The Best Cheap Renters Insurance in Wyoming

State Farm has the best and cheapest renters insurance in Wyoming, with an average cost of $7 per month.

Compare Renters Insurance Quotes in Wyoming

Best Cheap Renters Insurance in Wyoming

ValuePenguin collected 127 quotes from six top renters insurance companies across 24 of the largest cities in Wyoming to find the best company for you. Our experts looked at price, coverages, discounts and customer service to rank the companies.

See our full methodology.

Cheapest renters insurance companies in Wyoming

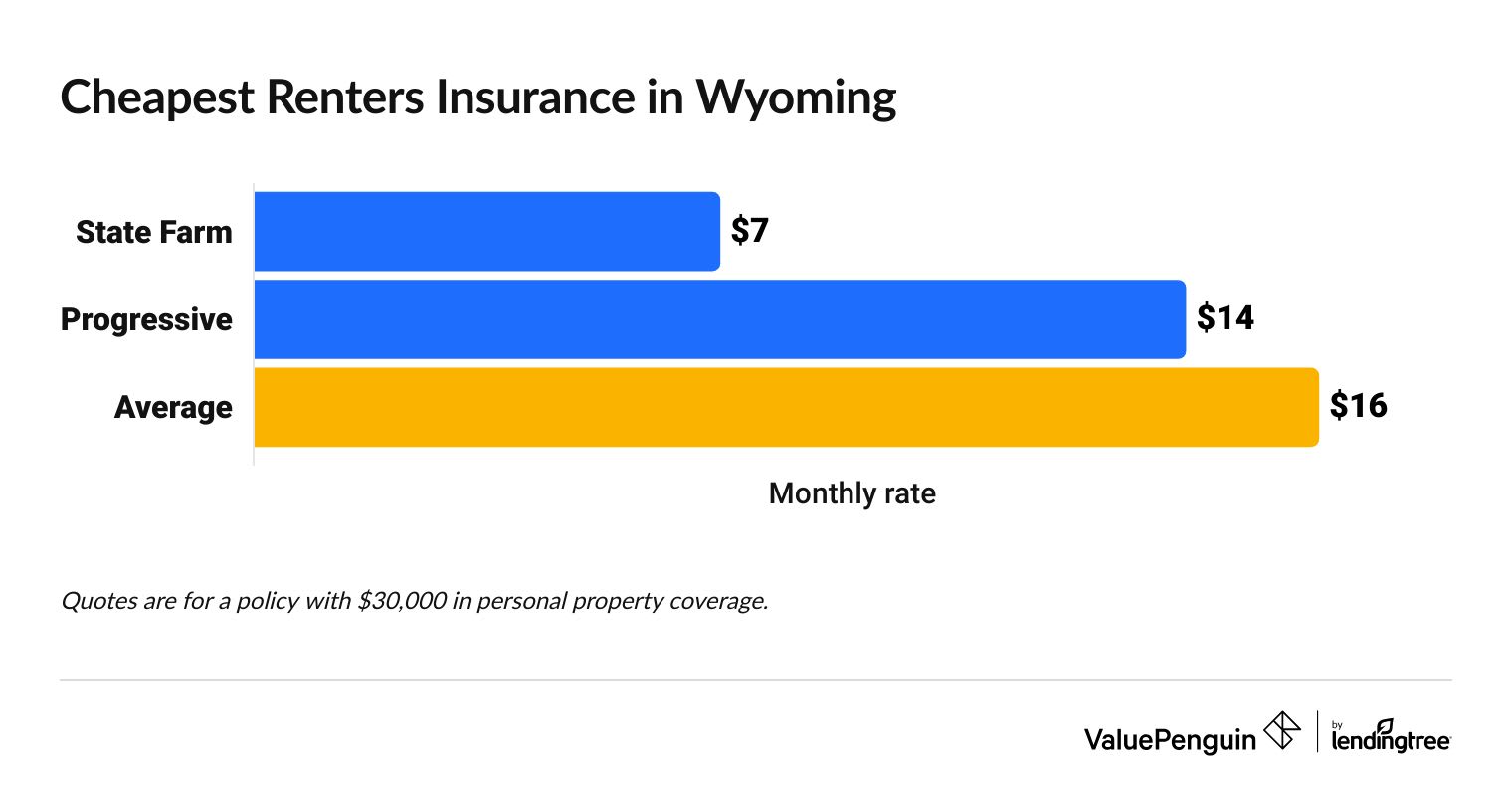

State Farm is the cheapest renters insurance company in Wyoming, with an average rate of $7 per month.

