The Best and Cheapest Homeowners Insurance Companies in Pennsylvania (2026)

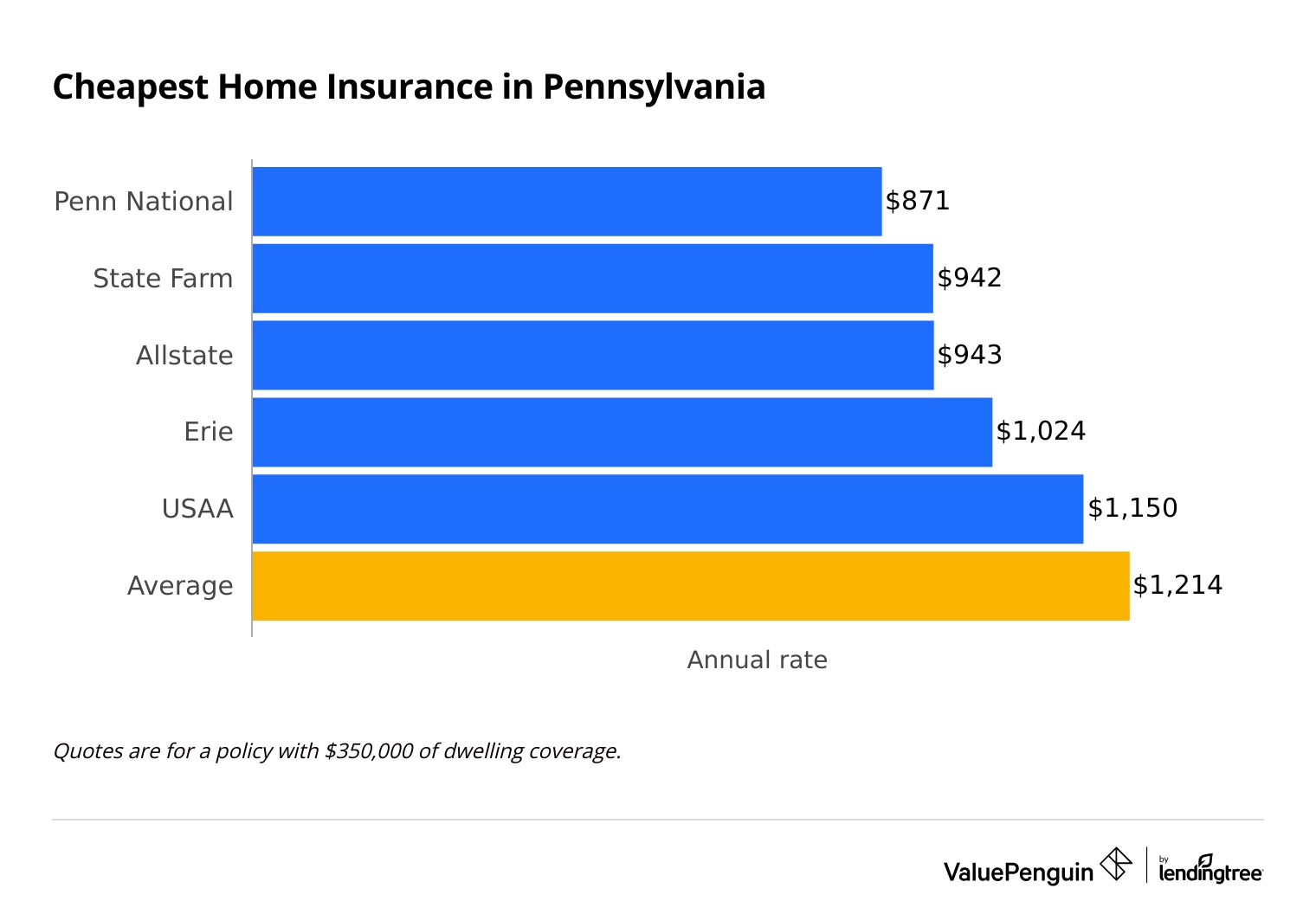

Penn National has the best cheap homeowners insurance in Pennsylvania, at $871 per year. | ||

Erie has the best customer service in Pennsylvania, at $1,024 per year. | ||

Allstate has the best coverage add-ons and discounts in PA, at $943 per year. |

Find Cheap Home Insurance Quotes in Pennsylvania

Best Cheap Home Insurance in Pennsylvania

ValuePenguin gathered thousands of quotes from top Pennsylvania homeowners insurance companies across hundreds of ZIP codes.

