The Best Cheap Renters Insurance in West Virginia

State Farm has the best cheap renters insurance in WV. Plans cost $13 per month for $30,000 of personal property coverage, on average.

Compare Renters Insurance Quotes in West-Virginia

Best Cheap Renters Insurance in WV

ValuePenguin editors compared rates, coverage, unique offerings and customer service ratings to find the best renters insurance companies in WV.

Our experts collected more than 100 renters insurance quotes from the 24 largest cities in West Virginia.

Cheapest renters insurance in WV

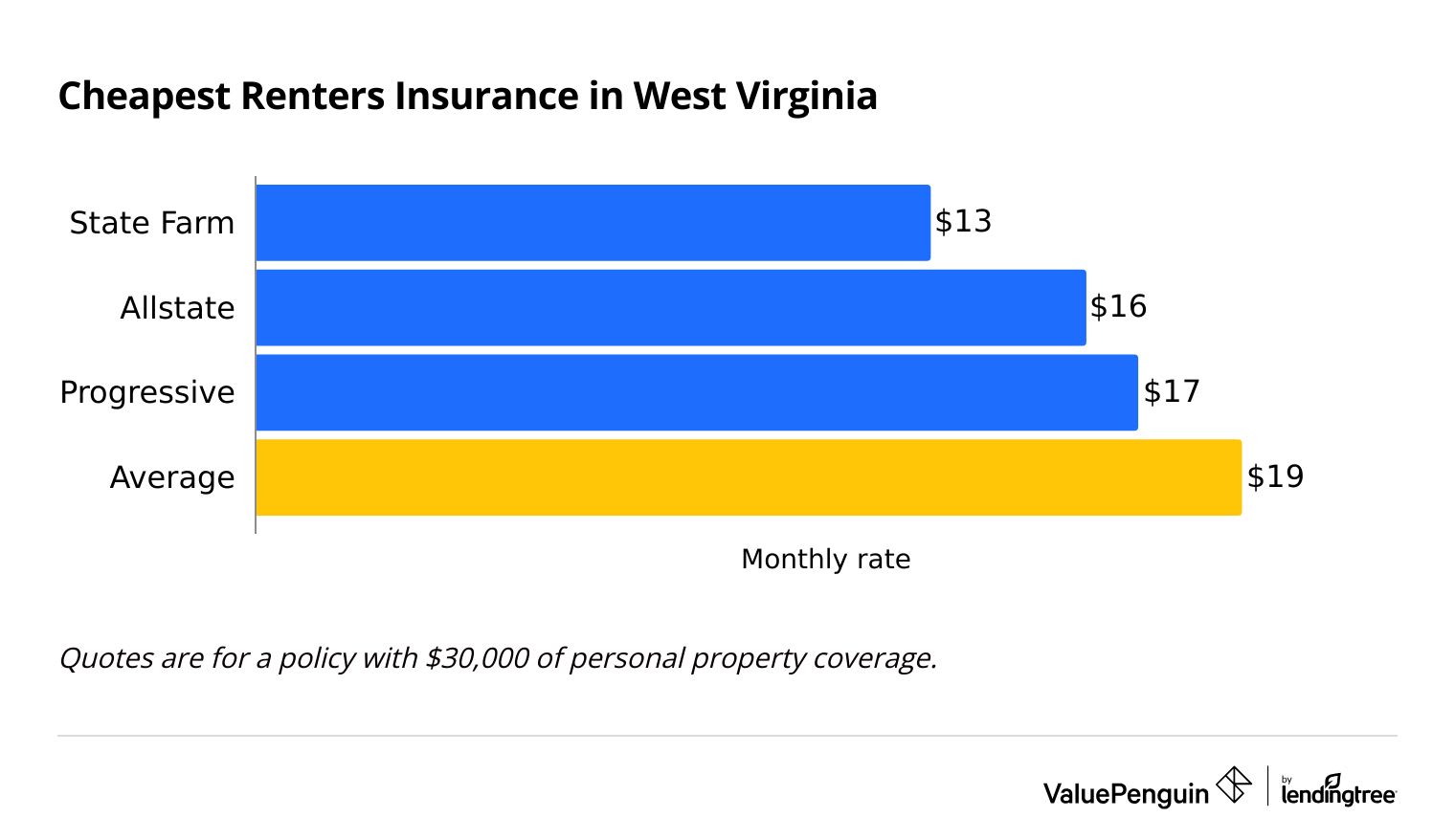

State Farm has the cheapest renters insurance in West Virginia, at an average of $13 per month for $30,000 of coverage to replace the things you own.

