The Best Cheap Renters Insurance in Idaho

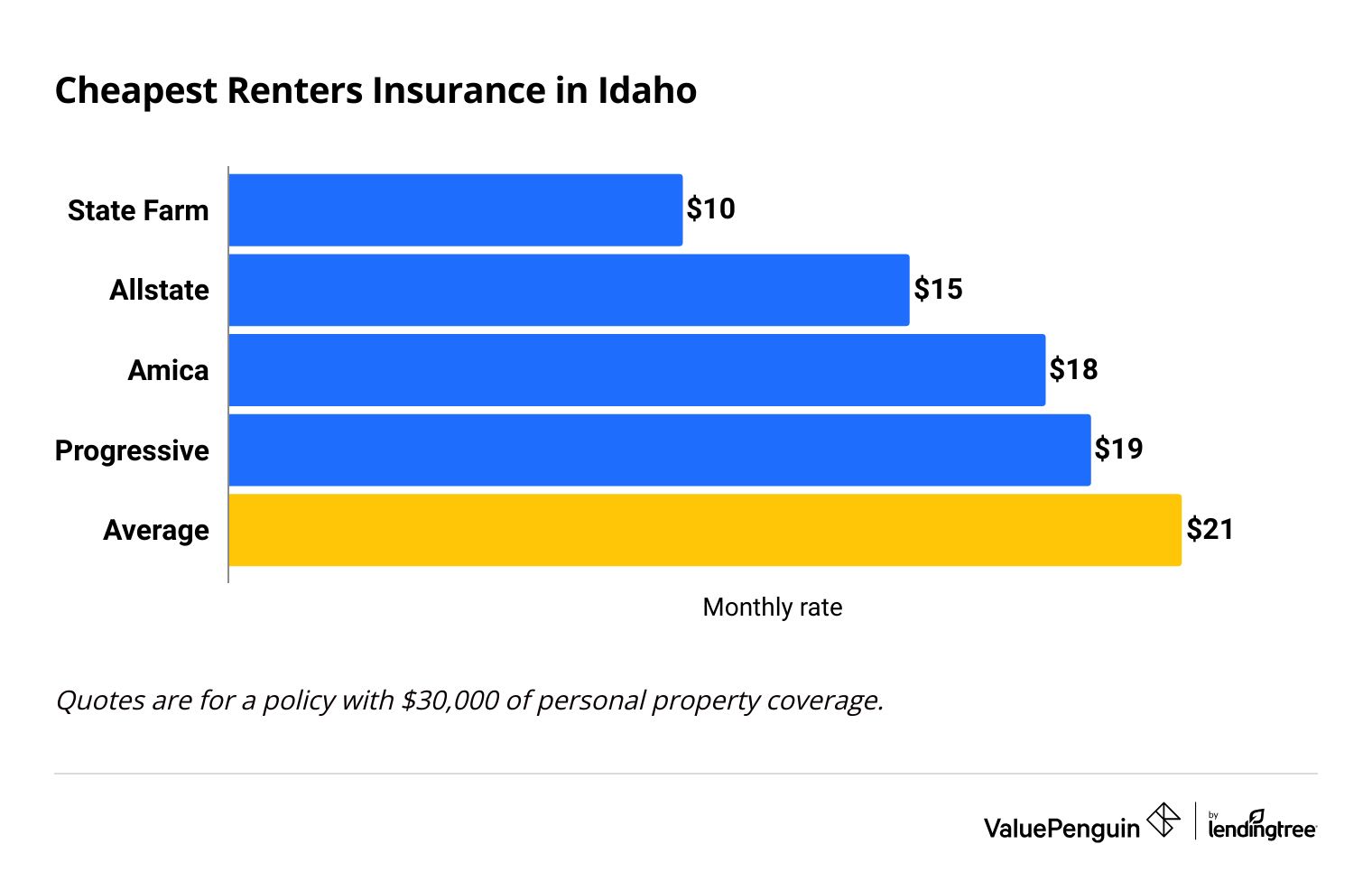

State Farm has the cheapest renters insurance in Idaho, at $10 per month for $30,000 of personal property coverage on average.

