Cost of weight loss drugs

Learn more

Weight loss drugs cost an average of $1,102 per month or $13,225 per year if you pay full price without any discounts or coupons.

If your insurance covers weight loss drugs like Ozempic and Wegovy, you'll pay an average of $331 per month. Though if your plan has good coverage, you could pay as little as $0 per month.

Insurance companies have increasingly cut back on coverage for GLP-1 drugs, such as Wegovy and Ozempic. That's because these medications are very expensive. Blue Cross Blue Shield (BCBS) of Michigan and Kaiser Permanente dropped coverage for several popular GLP-1 drugs on Jan. 1, 2025. BCBS of Massachusetts will tighten GLP-1 drug coverage starting next year.

Aetna cut coverage for Zepbound on July 1, 2025. Although UnitedHealthcare hasn't decreased coverage for GLP-1 drugs, the company has made it more difficult to get permission for these prescriptions, called prior authorization.

Cigna has taken steps to make GLP-1 drugs more affordable for its customers by capping the cost you'll pay for these medications at $200 per month. The company has also negotiated with drug manufacturers to manage price increases. However, being able to get these drugs remains an issue for some Cigna customers. The company was recently sued over its lack of GLP-1 coverage for those suffering from obesity.

Drug manufacturers have discounts that can significantly lower or even eliminate the costs you have to pay, if you have insurance.

Insurance is more likely to cover weight loss drugs if they're prescribed for diabetes, not for weight loss. And your insurance company will usually need to preapprove the prescription and check that you meet the coverage criteria before it will pay for weight loss drugs.

