The Best Cheap Renters Insurance in Maine

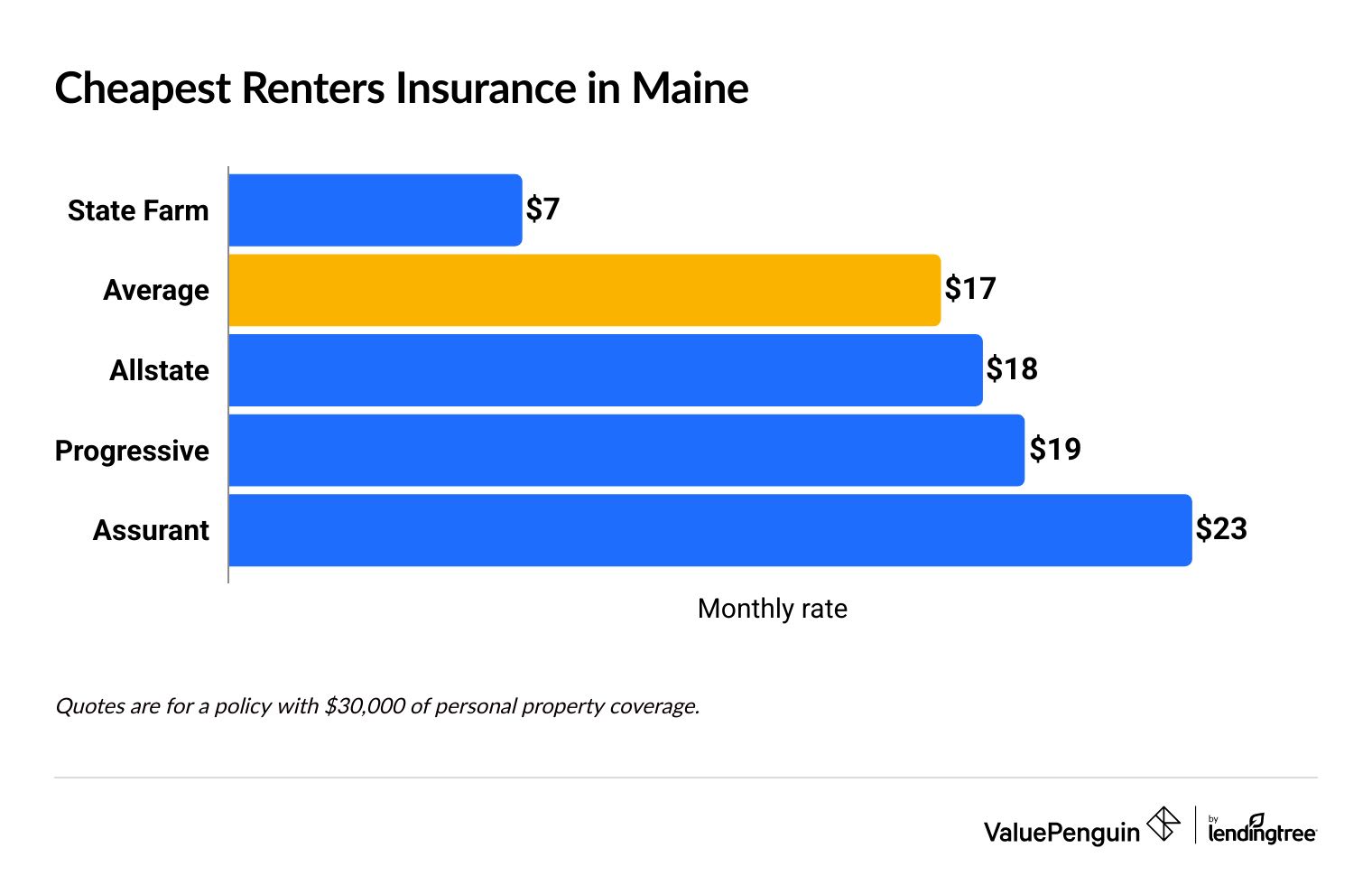

State Farm has the cheapest renters insurance rates in Maine. A policy costs $7 per month, on average.

Compare Renters Insurance Quotes in Maine

Best Cheap Renters Insurance in Maine

To find the best renters insurance in Maine, ValuePenguin reviewed 83 quotes from the top four renters insurance companies in the state. Our experts rated the companies based on price, coverage options and customer service.

See our full methodology.

Cheapest renters insurance companies in Maine

State Farm sells the cheapest renters insurance policies in Maine.

A renters insurance policy from State Farm costs $7 per month, on average.

Renters insurance in Maine usually costs an average of $17 per month. Maine has some of the cheapest renters insurance rates in the country.