That's 29% cheaper than the West Virginia state average. Allstate and Progressive also have affordable rates, at $16 and $17 per month on average, respectively.

Compare Cheap Renters Insurance in West Virginia

Renters insurance in West Virginia is slightly less expensive than the national average. Coverage costs $19 per month for $30,000 of personal property coverage on average. That's similar to what you'd pay in nearby Virginia and Pennsylvania. However, West Virginia has much cheaper rates than Ohio and Kentucky.

Top renters insurance companies in West Virginia

Company | Monthly cost | ||

|---|---|---|---|

| State Farm | $13 | ||

| Allstate | $16 | ||

| Progressive | $17 | ||

| Amica | $23 | ||

| Assurant | $24 | ||

Best renters insurance in West Virginia for most people: State Farm

-

Editor's rating

- Cost: $13/mo

State Farm has the cheapest renters insurance in West Virginia.

-

Affordable quotes

-

Quality coverage

-

Good renters-auto bundle

-

Few discounts

State Farm has the most affordable renters insurance in West Virginia, at $13 per month for $30,000 of personal property coverage. That's $6 per month cheaper than the state average.

State Farm also has a good reputation for customer service. The company scored high for customer satisfaction according to a recent J.D. Power survey. Plus, State Farm got a roughly average number of complaints for a company its size.

State Farm has a good renters-auto bundling discount. You should consider State Farm for your renters coverage if you already have State Farm auto insurance.

State Farm lets you personalize your renters insurance with coverage extras like flood insurance, water backup and identity theft protection.

Best renters insurance in West Virginia for people age 55 and up: Allstate

-

Editor's rating

- Cost: $16/mo

Allstate has the best renters insurance for retired West Virginia residents age 55 and up.

-

Cheap rates

-

55 and up discount available

-

Extra coverage options available

-

Poor customer service

Allstate lets retired renters age 55 and up save up to 25% on their monthly rate. Allstate is the only renters insurance company in West Virginia to offer this discount. Factoring in this discount, Allstate has the cheapest rates in West Virginia for older renters.

Allstate also has affordable base rates, with an average of $16 per month. That's 16% cheaper than the West Virginia state average. Allstate has other discounts you can take advantage of, such as a renters-auto bundling discount and autopay.

You can personalize your Allstate renters policy with several add-ons.

Allstate coverage extras

- Umbrella insurance

- Flood insurance for renters

- Identity theft protection

- Valuable items coverage

Allstate has a poor reputation for customer satisfaction. You shouldn't choose Allstate for your renters coverage if getting the best service is more important than getting the cheapest rate.

Best WV renters insurance for coverage extras: Progressive

-

Editor's rating

- Cost: $17/mo

Progressive has many coverage add-ons available to West Virginia renters.

-

Many coverage extras available

-

Cheap rates

-

Replacement cost coverage comes standard with all policies

-

Poor customer service

Progressive lets you personalize your renters insurance with a variety of coverage extras.

Progressive coverage add-ons

- Umbrella insurance

- Valuable items

- Equipment breakdown

In addition, all Progressive renters insurance policies come standard with replacement cost coverage. This pays the full cost to repair or replace the things you own. In contrast, when you file a claim, many renters insurance policies give you the current value of your stuff, called actual cash value.

For example, imagine you have a couch that you bought for $500. With replacement cost coverage, you would get $500 if your couch was destroyed in a fire. But, you might only get $300 with an actual cash value policy.

Progressive also has affordable rates, with an average of $17 per month. That's 10% cheaper than the West Virginia state average. You can lower the amount you pay for renters insurance even more by taking advantage of one or more discounts, such as Progressive's renters-auto bundling discount, quote in advance and gated community discount.

Progressive was ranked last for customer satisfaction according to a J.D. Power survey that looked at top renters insurance companies. In addition, Progressive gets more complaints than an average company its size.

West Virginia renters insurance: Costs by city

Charleston, the capital of West Virginia, has the most expensive renters insurance policies in the state, at $22 per month on average.

Teays Valley, a suburb of Charleston, has the cheapest rates among the larger cities in WV, at $17 per month on average.

Where you live has an impact on how much you pay for renters insurance. Factors like crime rates, natural disasters and the cost of labor and materials can all influence how much renters insurance costs in your city.

City | Monthly rate | % from average |

|---|---|---|

| Beckley | $19 | -1% |

| Bluefield | $19 | 1% |

| Bridgeport | $19 | -1% |

| Charleston | $22 | 16% |

| Cheat Lake | $19 | 0% |

How to save on your West Virginia renters insurance

You can save on your West Virginia renters insurance by figuring out the right coverage level for your needs, shopping around and taking advantage of discounts.