Compare Renters Insurance Quotes in Idaho

Best Cheap Renters Insurance in ID

To find the best renters insurance in Idaho, ValuePenguin editors rated companies by costs, coverage, unique offerings and customer service.

Our experts gathered 160 quotes from the 25 largest cities and towns in Idaho to find the cheapest rates in ID.

Most affordable renters insurance in ID

State Farm has the cheapest renters insurance quotes in Idaho.

The company's plans cost an average of $10 per month for $30,000 of personal property coverage That's roughly half the Idaho state average.

Allstate also has affordable rates at $15 per month on average. However, Allstate has a poor reputation for customer service, and the company offers fewer discounts and coverage add-ons than many of its competitors.

Compare Cheap Renters Insurance in Idaho

Renters insurance in Idaho is slightly cheaper than the national average. Rates are similar in nearby Oregon and Nevada. But, Idaho has more expensive coverage on average than Washington, Montana and Wyoming.

Top renters insurance companies in Idaho

Company | Monthly cost | ||

|---|---|---|---|

| State Farm | $10 | ||

| Allstate | $15 | ||

| Amica | $18 | ||

| Progressive | $19 | ||

| Assurant | $23 | ||

Best renters insurance in Idaho for most people: State Farm

-

Cost$10/moThis analysis used renters insurance quotes for the 25 largest cities in Idaho. Read our methodology.

Best Idaho renters insurance for customer service: Amica

-

Cost$18/moThis analysis used renters insurance quotes for the 25 largest cities in Idaho. Read our methodology.

Best renters insurance in Idaho for extra coverage: Progressive

-

Cost$19This analysis used renters insurance quotes for the 25 largest cities in Idaho.

Idaho renters insurance: Costs by city

Meridian, a Boise suburb, has the most expensive renters insurance in Idaho, at $25 per month on average.

Lewiston, a small city near Oregon, has the cheapest renters insurance in Idaho, at $19 per month on average.

How much you pay for renters insurance depends in part on where you live. Crime rates, some natural disasters and the cost of labor and materials can all impact your monthly rate.

City | Monthly rate | % from average |

|---|---|---|

| Blackfoot | $22 | 6% |

| Boise | $21 | -1% |

| Burley | $22 | 4% |

| Caldwell | $20 | -2% |

| Chubbuck | $21 | 4% |

How to get the cheapest renters insurance in Idaho

To get the cheapest renters coverage in Idaho, it's a good idea to:

Find the right amount of coverage

Add up the cost of everything in your apartment or rented home. Your personal property coverage shouldn't be higher than the cost of your stuff.

That's because renters insurance will never pay more than what your property is worth. In addition, many policies take wear and tear into account when it comes to paying out claims, called actual cash value.

Renters insurance includes coverage to pay for injuries that happen in your apartment or rented home, called liability coverage. For example, if someone slips on your driveway, your liability coverage would cover their medical bills.

Liability coverage is cheap and important. Without liability insurance, you may be responsible for tens of thousands of dollars or more if someone sues you after getting hurt on your rented property. Many companies let you raise your liability limits to $1 million or more by buying a separate umbrella policy.

Compare quotes

One of the easiest ways to save on your renters coverage is to compare quotes.

You could save $270 per year by switching from the most expensive renters insurance company in Idaho, American Family, to the cheapest, State Farm. You don't need to sacrifice coverage or quality to get a cheaper rate.

For example, State Farm gets fewer complaints and has a better J.D. Power customer satisfaction rating than American Family. Amica also has affordable rates, and it's the best renters insurance company in Idaho for customer satisfaction.

Take advantage of discounts

Most renters insurance companies in Idaho offer one or more discounts. Bundling your renters and auto insurance is one of the best ways to save on your renters coverage. Other common discounts include pay in full, signing up for online bill pay and going several years without filing a renters insurance claim.

Common natural disasters to watch out for in Idaho

You may need coverage for floods and fires depending on where you live in Idaho.