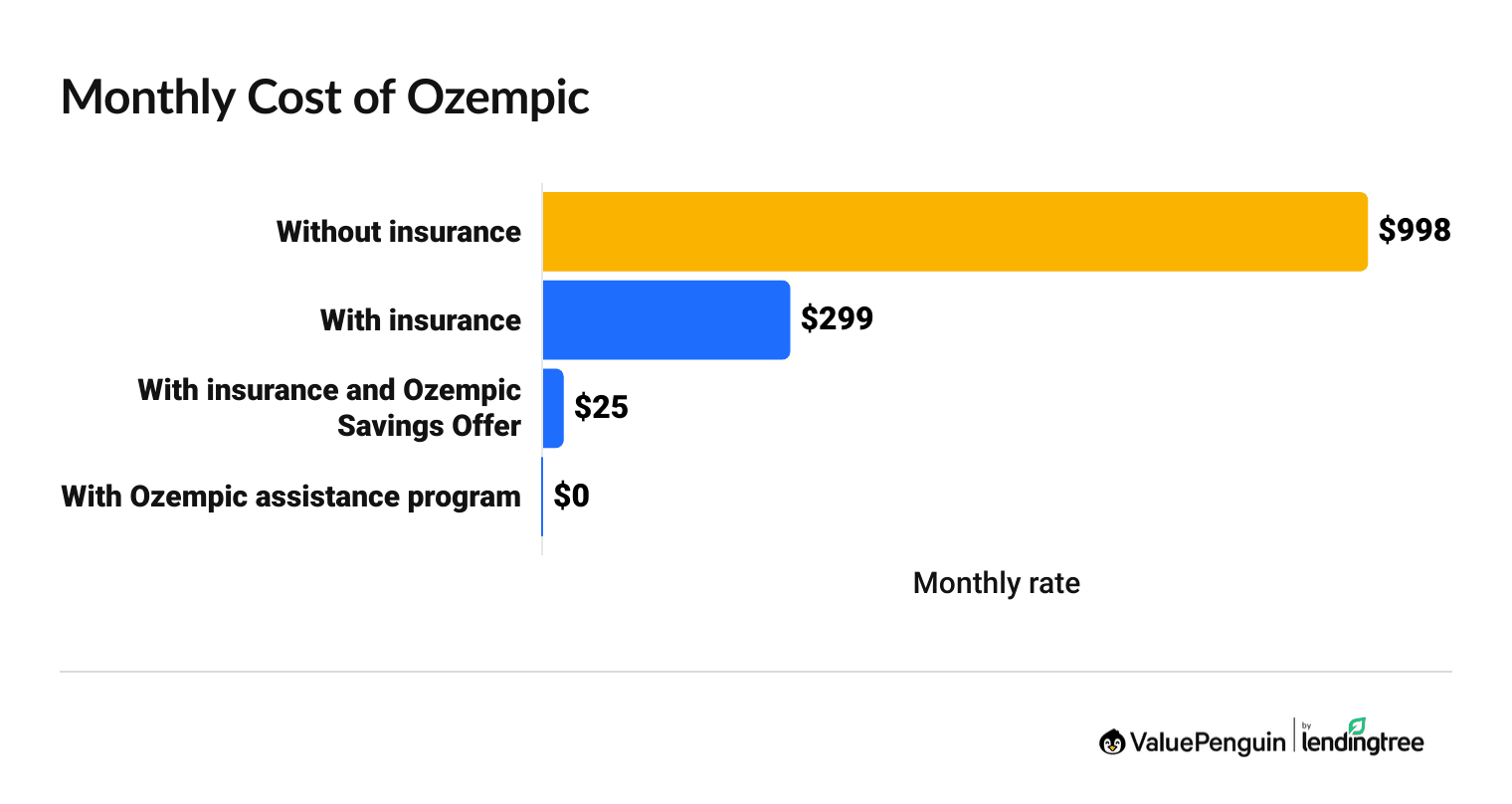

How much does Ozempic cost with insurance?

Ozempic costs $299 per month if you have insurance.

You'll pay $998 per month for Ozempic without insurance.

Find Cheap Health Insurance in Your Area

How much does Ozempic cost?

Monthly | Yearly | |

|---|---|---|

| Without insurance | $998 | $11,971 |

| With insurance | $299 | $3,591 |

| With insurance and an Ozempic Savings Offer | $25 | $300 |

| With the Ozempic assistance program | $0 | $0 |

When is Ozempic covered by insurance?

Ozempic is covered by most insurance companies when you're using it to help with diabetes. It's harder to get insurance to cover Ozempic for weight loss.

Insurance rules about Ozempic coverage can be strict. But every plan is different, so changing plans could also change your coverage. For example, some insurance covers Ozempic for prediabetes, while others will only cover Ozempic if you already have Type 2 diabetes.

The FDA has only approved Ozempic for those who have diabetes and kidney disease. For example, Medicare is not allowed to cover weight loss drugs, but it will cover Ozempic if it's prescribed for diabetes.

If your doctor prescribes Ozempic for weight loss, that's considered "off-label" because that's outside of the FDA's approval, so your insurance usually won't cover it.

With most insurance plans, you'll usually need to get approval from your insurance before filling a prescription for Ozempic and similar drugs, called GLP-1s.

This is called prior authorization, and it means your doctor will need to submit a form to your insurance company showing that Ozempic is "medically necessary" for your health.

Your insurance company will let you know if the request has been approved or denied. And you'll usually need to complete this paperwork each year.

Some insurance plans will only cover an expensive prescription like Ozempic if you've first tried other cheaper options. This is called step therapy. The rules will change by plan for which drugs you could have to try first and for how long.

Most employers can decide what their prescription insurance plans will cover. Companies may try to reduce their costs by putting a cap on how long it will cover Ozempic or not covering it at all.

How to get Ozempic covered by insurance

- Appeal an insurance company's decision if they've denied you coverage for Ozempic. Very few people appeal when an insurance company denies coverage, but overall, you have about a 44% chance of changing the outcome.

- Try switching insurance plans to get better coverage for weight-loss drugs. If you get insurance through work, you'll usually need to switch to a different type of insurance to find coverage for Ozempic. That's because coverage rules typically apply to all of the plan options through your job. Check if you can get health insurance through a family member, a government program like Medicare or Medicaid, or a private health insurance plan.

- Consider similar medications such as Wegovy. Wegovy is the exact same medication as Ozempic, but it's prescribed for weight loss, rather than diabetes. Your insurance may cover you for Wegovy instead of Ozempic.

How much does Ozempic cost with insurance?

Ozempic costs about $299 per month with a typical health insurance plan or $25 per month with both insurance and a manufacturer coupon.

Costs depend on your plan's prescription benefits. If you haven't met your plan's deductible yet, you could have upfront costs of hundreds or thousands of dollars before your full prescription coverage kicks in.

