per month before discounts.

Find Cheap Health Insurance Quotes in Kansas

Best and cheapest health insurance in Kansas

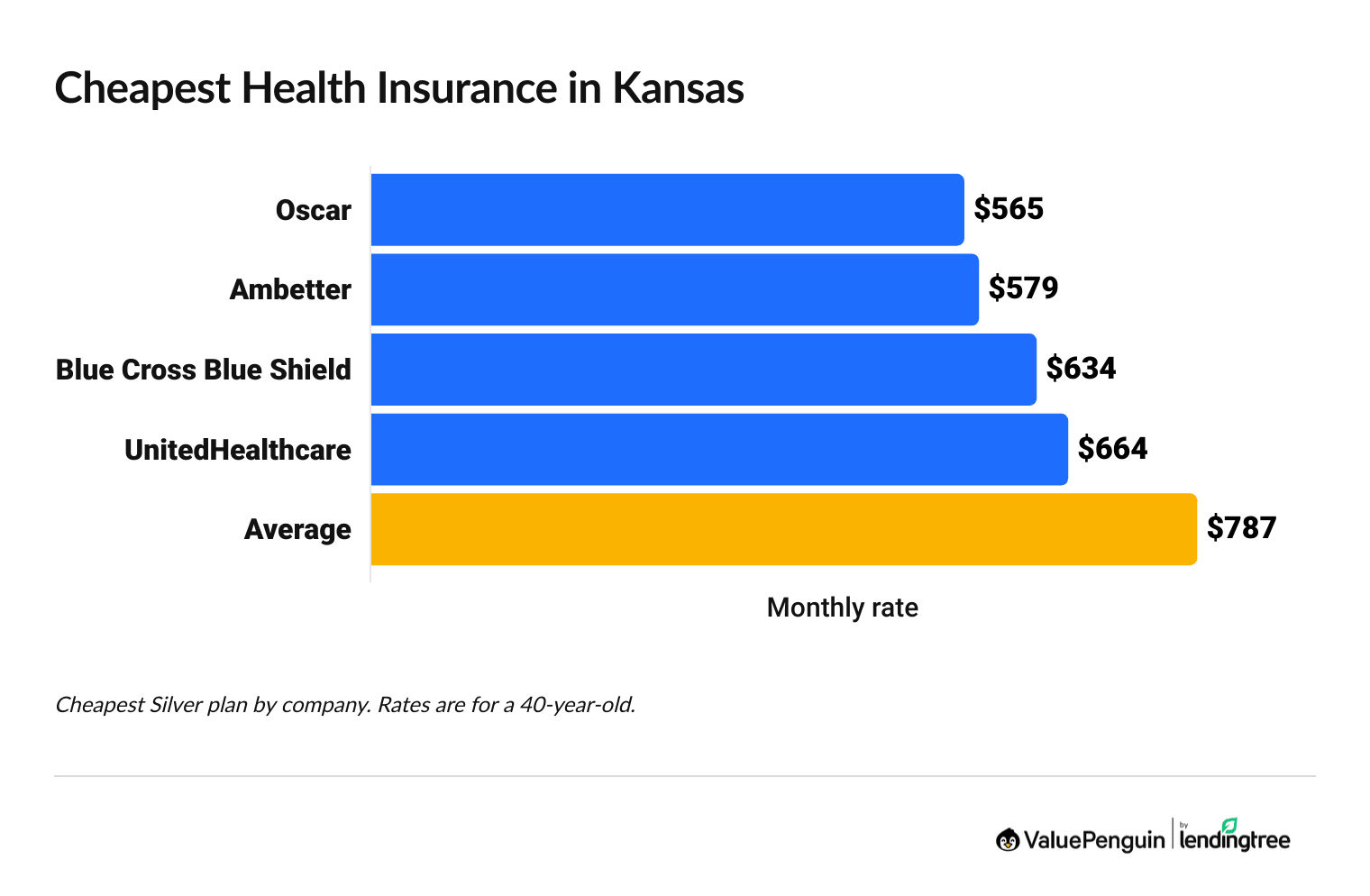

Cheapest health insurance companies in Kansas

Oscar, Ambetter and BCBS have the cheapest health insurance in Kansas, with Silver plans starting at $565 per month before discounts.