Our experts reviewed rates, coverage options, customer service and discounts to find the best home insurance in PA.

The cheapest home insurance quotes in PA

Penn National offers the cheapest homeowners insurance in Pennsylvania. On average, you'll pay $871 per year for $350,000 of dwelling coverage. That's 28% cheaper than the Pennsylvania state average of $1,214 per year.

Find Cheap Homeowners Insurance Quotes in Your Area

The cost of homeowners insurance in Pennsylvania differs widely between companies. You would pay nearly twice as much for a policy from the most expensive home insurance company in Pennsylvania, Chubb, compared to equivalent coverage from the cheapest home insurance company in Pennsylvania, Penn National.

Comparing quotes for homeowners insurance can save you $748 per year on $350,000 of dwelling coverage.

Cheap annual home insurance quotes in PA

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| Penn National | $577 | |

| Erie | $626 | ||

| State Farm | $658 | ||

| Allstate | $776 | ||

| Travelers | $779 | ||

Natural disasters to watch out for in Pennsylvania

Pennsylvania's location and landscape mean large parts of the state are vulnerable to hurricanes, flooding and blizzards. Those living in Philadelphia or other coastal areas should get coverage for powerful tropical storms, which sometimes make their way up the coast. You may also need extra protection against blizzards and heavy snowfall depending on where you live.

Pennsylvania residents in low-lying, flood-prone areas may need special flood insurance.

Best homeowners insurance in PA for most people: Penn National

-

Editor's rating

- Cost: $871/yr

Penn National has the cheapest homeowners insurance rates in Pennsylvania.

Pros:

-

Cheap rates

-

Great customer service

-

Strong network of local agents

-

Many coverage options available

Cons:

-

No online quotes

Penn National offers the lowest rates for homeowners insurance in Pennsylvania for $350,000 of dwelling coverage.

Penn National also has the best rates for cheaper homes, and it has competitive quotes for high-value homes. In addition, Penn National offers strong customer service. It gets roughly half as many complaints as an average insurance company of the same size, according to the National Association of Insurance Commissioners (NAIC).

Customers can modify their home insurance policies by choosing one or more of Penn National's coverage add-ons.

Penn National extra coverage options

- Identity theft: Pays for legal fees and other costs such as printing and mailing documents.

- Loss assessment: Covers losses you're responsible for as an HOA (homeowners association) member.

- PennPac: Increase your existing policy limits and get extra coverage for specific items such as your passport, rare coins and large appliances.

- Personal umbrella: Get $1 million or more in extra liability coverage.

- Personal property replacement cost: Pays to replace your personal property at today's prices without taking depreciation into account.

- Specified additional amount of coverage: Protects against sudden increases in the cost of labor and materials.

- Underground utility line coverage: Protects against burst sewer and water lines outside your home.

- Valuable articles: Covers specific, high-value items, such as fur coats, jewelry or art.

- Water backup and sump overflow: Pays for losses and damage caused by water from a backed-up pipe inside of your home.

You can't get an online quote for Penn National. This makes it harder to comparison shop since you'll have to pick up the phone and call an agent. However, some Pennsylvania homeowners appreciate the personalized touch offered by a local agent.

Best homeowners insurance in PA for customer satisfaction: Erie

-

Editor's rating

- Cost: $1,024/yr

Erie has low rates and a strong reputation for customer satisfaction.

Pros:

-

Excellent customer service

-

Affordable prices

-

Extra coverage included in basic policies

-

Strong network of local agents

Cons:

-

No online quotes available

-

Few discount options available

Erie gets significantly fewer complaints compared to an average company its size, according to the NAIC. That means most Erie customers probably have a smooth claims process.

Erie ranked No. 1 for customer satisfaction among large homeowners insurance companies, according to a recent J.D. Power survey.

It's important to choose a company with a strong customer service reputation because you don't want to deal with an extra headache while your home is being repaired.

Erie also has some of the most affordable rates of any Pennsylvania home insurance company. It charges $1,024 per year on average for $350,000 of dwelling coverage. That's $190 per year less than the PA state average.