The best way to make Ozempic more affordable when you have insurance is to take advantage of the Ozempic savings offer through NovoCare. This discount lets you save up to $100 per month, which can lower your costs after insurance to as low as $25 per month.

Find Cheap Health Insurance in Your Area

How much is Ozempic without insurance?

Ozempic costs $11,971 per year if you don't have insurance or if your insurance won't cover your prescription.

If you don't have insurance, you may be eligible for free Ozempic if you earn less than $62,600 as an individual. This is available if you qualify for the Ozempic Patient Assistance through the manufacturer, NovoCare.

Eligibility for Ozempic Patient Assistance:

- Be uninsured or have insurance that won't cover Ozempic or only have Medicare

- Earn less than $62,600 as an individual or $128,600 for a family of four

- Not be enrolled in a government program like Medicaid, Medicare Extra Help, Low-Income Subsidy or Veterans benefits

- U.S. citizen or legal resident

Can I get generic Ozempic, called semaglutide?

You can no longer buy generic semaglutide.

The FDA no longer lets companies sell generic semaglutide because the shortage of name-brand drugs such as Ozempic has ended. Plus, the FDA believes generic semaglutide may cause health problems in some people.

There are only two legal ways to get generic semaglutide.

- Your doctor has specifically ordered a customized generic semaglutide because of a specific medical condition you have.

- Your pharmacy offers generic semaglutide manufactured before May 22, 2025, and the drug is still within its expiration date.

Ozempic vs. Wegovy costs

Ozempic costs $351 less per month than Wegovy if you pay full price. And you're more likely to get insurance to cover Ozempic than Wegovy.

Ozempic and Wegovy have the same active ingredient, semaglutide. Wegovy has been approved by the Food and Drug Administration (FDA) for weight loss. Ozempic has been approved for diabetes, though it's sometimes still used for weight loss.

Rybelsus is a similar drug that's the same price and uses the same ingredient as Ozempic. But Rybelsus is a pill rather than an injection.

