Electric Insurance Review

A good option for versatile coverage, despite issues with rental reimbursement.

Find Cheap Auto Insurance Quotes in Your Area

Electric Insurance Company offers a strong set of coverage options for average rates. This includes a robust set of standard features, agents who can help guide you with what the company describes as its "Risk Coach Approach" and a claims service guarantee that gives you $100 if you're not satisfied.

The main negative we found is some concerns over claims service, especially as it relates to rental reimbursement. However, the company, which is part of General Electric and offers policies in all 50 states, has some above-average marks overall for customer service.

Pros and cons

Pros

Automatic new car replacement coverage

"Risk coaches" can help guide you

$100 payment if claims service is bad

Cons

Rental reimbursement can be confusing

Electric car insurance rates vs. competitors

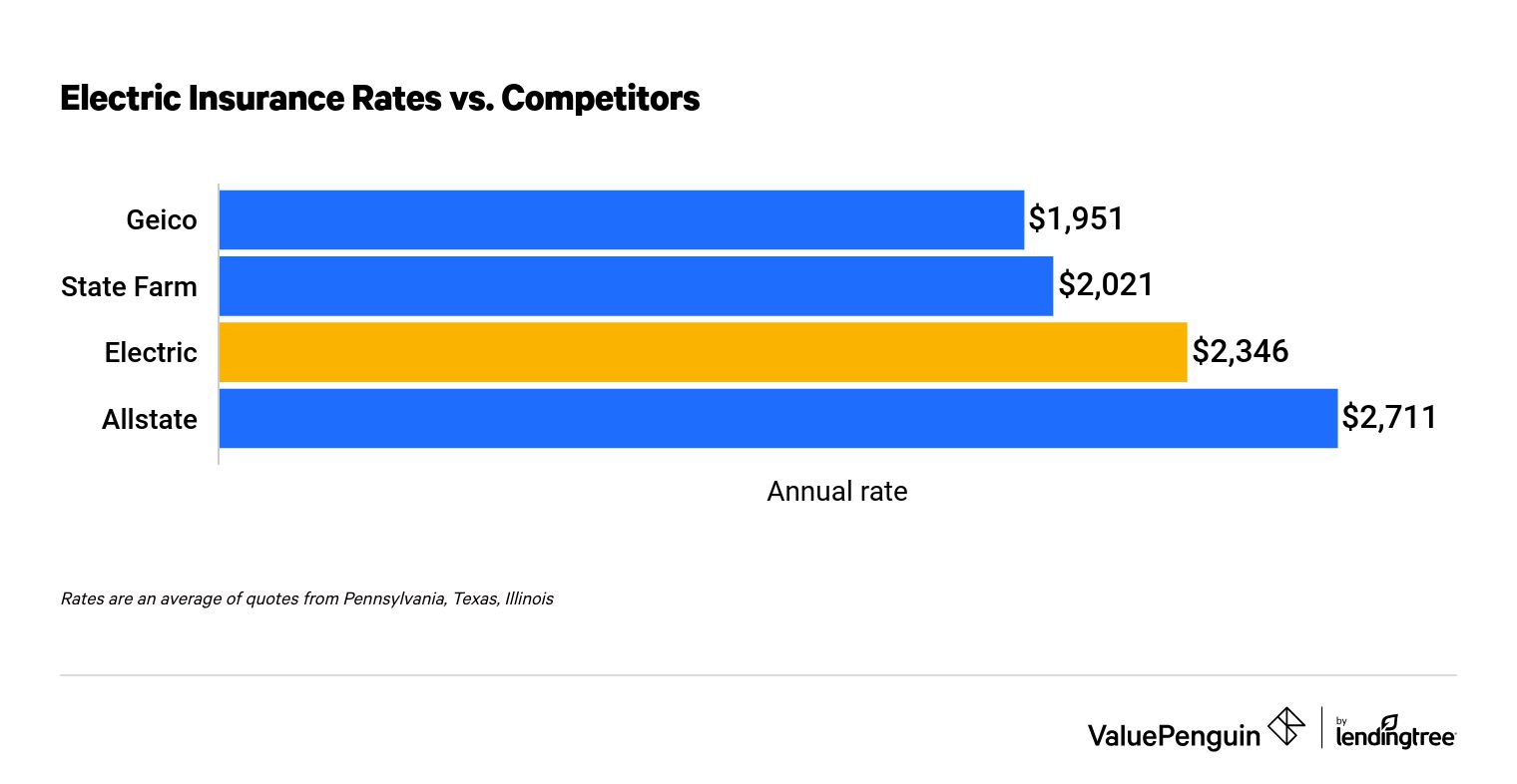

Electric Insurance has rates that are in line with some of the largest insurers in the country, a ValuePenguin analysis found. The average rate for full-coverage car insurance from Electric is 2% higher than the average, based on analysis that includes Allstate, Geico and State Farm.

Find Cheap Auto Insurance Quotes in Your Area

Electric Insurance rates vs. competitors

Company | Average annual rate |

|---|---|

| Geico | $1,951 |

| State Farm | $2,021 |

| Electric | $2,346 |

| Allstate | $2,711 |

Auto insurance policies and discounts

Electric provides a suite of added features and benefits above the standard coverage and protection typically offered in auto insurance policies. Those features are part of every policy the company offers. They include:

- Automatic new car replacement: If your new car (less than one year old) gets totaled in an accident or incident that is covered by your policy, Electric will replace your new car without any additional cost or deduction for mileage. This option can cost more than $100 per year with other companies.