Get the right coverage level for your needs

It's a good idea to add up the cost of everything you own before you buy renters insurance. The amount of personal property coverage you buy should roughly match the cost to replace the stuff you have.

That's because your renters policy won't pay more than the cost to replace your damaged or stolen items. For example, if a fire destroys $11,000 worth of your property, you won't get more than $11,000 regardless of whether your policy limit is $15,000 or $30,000.

Shop around for the most affordable quotes

You could save $130 per year by switching from the most expensive renters insurance company in West Virginia, Assurant, to the cheapest, State Farm.

Comparing quotes is one of the easiest ways to save on your renters insurance. It's important to remember that lower rates don't mean worse coverage or service. For example, State Farm has the cheapest rates in West Virginia and a good reputation for customer satisfaction.

Take advantage of discounts to get the cheapest rates

Factor in the discounts you qualify for to get the most affordable renters insurance quotes in West Virginia.

Most renters insurance companies in West Virginia let you save with one or more discounts. Typically bundling your auto and renters policies is one of the best ways to save on your renters insurance.

Other common discounts include pay in full, claim-free and home protection devices.

Common natural disasters in West Virginia

Renters in West Virginia may need coverage for floods and landslides.

Flood insurance in West Virginia

Renters insurance does not cover flood damage. Consider buying a separate flood insurance policy for renters if you live in a high-risk area, and you live in a ground floor or basement unit.

You may need flood coverage even if you don't live in a high-risk area. More than 40% of flood insurance claims come from low-to-moderate-risk areas. The Federal Emergency Management Agency (FEMA) has an online map tool that lets you find your area's risk level.

Flooding is the most common natural disaster in West Virginia. The state experienced over 1,600 floods between 2010 and 2021. West Virginia's mountainous terrain and many river valleys put low-lying areas at a particularly high risk of flooding.

Coverage for landslides in West Virginia

Landslides are one of the most common natural disasters in West Virginia.

Although West Virginia doesn't get many natural earthquakes, the state's history of mining has led to frequent earth movements. In addition, West Virginia's mountainous landscape and deep river valleys mean that floods are common.

A standard renters insurance policy won't cover landslides. In addition, flood and earthquake insurance won't cover landslides. Instead, you may be able to get extra coverage, called differences in conditions coverage, to protect the stuff you own.

