The Best Cheap Renters Insurance in Washington, D.C.

Lemonade has the best renters insurance in Washington, D.C., with an average rate of $14 per month.

Compare Renters Insurance Quotes in Washington-Dc

Best Cheap Renters Insurance in Washington, D.C.

To find the best and cheapest renters insurance in Washington, D.C., ValuePenguin got quotes from six of the biggest renters insurance companies in the nation's capital. Our experts reviewed the quotes and ranked the companies based on their rates, coverage options, discounts and customer service.

See our full methodology.

Cheapest renters insurance companies in Washington, D.C.

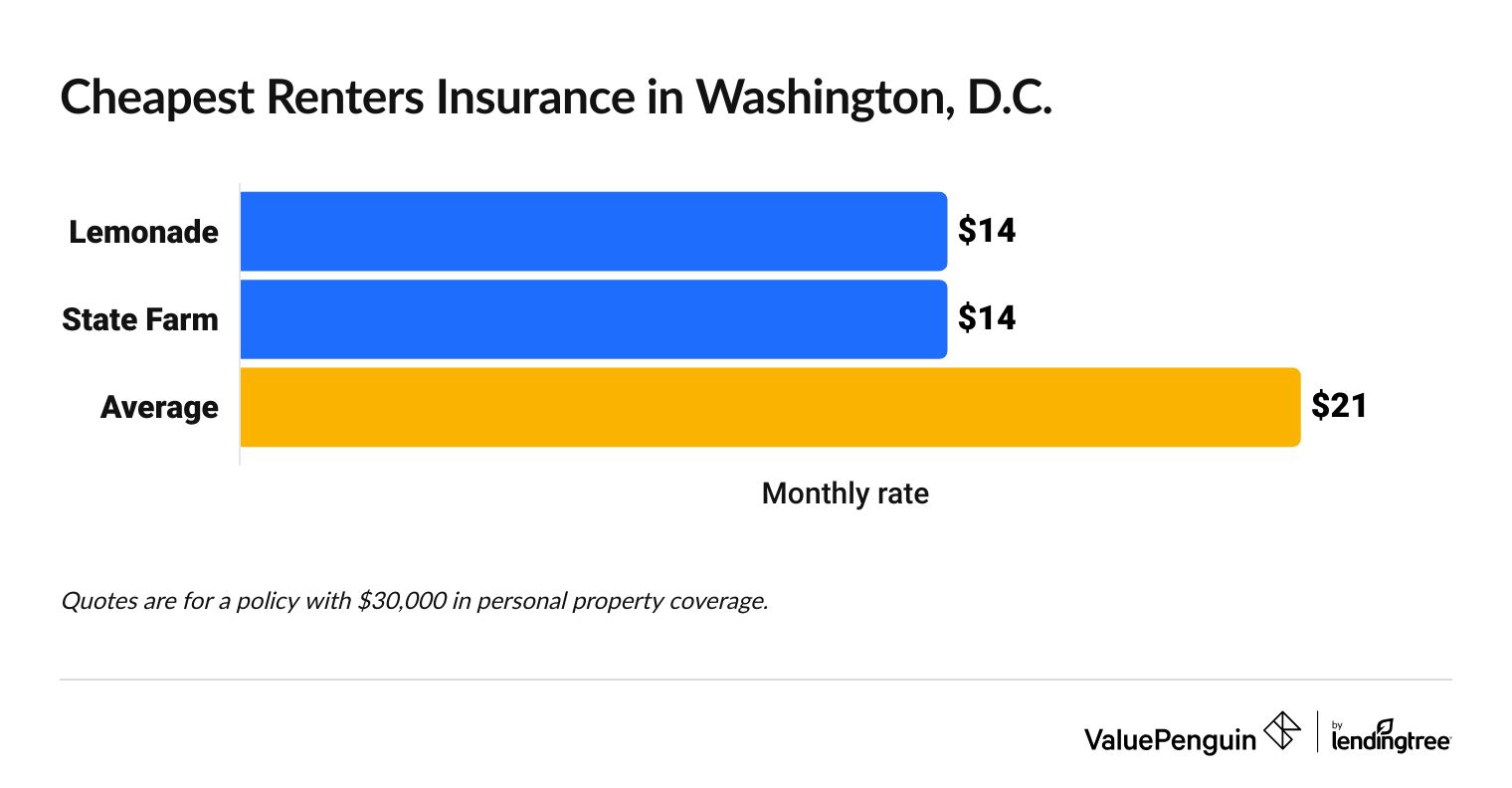

Lemonade has the cheapest renters insurance in Washington, D.C., with an average rate of just under $14 per month.