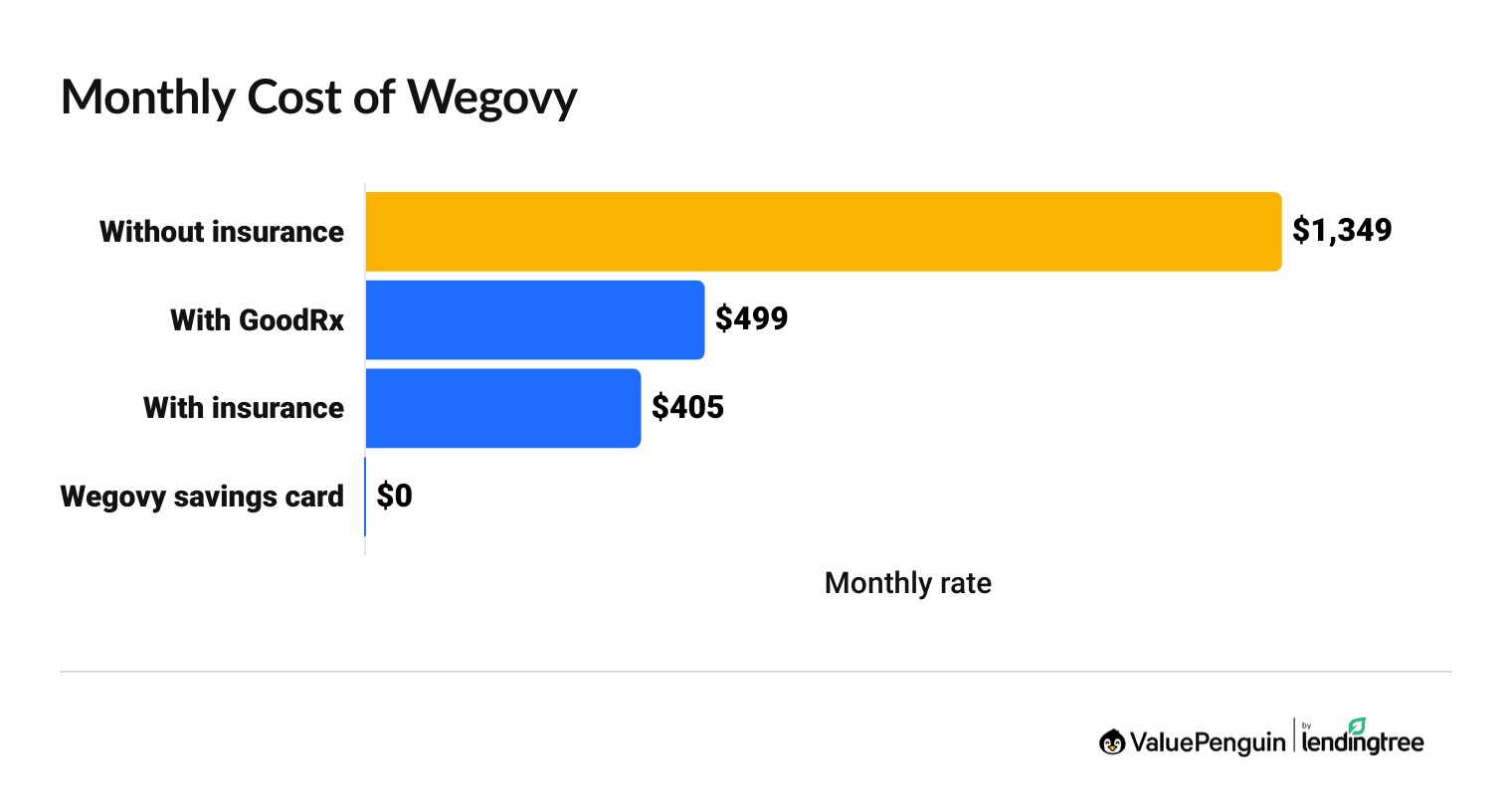

Wegovy costs with and without insurance

Wegovy costs $1,349 per month if you pay full price or about $405 per month if you have insurance coverage.

Wegovy could cost as little as $0 per month if you use insurance and a Wegovy coupon from the manufacturer.

How much does Wegovy cost?

Monthly | Yearly | |

|---|---|---|

| Without insurance | $1,349 | $16,188 |

| Without insurance, with a Wegovy savings card | $499 | $5,988 |

| With insurance | $405 | $4,856 |

| With insurance, with a Wegovy savings card | $0 | $0 |

The cost of Wegovy with insurance can sometimes be very cheap, and the drug maker estimates most people who have insurance coverage pay less than $25 per month.

How much you'll pay for Wegovy with insurance will depend on the rates set by your insurance plan and how your plan classifies Wegovy.

- If your plan says Wegovy is a preferred brand drug (tier 2), that means you'll pay less for the prescription. For example, you could have a low copay that is just $25 per month.

- If your plan says Wegovy is a nonpreferred brand drug (tier 3 or 4), your portion of costs will be higher. For example, you could pay about 25% to 50% of the drug's full price.

Does Medicare cover Wegovy?

Yes, Medicare covers Wegovy if you have type 2 diabetes or some types of heart disease.

Medicare will not pay for Wegovy to treat obesity. To get Medicare coverage for the drug, you need a diagnosis from your doctor for either type 2 diabetes or you need to be obese or overweight and have a history of heart disease.

Medicare will only pay for Wegovy if you have a Medicare Part D (drug plan) or a Medicare Advantage plan with drug coverage. That's because Original Medicare (Parts and B) doesn't cover drugs you take at home.

It's important to remember you'll still have to pay some of the costs when you get your prescription filled. Medicare Part D plans often require you to pay hundreds of dollars before coverage starts, called a deductible. Once you meet your deductible, you'll typically pay a fixed percent of the drug's cost, called coinsurance, until you meet your annual spending cap, called an out of pocket maximum.

An estimated 7% of people with Medicare are eligible to get Wegovy because they have a history of heart disease and meet Medicare's weight requirements. Among Medicare enrollees who are overweight or obese, that number rises to one in four.

If you think you fall into this group, consider scheduling an appointment with your doctor.

What insurance covers Wegovy?

Wegovy could be covered by some employer plans, marketplace plans, Medicare or Medicaid. However, even though you can sometimes get coverage, many plans don't cover Wegovy.

