What Are the Best Medicare Supplement Plans in Massachusetts?

Health New England (HNE) has the best Supplement 1A plan in Massachusetts.

Compare Medicare Plans in Your Area

Health New England's monthly rate for Supplement 1A is the cheapest in the state. Supplement 1A plans offer more coverage than Core plans, but they cost more each month. If you are looking for a cheaper policy, Blue Cross Blue Shield has the best Core plan in Massachusetts.

What's the best Medicare Supplement company in Massachusetts?

Health New England (HNE) is the best company for Supplement 1A plans, and Blue Cross Blue Shield is best for Core plans.

If you want a company with high customer satisfaction, AARP/UnitedHealthcare is the best option.

Top Medicare Supplement companies in Massachusetts

Company | Supplement 1A rate | |

|---|---|---|

| Health New England | $185 | |

| Fallon Health | $185 | |

| Blue Cross Blue Shield | $191 | |

| Harvard Pilgrim Health Care | $195 | |

| Tufts Health Plan | $196 |

Compare Medicare Plans in Your Area

How Massachusetts Medigap plans work

Medigap plans in Massachusetts work differently than the plans in the rest of the country. There are only three plan types available in Massachusetts: Core, Supplement 1 and Supplement 1A. You can only buy a Supplement 1 plan if you were eligible for Medicare before 2020 but are just now enrolling.

Best Supplement 1A Plan: Health New England (HNE)

Health New England has the best Medicare Supplement plans in Massachusetts. All of its plans are cheaper than the state average.

Health New England has the cheapest rates in Massachusetts for Medigap Supplement 1A.

HNE's Supplement 1A plan provides a lot of value for the $185 monthly rate. If you qualify for the Supplement 1 policy, HNE also has good rates. Supplement 1 provides the most coverage of the three Medigap plans in Massachusetts, but people who are newly eligible for Medicare can't buy it.

Health New England has an A+ rating with Better Business Bureau (BBB). This means the company actively communicates with members to try to resolve complaints and issues. However, there are only two reviews about HNE on BBB, and both are negative. The complaints revolve around coverage and availability of care.

Best Core plan: Blue Cross Blue Shield (BCBS)

-

Editor rating

- Core: $114

- Supplement 1A: $191

- Supplement 1: $226

If you want a bit of extra coverage but don't want to pay a high monthly rate, a Core plan from Blue Cross Blue Shield (BCBS) is a good choice. Core plans only cover inpatient hospital costs, medical costs, three pints of blood and your share of hospice bills from Medicare Part A.

A Core plan from BCBS is 19% cheaper than the state average.

If you buy a Core plan, you won't have coverage for your Part A or Part B deductible. You'll also have to pay for medical care you get while traveling abroad. Core plans can be a good option if you don't need a lot of medical care but still want coverage in case something bad happens, like a severe injury or illness.

Blue Cross Blue Shield of Massachusetts has poor reviews on BBB. Most people report claims being denied and long hold times. Many members also say that the company takes too long to fix their issues once they've been reported. Despite the review, the company has an A+ BBB rating. This means it stays in contact with its members to try to resolve problems.

Best for service: AARP/UnitedHealthcare (AARP/UHC)

-

Editor rating

- Core: $145

- Supplement 1A: $203

- Supplement 1: $261

AARP/UnitedHealthcare has outstanding customer service, with 61% fewer complaints than an average company its size, according to the National Association of Insurance Commissioners (NAIC). Although its rates for Medicare Supplement plans in Massachusetts are higher than average, AARP/UnitedHealthcare is a good choice if customer service is a priority for you.

If you need a lot of medical care, it might be worth it to pay more for a policy from AARP/UnitedHealthcare.

That's because you're less likely to have trouble with your policy from AARP/UHC. It may be easier to get your medical bills paid and to resolve any issues that do come up. You have to join AARP to buy a policy, and the membership costs $20 per year. This adds to the cost of a plan, but the membership also gives you access to AARP perks and discounts.

How much does a Medigap plan cost in Massachusetts?