Erie has a higher level of basic coverage compared to many of its competitors. For example, policies come standard with guaranteed replacement cost. This will pay the full cost to replace your personal property. A standard Erie homeowners policy also comes with coverage for pets, cash, precious metals like gold and silver, gift cards and hard-to-replace items like deeds and passports.

Erie offers a generous discount when you have more than one policy through Erie, called a multiline discount. However, it has fewer discounts overall than many of its competitors. In addition, Erie doesn't let you get a quote online. You'll have to get in touch with an agent to buy a policy.

Best homeowners insurance in PA for extra coverage and discounts: Allstate

-

Editor's rating

- Cost: $943/yr

Allstate offers a range of extra coverage options and discounts when you buy a homeowners policy.

Pros:

-

Many discounts and extra coverage options

-

Cheap rates

-

Helpful digital tools and resources

-

Strong network of local agents

Cons:

-

Middle-of-the-road customer satisfaction

-

Poor choice for bundling

Allstate offers a wide range of extra coverage options that you can add to your homeowners policy.

- Manufactured/mobile home insurance

- Host Advantage

An Allstate homeowners policy in Pennsylvania costs $943 per year for $350,000 of coverage in Pennsylvania, on average. That's $271 per year less than the PA state average. You can lower your monthly rate even further by taking advantage of one or more of Allstate's many discounts.

Allstate has a range of helpful tools and resources for homeowners on its website. You can access these for free, and you do not need an Allstate policy to take advantage of them. First-time homebuyers may find these tools particularly helpful.

Keep in mind that Allstate has middle-of-the-road customer satisfaction. It gets slightly fewer complaints compared to an average company of the same size, according to the NAIC. However, it ranks well below average on J.D. Power's most recent homeowners insurance survey.

Average cost of home insurance in Pennsylvania

Pennsylvania has the seventh-cheapest home insurance rates in the U.S.

Home insurance in Pennsylvania costs $1,214 per year on average. That's 44% less than the national average of $2,151 per year.

Average cost of home insurance in PA

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $832 |

| $350,000 | $1,214 |

| $500,000 | $1,615 |

| $1,000,000 | $3,025 |

Cost of Pennsylvania home insurance by city

Philadelphia has the most expensive home insurance rates in Pennsylvania, averaging $1,711 per year. State Line has the cheapest home insurance, at $1,016 per year.

Unlike most of Pennsylvania, Philadelphia is at risk of getting hit by hurricanes and nor'easters. That's one reason why home insurance costs 41% more in this city than in the state as a whole. By contrast, home insurance in Pittsburgh, Pennsylvania's second largest city, costs 5% less than the state average.

City | Annual rate | % from avg. |

|---|---|---|

| Aaronsburg | $1,093 | -10% |

| Abbottstown | $1,053 | -13% |

| Abington | $1,381 | 14% |

| Ackermanville | $1,139 | -6% |

| Acme | $1,138 | -6% |

Rates are for a policy with $350,000 of dwelling coverage.

The best home insurance companies in Pennsylvania

State Farm and Erie have the best combination of low rates and good customer service in Pennsylvania.

USAA also has great customer service, but it's only available to military members, veterans and their families.

Company |

Rating

|

Complaints

|

|---|---|---|

| State Farm | Average | |

| Erie | Average | |

| Penn National | Average | |

| Westfield | Low | |

| Travelers | Low |

It's important to look at more than monthly rates when shopping for a home insurance policy. Factors like a company's customer service reputation and financial stability will impact your claim filing experience.

The best home insurance companies in Pennsylvania offer a combination of low prices, good customer service and quality coverage.

Natural disasters in Pennsylvania

Depending on where you live in Pennsylvania, you may need coverage for common natural disasters like hurricanes, floods or snow.

Hurricanes and nor'easters only impact a small part of the state's eastern edge. However, this includes Philadelphia, which is the largest city in Pennsylvania. Fortunately, homeowners insurance typically includes protection against wind damage. That means you won't have to buy extra coverage to protect against storms.

However, it's a good idea to check your coverage limits to make sure you're protected.

Standard home insurance policies don't protect against flood damage.

You need to buy separate flood coverage if you live in an area at high risk for flooding. You check online through the FEMA website to see if your home lies in a vulnerable area or flood zone.