The insurance plan you choose determines if you'll have coverage for Wegovy. That's why it's important to shop around during Medicare open enrollment or health insurance open enrollment.

How to get Wegovy covered by insurance

If your insurance plan covers Wegovy, you'll usually need to meet the plan's coverage rules and weight requirements before it will pay for your prescription.

It's usually easier to get insurance to cover Wegovy to lose weight rather than to maintain your weight loss.

For example, if Wegovy successfully helped you to lose weight, you may no longer be eligible for coverage if your BMI has fallen below the FDA requirements for the drug.

If you are struggling to get your insurance to cover Wegovy, you can:

- Appeal to get the insurance company to change its decision.

- Ask your job to start covering weight loss drugs with its insurance plans.

- Change your health insurance plan.

Mounjaro costs with and without insurance

The weight loss drug Mounjaro costs $1,080 per month if you pay full price or $324 per month if you have insurance coverage.

You could pay about $25 per month for Mounjaro if you use a discount from the drug maker, Lilly, on top of insurance benefits.

How much does Mounjaro cost?

Monthly | Yearly | |

|---|---|---|

| Without insurance | $1,080 | $12,957 |

| With GoodRx coupon | $607 | $7,284 |

| If your insurance plan won't cover Mounjaro | $617 | $6,938 |

| With insurance coverage | $324 | $3,887 |

| With insurance, and with the Mounjaro coupon | $25 | $300 |

What does Mounjaro cost with insurance?

Mounjaro costs about $324 per month with insurance. That's $3,887 per year.

Prescription benefits vary widely. Depending on your plan, Mounjaro could be as cheap as a $25 per month copay or you could have to pay as much as 50% of the cost of the drug.

You'll get the best deal on Mounjaro if you use the drug maker's Mounjaro Savings Card program. This Mounjaro coupon can be used with your insurance to save you up to $150 per month. You can only use the discount with a private insurance plan (not Medicare or Medicaid).

When is Mounjarno covered by insurance?

Mounjarno is usually only covered by insurance for diabetes treatment.

Even though Mounjarno is sometimes used for weight loss, the FDA has only approved it for diabetes.

For weight loss, you're more likely to have your insurance plan pay for Zepbound, which has the same main ingredient as Mounjaro. The difference is that Mounjaro is for diabetes and Zepbound is for weight loss.

How much is Mounjaro without insurance?

Mounjaro costs $1,080 per month or $12,957 per year without insurance.

If you have health insurance but your plan won't cover Mounjaro, you can use a Mounjaro coupon from the drug maker to lower your costs to $617 per month. This Mounjaro discount is only available if you:

- Have a private insurance plan (not Medicare or Medicaid).

- Have a prescription to use Mounjaro for diabetes treatment.

- Use the discount no more than 13 times per calendar year with an annual savings cap of $6,019 per calendar year.

The cost of Mounjaro with a GoodRx coupon averages $995 per month, which is $11,940 per year.

If you are uninsured, the best way to get affordable Mounjaro is to use a GoodRx coupon, which could save you about 8% off the full retail price.

You could also ask your doctor for free samples of Mounjaro. However, the company that manufactures Mounjaro, Eli Lilly, doesn't offer free drugs to people who earn a low income. The company has some types of free prescriptions, but Mounjaro is not one of them.

Cost of tirzepatide: Mounjaro vs. Zepbound

Mounjaro and Zepbound are two brand names for the drug tirzepatide. The cost of tirzepatide averages $1,083 per month if you don't have insurance coverage. Mounjaro costs about $6 more per month than Zepbound.