Find Cheap Health Insurance Quotes in Kansas

Affordable health insurance in Kansas

Company |

Cost

| |

|---|---|---|

| Oscar | $565-$610 | |

| Ambetter | $579-$798 | |

| BCBS of Kansas City | $634-$979 | |

| UnitedHealthcare | $664-$743 | |

- Oscar's Silver plans start at $565 per month, which is $222 cheaper each month than the state average.

- Ambetter has the cheapest Silver plans in Wichita. Coverage there costs as little as $696 per month.

- UnitedHealthcare sells the most affordable Bronze health insurance in Kansas, with plans starting at $442 per month.

Aetna won't sell plans on the Kansas health exchange for 2026. If you have Aetna coverage, you'll need to shop for new coverage during open enrollment (Nov. 1 to Jan. 15).

Good coverage options include Blue Cross Blue Shield for quality service and affordable quotes or Oscar if you want the cheapest medical insurance in Kansas.

Best health insurance companies in Kansas

Blue Cross and Blue Shield (BCBS) sells the best medical insurance in Kansas.

The company has an excellent 5-out-of-5-star rating for member experience from HealthCare.gov. That means BCBS customers can easily set appointments and are generally satisfied with the quality of care.

Find Cheap Health Insurance Quotes in Kansas

Best-rated health insurance companies in KS

Company |

ACA rating

|

VP rating

|

|---|---|---|

| BCBS of Kansas | ||

| Ambetter | ||

| UnitedHealthcare | ||

| Medica | N/A | |

| Oscar |

Blue Cross and Blue Shield is the easiest health insurance in Kansas to use because most doctors and hospitals take its plans.This lets you choose from a large network of doctors when deciding where to get medical care.** Blue Cross and Blue Shield has excellent customer service.

Everyone in Kansas can get a plan from Blue Cross and Blue Shield. If you live in Johnson or Wyandotte Counties near Kansas City, Blue Cross and Blue Shield of Kansas City sells the best plans. Even though BCBS of Kansas City is only available in a few counties, it's the most popular insurance company in Kansas, selling about 40% of all plans in the state.

If you live anywhere else in the state, the best option is Blue Cross and Blue Shield of Kansas.

Ambetter is another good option in Kansas. The company has a 5-out-of-5-star rating for member experience from HealthCare.gov. Plus, most people in Kansas can get Ambetter, and it has affordable rates.