The average cost of renters insurance in Washington, D.C. is $21 per month. That means Lemonade saves you $7 per month, on average, or $84 per year.

Compare Cheap Renters Insurance Quotes in Washington, D.C.

State Farm also has cheap rates, with a policy costing just over $14 per month, on average. Plus, State Farm has local agents throughout Washington, D.C., so it's a good option if you want to handle your insurance in person.

Cheap renters insurance quotes in Washington, D.C.

Company | Monthly cost | ||

|---|---|---|---|

| Lemonade | $14 | ||

| State Farm | $14 | ||

| Amica | $23 | ||

| Progressive | $23 | ||

| Allstate | $26 | ||

Best renters insurance for most people: Lemonade

-

Editor's rating

- Cost: $14/mo

Lemonade's cheap rates and good coverage make it the best option for most people.

Pros:

-

Cheap rates

-

Good customer service

-

Easy online experience

Cons:

-

No local agents

-

Can't bundle with car insurance

Lemonade has cheap rates, good coverage and good customer service, making it the best option for most D.C. renters. A policy with $30,000 in personal property coverage costs just under $14 per month, on average, in D.C.

You can get quotes for Lemonade renters insurance online. The company has a great online tool that walks you through the process of entering your info and choosing your coverage. It takes about five minutes to get a quote, and the system helps you look for extra coverage and discounts to customize your policy.

Lemonade has good coverage options, too. You can get add-ons for damage caused by mold, which could be useful for renters in D.C., given the capital's reputation for hot and humid summers. You can also add extra coverage for expensive items like jewelry and collectibles.

But Lemonade doesn't sell car insurance in Washington, D.C., so you can't bundle your renters and car insurance. Lemonade also doesn't use local or live agents (in most cases). If you have questions or issues, you have to go online, which might be frustrating for some people.

Best renters insurance with local agents: State Farm

-

Editor's rating

- Cost: $14/mo

State Farm is a good option if you want to have a local agent help with your insurance.

Pros:

-

Local agents available

-

Cheap rates

-

Good extra coverage

Cons:

-

Not many discounts

-

Service can depend on your agent

If you want a local expert to help inform your insurance choices, State Farm is a great choice. There are 26 State Farm agents in Washington, D.C., which means there's probably an agent near you. State Farm is also generally known to have good customer service, but the service you get probably depends on your agent.

Working with a local agent can be helpful if you're not sure how much or what kind of coverage you need. An agent can use their expertise to help guide you toward the right amount of insurance for your needs.

State Farm also has cheap rates, with an average policy costing just over $14 per month for $30,000 in personal property coverage. However, State Farm doesn't have as many discounts as most other companies. Because its rates are cheap, that might not be a deterrent, but it's worth keeping in mind.

Best renters insurance discounts: Progressive

-

Editor's rating

- Cost: $23/mo

Progressive offers lots of discounts to help you get a cheaper rate.

Pros:

-

Lots of discounts

-

Good extra coverage

Cons:

-

Expensive average rates

-

Poor customer service

Progressive has lots of cheapest renters insurance discounts that might help you get a cheaper rate. For example, you can save if you get a quote ahead of when you need your policy to start. You can also save by paying your full annual rate at once and by signing up to have all of your bills and statements emailed to you.

You can also add lots of extra coverages to your Progressive policy. There's identity theft coverage, which helps you pay to recover your identity if it's stolen. You can add coverage for mold damage, too. You might even be able to get a separate flood insurance policy through Progressive for your apartment or rented home.

But Progressive tends to be expensive, with an average monthly rate of $23 for a policy with $30,000 in personal property coverage. It's worth getting a quote to see if you can get discounts that would make the policy cheaper. But if you're on a tight budget, Lemonade or State Farm might be better options.

How to get the best renters insurance in Washington, D.C.

To get the best renters insurance policy for you, you first have to decide how much coverage you need and how much you can afford to spend each month. Then, shop around and compare different companies to find the best option for your needs.

Figure out how much coverage you need. To do this, you can create an inventory of your stuff and estimate the cost it would take to replace everything. That total will show you how much personal property coverage you need. Your landlord may also require that you have at least $100,000 in liability coverage, which pays if someone is hurt in your apartment or you damage their things.