Compare Cheap Renters Insurance Quotes in Maine

While State Farm is the only company with average rates cheaper than the state average, Progressive and Allstate are also good options. Progressive has lots of extra coverage options that can help you personalize your policy to your needs. And Allstate has a large discount for seniors who rent.

Cheap renters insurance quotes in Maine

Company | Monthly cost | ||

|---|---|---|---|

| State Farm | $7 | ||

| Allstate | $18 | ||

| Progressive | $19 | ||

| Assurant | $23 | ||

Renters insurance rates are set using several factors, including where you live and the amount of coverage you need.

Your rates are also influenced by things like your age, marital status and insurance history — including whether you've made claims in the past. For this reason, you may even have different rates than someone else who lives in your neighborhood.

Best renters insurance for most people: State Farm

-

Editor's rating

- Cost: $7/mo

State Farm's cheap renters insurance is a good option for most renters in Maine.

Pros:

-

Cheap rates

-

Good customer service

Cons:

-

Fewer discounts than other companies

State Farm's cheap renters insurance policies also have good quality coverage.

On average, a policy from State Farm costs $7 per month. That's $10 cheaper each month than the state average.

State Farm's customer service is also highly rated. Customers are usually happy with the service and coverage they get with State Farm. That might be because State Farm policies come with a dedicated local agent. If you have questions or problems, you'll talk with your agent. That means you should get more personalized service than you would by calling an 800 number.

State Farm also offers good extra coverages. You can add identity theft coverage, which helps pay for the cost to restore your identity if it's stolen, and water backup coverage to protect your belongings from water damage when a basement, sewer or drain line backs up.

State Farm also offers replacement cost coverage for your belongings. That means, if you file a claim, you'll get the actual cost to replace your stuff instead of the amount it's worth. For example, a 5-year-old TV might only be worth $100, but it could cost $500 to replace it with a similar new model. With replacement cost coverage, you'll get the full $500, even if your TV is old and worn.

But State Farm doesn't have as many discounts as other companies. You can only save if you bundle your renters insurance with car or motorcycle insurance and if you have a home security system. But because State Farm's rates are so cheap, this might not be a problem.

Best renters insurance for extra coverage: Progressive

-

Editor's rating

- Cost: $19/mo

Progressive has lots of coverage options that let you customize your policy.

Pros:

-

Lots of extra coverage options

-

Several discounts available

Cons:

-

Rates are higher than average

-

Customer satisfaction is low

Progressive's extra coverage options let you build a policy that works for your needs.

Progressive renters insurance automatically comes with replacement cost coverage for your belongings. If you have high-value items like jewelry, you can add extra coverage to protect them. And Progressive is one of the few companies that offers coverage for mold damage to your things.

Progressive also has several discounts to help you get a cheaper monthly rate. Like most companies, Progressive lets you save if you bundle your car and renters insurance. But you can also save if you get a quote ahead of when you need your policy to start, if you sign up for paperless statements and if you pay your full yearly bill at once.

Progressive's monthly rate is higher than the state average. You might be able to save money with the discounts, but it's still not the best option if you're on a budget. And Progressive has lower customer satisfaction than other top companies, like State Farm.

Best renters insurance for seniors: Allstate

-

Editor's rating

- Cost: $18/mo

If you're at least 55 and retired, Allstate gives you a 25% discount on renters insurance.

Pros:

-

25% discount for seniors

-

Local agents can offer personal service

Cons:

-

More expensive than average

-

Customer satisfaction is below average

Allstate offers a big renters insurance discount to retired people over 55.

If you're at least 55, don't work and aren't actively looking for a job, you can get 25% off your Allstate renters insurance policy. You can also save by bundling your auto and home insurance with Allstate or by paying automatically or in full.

Allstate also has local agents in several Maine cities. Working with an agent can be helpful, especially if you want extra guidance on your coverage.

Allstate's rates tend to be higher than the state average. Seniors can still get a cheap policy because of the discount, but if you're younger, you're better off with State Farm.

Allstate also doesn't have the best customer service. But you can work with a local agent to get an Allstate renters insurance policy, and service varies depending on your agent. Talking to people in your area might help you find an Allstate agent who provides good service.

Renters insurance cost in Maine by city

Topsham, which is north of Brunswick, has the cheapest renters insurance rates among Maine's larger cities, at an average of $15 per month.

Augusta, the state's capital, is the most expensive city for renters insurance, with rates averaging $27 per month.

The cost for renters insurance changes based on where you live. Larger cities usually have a higher cost of living, which means claims are more expensive. That translates to higher rates.