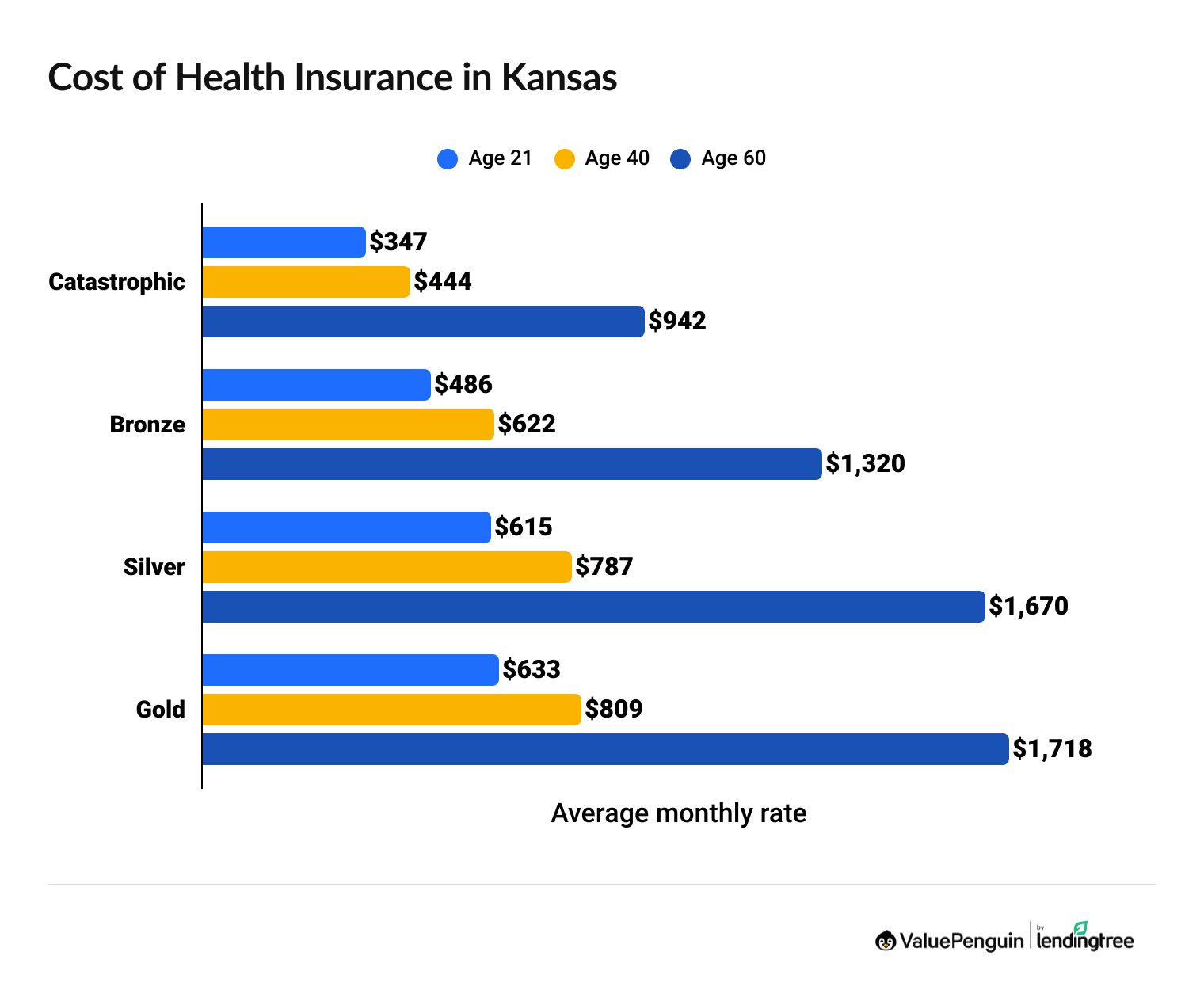

How much does health insurance cost in Kansas?

Health insurance in Kansas costs $787 per month, on average, but you could pay an estimated average of $166 per month if you get discounts based on your income.

Find Cheap Health Insurance Quotes in Kansas

- Health insurance rates generally go up as you get older. In Kansas, a 60-year-old pays more than twice as much each month as a 40-year-old for the same coverage. That's because age makes it more likely that you'll need medical care.

- The plan level you choose also affects your quotes. Health insurance plans are cheaper when they pay for less of your medical care. That's why Catastrophic and Bronze plans are more affordable than Silver and Gold plans.

Health insurance discount changes in Kansas for 2026

Medical insurance costs $787 in Kansas, or roughly $166 per month, on average, if you get discounts based on your income.

Rates after discounts project to rise from about $78 in 2025 to $166 in 2026. That's because discounts available for 2026 are smaller.

Between 2021 and 2025, you could get larger discounts because of extra pandemic era discounts. Keep in mind, you can still get discounts, but they won't be as generous as in previous years.

Health insurance rates in Kansas after subsidies (2025 vs. 2026)

Income | 2025 rate | 2026 rate | Difference |

|---|---|---|---|

| $30,000 | $49 | $155 | 216% |

| $40,000 | $154 | $287 | 86% |

| $50,000 | $283 | $415 | 47% |

| $60,000 | $423 | $498 | 18% |

| $70,000 | $496 | $670 | 35% |

Average cost after subsidies for a single 40-year-old with a Benchmark Silver plan.

