Best Cheap Health Insurance in Alaska (2026)

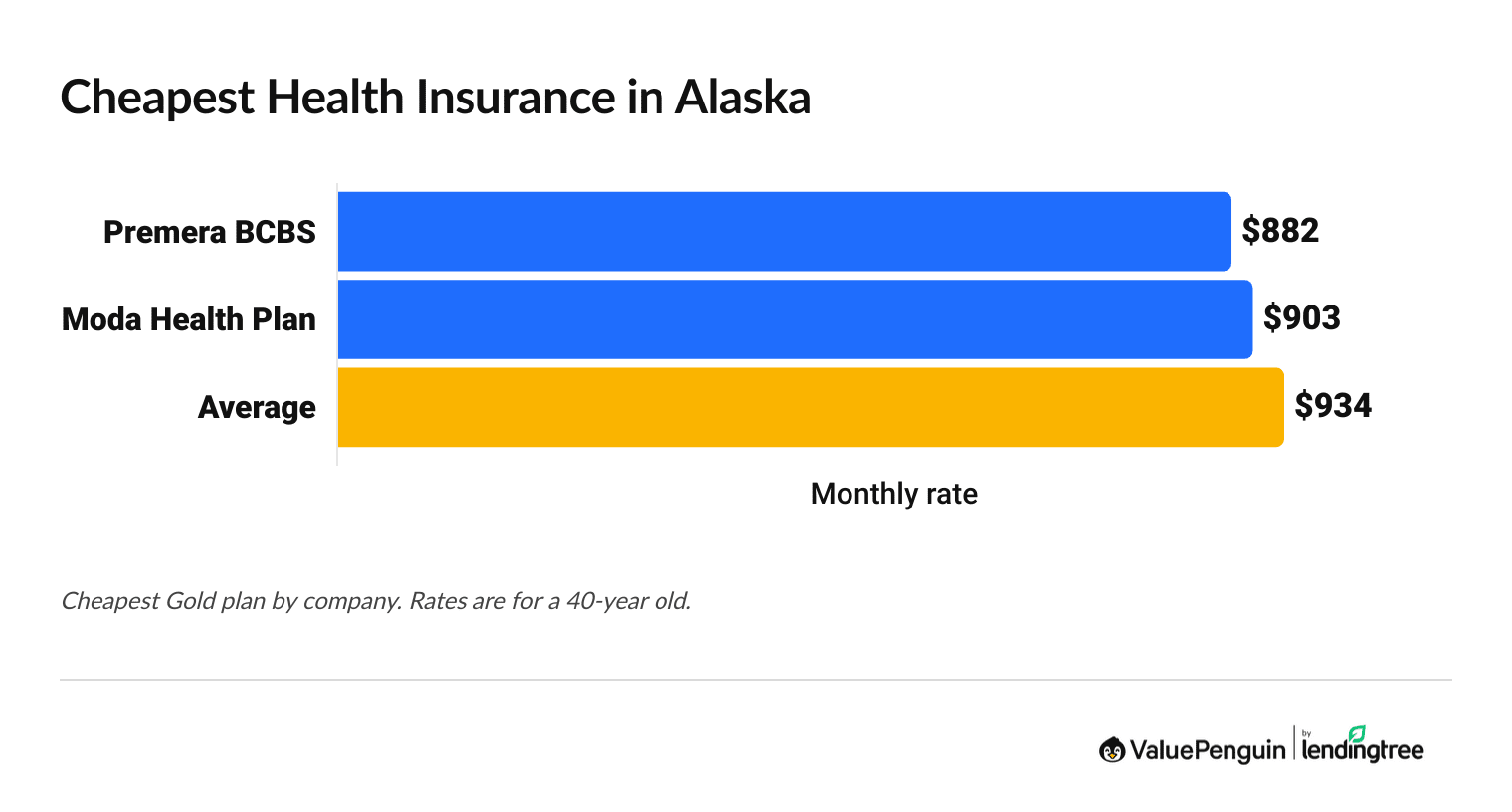

Premera Blue Cross Blue Shield has the best and cheapest health insurance plans in Alaska, with Gold plans starting at $882 per month before discounts.

Find Cheap Health Insurance Quotes in Alaska

Best and cheapest health insurance plans in Alaska

Cheapest health insurance companies in Alaska

Of the two health insurance companies on the AK marketplace, Premera BCBS sells the cheapest plans, followed by Moda, with Gold plans starting at $882 per month before discounts.