Your mortgage company may require you to buy flood insurance if you live in a high-risk location. Many home insurance companies in Pennsylvania offer flood insurance including Allstate, Farmers and other national companies.

Snowstorms are common in Pennsylvania. Fortunately, your homeowners insurance will almost always cover damage caused by heavy snowfall. Frozen pipes are also usually covered, so long as you made an effort to keep them from freezing.

Tips to save money on your Pennsylvania home insurance policy

Comparing quotes from different companies is the easiest way to get the best rate on your Pennsylvania homeowners insurance.

You could save $748 per year by switching from Chubb to Penn National. It's always a good idea to get quotes from several companies to make sure you're getting the best rate.

If you're still not satisfied with your monthly rate, consider raising your deductible. Keep in mind that you're responsible for paying your entire deductible. You should never raise your deductible beyond what you have in your savings account.

Many companies offer home insurance discounts you can take advantage of to lower your monthly rate even further.

Common home insurance discounts in PA

- Bundling discounts: When you buy two or more different types of insurance from the same company.

- Loyalty discounts: For staying with a single company for a set period of time.

- New customer discounts: When you buy a new policy.

- Claim-free discounts: When you haven't filed a claim in a set period of time.

- Home improvement/safety discounts: For making certain improvements or installing safety devices in your home like a burglar or fire alarm.

It's important to factor in the discounts you qualify for when comparing rates to make sure you're getting the best deal.