The average cost of renters insurance in Wyoming is $16 per month. But rates can be more or less, depending on where you live, the company you choose and more.

Compare Cheap Renters Insurance Quotes in Wyoming

Progressive is also a cheap choice for Wyoming renters insurance. And Progressive has lots of discounts that can make your rate even lower.

Cheap renters insurance quotes in Wyoming

Company | Monthly cost | ||

|---|---|---|---|

| State Farm | $7 | ||

| Progressive | $14 | ||

| Farmers | $16 | ||

| Allstate | $16 | ||

| Amica | $21 | ||

Best renters insurance for most people: State Farm

-

Editor's rating

- Cost: $7/mo

State Farm's renters insurance has cheap rates and good coverage.

Pros:

-

Cheapest rates in WY

-

Good coverage options

-

Local agents available

Cons:

-

Not many discounts

-

Service can depend on your agent

State Farm has the cheapest renters insurance rates in Wyoming, at $7 per month, on average, for a policy with $30,000 in dwelling coverage. State Farm also has great extra coverage options, so it's a good choice for most people.

For example, you might want to add identity theft coverage, which will help you pay for the cost to restore your identity if it's stolen. You can also add extra coverage for high-value items like jewelry.

State Farm is a great choice if you want to bundle your car and renters insurance. Not only does State Farm have the cheapest renters insurance rates in Wyoming, it also has the cheapest full coverage car insurance in Wyoming.

But State Farm doesn't have as many discounts as other renters insurance companies. It has cheap rates, though, so this may not be a concern. And although State Farm generally has good customer service, your experience could depend on your agent.

Best renters insurance discounts: Progressive

-

Editor's rating

- Cost: $14/mo

Progressive's long list of discounts can help you get a cheaper renters insurance rate.

Pros:

-

Lots of discounts

-

Cheaper-than-average rates

-

Good coverage options

Cons:

-

Poor customer service

Progressive has a long list of renters insurance discounts that can lower your monthly rate. Although its average rates aren't as cheap as State Farm's, the discounts might end up making your cost even lower.

With Progressive, you can save by bundling your car and renters insurance, getting a quote before you need your policy to start, paying your annual rate in full, signing up for paperless statements, living in a gated community and more.

But Progressive doesn't have good customer service. Choosing a company with low service ratings can be risky. If you have questions, need to make changes to your policy or need to file a claim, you may find yourself wishing you had chosen a company with better customer satisfaction.

Best renters insurance for seniors: Allstate

-

Editor's rating

- Cost: $16/mo

Allstate has a discount just for senior renters that can lower your monthly rate.

Pros:

-

Discount for seniors

-

Local agents available

Cons:

-

Rates are slightly higher than average

-

Customer satisfaction is below average

If you're over 55 and don't work anymore, you can get a discount of up to 25% on Allstate renters insurance. You can also get a lower rate if you get your car insurance with Allstate and by paying automatically or in full.

Allstate has local agents throughout Wyoming. Working with a local agent can be especially helpful if you're not sure what kind of coverage you need or how much. An agent can help guide you so you make good choices about your insurance coverage.

Allstate's rates are slightly higher than average, but you might be able to get a cheaper cost with discounts. However, Allstate's customer service is below average. You might want to talk to current Allstate customers before you buy a policy, if you can.

Wyoming renters insurance costs by city

Jackson, in western Wyoming, has the most expensive average rates for the state's larger cities, at $26 per month.

Renters insurance in Cheyenne, Wyoming's capital, costs an average of $16 per month. Meanwhile, renters in Worland, a town in north-central Wyoming, pay just $15 per month, on average. That's the lowest rate of the state's larger cities.

City | Monthly rate | % from average |

|---|---|---|

| Bar-Nunn | $17 | 3% |

| Buffalo | $16 | 0% |

| Casper | $17 | 4% |

| Cheyenne | $16 | 0% |

| Cody | $16 | -1% |

How to get the best renters insurance in Wyoming

To find the best renters insurance, you first have to understand what you need from your policy. You should know how much you can afford to spend each month and how much coverage you need, and then you can look for a policy that fits your specific situation.

Decide on your coverage needs and budget. Knowing your monthly budget helps you know what you can afford to pay each month. And knowing how much coverage you need keeps you from getting too much or too little coverage. To figure out what's called your personal property coverage amount, which is the amount of coverage for your stuff, create an inventory of all your belongings and how much everything is worth.

Also remember that your landlord likely requires you to have at least $100,000 in liability coverage. Liability coverage protects you from lawsuits if someone is injured in your apartment or you damage someone's belongings.