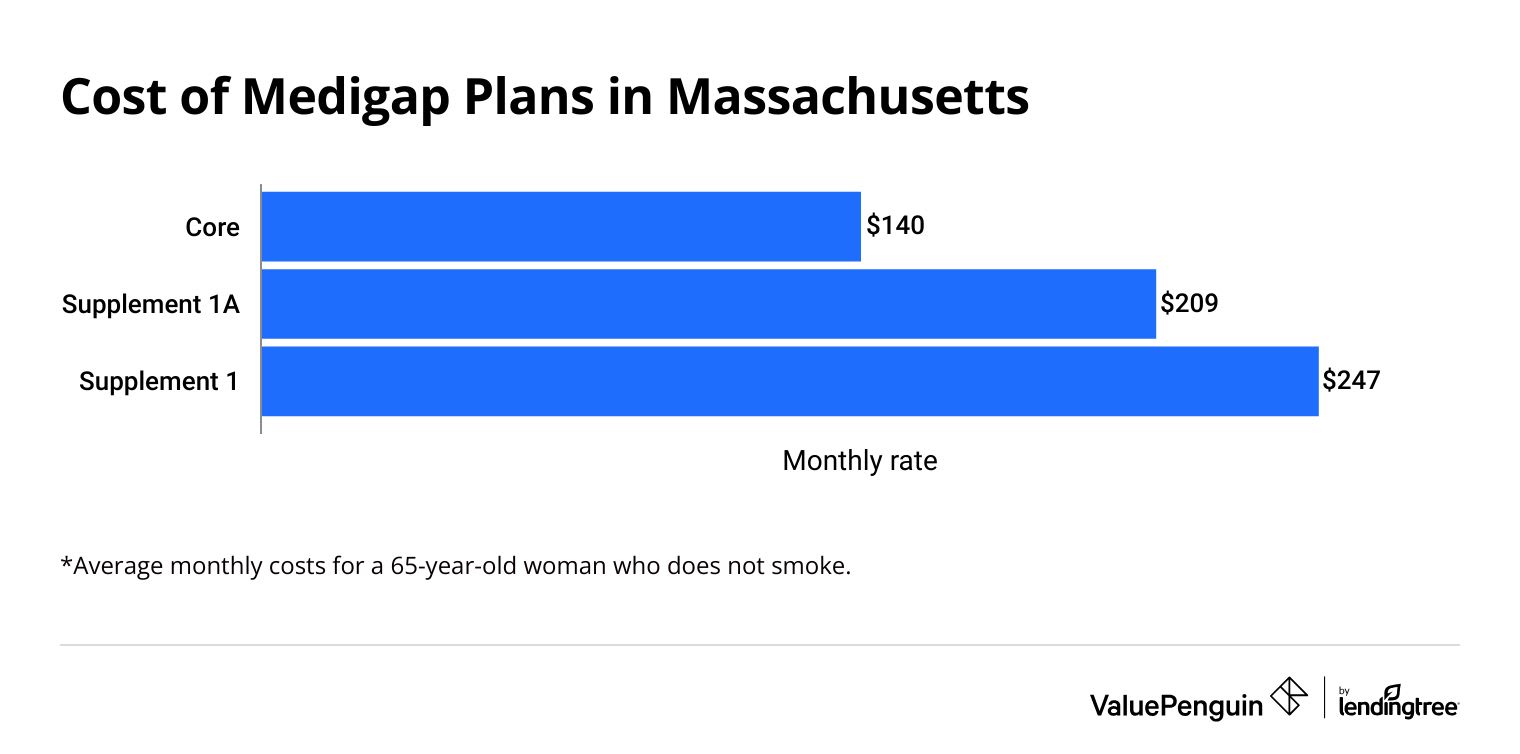

Medigap plans in Massachusetts cost between $140 and $247 per month.

Massachusetts only has three Medicare Supplement options, which means prices don't vary as much as they do in other places.

Compare Medicare Plans in Your Area

Core plans are the cheapest, but they also don't give you much coverage. Supplement 1 plans cost the most, but only people eligible for Medicare before 2020 can buy them. The Supplement 1A policy is the best option for most people in Massachusetts. It gives you more coverage than the Core plan but costs less than the Supplement 1 plan.

