The Best Cheap Renters Insurance in Missouri

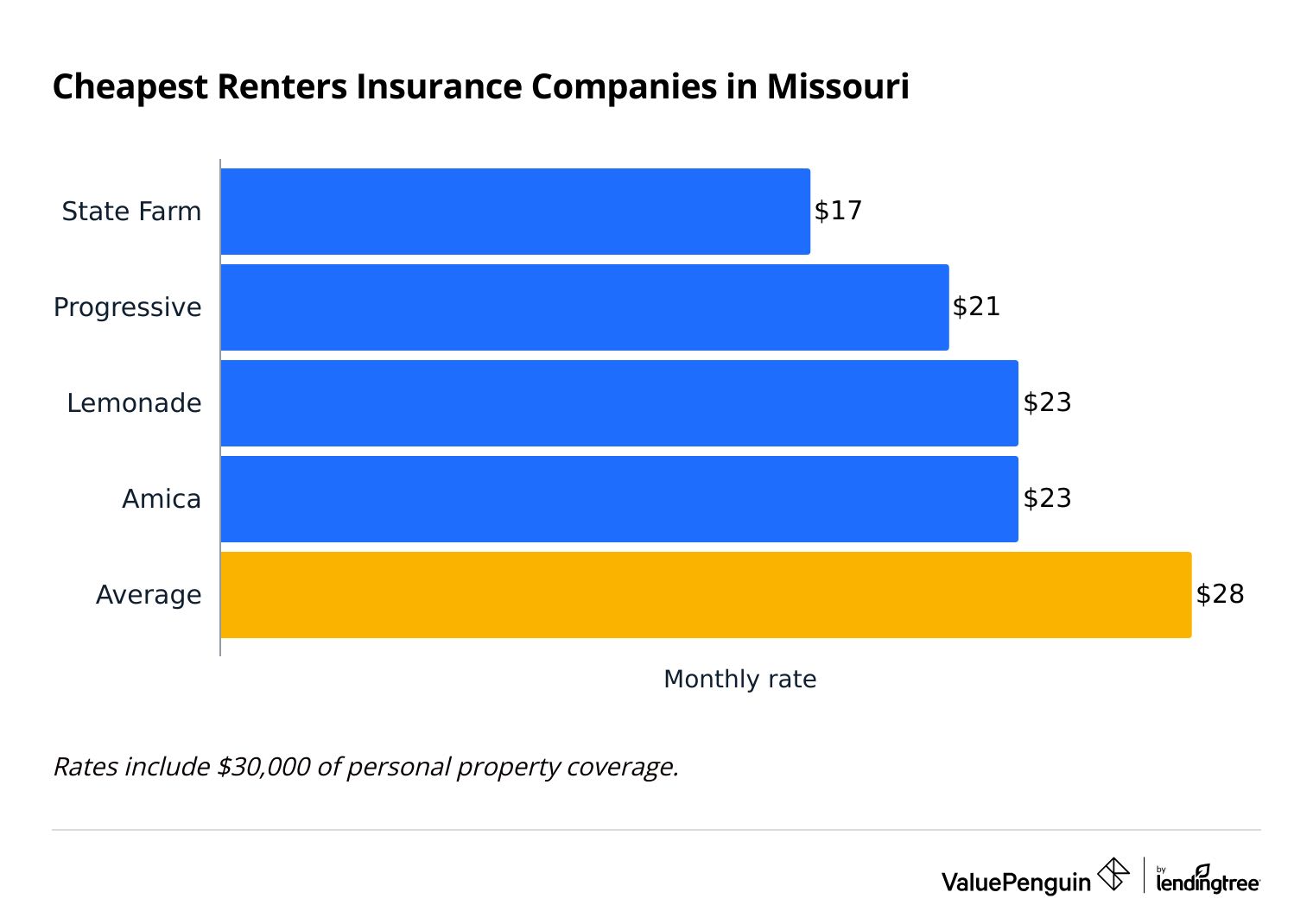

State Farm has the cheapest renters insurance in Missouri, at $17 per month for $30,000 of personal property coverage, on average.

Compare Renters Insurance Quotes in Missouri

Best Cheap Renters Insurance in MO

ValuePenguin editors found the best cheap renters insurance companies in Missouri by looking at rates, customer satisfaction, coverage options and discounts.

Our experts calculated average renters insurance rates by gathering quotes from eight top companies across 21 of Missouri's largest cities.

Cheapest renters insurance companies in Missouri

State Farm has the cheapest renters insurance in Missouri, at an average price of $17 per month for $30,000 of personal property coverage. That's 39% cheaper than the Missouri state average.