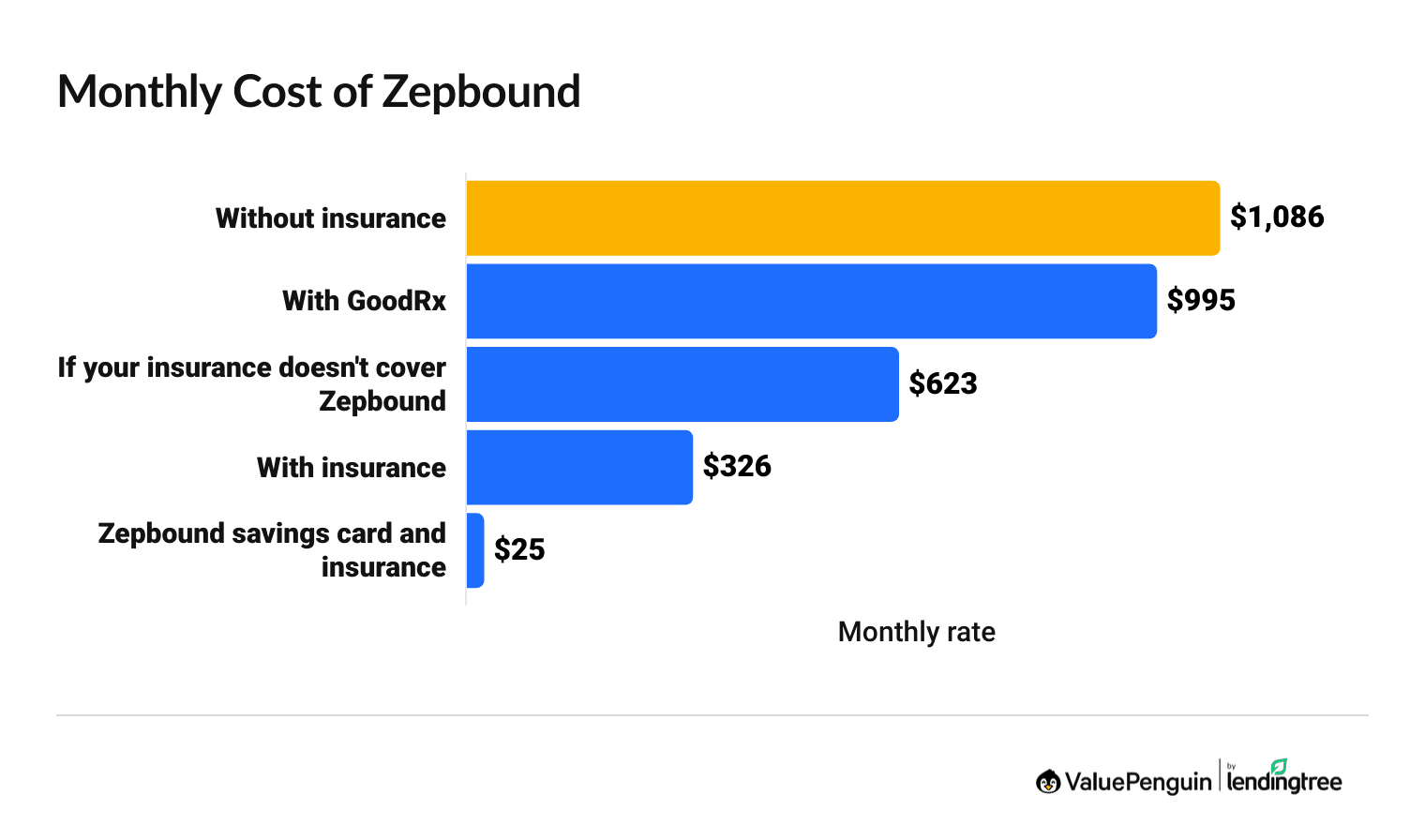

Zepbound costs with and without insurance

Zepbound costs $1,080 per month without insurance or $326 per month after insurance coverage.

If you have insurance, but the plan won't cover Zepbound, you'll pay $597 per month after the drug maker's discount.

How much does Zepbound cost?

Monthly | Yearly | |

|---|---|---|

| Without insurance | $1,080 | $13,036 |

| If your insurance plan won't cover Zepbound | $611 | $7,017 |

| With insurance | $326 | $3,912 |

| With insurance, with Zepbound coupon | $25 | $300 |

The cost of Zepbound with insurance averages $326 per month or $3,912 per year. The Zepbound coupon can be used to save up to $150 per month off of your insurance rates. This could reduce the cost of Zepbound to as low as $25 per month, although you may pay more depending on your health plan's coverage.

Will insurance cover Zepbound?

Many health insurance plans don't cover the weight loss drug Zepbound because it's so new. It was approved by the FDA at the end of 2023.

