What is Medigap Insurance and What Does it Cover?

Medigap, also called Medicare Supplement, covers some of the costs left over by Original Medicare so you pay less overall for health care.

Compare Medicare Plans in Your Area

There are 10 different Medicare Supplement plans to choose from, each with its own level of coverage. With some of the higher-coverage plans, you might not have to pay much, if anything, when you go to the doctor or hospital.

What is Medigap insurance?

Medigap is an extra insurance plan you can buy to cover some of the costs you have to pay when you have Original Medicare (Parts A and B).

Also called Medicare Supplement, Medigap plans help you cover Medicare costs like your deductible, copays and coinsurance. Medigap plans help you lower or even eliminate what you pay for most medical care when you have Medicare.

Medicare Supplement plans are from insurance companies, not from the government. But the government determines what each plan letter covers, and the coverage is the same no matter what company you buy it from. That means you get the same coverage with Plan G from Aetna or Blue Cross Blue Shield. Once you decide which plan letter is right for you, you can compare companies based on price and customer service reputation.

You cannot buy a Medicare Supplement plan if you have Medicare Advantage.

You can only get Medigap if you have Original Medicare, which is made up of Part A and Part B, from the government. You can also have a Part D plan for prescription drug coverage. This is usually a good idea, because Medigap doesn't have any coverage for prescription medications.

What does Medigap cover?

Medigap pays for some of the costs that Original Medicare (Parts A and B) won't cover.

That often includes what you pay when you go to the doctor or hospital, called the Parts A and B deductibles and coinsurance. The exact coverage depends on your plan.

For example, when you have Medicare and you go into the hospital, you have to pay a deductible and a daily amount depending on how many days you have to stay. If you have a Medigap plan, you might not have to pay anything.

Most popular plans

Other plans

Average costs are for a 65-year-old female nonsmoker. Rates vary by location, age, gender and other factors.

Most popular plans

Average costs are for a 65-year-old female nonsmoker. Rates vary by location, age, gender and other factors.

Other plans

Plan B | Plan C | Plan D | Plan L | Plan M | |||

|---|---|---|---|---|---|---|---|

| Monthly cost | $151 | $196 | $222 | $178 | $83 | $126 | $143 |

| Part A coinsurance | |||||||

| Part B coinsurance | 50% | 75% | |||||

| Blood (3 pints) | 50% | 75% | |||||

| Part A hospice care | 50% | 75% | |||||

| Skilled nursing facility | 50% | 75% | |||||

| Part A deductible | 50% | 75% | 50% | ||||

| Part B deductible | |||||||

| Part B excess charges | |||||||

| Foreign travel emergency | 80% | 80% | 80% |

Average costs are for a 65-year-old female nonsmoker. Rates vary by location, age, gender and other factors.