Compare Cheap Renters Insurance Quotes in Missouri

Progressive also has relatively low prices, with an average rate of $21 per month. That's 24% less than the state average of about $28 per month.

Cheapest renters insurance companies in Missouri

Company | Monthly cost | ||

|---|---|---|---|

| State Farm | $17 | ||

| Progressive | $21 | ||

| Lemonade | $23 | ||

| Amica | $23 | ||

| Assurant | $30 | ||

Best renters insurance in Missouri for most people: State Farm

-

Editor's rating

- Cost: $17/mo

State Farm has the cheapest renters rates in Missouri, plus in-person help if you need it.

-

Cheap rates

-

Good customer service

-

Renters-auto bundling discount available

-

Strong network of local agents

-

Few discounts

State Farm has the cheapest renters insurance in Missouri, at $17 per month for $30,000 of personal property coverage, which pays for your stuff if it's damaged or stolen. That's 39% cheaper than the MO state average rate.

State Farm stands out among renters insurance companies when it comes to in-person service. Unlike many competitors, State Farm will automatically pair you with a local agent when you sign up. They can help manage your policy, answer questions and help you with a claim if you need to make one.

State Farm has a middle-of-the-road reputation for customer satisfaction. The company gets an average number of complaints compared to other insurance companies. State Farm scored above average on a recent renters insurance satisfaction survey by J.D. Power.

However, the company only offers a few discount opportunities. You can take advantage of a bundling discount when you buy two types of insurance, such as renters and auto. You can also qualify for a discount by installing smoke and burglar alarms. There aren't many others available.

Best renters insurance for extra coverage options in MO: Progressive

-

Editor's rating

- Cost: $21/mo

Progressive offers a wide range of discounts and extra coverage options.

-

Affordable rates

-

Many extra coverage options and discounts

-

Weak customer service

Consider Progressive if you want more protection from your renters insurance than just property and liability coverage.

Progressive lets you tailor your renters policy to your needs with a range of coverage add-ons. For example, if you own the appliances in your apartment, you could benefit from mechanical breakdown coverage. This pays to repair your washing machine, refrigerator or even computer if it's damaged by something like a power surge.

It also offers mold protection and separate flood insurance, if you need them.

Progressive's rates aren't the cheapest in the state, but you can lower your bill by qualifying for as many discounts as possible.

Progressive discounts for Missouri renters

- Renters-auto bundling

- Electronic document delivery

- Gated community

- Quote in advance

- Single deductible

- Pay in full

However, Progressive has a poor customer service reputation.

Progressive ranked last in a recent customer satisfaction survey for renters insurance by J.D. Power. It also gets 43% more complaints than an average company its size, according to the National Association of Insurance Commissioners (NAIC). If customer satisfaction is a high priority for you, consider Amica. It gets significantly fewer complaints than an average company its size for $2 more per month.

Best renters insurance for customer service in Missouri: Amica

-

Editor's rating

- Cost: $23/mo

Amica gets far fewer complaints than an average company its size.

-

Strong customer service

-

Good bundle discount

-

Few extra coverage options available

-

Average rates

Amica is an excellent choice for renters willing to spend more than the minimum for great service. It costs about $6 more per month than ValuePenguin's top pick, but it consistently gets top marks from its customers.

Amica gets two-thirds fewer complaints than an average insurance company its size. That makes Amica the best company for customer service in Missouri.

The average price at Amica is about $23 per month for $30,000 of personal property coverage. That's 16% cheaper than the state average.

However, you may be able to reduce your price by taking advantage of Amica's discounts. One of the best available is for bundling your renters insurance with an auto policy since it lowers what you pay for both auto and renters coverage.

Unfortunately, Amica doesn't offer many common coverage add-ons. For example, you can't get water backup protection or mold coverage.

Amica does offer a few coverage extras, such as higher limits for valuable items, replacement cost and identity theft protection.

Missouri renters insurance: Costs by city

Florissant, a suburb of St. Louis, has the most expensive renters insurance among Missouri's larger cities, at $30 per month.

St. Louis proper and St. Joseph are also among the most expensive cities, at $29 per month each.

Renters insurance costs can change based on where you live. Your bill might be more expensive if you live in an area with a higher crime rate, or lower if your home is located on high ground, away from a flood zone. But the cost of renters insurance doesn't vary much by location in Missouri. There's only a $7 per month price difference between Florissant and the cheapest major city, Columbia.