- Who can get subsidies? You may be able to get subsidies if you earn between $15,650 and $62,600 as a single person ($32,150 to $128,600 for a family of four). The less money you make, the larger your subsidy.

- How do subsidies work? You can use your subsidy on any Bronze, Silver or Gold plan available through HealthCare.gov. You can choose to have your subsidy automatically applied to your monthly rate, or you can get it as a lump sum at the end of the year when you file your taxes. You don't need to take any special extra steps to get your subsidy. HealthCare.gov will show you what subsidies you qualify for based on your income when you go to buy coverage.

- How much do you save? Use ValuePenguin's subsidy calculator to find out how much you'll pay for coverage after discounts.

Cheap Kansas health insurance plans by city

Ambetter sells the cheapest medical insurance in Wichita.

But if you live in the Kansas City metro area, Topeka or Lawrence, Oscar has the most affordable Silver plan. Oscar and Ambetter have the cheapest coverage for more than nine in 10 Kansans.

Just because a company sells the cheapest Silver plan in your area doesn't mean it's the cheapest for you. It's a good idea to compare health insurance plans to find the best coverage and price for you.

Cheapest health insurance plan by KS county

Allen | Oscar Silver Classic Standard | $588 |

|---|---|---|

| Anderson | Oscar Silver Classic Standard | $565 |

| Atchison | Oscar Silver Classic Standard | $565 |

| Barber | Ambetter Standard Silver | $739 |

| Barton | Ambetter Standard Silver | $746 |

| Bourbon | Ambetter Standard Silver | $719 |

Cheapest Silver plan with rates for a 40-year-old

Find Cheap Health Insurance Quotes in Kansas

Best health insurance by level of coverage

The best health insurance plan for you depends on where you live, how much medical care you expect to need and how much you can afford to spend each month.

Usually, the more health care you need, the higher the plan tier you should choose. If you're young or generally healthy, you could consider a lower-tier plan and pay for more of your medical bills yourself.

Gold plans: Best for high medical costs

| Gold plans pay for about 80% of your medical care. |

Gold plans cost $809 per month, on average, in Kansas.

Gold plans give you the highest level of coverage and come with the highest monthly costs. You pay more each month for a Gold plan, and you get the benefit of paying a lower portion of your overall health care bills. That's because Gold plans have lower deductibles and out-of-pocket maximums.

Despite the more expensive quotes, Gold plans are a good option if you go to the doctor often or manage a chronic or complex health care issue.

Silver plans: Best for average medical costs

| Silver plans pay for about 70% of your medical care. |

Silver plans cost $787 per month, on average, in Kansas.

Silver plans are a good choice for most people because they give you good coverage at a good price. They have average deductibles, coinsurance and copays, but they cost less than Gold plans each month.

Plus, if you have a low income, you might get a discount that makes your medical bills more affordable. Silver plans are the only plans with this type of discount.

Bronze plans: Best for low medical costs

| Bronze plans pay for about 60% of your medical care. |

Bronze plans cost $622 per month, on average, in Kansas.

Bronze plans have affordable quotes but only pay for about 60% of your medical bills. Bronze plans can be good if you don't need much medical care. But you should make sure you have savings to pay the high out-of-pocket costs in case something serious happens, such as a hospitalization or major injury.

Catastrophic plans: Best as a last resort

Catastrophic plans cost an average of $347 per month in Kansas for a 21-year-old.

Catastrophic plans have the cheapest quotes in Kansas but give you the lowest level of coverage. A Catastrophic plan is better than not having any health insurance, but it isn't the best option for most people.

To get a Catastrophic plan, you have to be younger than 30 or qualify for an exemption. You also can't use rate subsidies to lower the monthly cost of a Catastrophic plan like you can with Bronze, Silver and Gold plans.

Cheap or free health insurance plans in Kansas if you have a low income

If you can't afford health insurance, you might be able to get free or low-cost medical insurance through Medicaid. And if you buy a Silver plan, you might qualify for discounts that make medical care cheaper.