Set your budget. Knowing your monthly budget helps you avoid overspending on insurance. It can also make shopping easier, because you can quickly discard quotes that don't fit with your finances. To figure out how much you can afford to pay each month, go through your current spending and decide what amount is affordable for you.

Get several quotes. Comparing renters insurance quotes from several companies helps you find the coverage you need at the best price. It's also a good idea to compare customer service ratings and discounts.

What kind of renters insurance coverage do I need in Washington, D.C.?

If you live in Washington, D.C., you're probably familiar with the weather swings. Temperatures can be cold in winter and hot in summer, which means you might need coverage for damage caused by frozen and burst pipes, as well as damage caused by mold and mildew. Flooding is also possible, so if you live on the ground floor you may want to look into flood insurance.

Renters insurance covers many types of damage, but not everything. It's important to make sure your policy covers the things that are most likely to happen to you.

Does D.C. renters insurance cover burst pipes?

If a pipe in your rented house or apartment freezes and bursts, your renters insurance will cover the water damage to your stuff. The damage to the pipe itself isn't covered, because you don't own the building or the pipe. But if a burst pipe soaked and ruined your couch or any other belongings, your renters insurance would pay for you to replace them.

Does renters insurance in D.C. cover flooding?

Renters insurance doesn't cover flooding. You need a separate flood insurance policy if you want your stuff covered for flood damage. Flood insurance is especially important if you live in a basement or ground-floor apartment.