Find Cheap Health Insurance Quotes in Alaska

Affordable health insurance plans in Alaska

Company |

Cost

| |

|---|---|---|

| Premera Blue Cross | $882-$960 | |

| Moda Health Plan, Inc. | $903-$965 | |

- Moda has the most affordable medical insurance in Anchorage, Alaska's biggest city. If you live in other areas of Alaska, Premera BCBS is likely cheaper.

- But Moda doesn't have great customer service, with more complaints than expected for a company of its size. If good service is a priority for you, Premera is a better option.

- In Alaska, Gold plans cost less than Silver plans. Because Gold plans also cover more of your medical bills, they're a better option than Silver plans for most people in AK.

Best health insurance companies in Alaska

Premera Blue Cross Blue Shield (BCBS) sells the best health insurance in Alaska.

Premera BCBS has a perfect 5 out of 5 member experience star rating from HealthCare.gov. That means Premera customers have an easy time scheduling appointments, and they're happy with the quality of medical care.

Find Cheap Health Insurance Quotes in Alaska

Best-rated health insurance companies in Alaska

Company |

ACA rating

|

VP rating

|

|---|---|---|

| Moda Health Plan, Inc. | ||

| Premera Blue Cross Blue Shield |

As part of Blue Cross Blue Shield (BCBS), Premera gives you access to a large network of doctors and hospitals. This makes it easier to find covered medical care, even if you're in a rural area. And Premera has excellent customer service, with far fewer complaints than expected.

How much does health insurance cost in Alaska?