Medicaid in Kansas

If you have a low income, you might be able to get cheap or free health insurance with Medicaid.

Kansas has three Medicaid programs.

- KanCare Medicaid can cover children under 19, people under age 26 who aged out of foster care, adult parents and relative caretakers of children, pregnant women, people who are blind or have disabilities and people age 65 or older. This is the main Medicaid program in Kansas.

- KanCare Children's Health Insurance Program, also called CHIP, covers children under age 19 who don't qualify for KanCare Medicaid.

- MediKan covers people applying for Social Security disability benefits.

Kansas is one of the few states that has not expanded its Medicaid program. Qualifying for Medicaid in Kansas is much more difficult than it is in other states.

Use cost-sharing reductions for cheaper medical care

| Silver plans will pay 74% to 90% of your medical costs if you have a low income. |

If you don't qualify for Kansas Medicaid, consider buying a Silver plan. If you make between $15,650 and $39,125 per year as an individual or between $32,150 and $80,375 per year as a family of four, you can get a discount that lowers the amount you have to pay when you go to a doctor. It's called a cost-sharing reduction, and you can only get it on Silver plans.

Plus, you probably also qualify for rate subsidies that make your monthly rate more affordable.

Are health insurance rates going up in KS?

The cost of health insurance in Kansas is rising by an average of 23% in 2026 across all plan tiers.

Catastrophic plans in the state are getting 29% more expensive, on average. The cost of Bronze and Silver plans are rising by 23% year on year, and Gold plans are going up by 19%. Between 2022 and 2026, the cost of Silver health insurance rose by an average of 47%.

Catastrophic

Bronze

Silver

Gold

Year | Cost | Change |

|---|---|---|

| 2022 | $490 | – |

| 2023 | $527 | 8% |

| 2024 | $378 | -28% |

| 2025 | $345 | -9% |

| 2026 | $444 | 29% |

Monthly costs are for a 40-year-old.

Catastrophic

Year | Cost | Change |

|---|---|---|

| 2022 | $490 | – |

| 2023 | $527 | 8% |

| 2024 | $378 | -28% |

| 2025 | $345 | -9% |

| 2026 | $444 | 29% |

Monthly costs are for a 40-year-old.

Bronze

Year | Cost | Change |

|---|---|---|

| 2022 | $413 | – |

| 2023 | $487 | 18% |

| 2024 | $481 | -1% |

| 2025 | $504 | 5% |

| 2026 | $622 | 23% |

Monthly costs are for a 40-year-old. Expanded Bronze plans are included in 2024, 2025 and 2026 averages, when they're offered.

Silver

Year | Cost | Change |

|---|---|---|

| 2022 | $534 | – |

| 2023 | $565 | 6% |

| 2024 | $602 | 7% |

| 2025 | $642 | 7% |

| 2026 | $787 | 23% |

Monthly costs are for a 40-year-old.

Gold

Year | Cost | Change |

|---|---|---|

| 2022 | $594 | – |

| 2023 | $602 | 1% |

| 2024 | $628 | 4% |

| 2025 | $682 | 9% |

| 2026 | $809 | 19% |

Monthly costs are for a 40-year-old.

Why is health insurance expensive in Kansas in 2026?

Insurance companies are significantly raising health insurance rates in the coming year because of inflation and expiring tax credits.

There are several reasons behind this large price increase, including more expensive prescription drug prices, higher health care costs, tariffs and inflation.

Another big factor behind this sudden run-up in the cost of Kansas health insurance is the expiration of Covid-era enhanced government subsidies.

How to save on Kansas health insurance in 2026

- You may be eligible for free government health insurance if you earn a low income, called Medicaid.

- If your income is too high for Medicaid, you may still qualify for discounts on plans bought through the Kansas health exchange.

- You can get cheaper quotes by choosing a high-deductible health plan (HDHP). Then open a health savings account (HSA) for more savings.

- Compare quotes from several companies to get the best cheap medical insurance in your area.