Shop around and compare quotes. Each insurance company has its own way of setting rates, so the same coverage might be cheaper with one company than with another. Shopping around lets you compare prices so you get the best deal on the coverage you need.

You can also compare the extra coverage options at each company to what you need from your policy. If you have a cat, for example, you probably want to choose a company that lets you add coverage for damage caused by pets.

Ask about discounts. Most insurance companies have discounts that can get you a lower rate. You might qualify automatically, but it never hurts to ask an agent or representative what discounts are available.

Common discounts include bundling your car and renters insurance, paying your annual rate in full, signing up for electronic statements and getting a quote a week or more before you need the policy to start.

What kind of renters insurance coverage do I need in Wyoming?

In Wyoming, it's especially important that your policy covers fire and water damage.

Understanding what your renters insurance policy does and doesn't cover can help you identify gaps. That lets you know if you need to add extra coverage.

Does Wyoming renters insurance cover fire damage?

Renters insurance covers damage caused by fire, whether it's a home fire or a wildfire. You shouldn't have to add anything extra to your policy to get fire coverage, but it never hurts to call your company or talk to your agent to make sure. Wildfires are relatively common in Wyoming.

Does renters insurance in Wyoming cover water damage?

Renters insurance covers some types of water damage. For example, the damage caused by frozen and burst pipes is covered, as is damage caused by rain that gets inside your apartment or home. You can add extra coverage for damage caused by a sewer or drain line backing up, commonly called "water backup coverage."

But renters insurance doesn't cover flood damage. If your rented home or apartment floods, you have to have a separate flood insurance policy for your stuff to be covered. If you rent a home or live in a basement or first-floor apartment, looking into flood insurance is especially important.

Frequently asked questions

What's the best renters insurance in Wyoming?

State Farm has the best renters insurance for most people in Wyoming. Its rates are cheap, at just $7 per month, on average, for a policy with $30,000 in personal property coverage. Plus, State Farm has good coverage and typically has good service.

How much is renters insurance in Wyoming?

On average, renters insurance in Wyoming costs $16 per month for a policy with $30,000 in personal property coverage. Rates change depending on how old you are, where you live, how much coverage you need and if you've ever filed a renters insurance claim in the past.

Does Wyoming require renters insurance?

The state of Wyoming doesn't require renters insurance by law, but your landlord probably requires you to have a policy. Usually, landlords want you to have a policy with at least $100,000 in personal liability coverage, to cover you in case someone is hurt at your apartment or you damage someone's stuff.

Methodology

To determine the average cost of renters insurance in Wyoming, ValuePenguin got renters insurance quotes from six major insurance companies in 24 of the largest cities in the state. The quotes are for a 30-year-old woman who lives alone, has no renters insurance claims on her record, and has the following coverage limits:

- Personal property: $30,000

- Loss of use: $9,000

- Liability: $100,000

- Medical payments: $1,000

- Deductible: $500

Renters insurance rates change depending on where you live, your age, the amount of coverage you need, your insurance claim history and more. Your rates will be different from the rates shown in this article.

To choose the best renters insurance companies in Wyoming, our experts reviewed the average rates, customer satisfaction, coverage offerings and discounts for each company. Data from the National Association of Insurance Commissioners (NAIC), J.D. Power and ValuePenguin's editors' ratings were used to rank the companies.

Insurance Writer

Cate Deventer is a ValuePenguin writer who specializes in health insurance, Medicare, auto and home insurance. She's been a licensed insurance agent since 2011.

She started her insurance career working as a customer service agent for State Farm. She later moved to an independent agency, where she worked with several insurance companies and hundreds of clients. She quoted policies, filed claims and answered insurance questions. In 2021, she pivoted her career and began writing about insurance for Bankrate. She moved to ValuePenguin in 2023 and began writing about health insurance and Medicare.

Cate has a passion for helping readers choose insurance to fit their needs. She enjoys knowing that her research and knowledge help people choose insurance products that make a positive difference in their lives.

How insurance helped Cate

Cate used her health insurance knowledge to navigate a surgery in 2023. Understanding how her policy worked let her focus on recovery instead of worrying about bills.

Expertise

- Health insurance

- Medicare & Medicaid

- Auto insurance

- Home insurance

- Life insurance

Credentials

- Licensed Life, Accident & Health Insurance Agent

- Licensed Property & Casualty Insurance Agent

Referenced by

- CBS

- NBC

- Wall Street Journal

Education

- BA, Theatre, Purdue University

- BA, English, Indiana University

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.