However, it's expected that insurance coverage for Zepbound will expand as insurance companies update their drug coverage rules. That's similar to what's happening with insurance coverage for another weight loss drug, Wegovy.

When insurance covers Zepbound, the weight requirements are similar to Wegovy's.

- Zepbound is approved for use by those who have a body mass index (BMI) of 30 or higher. That could be a person who is five and a half feet tall and weighs more than 180 pounds.

- You can also use Zepbound if you have a BMI of 27 or higher and a weight-related condition like high cholesterol or high blood pressure.

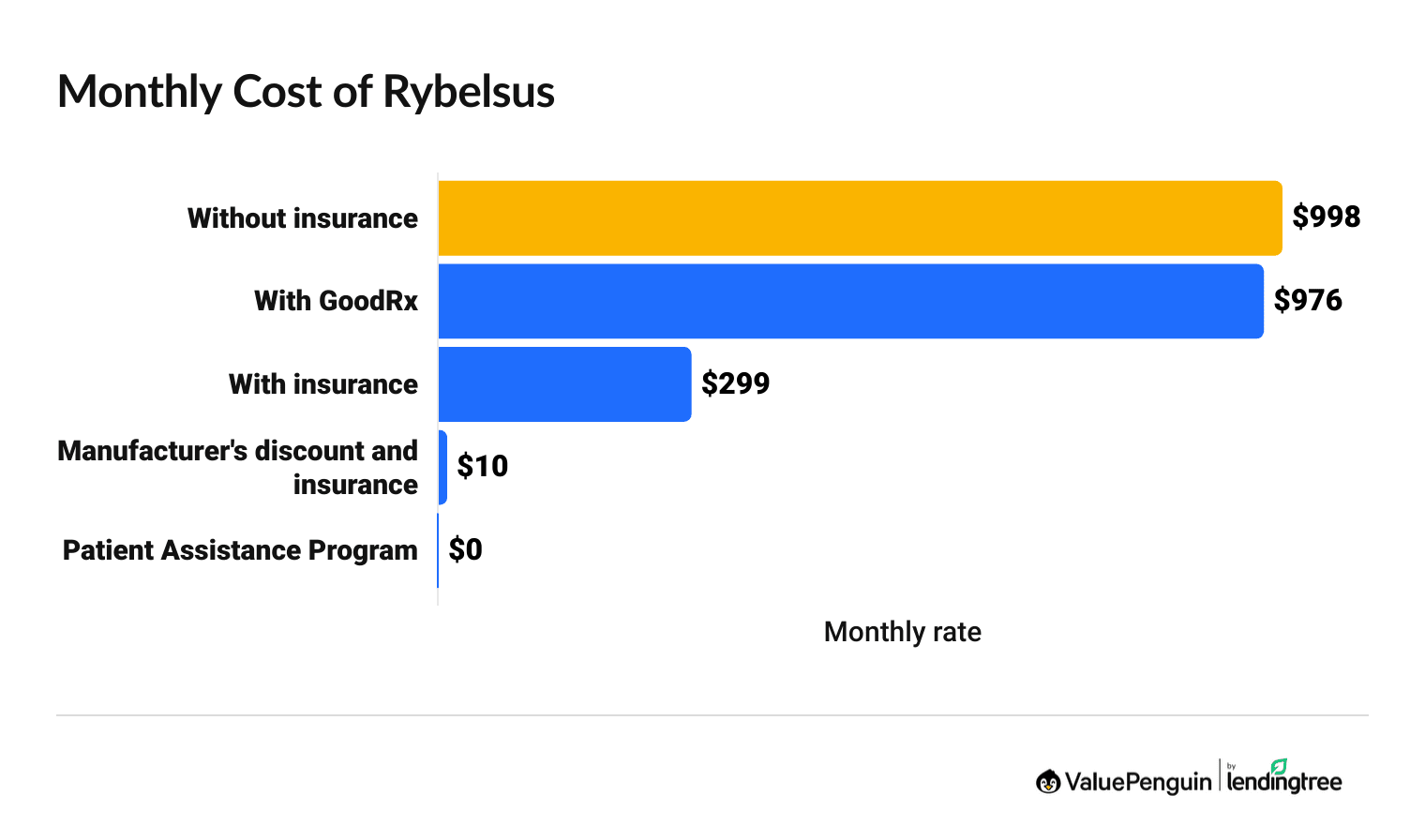

Rybelsus costs with and without insurance

The weight loss drug Rybelsus costs $998 per month at full price or $299 per month with insurance.