Washington, D.C. renters insurance trends

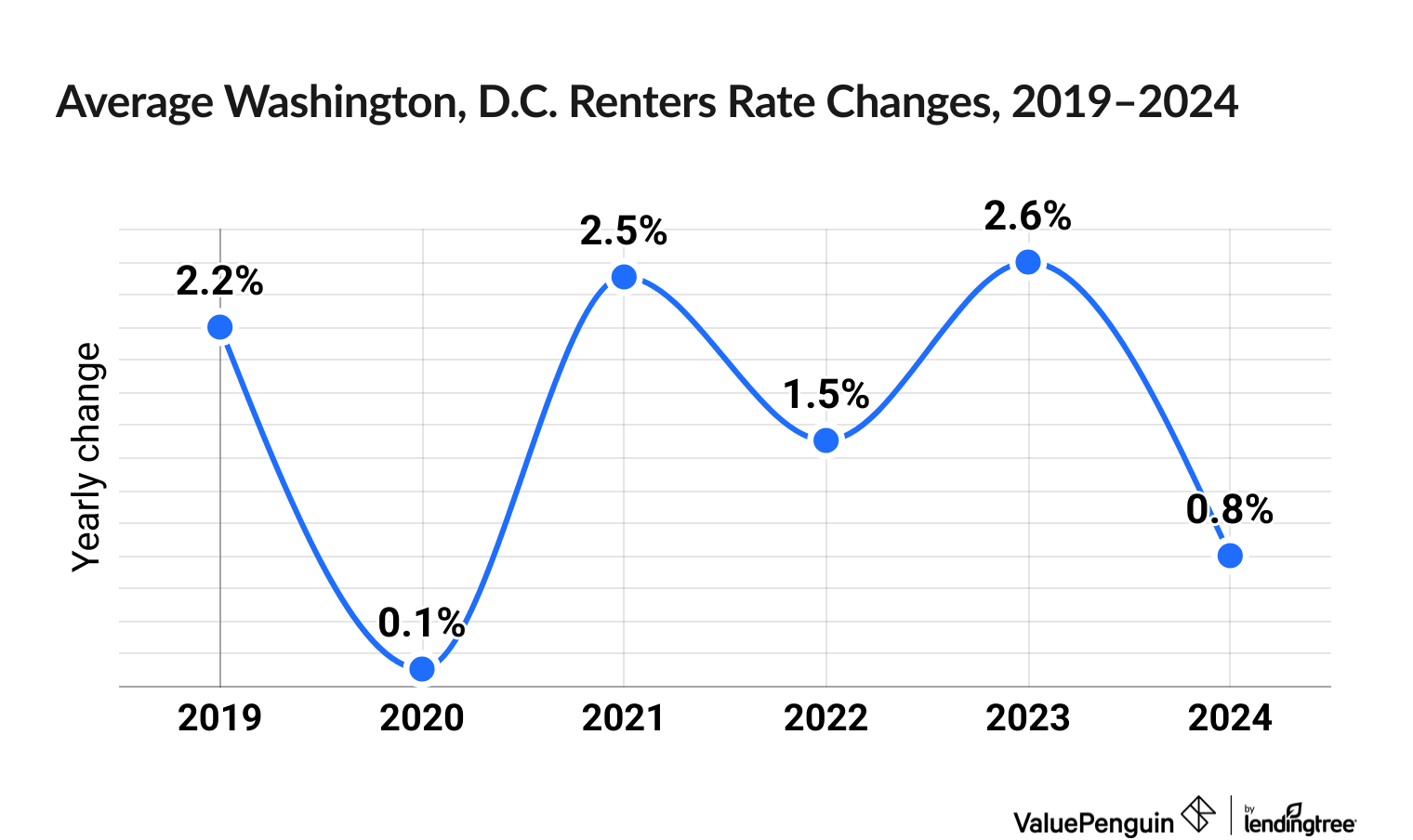

Renters insurance prices have gone up 10.1% in Washington, D.C. over the last six years.

Washington, D.C. renters insurance rates went up between 2.3% and 62.5% over the last six years, depending on the company.

Renters insurance prices, on average, saw small increases between 2020 and 2022, but then went up slightly by 3.4% across 2023 and 2024.

Among the major DC insurers, the biggest increases have been at Nationwide (62.5%), Chubb (25.2%) and Liberty Mutual (18.3%).

Renters insurance rate change data was compiled using RateWatch from S&P Global, which uses information from the National Association of Insurance Commissioners (NAIC).

Frequently asked questions

What is the best renters insurance in Washington, D.C.?

Lemonade sells the best renters insurance in Washington, D.C. for most people. Its rates are cheap, with a policy costing just under $14 per month, on average, for $30,000 in property coverage. Lemonade also offers good coverage and customer service.

How much is renters insurance in D.C.?

Renters insurance in D.C. costs $21 per month, on average. But rates vary depending on your age, if you have renters insurance claims on your record, where you live and how much coverage you need.

Can D.C. landlords require renters insurance?

Yes, landlords in Washington, D.C. can and often do require renters insurance. Specifically, landlords usually require you to have a policy with at least $100,000 in liability insurance in case someone is hurt at your apartment.

Methodology

To find the average cost and the cheapest rates for renters insurance in Washington, D.C., ValuePenguin got a quote from six major insurance companies in the nation's capital. The quotes are for a 30-year-old unmarried woman with no insurance claims and the following coverage:

- Personal property: $30,000

- Loss of use: $9,000

- Liability: $100,000

- Medical payments: $1,000

- Deductible: $500

The rates in this article are for comparison only. Your renters insurance rate will likely be different, depending on your age, where you live, your claims history and how much coverage you need.

Our insurance experts chose the best renters insurance companies in Washington, D.C. after reviewing each company's average rates, customer service, coverage offerings and discounts. The ratings include data from the National Association of Insurance Commissioners (NAIC), J.D. Power and ValuePenguin's own editors' ratings.

Insurance Writer

Cate Deventer is a ValuePenguin writer who specializes in health insurance, Medicare, auto and home insurance. She's been a licensed insurance agent since 2011.

She started her insurance career working as a customer service agent for State Farm. She later moved to an independent agency, where she worked with several insurance companies and hundreds of clients. She quoted policies, filed claims and answered insurance questions. In 2021, she pivoted her career and began writing about insurance for Bankrate. She moved to ValuePenguin in 2023 and began writing about health insurance and Medicare.

Cate has a passion for helping readers choose insurance to fit their needs. She enjoys knowing that her research and knowledge help people choose insurance products that make a positive difference in their lives.

How insurance helped Cate

Cate used her health insurance knowledge to navigate a surgery in 2023. Understanding how her policy worked let her focus on recovery instead of worrying about bills.

Expertise

- Health insurance

- Medicare & Medicaid

- Auto insurance

- Home insurance

- Life insurance

Credentials

- Licensed Life, Accident & Health Insurance Agent

- Licensed Property & Casualty Insurance Agent

Referenced by

- CBS

- NBC

- Wall Street Journal

Education

- BA, Theatre, Purdue University

- BA, English, Indiana University

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.