What is Other Structures Coverage for Home Insurance?

In most cases, 10% of the main dwelling part of your homeowners insurance covers other structures on your property, such as detached... Read More

Compare life insurance quotes and find the best rates for a policy.

Life insurance can help protect your family financially if anything happens to you, but it’s important to make sure you’re not overpaying for the coverage you need.

Life insurance is a planning tool that provides financial protection for your dependents.

The asset provides a tax-free lump sum of money which is paid to your dependent after your death. Typically, life insurance is bought so that your dependents would be able to sustain payments for bills, college tuition or other after-life expenses.

Key components of life insurance policies are:

Every individual has a different financial situation and therefore will require different life insurance needs.

When calculating your needs you should consider what the life insurance will be used for and why you may need life insurance in general.

If you are young and do not have any dependents then buying life insurance may not be a necessary purchase at this point in your life. On the other hand, if you are starting a family in which the financial livelihood of the family relies on your salary, then you may want to consider purchasing some life insurance coverage and calculate your future needs.

When beginning to calculate how much life insurance you need, you should start by adding up your current and future financial obligations. This can include obligations such as:

After you have figured out your obligations, you can add up your current assets such as savings and college funds. Finally, by subtracting your current assets from the obligations you will arrive at a target amount for how much life insurance you will need. It is important to note that this is a rough estimate for coverage and it may be useful to purchase slightly more life insurance to compensate for unexpected financial situations that your dependents might face.

Life insurance companies will typically offer two different types of life insurance: term life insurance and permanent life insurance.

A term policy will last for a set period of time before expiring while permanent plans stay in effect for your entire life. Furthermore, some permanent life insurance policies will have a cash value component that will grow as you make premium payments.

Term life insurance | Permanent life insurance | |

|---|---|---|

| Period of coverage | Specified term, usually one to 30 years | Lifelong |

| Cash value | No | Yes |

| Average monthly premium | Cheap | Expensive |

Depending on your situation and what the purpose of your life insurance is, the type of life insurance that you need will change.

For example, if you are looking for a cheap policy to cover future financial obligations like college tuition, then choosing a term life insurance policy with a death benefit that matches the total tuition may be the best option. On the other hand, say you have Type 1 diabetes and have had problems with getting approved for life insurance. In this case, a permanent policy like guaranteed acceptance life insurance may be a better option for coverage.