= 100%

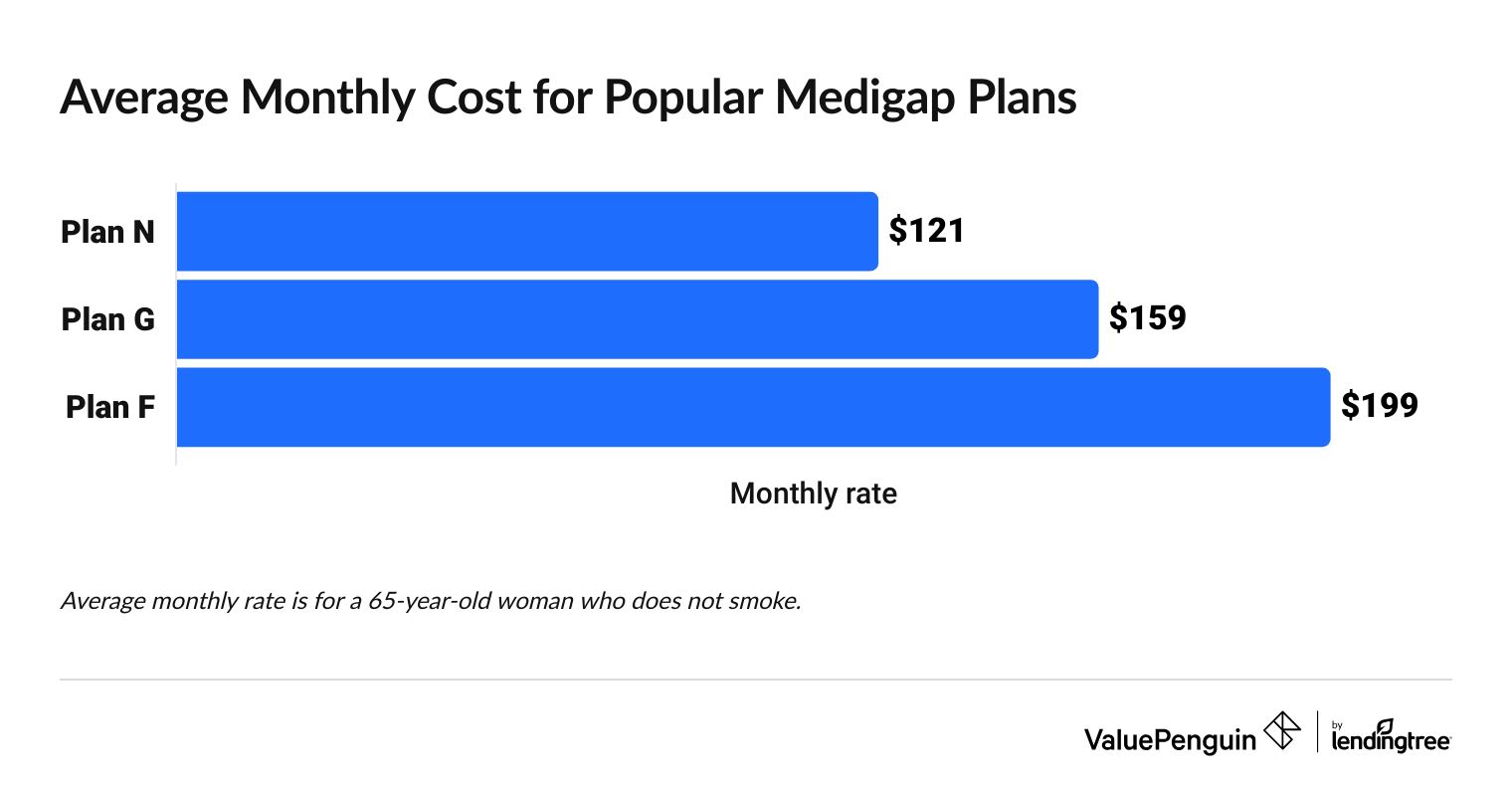

Plans F, G and N make up more than four out of five Medicare Supplement policies sold. These plans all provide high levels of coverage.

- Plan G has the highest level of coverage for people who are new to Medicare. It's the best option for most people.

- Plan F has the most coverage overall, but you can only get it if you could get Medicare before Jan. 1, 2020.

- Plan N has a good balance of coverage and cost. It has coverage that's almost as good as Plan G but at a lower monthly rate.

What does Medigap not pay for?

Medicare Supplement plans don't pay for dental, vision or hearing coverage.

Medigap plans are not regular health insurance. They're a type of supplemental insurance designed to help you pay for the costs not covered by Original Medicare. That means Medicare Parts A and B still pay for most of your medical bills, and your Medigap plan helps pay for what's left over.

Medigap plans also don't include coverage for vision or dental care. Although Medicare covers some vision and dental procedures, you're better off buying a separate plan for each to get the best coverage.

Not covered by Medicare Supplement plans

- Dental

- Vision

- Hearing

- Prescription drugs

- Transportation

Some states have "innovative" Medigap plans that bundle extra benefits onto your regular Medigap plan. These plans might include dental, hearing or vision coverage as well as access to a fitness program and other perks. However, these plans are not common or widespread.