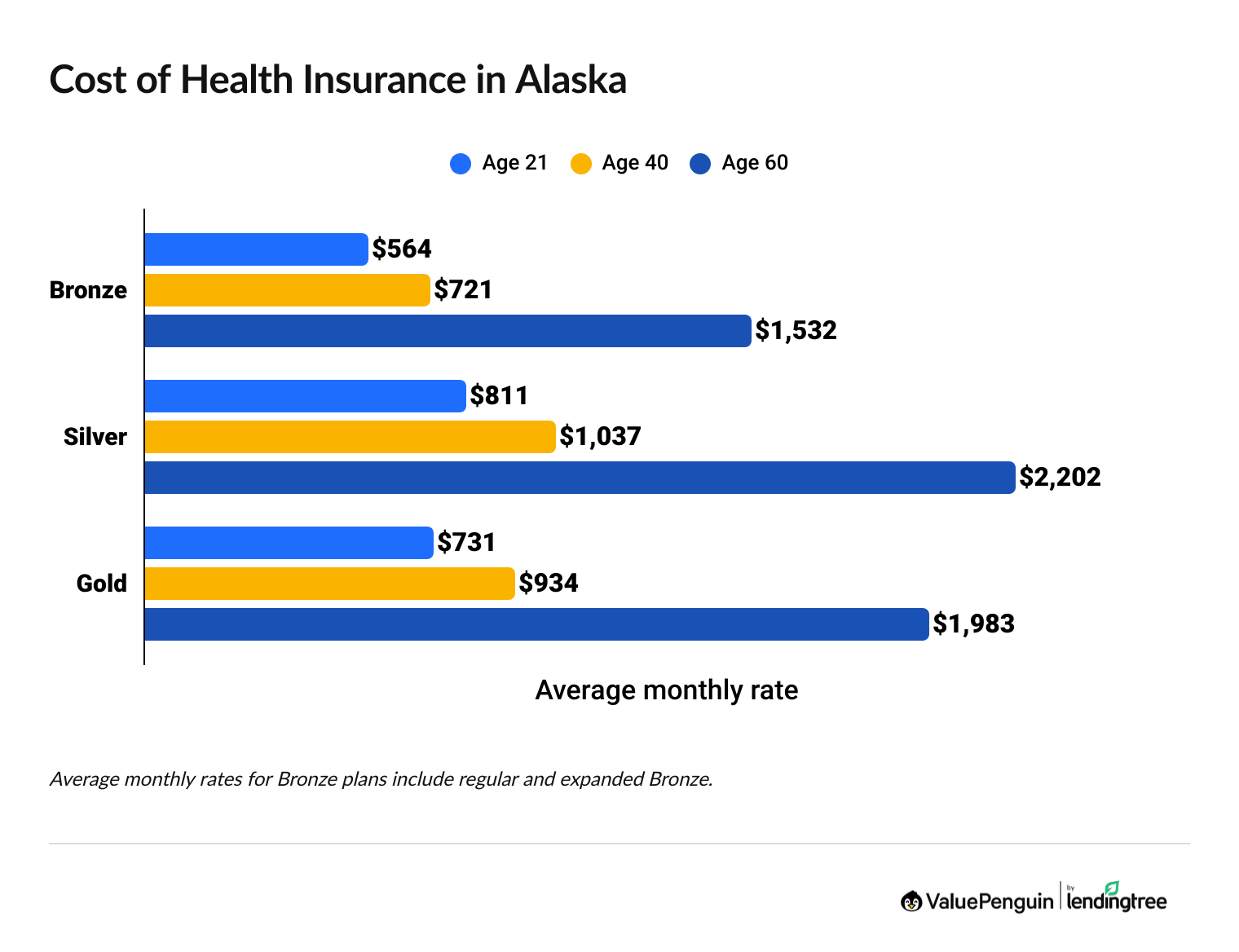

Health insurance in Alaska costs an average of $934 per month at full price for a Gold plan or around $474 per month, for a Silver plan on average, if you're eligible for discounts based on your income.

Find Cheap Health Insurance Quotes in Alaska

- Gold plans have more affordable quotes than Silver plans in Alaska, and they give you more coverage. Unless you have a low income and can get discounts on your medical care, Gold plans make more sense.

- Your age also affects how much you pay for coverage. Plans get more expensive as you get older because you're more likely to have health issues that require expensive medical care.

Health insurance discount changes in Alaska for 2026

A Gold health insurance plan costs $934 on average in Alaska, but, if you get discounts based on your income, you could pay $474 per month, on average, for a Silver plan.

For people who can get subsidies, rates will increase from about $269 in 2025 to $474 in 2026. Higher discounts called "expanded subsidies" have been available on HealthCare.gov and state marketplaces since 2021. But Congress voted not to extend them into 2026. While you could still get some discounts based on your income, they won't be as good.

Health insurance rates in Alaska after subsidies (2025 vs. 2026)

Income | 2025 rate | 2026 rate | Difference |

|---|---|---|---|

| $30,000 | $9 | $109 | 1111% |

| $40,000 | $84 | $226 | 169% |

| $50,000 | $193 | $359 | 86% |

| $60,000 | $324 | $498 | 54% |

| $70,000 | $455 | $581 | 28% |

Average cost after subsidies for a single 40-year-old with a Benchmark Silver plan.

- Who can get subsidies? To qualify for subsidies in Alaska, you have to make between $19,550 and $78,200 as a single person, or $40,190 and $160,760 as a family of four. These ranges are different from those in the rest of the country because of the high cost of living in the Last Frontier.

- How do subsidies work? You can use a subsidy to cover the cost of a Bronze, Silver or Gold plan from any company. They can't be used on Catastrophic plans, but none are available in AK.

- How much do you save? You can use ValuePenguin's subsidy calculator to see how much a subsidy will drop your health insurance rate.

Cheap Alaska health insurance plans by city

Moda sells the cheapest medical insurance in Anchorage, while Premera sells the most affordable plans in Fairbanks and Juneau.

If you live in the more rural areas of Alaska, Premera is also probably cheaper.

Cheapest health insurance by AK borough

County | Cheapest plan | Monthly rates |

|---|---|---|

| Aleutians East | Premera BCBS Alaska Standard Gold | $928 |

| Aleutians West | Premera BCBS Alaska Standard Gold | $928 |

| Anchorage | Moda Pioneer Alaska Standard Gold | $903 |

| Bethel | Premera BCBS Alaska Standard Gold | $918 |

| Bristol Bay | Premera BCBS Alaska Standard Gold | $928 |

Cheapest Gold plan with rates for a 40-year-old

Find Cheap Health Insurance Quotes in Alaska

Best health insurance by level of coverage

To find the best health insurance in Alaska, think about your monthly budget and how much medical care you need.

For most people, it makes sense to buy a Gold plan because it gives you the highest level of coverage and usually has cheaper quotes than a Silver plan. However, if you're young and healthy, a Bronze plan could be a good choice.

Gold plans: Best for most people

| Gold plans pay for about 80% of your medical care. |

Gold plans cost an average of $934 per month in Alaska.