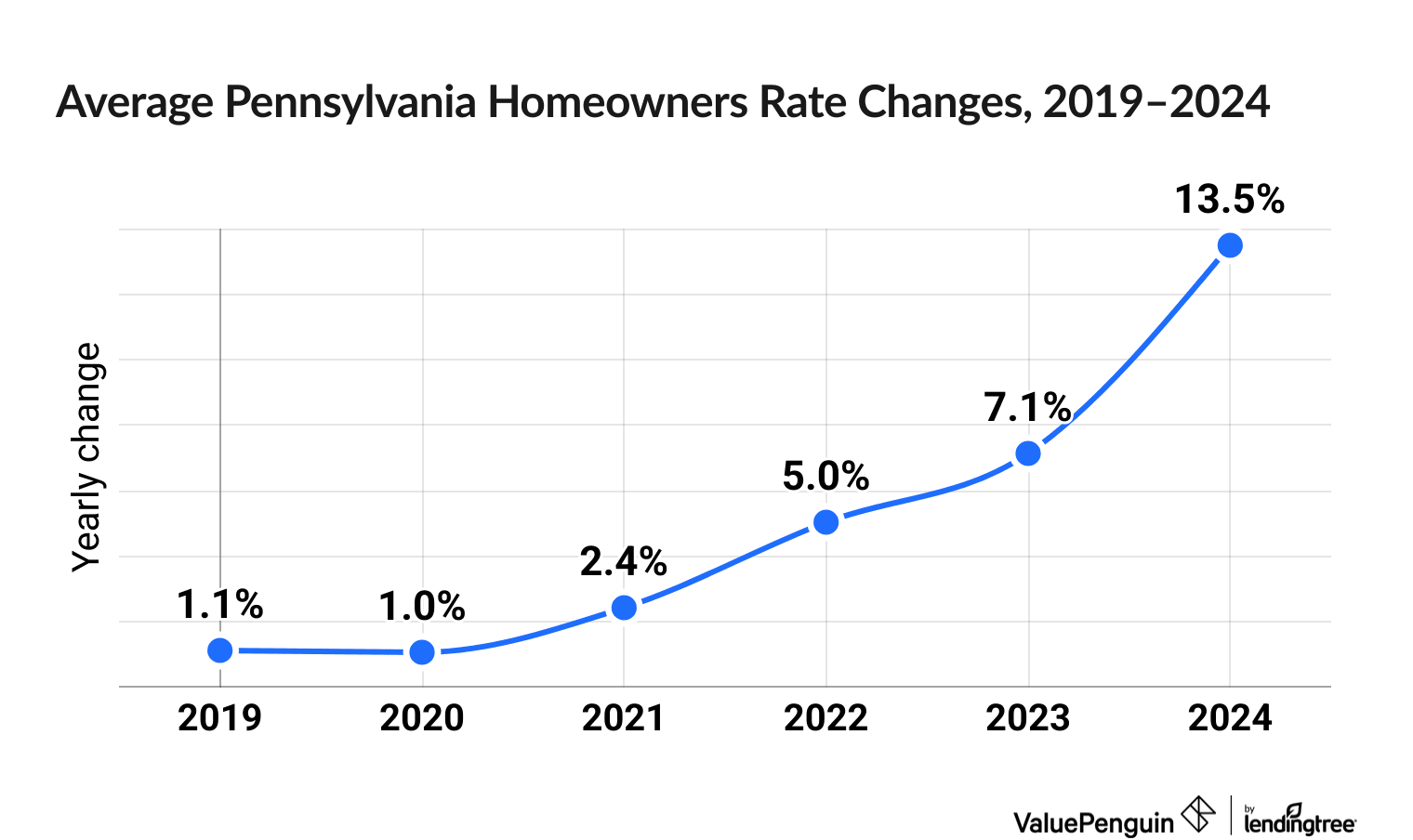

Change in Pennsylvania home insurance cost over time

Home insurance prices are up 33.4% in Pennsylvania over the last six years.

Home insurance costs in Pennsylvania were quite level in the early 2020s before seeing more substantial increases in 2023 and 2024.

Pennsylvania homeowners faced a rate jump of 13.5% in 2024. That nearly doubled the increase in 2023 of 7.1%.

Among companies, Farmers Insurance rates more than doubled (102.5%) between 2019 and 2024, making it the biggest increase over that period. The next highest was Progressive at 57.7%.

USAA had the smallest increase among companies with just an 11.8% increase in home insurance prices.

Home insurance rate change data was compiled using RateWatch from S&P Global, which uses information from the National Association of Insurance Commissioners (NAIC).

Frequently asked questions

What's the best and cheapest company for homeowners insurance in Pennsylvania?

Penn National has the cheapest rates for home insurance in Pennsylvania. It costs $871 per year for $350,000 of dwelling coverage, which is 28% below the PA state average.

What is the average price for homeowners insurance in Pennsylvania?

Pennsylvania home insurance costs an average of $1,214 per year on average. That's 44% below the $2,151 per year national average.

Which homeowners insurance has the highest customer satisfaction rating in PA?

Erie is the best company for customer satisfaction in Pennsylvania. It gets significantly fewer complaints compared to an average company of the same size. Erie was also ranked No. 1 in a recent customer satisfaction survey run by J.D. Power.

Methodology

ValuePenguin collected quotes from the largest home insurance companies in Pennsylvania across hundreds of ZIP codes. Rates are for a 45-year-old married man with no history of insurance claims.

Quotes include the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. Quadrant's rates were taken from public filings and should only be used for comparative purposes.

Home insurance ratings were created using complaint data from the National Association of Insurance Commissioners (NAIC), the J.D. Power customer satisfaction survey and ValuePenguin's ratings.

About the Author

Senior Writer

Talon Abernathy is a ValuePenguin Senior Writer who specializes in health insurance, Medicare and Medicaid. He's also contributed to other insurance verticals including home, renters, auto, motorcycle and flood insurance.

Talon came to ValuePenguin in 2023. Since his arrival, he's helped to expand the site's health insurance-related content offerings. He enjoys helping readers understand the ins and outs of America's all too complicated health insurance landscape.

Before coming to ValuePenguin, Talon worked as a freelance writer. His prior work has touched on a broad range of personal finance-related topics including credit-building strategies, small business incorporation tactics and creative ways to save for retirement.

Insurance tip

In many parts of the country, you can qualify for a free Silver health insurance plan if you meet certain income requirements. Government subsidies in the form of premium tax credits and cost-sharing reductions may mean you'll pay nothing for coverage.

Expertise

- Health insurance

- Medicare and Medicaid

- Flood insurance

- Homeowners insurance

- Renters insurance

- Auto and motorcycle insurance

Referenced by

- The Miami Herald

- Money.com

- MSN

- Nasdaq

- The Sacramento Bee

- Yahoo! Finance

Education

- BA, University of Washington

- Certificate in Copyediting, UC San Diego

Credentials

- Licensed Life & Disability Insurance Agent

- Licensed Property & Casualty Insurance Agent

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.