Rybelsus has the same main ingredient as Ozempic and Wegovy, semaglutide. The difference is that Rybelsus is a pill, and Ozempic and Wegovy are at-home injections.

How much does Rybelsus cost?

Monthly | Yearly | |

|---|---|---|

| Without insurance | $998 | $11,971 |

| With insurance | $299 | $3,591 |

| With insurance and Rybelsus coupon | $10 | $120 |

| With the Rybelsus coupon | $0 | $0 |

If you have insurance, Rybelsus is usually one of the cheapest weight loss medications you can get. That's because there's a very good manufacturer discount for Rybelsus if you also have insurance coverage. It lowers the cost of Rybelsus to as little as $10 per month with a maximum savings of $300 per month.

In comparison, the manufacturer discount for other weight loss drugs typically has a $150 per month maximum discount.

Is Rybelsus covered by insurance?

Your insurance is more likely to cover Rybelsus if it's prescribed for diabetes than for weight loss. That's because the FDA has only approved Rybelsus to be used for treating Type 2 diabetes.

Rybelsus is sometimes used for weight loss, and it will depend on your insurance plan if Rybelsus is covered when it's not specifically prescribed for diabetes. It's called "off-label" use when a drug is prescribed for something outside of the FDA's recommendation.

Best insurance companies for weight loss drug coverage

Cigna is the best insurance company for weight loss drugs like Wegovy.

Cigna has copay caps on GLP-1 drugs. Plus, the company has entered into negotiations with Ely Lilly and NovoNordisk to lower the cost of these medications.

Unlike other major health insurance companies, Cigna hasn't cut coverage for GLP-1 drugs in recent months.

Cigna: Best insurance for Wegovy and other weight loss drugs

Blue Cross Blue Shield: Affordable GLP-1 coverage for federal employees

UnitedHealthcare: Good insurance for weight loss drugs, especially if you have diabetes

Aetna: Weight loss drug coverage can sometimes have steep requirements

Kaiser Permanente: Limited coverage for weight loss drugs

Nearly all insurance plans will only cover weight loss drugs if you:

- Get prior authorization from the insurance company

- Meet the drug's weight criteria set by the FDA.

Frequently asked questions

How much does Ozempic cost?

Ozempic costs $998 per month without insurance or $299 after insurance. If you have insurance coverage and you use the Ozempic savings offer through NovoCare, the cost of Ozempic can drop to as low as $25 per month.

What insurance companies cover Wegovy?

Most insurance companies including Cigna, UnitedHealthcare, Aetna, Blue Cross Blue Shield and Kaiser Permanente cover Wegovy. However, the rules on when you can get coverage will be different between insurance companies, plans and plan types. If you have health insurance through your job, weight loss drug coverage will usually depend on your employer's rules, rather than the insurance company.

How do I get Ozempic for $25 per month?

You can get Ozempic for $25 per month if you use the Ozempic Savings Program on top of your insurance benefits. This Ozempic coupon is available for free from the drug maker NovoCare, and you can use it for up to two years. Keep in mind, the Ozempic Savings Program caps your monthly discount at $150, so you may pay more than $25 per month depending on your insurance coverage.

Sources and methodology

The full price of weight loss drugs is based on manufacturer list prices. The average cost with insurance is based on coverage after meeting the deductible and a typical plan that has a 30% coinsurance. Weight loss drug coverage varies widely, so your costs could be higher or lower. The cost after manufacturer discounts is based on the maximum savings you could get.

Additional sources include:

- KFF

- US Health & Human Services Department (HHS)

- International Foundation of Employee Benefit Plans (IFEBP)

- Drug manufacturers NovoCare and Lilly

- Insurance company coverage documentation

- U.S. Food and Drug Administration (FDA)

- Research from Tufts Medical Center

- J.P. Morgan survey of U.S. benefits executives

- Research from weight management platform, Found, and health care firm, Accolade

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.