Gold plans are the highest plan tier offered in Alaska, which means they pay the highest portion of your medical bills. This lets you pay less when you go to the doctor. Because Gold plans usually have more affordable quotes than Silver plans in Alaska, they're a good option for most people with moderate to high medical care needs.

Silver plans: Best if you have a lower income

| Silver plans pay for about 70% of your medical care. |

Silver plans cost an average of $1,037 per month in Alaska.

Silver plans typically aren't the best deal in Alaska, even though they're a good option in most states. If you buy a Silver plan in AK, you'll likely pay more than you would for a Gold plan, which gives you more coverage.

However, if you make between $19,550 and $48,875 per year as an individual, a Silver plan may be a more affordable option because you can get an extra discount, on top of rate subsidies, that makes the amount you have to pay for medical care cheaper.

Bronze plans: Best if you are young and healthy

| Bronze plans pay for about 60% of your medical care. |

Bronze plans cost an average of $721 per month in Alaska.

Bronze plans have the cheapest quotes, but they also pay the least toward your medical bills. That means if you have a Bronze plan, you will pay more when you get health care. If you are young and healthy, these plans can be a good idea as long as you have money in the bank to pay for your share of medical bills. But if you need medical care often, they're not the best fit.

Cheap or free health insurance in Alaska if you have a low income

If you can't afford health insurance, you might be able to get Medicaid, which is free. If you can't get Medicaid, consider a Silver plan with rate subsidies and another discount that makes your medical care more affordable.

Medicaid in Alaska

Medicaid is free or very low-cost health insurance from the government for low-income households.

To get Medicaid in AK, you have to make about $27,000 or less per year for individuals or less than about $55,400 per year as a family of four. These limits are higher than they are in other states, which means you can make more in Alaska and still get Medicaid.

Alaska has programs for low-income adults, children, pregnant women, seniors and those who are blind or disabled.

Use cost-sharing reductions for cheaper medical care

If you can't get Medicaid, buying a Silver medical insurance plan might be a good option. If you make between $19,550 and $48,875 as a single person or $40,190 and $100,475 as a family of four, you could get extra discounts that let you pay less when you go to the doctor. These are called cost-sharing reductions, and they're only available for Silver plans. If you qualify, your Silver plan might pay for more of your medical bills than a Gold plan.

Are health insurance rates going up in AK?

Health insurance in Alaska costs 3% less for 2026 compared to 2025.

Bronze

Silver

Gold

Year | Cost | Change |

|---|---|---|

| 2022 | $413 | – |

| 2023 | $544 | 32% |

| 2024 | $625 | 15% |

| 2025 | $721 | 15% |

| 2026 | $721 | 0% |

Monthly costs are for a 40-year-old. Expanded Bronze plans are included in 2024, 2025 and 2026 averages, when they're offered.

Why is health insurance expensive in Alaska in 2026?

Expiring tax credits made health care more expensive for many Americans.

In 2026, the average cost of health care plans in Alaska stayed the same or decreased. But in 2025, all the plan tiers — Bronze, Silver and Gold — went up by about 15%. The same is true for the year before.

How to save on Alaska medical insurance in 2026

- You may be eligible for free government health insurance, called Medicaid, if you earn a low income.

- Compare quotes from different companies in your area on HealthCare.gov to get the most affordable coverage available.

- If you shop for medical insurance on HealthCare.gov, you'll automatically see what discounts you're eligible for based on your income. Keep in mind, subsidy cuts for 2026 may make plans less affordable than in years past.

- You'll get more affordable quotes by choosing a high-deductible health plan (HDHP).

- If you pick a high-deductible health plan, you can get extra tax savings by opening a health savings account (HSA).

Essential health coverage in Alaska

You can buy Affordable Care Act (ACA) plans, also called "Obamacare" plans, on HealthCare.gov between Nov. 1 and Jan. 15 every year. For 2025, only two companies — Moda and Premera Blue Cross Blue Shield — sell plans in Alaska.

One of the biggest benefits of ACA plans is that they don't take your health into account when setting your rates. Companies can only use five things to set your rates:

- Your age

- The plan tier you buy

- Where you live

- How many people you want on your plan

- Whether or not you smoke or use tobacco

Even if you have a preexisting condition, , you'll still be able to buy a plan, and you won't pay more because of your health.