Many Medigap companies sell separate supplemental insurance like vision, dental and hearing policies. This can be a good way to get coverage while keeping all your policies with one company for convenience.

Medicare Supplement plan cost

The most popular Medigap plans — F, G and N — cost between $121 and $199 per month.

Compare Medicare Plans in Your Area

Plans with more coverage typically cost more. For example, Plan F policies typically cost more than Plan K policies since Plan F offers significantly more coverage than Plan K.

Other factors like your age, health status and when you buy your Medigap plan also affect how much you pay.

Medigap plan costs

Plan letter | Monthly rate |

|---|---|

| High-deductible Plan G | $49 |

| High-deductible Plan F | $54 |

| Plan K | $83 |

| Plan N | $121 |

| Plan L | $126 |

Prices are for a 65-year-old woman who doesn't smoke.

You should buy your Medigap plan when you become eligible for Medicare, during what's called your " initial enrollment period, " to get the best price on your Medigap policy. During this period, your health can't be used to set your monthly rate. It's the best time to get a Medigap policy because it helps you pay less overall.

Insurance companies set prices for Medicare Supplement policies in three different ways. Some states require Medigap companies to set prices in one of those ways, while other states let companies choose.

- Community-rated: Age doesn't impact your price.

- Issue-age-rated: Your rate is based on the age you are when you first get a policy, but you don't pay more just because you get older.

- Attained-age-rated: Your Medicare Supplement plan gets more expensive every year, as you age.

Each option has pros and cons. For example, plans that take age into account may be cheaper when you first enroll, but they can grow unaffordable over time. Plans that don't use age at all might be more expensive at first, but your rate stays steady over time.

Frequently asked questions

What does Medigap typically cover?

Medigap plans cover most of what you still have to pay for medical care even when you have Medicare Part A and B. Some plans also pay for up to 80% of emergency medical costs you get while traveling.

What does Medigap not pay for?

Medigap doesn't pay for vision, dental or hearing care unless you have an "Innovative" plan, which isn't common. Medicare Supplement plans also don't actually pay for the majority of your medical bills. Original Medicare (Parts A and B) will always pay first, and Medigap will pay some or all of what's left over.

What are the disadvantages of a Medigap plan?

Medigap plans can be expensive, especially if you buy a plan with a high level of coverage. It can be hard to get a Medigap plan if you don't buy one when you're first eligible, because rates can be higher. You also should buy a separate plan for medication coverage, called a Part D plan, because Medicare Supplement doesn't cover prescriptions.

Methodology and sources

ValuePenguin sourced Medicare Supplement rates from private insurance companies. Rates are for a 65-year-old woman who does not smoke and who signed up for Medigap when she was first eligible. Rates don't include Select plans or plans in Massachusetts, Minnesota or Wisconsin, which have their own Medigap systems.

Plan popularity info is from AHIP.

Insurance Writer

Cate Deventer is a ValuePenguin writer who specializes in health insurance, Medicare, auto and home insurance. She's been a licensed insurance agent since 2011.

She started her insurance career working as a customer service agent for State Farm. She later moved to an independent agency, where she worked with several insurance companies and hundreds of clients. She quoted policies, filed claims and answered insurance questions. In 2021, she pivoted her career and began writing about insurance for Bankrate. She moved to ValuePenguin in 2023 and began writing about health insurance and Medicare.

Cate has a passion for helping readers choose insurance to fit their needs. She enjoys knowing that her research and knowledge help people choose insurance products that make a positive difference in their lives.

How insurance helped Cate

Cate used her health insurance knowledge to navigate a surgery in 2023. Understanding how her policy worked let her focus on recovery instead of worrying about bills.

Expertise

- Health insurance

- Medicare & Medicaid

- Auto insurance

- Home insurance

- Life insurance

Credentials

- Licensed Life, Accident & Health Insurance Agent

- Licensed Property & Casualty Insurance Agent

Referenced by

- CBS

- NBC

- Wall Street Journal

Education

- BA, Theatre, Purdue University

- BA, English, Indiana University

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.