Does renters insurance cover wildfires in Idaho?

Wildfires have burned over 400,000 acres in Idaho this year.

Wildfires have become more common in Idaho in recent years because of global warming. Fortunately, renters insurance typically covers fire and smoke damage. Keep in mind that renters insurance won't pay for damage to the building you live in. That's your landlord's responsibility.

Some renters policies also pay for you to stay at a hotel, AirbnB or VRBO, called loss of use coverage. Loss of use coverage doesn't come with every policy, so it's important to check your plan details before you buy.

Flood coverage for renters in Idaho

Floods are one of the most common natural disasters in Idaho.

Normal renters insurance does not cover flood damage. If you live in a basement or ground floor unit in a flood-prone area, consider getting a separate flood insurance policy for renters.

You can find your area's risk level by using FEMA's free online map tool.

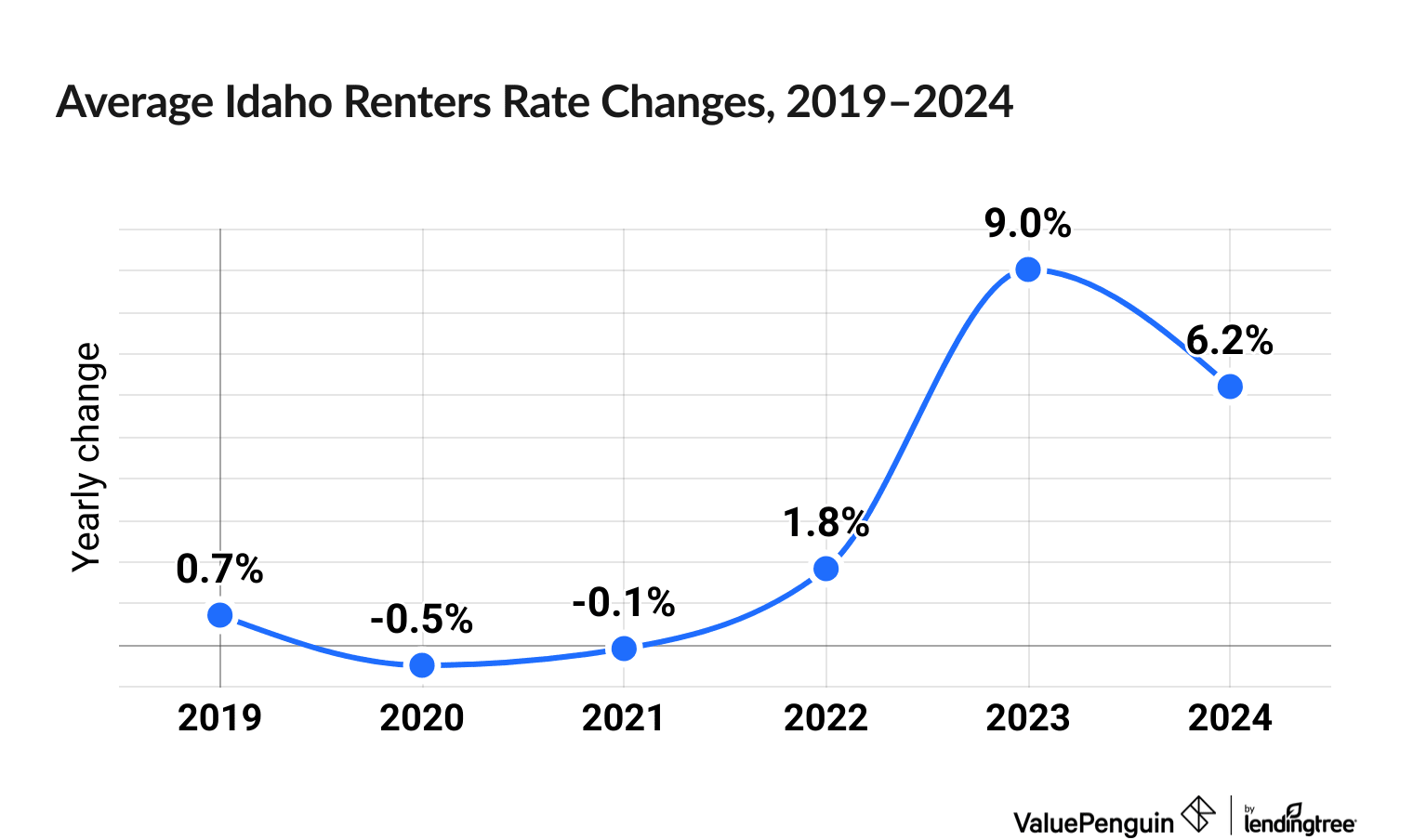

Idaho renters insurance trends

Renters insurance prices have gone up 15.8% in Idaho over the last six years.

Idaho renters insurance rates for different companies went up between 2.2% and 62.8 % over the last six years, with an overall increase of 15.8%. Only one company, Progressive, saw a decrease, by 4.2%.

Renters insurance prices, on average, decreased in 2020 and 2021, but then jumped by 13.7% across 2023 and 2024.

Among the biggest ID insurers, the biggest increases have been at Auto-Owners (62.8%), Nationwide (33.1%) and Farmers (30.5%).

Renters insurance rate change data was compiled using RateWatch from S&P Global, which uses information from the National Association of Insurance Commissioners (NAIC).

Frequently asked questions

Who has the best renters insurance in Idaho?

State Farm has the best renters insurance in Idaho. The company has cheap rates and a good reputation for customer satisfaction.

Does Idaho require renters insurance?

No, Idaho does not require renters to carry insurance. However, your landlord may require you to have renters insurance as part of your lease agreement.

What is the average cost of renters insurance in Idaho?

Renters insurance in Idaho costs $21 per month for $30,000 of personal property coverage on average. Keep in mind that your monthly rate depends on factors like where you live, the company you choose and the discounts you qualify for.