Minimum essential health coverage in Kansas

To buy marketplace insurance in Kansas, you can shop on HealthCare.gov. These plans are sometimes called ACA or "Obamacare" plans.

One of the most valuable features of buying ACA plans is that you won't get higher quotes or be denied coverage based on your health or preexisting conditions when you buy a plan.

Every plan has to cover at least 10 common medical situations.

- Doctor visits

- Preventive and wellness care

- Emergency care

- Hospital stays

- Prescription medications

- Lab services

- Pregnancy, maternity and newborn care

- Pediatric care

- Mental health and substance use care

- Rehab services

No matter what plan tier you buy, you'll have coverage for at least these 10 scenarios. Catastrophic and Bronze plans pay the lowest amounts toward your medical bills, while Silver and Gold plans pay the highest amounts.

Average cost of health insurance by family size in Kansas

The more people you cover on your health insurance plan, the more expensive your quote.

An adult couple with two children younger than 15 pays $2,515 per month, on average, for a Silver plan. Children are cheaper to insure than adults, since it's less likely that a child will have a serious or expensive health issue.

Unlike with adults and older children, age doesn't have an impact on the rates of young children. Adding a child under age 15 to a Silver plan in Kansas costs $471 per month. After age 15, your child's rate will increase with age each year.

Family size | Average monthly cost |

|---|---|

| Individual | $787 |

| Individual and child | $1,257 |

| Couple | $1,573 |

| Family of three | $2,044 |

| Family of four | $2,515 |

Averages based on a Silver plan for 40-year-old adults and children who are under age 15.

COBRA insurance plans in Kansas

COBRA costs an average of $767 per month for an individual in Kansas.

For a family, the average rate is $2,216 per month. That's roughly what you'd pay for coverage from HealthCare.gov if you're not eligible for subsidies. But if your income qualifies you for discounts, you could pay significantly less for health insurance.

It's a good idea to get quotes for both ACA plans and COBRA insurance in Kansas, because the two types of insurance cost roughly the same amount, on average. If you rely on a specific coverage that your employer plan has, though, COBRA is probably a better option.

COBRA is a program that lets you keep the health insurance plan you had at your job after you leave.

But once you leave, you have to pay the full cost of the plan. Your employer will no longer pitch in to lower the monthly rate. Because of this, COBRA can be expensive.

Short-term health insurance plans in Kansas

The Trump administration rolled back a Biden-era rule that limited the length of a short-term health policy to three months, at the start of 2025. That means you can now buy short-term coverage in Kansas for up to 364 days or two years total, including renewals.

Short-term health insurance can be a good option if you only need coverage for a short amount of time. One of the most common reasons to buy short-term health insurance is to have coverage when you're between jobs.

However, it's important to remember these plans typically have worse coverage and fewer protections than regular health insurance you'd get through work or HealthCare.gov.

Pros of short-term health insurance plans in Kansas

Cons of short-term health insurance plans in Kansas

Health insurance enrollment by income level in Kansas

Nearly eight in 10 Kansans with ACA coverage made $37,650 per month or less in 2025.

That means smaller discounts will disproportionately impact people who earn a below-average income in Kansas. Only about 3% of Kansas residents who have marketplace coverage earned more than $75,300 per year.

Enrollment by income

Income | % of total enrollment |

|---|---|

| Less than $15,060 | 2% |

| $15,060 to $20,783 | 38% |

| $20,784 to $22,590 | 13% |

| $22,591 to $30,120 | 16% |

| $30,121 to $37,650 | 9% |

Enrollment in 2025 marketplace plans made during the 2024-2025 Open Enrollment period. Total may not be 100% due to rounding

Frequently asked questions

Is $200 a month expensive for health insurance in Kansas?

No, $200 per month for health insurance in Kansas is quite an affordable rate. That's roughly a quarter of what the average person pays for medical coverage in KS. The best way to save on health insurance in Kansas is to take advantage of ACA subsidies.

What is the best health insurance in Kansas?