City | Monthly rate | % from average |

|---|---|---|

| Ballwin | $27 | -3% |

| Blue Springs | $28 | 1% |

| Cape Girardeau | $27 | -2% |

| Chesterfield | $27 | -3% |

| Columbia | $23 | -17% |

Tips for getting cheap renters insurance in Missouri

Save on Missouri renters insurance by picking the right coverage levels, comparing quotes and taking advantage of discounts.

Add up the cost of the items you own to find out how much coverage you need. The amount of coverage to replace your personal belongings, called personal property coverage, will have a big impact on your monthly rate.

It's important to buy the right amount of coverage to replace the items you currently have. If you buy too much coverage, you could pay hundreds of dollars extra each year.

Take a look at the other coverages you have on your policy, too. If you have extra protection for your bicycle or valuable jewelry but don't own those things anymore, make sure to cancel the add-ons. There's no reason to pay for coverage you aren't using.

Comparing quotes from different companies is the best way to save on your renters insurance. You could save $364 per year in Missouri by switching from American Family to State Farm.

It's a good idea to compare quotes each year because rates can change over time. The company that had the cheapest rates a year ago might not have the best rates when you renew your policy.

Most Missouri renters insurance companies offer one or more discounts.

It's important to consider which discounts you might qualify for when comparing quotes. That's because discounts can lower your final costs significantly.

Common renters insurance discounts in Missouri

- Renters-auto bundling

- Claim-free discount

- Automatic payments/pay in full

- Loyalty

- Switch discount

- Buy online

Common renters insurance risks in MO

Missouri renters may be at risk of flooding, tornadoes and ice storms.

Tornadoes and ice storms

Fortunately, a standard renters insurance policy will cover damage caused by a tornado or ice storm. It's important to remember that your renters insurance policy will not cover the structure of your apartment or rented home. That's your landlord's responsibility.

Your renters policy will pay to replace your stuff if it's damaged or destroyed by a tornado or storm. Keep in mind that your insurance company may deny your claim if you don't take standard precautions. For example, a typical renters insurance policy won't cover water damage if you leave your window open during a storm.

If you have additional living expense coverage, also called loss of use coverage, your policy will also cover things like a hotel or apartment sublet if your home is temporarily unsafe to live in.

Flooding

Flooding is common in Missouri, especially near the Mississippi and Missouri rivers. People who live at low elevations near a major body of water are at risk of floods damaging their property.

Renters insurance won't pay for flood damage. Renters insurance generally defines flooding as water that comes from outside the house. Fortunately, flood insurance for renters tends to cost less than flood insurance for homeowners.

You can find your risk level by using the flood map tool available on the Federal Emergency Management Agency (FEMA) website.

But remember that you're only responsible for flood damage to your personal property. Unless you live in a first-floor apartment or freestanding rental house in a flood zone, most renters are fairly unlikely to face flood damage directly.