City | Monthly rate | % from average |

|---|---|---|

| Auburn | $21 | 28% |

| Augusta | $27 | 60% |

| Bangor | $17 | 1% |

| Biddeford | $18 | 9% |

| Brewer | $17 | 4% |

How to get the best renters insurance in Maine

To get the best renters insurance for you, think about your coverage in addition to your budget. Buying a policy just because it's cheap could cause issues if it doesn't have proper coverage.

Decide how much coverage you need. Before you shop for quotes, figure out how much coverage you need. Most landlords require at least $100,000 in personal liability coverage, which protects you from lawsuits if you're found at fault for someone's injuries or damage to their property.

You should also think about your personal property coverage, which covers your belongings. Make a rough list of all your things, including clothes, furniture and electronics, and estimate how much they are worth.

Get quotes from several companies. Different companies charge different rates, so you should get quotes from a few different insurance providers. Reviewing quotes from several companies lets you get the coverage you need at the best price.

Pay attention to the extra coverage options each company has, especially if you need specialized coverage for things like high-value items or liability coverage for damage or injuries caused by pets. Review each company's customer satisfaction too. Choosing a company with good service can make things easier if you need to file a claim.

Ask about discounts. Most online quote tools and agents will automatically apply discounts that you qualify for, but it never hurts to see if there are other ways to save. You can probably save money by getting your renters insurance from the same company that has your car insurance, paying in full or automatically, or having a security system in your rented house or apartment.

What renters insurance coverage do I need in Maine?

Maine's position on the coast makes it vulnerable to winter storms and flood damage. Making sure you have the right coverage can help you ensure your stuff is protected if it gets damaged.

Does Maine renters insurance cover winter storms?

Renters insurance usually covers water damage caused by winter storms.

Winter storms can bring heavy snow, wind and ice, all of which can cause water to leak into your rented home or apartment. If you have furniture, clothes or electronics in an area that gets wet, your renters insurance will probably pay to repair or replace them.

Does renters insurance in Maine cover flooding?

Renters insurance doesn't automatically cover damage caused by floods.

All of Maine's counties have a risk of flooding, not just the coastal areas. If you live in an apartment that isn't on the ground floor, flooding might not be an issue for you. But if you live in a ground-floor apartment or rented home, consider buying flood insurance to protect your stuff from flood damage.