The best health insurance in KS comes from Blue Cross Blue Shield. If you live in or around Kansas City, you can buy a plan from BCBS of Kansas City, which is also the most popular company in the state. If you live anywhere else in Kansas, you can buy a plan from BCBS of KS.

Why did insurance go up in Kansas?

Health insurance in Kansas is getting more expensive in 2026 because of inflation, more expensive prescription drugs and expiring pandemic-era tax credits. If you're struggling to afford coverage, consider going with a cheaper plan tier, such as Bronze.

How much does health insurance cost per month in Kansas?

Health insurance costs $787 per month, on average, for a 40-year-old with a Silver plan in Kansas. But quotes change depending on your age, how many people you have on your plan, where you live, the plan tier you buy, the company you choose and whether you smoke or use tobacco.

How do I get health insurance in KS?

If you don't have a health plan from your job, you can buy a plan from HealthCare.gov. You'll be able to browse and compare the plans in your area to find the best option for you. To buy a plan, you'll need to create an account and fill out the application.

Methodology

Kansas health insurance rate data for 2026 is from the Centers for Medicare & Medicaid Services (CMS) website. ValuePenguin used the CMS public use files (PUFs) to find average rates for different plan tiers, geographic locations and family sizes.

Rates

Rates are based on a 40-year-old with a Silver plan, unless otherwise noted. Rates for Bronze plans include regular and Expanded Bronze plans for 2024, 2025 and 2026, when the plans are available. Your costs and plan options will vary; plans aren't always available in all parts of a state or county.

Subsidies

Rates after subsidies are estimates for a 40-year-old with a Benchmark Silver plan and are based on how subsidies were structured before 2021. Prices are calculated using KFF's rates for full-price Benchmark plans, federal poverty levels (FPLs), IRS rules about premium tax credits and Congressional reports about expanded tax credits. The total cost in the state uses rates calculated by income, which are weighted using CMS data on the incomes of those who purchased plans during last year's open enrollment. The median was used for each income range. Unknown incomes were excluded from the calculations. Incomes of 100% of the federal poverty line and 500% of the federal poverty line were assumed for enrollees who earn less than 100% FPL and more than 500% FPL, respectively. Information about state subsidies, when available, was sourced from state marketplaces.

Ratings

ValuePenguin's experts rank companies based on cost, coverage options, customer satisfaction and unique value. Ratings are out of 100 possible points. ACA ratings show how the company performs in Kansas for medical care, member experience and plan administration. This 2026 plan quality data from CMS is based on data from last year. Ratings are not available for new plans or plans with low enrollment.

More sources

Enrollment trends, including plan selections by tier and enrollment by income, are from CMS data for the 2025 open enrollment period.

Other sources include S&P Global Capital IQ and the National Association of Insurance Commissioners (NAIC).

Senior Writer

Talon Abernathy is a ValuePenguin Senior Writer who specializes in health insurance, Medicare and Medicaid. He's also contributed to other insurance verticals including home, renters, auto, motorcycle and flood insurance.

Talon came to ValuePenguin in 2023. Since his arrival, he's helped to expand the site's health insurance-related content offerings. He enjoys helping readers understand the ins and outs of America's all too complicated health insurance landscape.

Before coming to ValuePenguin, Talon worked as a freelance writer. His prior work has touched on a broad range of personal finance-related topics including credit-building strategies, small business incorporation tactics and creative ways to save for retirement.

Insurance tip

In many parts of the country, you can qualify for a free Silver health insurance plan if you meet certain income requirements. Government subsidies in the form of premium tax credits and cost-sharing reductions may mean you'll pay nothing for coverage.

Expertise

- Health insurance

- Medicare and Medicaid

- Flood insurance

- Homeowners insurance

- Renters insurance

- Auto and motorcycle insurance

Referenced by

- The Miami Herald

- Money.com

- MSN

- Nasdaq

- The Sacramento Bee

- Yahoo! Finance

Education

- BA, University of Washington

- Certificate in Copyediting, UC San Diego

Credentials

- Licensed Life & Disability Insurance Agent

- Licensed Property & Casualty Insurance Agent

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.