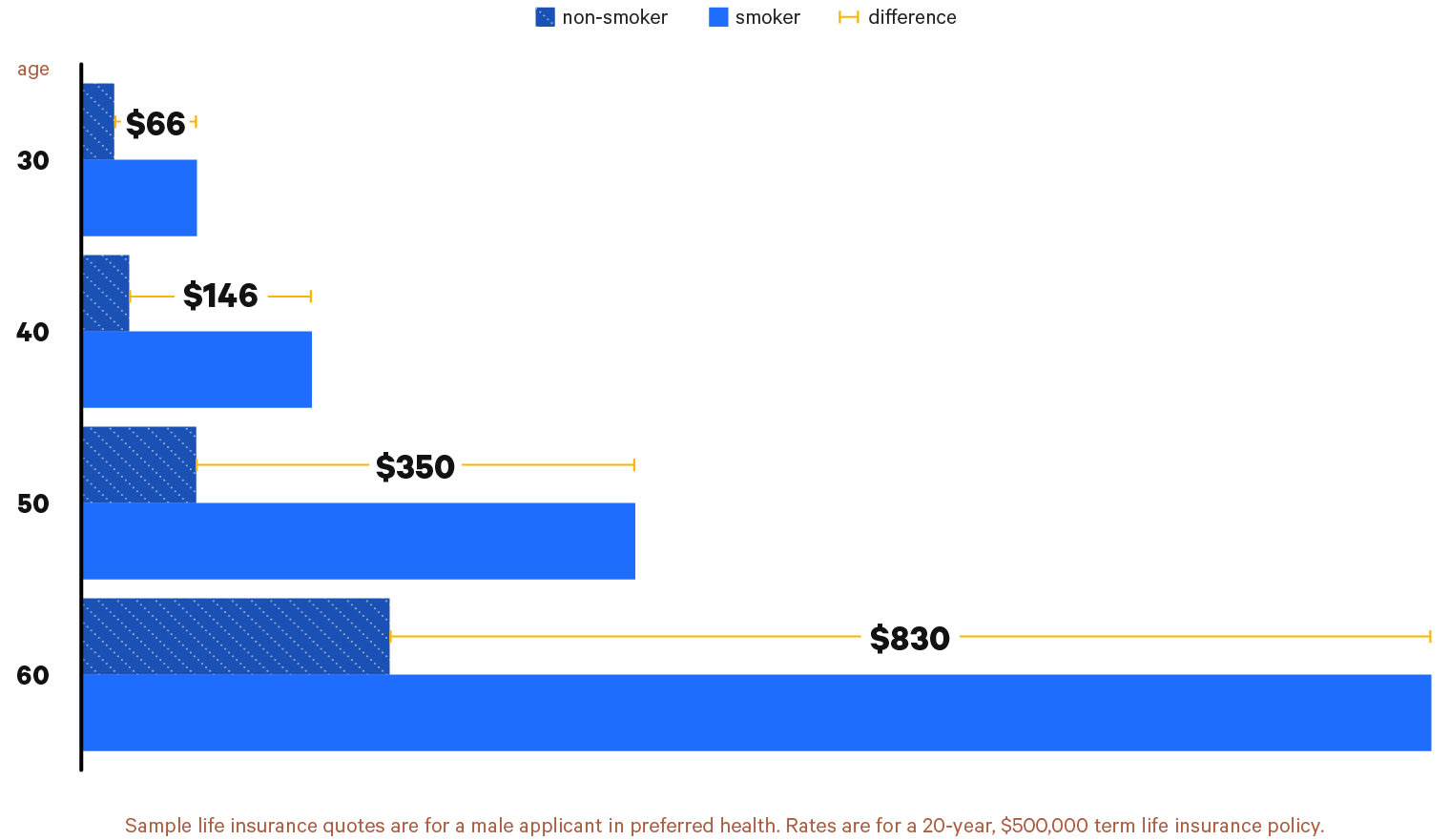

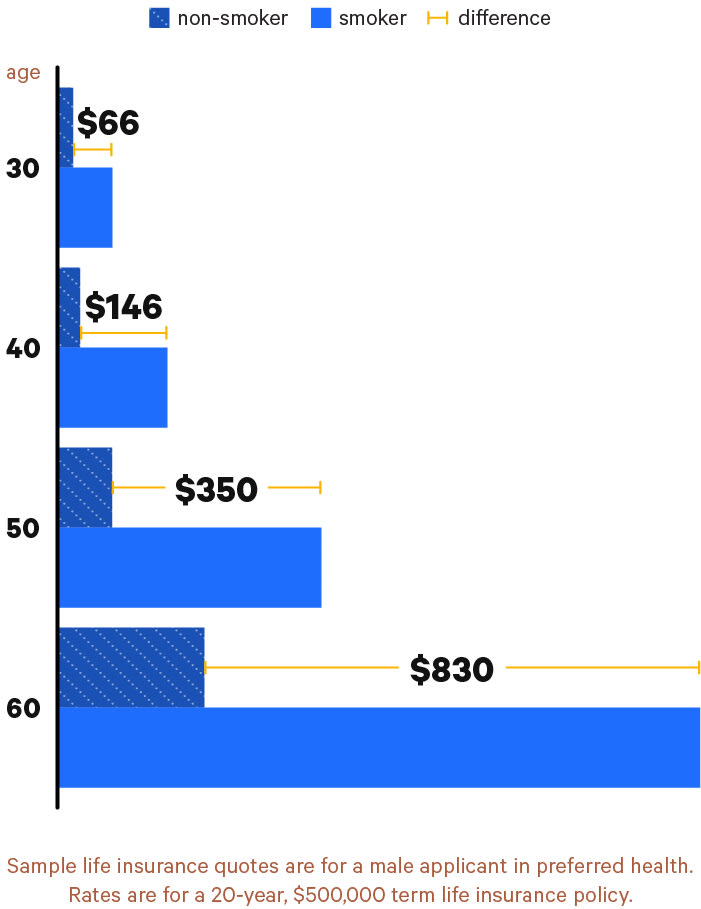

The cost of your life insurance policy will be dependent on a variety of factors including your health, age, occupation and if you smoke. However, the largest determinant will be if you are a smoker.

Smokers will have an average cost of life insurance that is 306% higher when compared to a nonsmoker.

Find Cheap Life Insurance Quotes in Your Area

When searching for the best cheap life insurance we would recommend getting life insurance quotes from as many insurers as possible. To aid you in this process we have provided detailed reviews of some of the best life insurance companies in the industry.

You will notice that many life insurance providers will have favorable underwriting requirements for certain individuals. For example, if you smoke you may find that Northwestern Mutual will have some of the best smoker life insurance rates available. Additionally, some insurers will specialize in certain products such as Mutual of Omaha which has one of the cheapest guaranteed whole life insurance products in the industry.

In most cases, 10% of the main dwelling part of your homeowners insurance covers other structures on your property, such as detached... Read More

Your homeowners insurance covers your child in most cases while they attend college, as long as they're full-time students living in... Read More

Lemonade has the most affordable renters coverage in Chicago, at $12 per month on average. That's roughly half the city average of $23 per... Read More

Insurtech is the use of innovative technologies to improve business processes in the insurance sector. Insurtech helps insurance companies... Read More

A 23-year-old pays $259 per month for full coverage car insurance, on average. State Farm usually has the best... Read More

State Farm has the cheapest homeowners insurance for most people, at $1,514 per... Read More

ValuePenguin surveyed thousands of fatal traffic accidents and found that people who drive certain car models were 12% more likely to cause... Read More

Non-owner SR-22 insurance is for drivers who are required to have SR-22 insurance but do not own a car. Certain nonstandard insurers, such... Read More

NYCM Insurance has the best home insurance for most New York homeowners. A policy costs $520 per year, which is $818 less than the... Read More

SR-22 coverage in Wisconsin provides proof of insurance for drivers following a suspension of their license due to a serious driving... Read More

A full coverage policy costs $312 per month for a 21-year-old man. In comparison, a 21-year-old woman pays $292 per month for the same... Read More

Most motorcycle insurance companies let you get a quote through a simple online form. Before you begin, it's important to gather details... Read More