Maine renters insurance trends

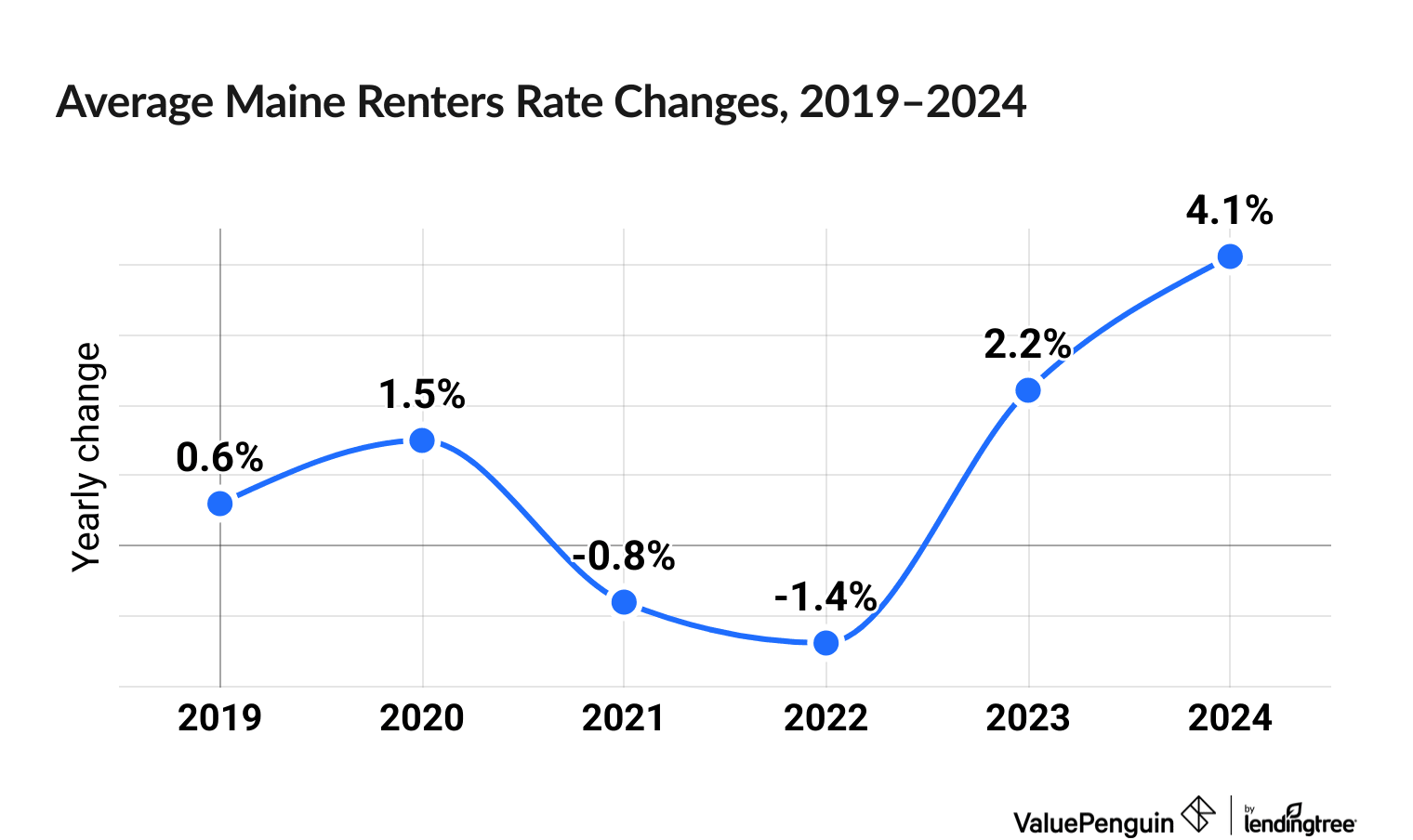

Renters insurance prices have gone up 6.2% in Maine over the last six years.

For most companies, Maine renters insurance rates went up between 4.4% and 50.3% over the last six years, with an overall increase of 6.2%. Only two companies, State Farm and Progressive, saw a decrease in rates.

Renters insurance prices, on average, decreased overall in 2021 and 2022, but then saw a slight uptick of 6.4% across 2023 and 2024.

Among the major ME insurers, the biggest increases have been at Nationwide (69.1%), USAA (50.3%) and Farmers (25.4%).

Renters insurance rate change data was compiled using RateWatch from S&P Global, which uses information from the National Association of Insurance Commissioners (NAIC).

Frequently asked questions

What's the best renters insurance in Maine?

State Farm sells the best renters insurance in Maine for most people. State Farm's rates for renters insurance are the cheapest in the state, averaging $7 per month, and the company has excellent customer service.

What is the average cost of renters insurance in Maine?

Maine renters insurance costs $17 per month, on average. Your rate depends on how much coverage you need, where you live and if you've ever filed an insurance claim before. Shopping around and comparing quotes can help you find a cheaper policy.

Is renters insurance required in Maine?

No state requires renters insurance by law. But it's very common for landlords and apartment complexes to require proof of renters insurance. Even if you aren't required to have a policy, it's usually a good idea.

Methodology

To find the cheapest renters insurance in Maine, ValuePenguin reviewed quotes from the largest four renters insurance companies in the state across the 25 largest cities. The quotes are for a 30-year-old single woman with no past claims and the following coverage limits:

- Personal property: $30,000

- Loss of use: $9,000

- Liability: $100,000

- Medical payments: $1,000

- Deductible: $500

The quotes in this report are for comparison purposes only. Your rates will be different.

ValuePenguin reviewed and ranked each renters insurance company in Maine based on average cost, coverage options and customer service. Customer service ratings were determined based on our own ValuePenguin editor's rating, J.D. Power annual customer satisfaction survey scores and National Association of Insurance Commissioners (NAIC) complaint index data.

Insurance Writer

Cate Deventer is a ValuePenguin writer who specializes in health insurance, Medicare, auto and home insurance. She's been a licensed insurance agent since 2011.

She started her insurance career working as a customer service agent for State Farm. She later moved to an independent agency, where she worked with several insurance companies and hundreds of clients. She quoted policies, filed claims and answered insurance questions. In 2021, she pivoted her career and began writing about insurance for Bankrate. She moved to ValuePenguin in 2023 and began writing about health insurance and Medicare.

Cate has a passion for helping readers choose insurance to fit their needs. She enjoys knowing that her research and knowledge help people choose insurance products that make a positive difference in their lives.

How insurance helped Cate

Cate used her health insurance knowledge to navigate a surgery in 2023. Understanding how her policy worked let her focus on recovery instead of worrying about bills.

Expertise

- Health insurance

- Medicare & Medicaid

- Auto insurance

- Home insurance

- Life insurance

Credentials

- Licensed Life, Accident & Health Insurance Agent

- Licensed Property & Casualty Insurance Agent

Referenced by

- CBS

- NBC

- Wall Street Journal

Education

- BA, Theatre, Purdue University

- BA, English, Indiana University

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.