West Virginia renters insurance trends

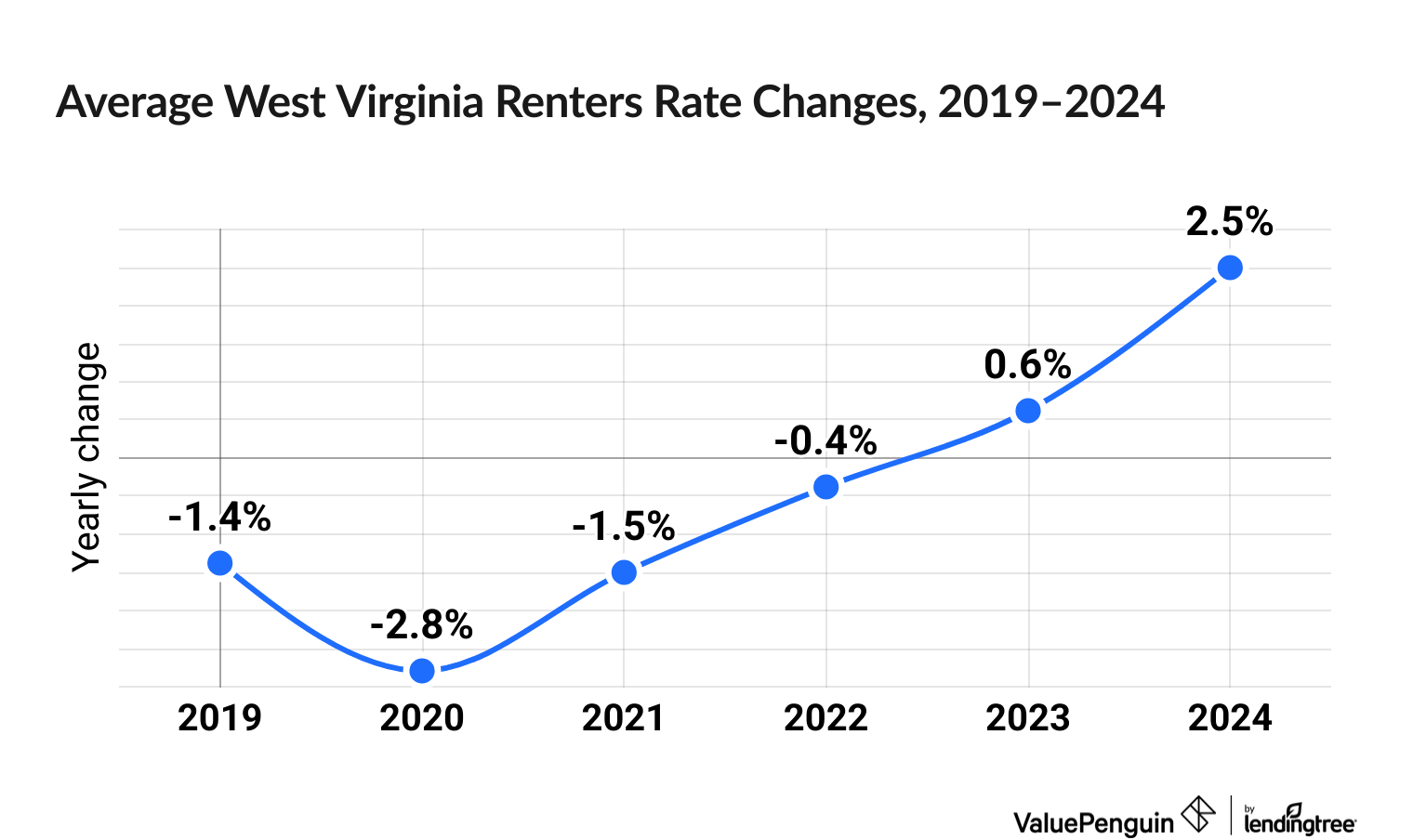

Renters insurance prices have dropped 3.1% in West Virginia over the past six years.

West Virginia is the only state to see their renters insurance rates, on average, drop over the five-year period.

However, despite the overall rate decreasing, West Virginia has been seeing a slight uptick in prices in recent years, with a 3.1% increase in rates across 2023 and 2024.

Among the major WA insurers, the biggest increases have been at USAA (18.7%) and Liberty Mutual (18.4%)

Renters insurance rate change data was compiled using RateWatch from S&P Global, which uses information from the National Association of Insurance Commissioners (NAIC).

Frequently asked questions

Who has the best cheap renters insurance in West Virginia?

State Farm has the best cheap renters insurance in West Virginia, at $13 per month on average. The company has affordable rates and a good reputation for customer satisfaction.

How much does renters insurance cost in Morgantown, WV?

Renters insurance in Morgantown, WV, costs $18 per month. That's slightly below the state average.

How much does renters insurance cost in WV?

Renters insurance in West Virginia costs $19 per month for $30,000 of personal property coverage on average. That's slightly cheaper than the national average of $23 per month.

Methodology

ValuePenguin collected dozens of quotes from West Virginia's 24 largest cities for a single 30-year-old woman with no claim history. Coverage limits include:

- $30,000 of personal property coverage

- $9,000 for loss of use

- $500 deductible

- $100,000 of personal liability

- $1,000 of medical payments to guests

Customer service ratings were created using renters insurance quotes, complaint data from the National Association of Insurance Commissioners (NAIC) and J.D. Power's 2023 renters insurance customer satisfaction survey.

These rates are only for comparative purposes. Your quotes will differ.

Natural disaster-related information was taken from the West Virginia Geological and Economic Survey.

About the Author

Senior Writer

Talon Abernathy is a ValuePenguin Senior Writer who specializes in health insurance, Medicare and Medicaid. He's also contributed to other insurance verticals including home, renters, auto, motorcycle and flood insurance.

Talon came to ValuePenguin in 2023. Since his arrival, he's helped to expand the site's health insurance-related content offerings. He enjoys helping readers understand the ins and outs of America's all too complicated health insurance landscape.

Before coming to ValuePenguin, Talon worked as a freelance writer. His prior work has touched on a broad range of personal finance-related topics including credit-building strategies, small business incorporation tactics and creative ways to save for retirement.

Insurance tip

In many parts of the country, you can qualify for a free Silver health insurance plan if you meet certain income requirements. Government subsidies in the form of premium tax credits and cost-sharing reductions may mean you'll pay nothing for coverage.

Expertise

- Health insurance

- Medicare and Medicaid

- Flood insurance

- Homeowners insurance

- Renters insurance

- Auto and motorcycle insurance

Referenced by

- The Miami Herald

- Money.com

- MSN

- Nasdaq

- The Sacramento Bee

- Yahoo! Finance

Education

- BA, University of Washington

- Certificate in Copyediting, UC San Diego

Credentials

- Licensed Life & Disability Insurance Agent

- Licensed Property & Casualty Insurance Agent

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.