- Signature claim service guarantee: Drivers can get $100 back if service is not prompt and satisfactory.

- Total care for totaled vehicles: Customers can quickly get reimbursement for a total vehicle and extended time with a rental.

Electric also offers access to "Risk Coaches," which are agents who can help guide customers through the ins and outs of their policies, as well as common insurance misconceptions. The company has online resources and an interactive tool to help fill gaps in a policyholder's understanding of coverage.

In addition, drivers can add roadside assistance for $25 or less per month. That coverage includes lockout services, flat tire changes, jump starts and towing, among other services.

Customers can get a range of standard coverages, such as liability, comprehensive, collision and personal injury protection (PIP), as well as gap coverage.

Insurance discounts

Electric provides a slew of discounts to its policyholders that range from the standard anti-lock brakes and anti-theft discounts to the more unique electric and hybrid vehicle discount. The actual amount of the discount varies by state.

Discount | Details |

|---|---|

| Accident-free discount/safe driver discount | Avoid accidents for a set period of time |

| Antilock brake discount | Applies to vehicles with a four-wheel, anti-lock braking system |

| Anti-theft devices discount | Reduces price of comprehensive coverage with both active and passive alarms |

| Driver training credit | Applies only to younger drivers |

| Electric and hybrid vehicle discount | Not for light electric vehicles and cannot be combined with new vehicle discount |

| Family and friends referral discount | Referral must come from a family or friend who is a current customer or an active or retired GE or Electric Insurance employee |

| Good student credit | For students with a B average or in the top 20% of their class |

| Low annual mileage discount | Applies if vehicle is driven less than a mileage total that varies by state |

| Married status discount | Married drivers get a break on most coverages, though it does not apply to younger drivers |

| Mature driver accident prevention course discount | Driver must complete a state-approved accident prevention course, and other requirements apply |

| Multi-policy discount | Auto policies can pair with a home, condo or tenants policy |

| New vehicle discount | For vehicles up to three model years old |

Perks for General Electric employees

Electric Insurance offers financial discounts and convenient perks for GE employees. Workers for the company can get a 15% car insurance discount off the top and save 4% per policy term for paying through a payroll deduction program.

Other employee discounts include:

- New customer discount: Saves between 7% and 15%

- Bundled coverage discount: Saves up to 15% on auto coverage

- Electric/hybrid vehicle discount: Up to 10% off

- New/newer car discount: Saves 3% to 7%

The quote process on Electric Insurance's website is straightforward. There are four sections that ask for your basic home address, any group/company affiliation, your license and insurance duration history, vehicle safety and security features, annual mileage and any driving record incidents. You do not need to provide a VIN or Social Security number. The most personally identifiable information requested is your name, address and date of birth.

Electric's online quote tool does not allow for much flexibility, with most of the default coverage options being on the higher end of coverage limits.

Electric Insurance ratings and reviews

Electric Insurance has mixed ratings for customer service and financial stability. Although it has a lower-than-average number of complaints from the National Association of Insurance Commissioners (NAIC), the company has several complaints with the Better Business Bureau.

Reviewer | Rating |

|---|---|

| AM Best Financial Strength Rating | A ("Excellent") |

| Better Business Bureau rating | A+ |

| NAIC Complaint Index | 0.79 (Average is 1.0) |

Complaints focused on issues with coverage for rental reimbursement, as well as communication around those issues. In some cases, customers complained they lost access to a rental vehicle before repairs were completed.

How to file a claim

Customer service phone number: (800) 227-2757

- Press 2, then 1 for claims.

- Press 1 for glass claims.

- Press 2 to report an accident.

- Press 3 for towing reimbursements.

- Press 4 for the status of an existing claim.

Claims can be reported online 24/7.

Other Electric Insurance options

Customers can get more than just auto insurance coverage from Electric Insurance. The company also offers:

Find Cheap Auto Insurance Quotes in Your Area

Frequently asked questions

Who owns Electric Insurance company?

Electric Insurance is owned by the General Electric Company. It began as a way to insure the company's employees, but now sells to the general public.

What is the A.M. Best rating for Electric Insurance company?

Electric Insurance Company got an A rating ("Excellent") from A.M. Best. That means it is in stable financial position and should be able to pay out all claims in the event of a significant catastrophe

Is Electric Insurance a good company?

Electric Insurance is a generally good company with fair rates and a wide variety of coverage options. It is also widely available, as customers in all 50 states can purchase policies.

Methodology

Rates were collected using quote tools from Electric Insurance and three other large insurers: State Farm, Allstate and Geico. The sample driver is a 30-year-old single man who owns a home and drives a 2015 Honda Accord EX 11,000 miles per year. Quotes were collected for addresses in Illinois, Texas and Pennsylvania.

Coverage limits were as follows:

- Bodily injury liability coverage: $100,000 per person/$300,000 per accident

- Property damage liability coverage: $100,000 per accident

- Collision coverage: Included/$1,000 deductible

- Comprehensive coverage: Included/$1,000 deductible

- Uninsured/underinsured bodily injury liability coverage: $100,000 per person/$300,000 per accident

- Uninsured/underinsured property damage liability coverage: None

- Medical payments: $5,000

- Personal injury protection: $2,500

- Rental reimbursement: $30 per day, $900 overall

Rates are for comparative purposes only. Your rates may differ.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.