Average cost of health insurance by family size in Alaska

A couple with two young children pays $2,986 per month, on average, for a Gold plan in Alaska. Children ages 14 and under are charged a fixed rate of $559 per month. Once a child turns 15, their rate begins to increase every year.

Family size | Average monthly cost |

|---|---|

| Individual | $934 |

| Individual and child | $1,493 |

| Couple | $1,868 |

| Family of three | $2,427 |

| Family of four | $2,986 |

Averages based on a Gold plan for 40-year-old adults and children who are under age 15.

Short-term health insurance plans in Alaska

At the start of 2025, the current administration rolled back a rule that would limit the length of a short-term medical insurance policy to three months. Although there isn't a timeline for when this change will happen, you may be able to find short-term health plans in Alaska that last for up to 364 days sometime in the coming year.

Pros of short-term health insurance plans in Alaska

Cons of short-term health insurance plans in Alaska

Frequently asked questions

Is $200 a month expensive for health insurance in Alaska?

No, $200 per month is not an expensive price to pay for health insurance in Alaska. That's less than one-fifth the cost of a Silver plan, on average, bought through the Alaskan health exchange .

How do I get health insurance in Alaska?

Comparing quotes on HealthCare.gov is the best way to get health insurance in Alaska. The website shows all available plans in your area. Plus, you'll automatically see what discounts, called subsidies, you're eligible for.

What is the best health insurance company in Alaska?

Premera BCBS is the best health insurance company in Alaska. It has good quality plans and high customer satisfaction. Plus, you can use Premera BCBS insurance at most medical offices. But the best health insurance for you will be a company and plan that fits your budget and medical needs.

How much is health insurance in Alaska per month?

A Gold health insurance plan costs an average of $934 per month for a 40-year-old in Alaska. Gold plans give you the most coverage, and in Alaska, they're cheaper than Silver plans, which give you moderate coverage. A Silver plan costs $1,037 per month, on average, for a 40-year-old in Alaska.

What is the cheapest health insurance in Alaska?

Premera Blue Cross Blue Shield sells the cheapest health insurance plans in most of Alaska. Gold plans start at $882 per month for a 40-year-old man. The same person will find that Moda offers the most affordable plans in Anchorage, at $903 a month for a Gold plan.

Methodology

Rates after subsidies are estimates for a 40-year-old with a Benchmark Silver plan and are based on how subsidies were structured before 2021. Prices are calculated using KFF's rates for full-price Benchmark plans, federal poverty levels (FPLs), IRS rules about premium tax credits and Congressional reports about expanded tax credits. The total cost in the state uses rates calculated by income, which are weighted using CMS data on the incomes of those who purchased plans during last year's open enrollment. The median was used for each income range. Unknown incomes were excluded from the calculations. Incomes of 100% of the federal poverty line and 500% of the federal poverty line were assumed for enrollees who earn less than 100% FPL and more than 500% FPL, respectively. Information about state subsidies, when available, was sourced from state marketplaces.

Ratings

ValuePenguin's experts rank companies based on cost, coverage options, customer satisfaction and unique value. Ratings are out of 100 possible points. ACA ratings show how the company performs in Alaska for medical care, member experience and plan administration. This 2026 plan quality data from CMS is based on data from last year. Ratings are not available for new plans or plans with low enrollment.

More sources

Enrollment trends, including plan selections by tier and enrollment by income, are from CMS data for the 2025 open enrollment period.

The National Association of Insurance Commissioners (NAIC) and S&P Global Capital IQ also provided data for this report. Cost increase projections came from KFF and the Alaska Division of Insurance.

About the Author

Senior Writer

Jenn Jones is a Senior Writer at LendingTree where she covers auto, home, renters and motorcycle insurance topics.

Previously an editor for USA TODAY Blueprint and a finance manager at World Car dealerships, she has more than a decade of experience in the world of personal finance and a deep interest in sharing knowledge that empowers others. She’s also served as a freelance translator, copy editor, writer and researcher. She graduated from the University of Virginia with a B.S. in commerce and a B.A. in Chinese language and literature.

How insurance helped Jenn

Jenn first came to appreciate pet insurance when annual checkups for her cat and dog totaled more than $700.

Expertise

- Auto insurance

- Renters insurance

- Condo insurance

- Home insurance

Referenced by

- USA TODAY

- MSN

- F&I Magazine

- Automotive News

Education

- BS, Commerce, University of Virginia

- BA, Chinese Language and Literature, University of Virginia

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.