Missouri renters insurance trends

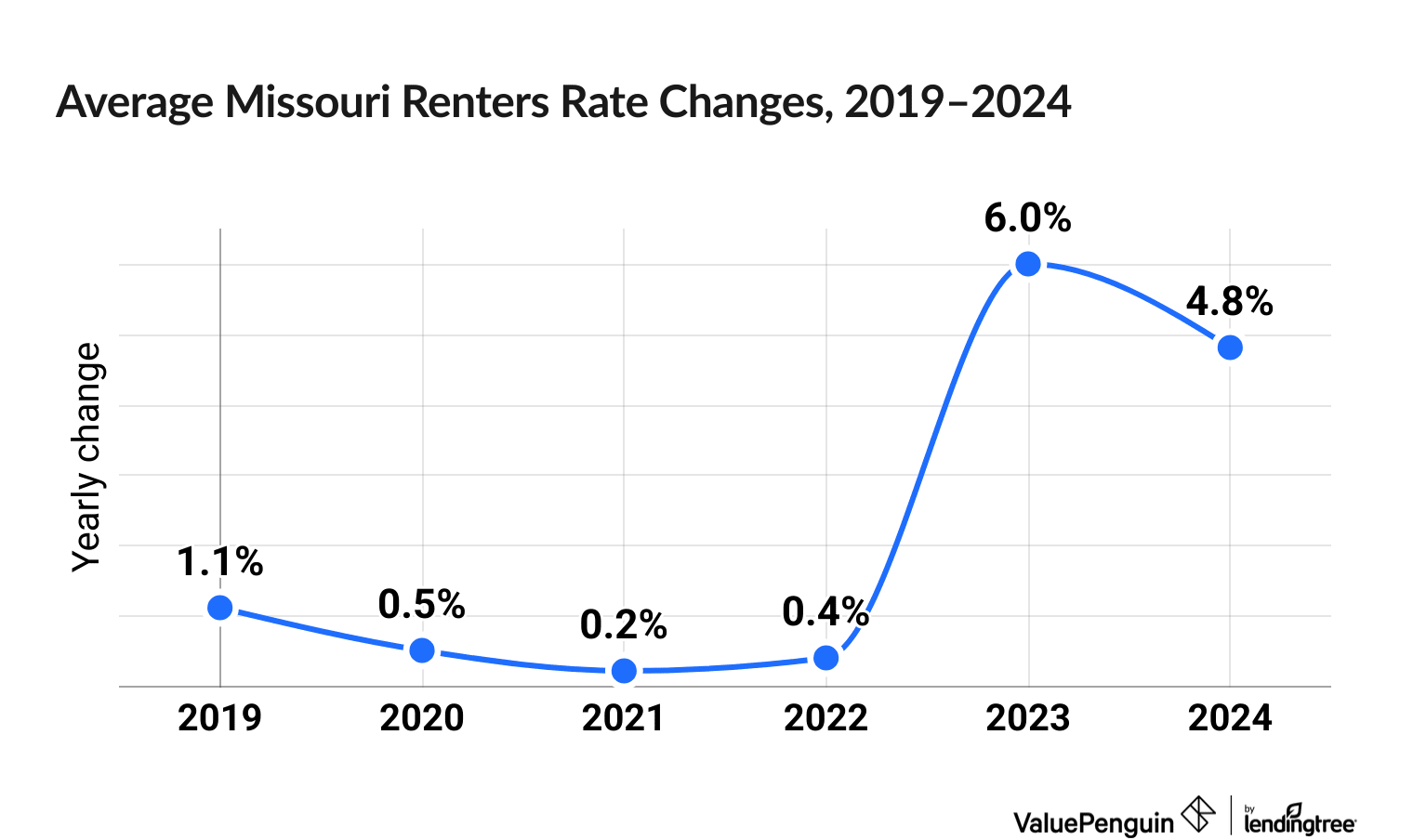

Renters insurance prices have gone up 13.9% in Missouri over the last six years.

Depending on the company, Missouri renters insurance went up between 4.4% to 26.5% over the last six years.

Renters insurance prices, on average, saw little to no increase between 2020 and 2022, but then saw a sharper rise of 11.5% across 2023 and 2024.

Among the major MO insurers, the biggest increases have been at Travelers (26.5%), Chubb (25.4%) and Shelter Insurance (23.4%).

Renters insurance rate change data was compiled using RateWatch from S&P Global, which uses information from the National Association of Insurance Commissioners (NAIC).

Frequently asked questions

How much is renters insurance in Missouri?

The average cost of renters insurance in Missouri is $28 per month. MO renters can find the cheapest rates at State Farm, where a policy costs $17 per month.

Can a landlord require renters insurance in Missouri?

Yes, your landlord can require you to buy renters insurance. It's important to check your lease agreement to make sure you have enough coverage to satisfy your contract.

How much is renters insurance in St. Louis, MO?

Renters in St. Louis pay around $29 per month for insurance, which is 4% more than the Missouri state average. In comparison, people living in Kansas City, MO, pay $28 per month.

Methodology

ValuePenguin collected more than 130 quotes from across Missouri's 21 most populated cities for an unmarried 30-year-old woman with no claim history. Coverage limits include:

- $30,000 of personal property coverage

- $9,000 for loss of use

- $500 deductible

- $100,000 of personal liability

- $1,000 of medical payments to guests

Customer service ratings were created using cost data, information from the National Association of Insurance Commissioners (NAIC) complaint index scores and J.D. Power's 2023 renters insurance customer satisfaction study rankings.

These rates should be used for comparative purposes only. Your quotes may differ.

Lead Writer

Matt Timmons is a Lead Writer on the insurance team at ValuePenguin, where he writes in-depth and timely pieces helping find the right coverage for them.

He's covered insurance at ValuePenguin since 2018, specializing in auto and home insurance, as well as life insurance. He's paid special attention to the EV insurance market, where prices are much higher than for gas cars.

Before he started writing about personal finance, Matt wrote about professional skills and online tools at an e-learning company.

How insurance helped Matt

During freshman orientation in college, Matt's iPod was stolen off his table while he was eating lunch. Luckily, he'd bought a college insurance plan the day before and he had money to buy a replacement before classes started.

Expertise

- Auto insurance

- Home insurance

- Insurance rate analysis

- Life insurance

Referenced by

- CNBC

- Miami Herald

- Yahoo! Finance

Education

- BA, Wesleyan University

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.