Massachusetts Medicare Supplement plan costs

Medigap plan | Monthly cost |

|---|---|

| Core | $140 |

| Supplement 1A | $209 |

| Supplement 1 | $247 |

What Massachusetts Medigap plans cover

All Massachusetts Medigap plans cover the "basic benefits," which are:

- Medicare Part A hospital coinsurance

- Medicare Part A hospice coinsurance or copayment

- Medicare Part B doctor visit coinsurance

- Three pints of blood

That means that, no matter what Medigap plan you choose, you likely won't have to pay when you see a doctor, go to the hospital or get hospice care. You might still have to pay your deductible, depending on the plan you choose. The specific Medigap plan you choose might give you coverage beyond these basic benefits.

Core plan | Supplement 1* | Supplement 1A | |

|---|---|---|---|

| Basic benefits | |||

| Part A deductible | |||

| Skilled nursing facility | |||

| Part B deductible | |||

| Foreign travel emergency | |||

| Other state-mandated benefits | |||

| Yearly inpatient mental hospital days | 60 | 120 | 120 |

*Supplement 1 is only available to those who were eligible for Medicare prior to 2020 but have not yet enrolled.

In Massachusetts, everyone with the same plan pays the same rate within a company. For example, everyone with the Supplement 1A plan with Health New England pays the same amount. Your age, gender and health don't affect your rates, although you might see your price change yearly with inflation. This is called "community rating." You also can't be denied a policy, which is called "guaranteed issue."

It's still useful to shop around and compare Medigap plans, because prices are different between companies and plans.

Frequently asked questions

What are the best Medicare Supplement plans in Massachusetts?

Health New England has the best Medigap plans in Massachusetts. It's an especially good choice for a Supplement 1A plan because of its cheap rates. Blue Cross Blue Shield has the cheapest Core plan, and AARP/UnitedHealthcare is the best for good customer service.

How much does Medigap cost in Massachusetts?

A Medicare Supplement plan costs between $140 and $247 per month in Massachusetts. Your rate will vary depending on the company you choose and the plan you buy. Your age, gender and health won't affect your monthly rate.

Is Medigap Plan G available in Massachusetts ?

No, Medigap Plan G is not available in Massachusetts. The state has its own unique Medigap plans called Core, Supplement 1 and Supplement 1A. If you want a plan that is similar to Plan G, Supplement 1A is the best choice.

Methodology and sources

The Medicare Supplement prices featured are preferred rates at initial enrollment, when shoppers are first eligible for a policy and rates are generally lower. Medical underwriting is not factored in. Rates are based on actuarial data from all private health insurance companies in Massachusetts and are for a 65-year-old woman who doesn't smoke.

Rates, customer satisfaction, financial strength ratings from AM Best and added perks are all used to choose the best companies and plans. Other sources include AARP/UnitedHealthcare, Better Business Bureau (BBB), Blue Cross Blue Shield of Massachusetts, Health New England, Kaiser Family Foundation and the National Association of Insurance Commissioners (NAIC).

About the Author

Senior Writer

Cate Deventer is a Senior Writer who specializes in health insurance, Medicare, auto and home insurance. She's been a licensed insurance agent since 2011.

She started her insurance career working as a customer service agent for State Farm. She later moved to an independent agency, where she worked with several insurance companies and hundreds of clients. She quoted policies, filed claims and answered insurance questions. In 2021, she pivoted her career and began writing about insurance for Bankrate. She moved to ValuePenguin in 2023 and began writing about health insurance and Medicare.

Cate has a passion for helping readers choose insurance to fit their needs. She enjoys knowing that her research and knowledge help people choose insurance products that make a positive difference in their lives.

How insurance helped Cate

Cate used her health insurance knowledge to navigate a surgery in 2023. Understanding how her policy worked let her focus on recovery instead of worrying about bills.

Expertise

- Health insurance

- Medicare & Medicaid

- Auto insurance

- Home insurance

- Life insurance

Credentials

- Licensed Life, Accident & Health Insurance Agent

- Licensed Property & Casualty Insurance Agent

Referenced by

- CBS

- NBC

- Wall Street Journal

Education

- BA, Theatre, Purdue University

- BA, English, Indiana University

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.