Methodology

ValuePenguin collected 160 quotes from Idaho's 25 largest cities for a single 30-year-old woman who has never filed a claim before. Coverage limits include:

- $30,000 of personal property coverage

- $9,000 for loss of use

- $500 deductible

- $100,000 of personal liability

- $1,000 of medical payments to guests

Customer service ratings were created using renters insurance quotes, complaint data from the National Association of Insurance Commissioners (NAIC) and the most recent J.D. Power 2023 renters insurance customer satisfaction survey.

These rates are only for comparative purposes. Your quotes will differ.

Natural disaster-related information was taken from the Idaho Office of Emergency Management, the U.S. Department of Agriculture and the National Interagency Fire Center.

About the Author

Senior Writer

Talon Abernathy is a ValuePenguin Senior Writer who specializes in health insurance, Medicare and Medicaid. He's also contributed to other insurance verticals including home, renters, auto, motorcycle and flood insurance.

Talon came to ValuePenguin in 2023. Since his arrival, he's helped to expand the site's health insurance-related content offerings. He enjoys helping readers understand the ins and outs of America's all too complicated health insurance landscape.

Before coming to ValuePenguin, Talon worked as a freelance writer. His prior work has touched on a broad range of personal finance-related topics including credit-building strategies, small business incorporation tactics and creative ways to save for retirement.

Insurance tip

In many parts of the country, you can qualify for a free Silver health insurance plan if you meet certain income requirements. Government subsidies in the form of premium tax credits and cost-sharing reductions may mean you'll pay nothing for coverage.

Expertise

- Health insurance

- Medicare and Medicaid

- Flood insurance

- Homeowners insurance

- Renters insurance

- Auto and motorcycle insurance

Referenced by

- The Miami Herald

- Money.com

- MSN

- Nasdaq

- The Sacramento Bee

- Yahoo! Finance

Education

- BA, University of Washington

- Certificate in Copyediting, UC San Diego

Credentials

- Licensed Life & Disability Insurance Agent

- Licensed Property & Casualty Insurance Agent

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.