Best Cheap Health Insurance in Michigan for 2026

Blue Care Network of Michigan has the best individual health insurance plans in Michigan. The cheapest plan costs $503 per month before discounts.

Find Cheap Health Insurance Quotes in Michigan

Best and cheapest health insurance plans in Michigan

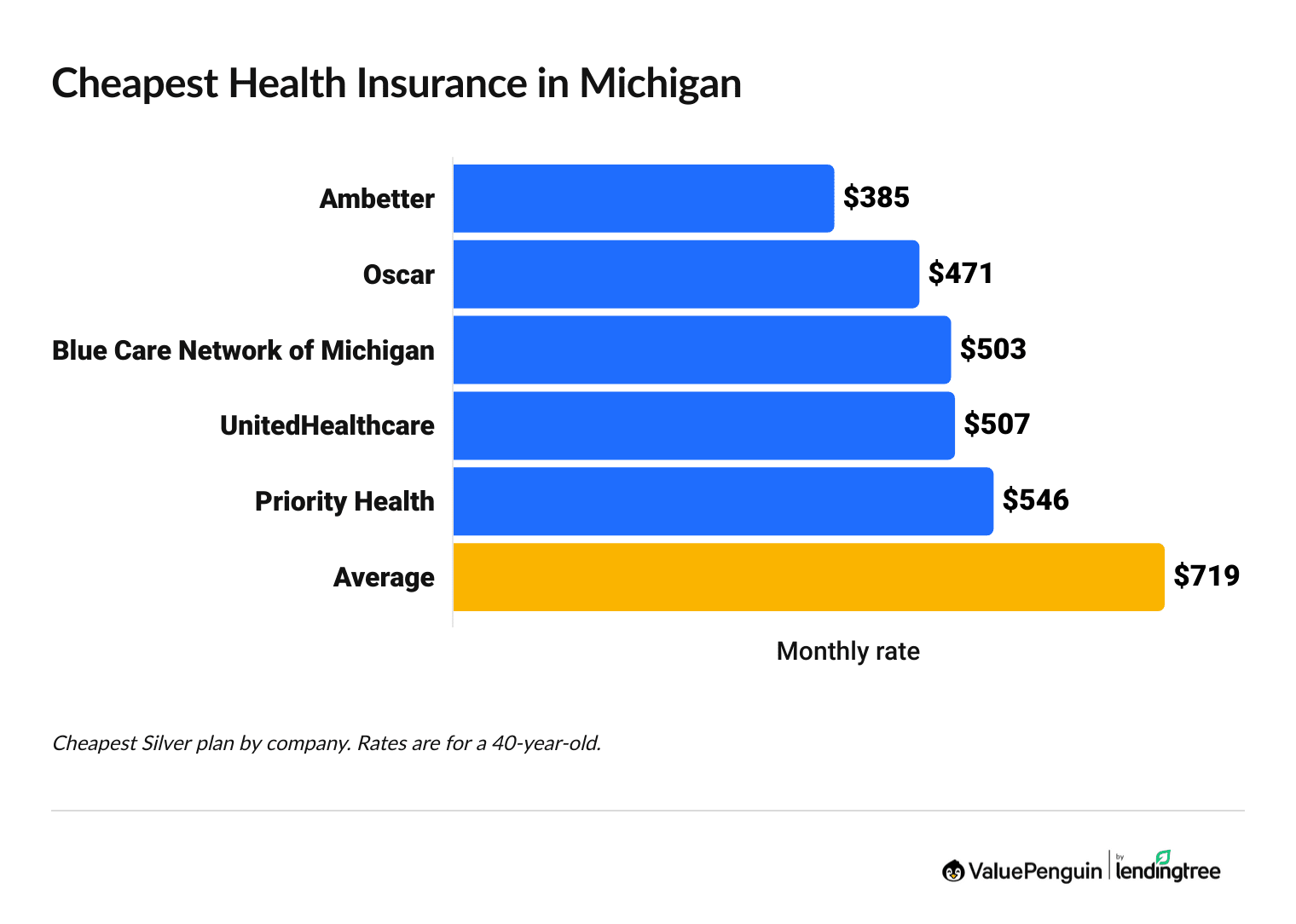

Cheapest health insurance companies in Michigan

Ambetter, Oscar, Blue Care Network of Michigan and UnitedHealthcare have the cheapest health insurance plans in MI, with Silver plans starting at $385 per month before discounts, called subsidies.

Find Cheap Health Insurance Quotes in Michigan

Affordable individual health insurance plans in Michigan

Company |

Cost

| |

|---|---|---|

| Ambetter | $385-$618 | |

| Oscar | $471-$476 | |

| Blue Care of MI | $503-$910 | |

| UnitedHealthcare | $507-$594 | |

Blue Care Network of Michigan has the cheapest health insurance quotes for most people in Michigan, including in Detroit. However, where you live in Michigan will change the cheapest plan option for you. Oscar has the most affordable health insurance in Grand Rapids, and Ambetter has the cheapest quotes in Ann Arbor.

Best health insurance companies in Michigan

Blue Care Network of Michigan has the best cheap health insurance in Michigan for most people.

Blue Care Network of Michigan stands out for its strong rating of 4 out of 5 stars from HealthCare.gov, which is among the best in the state. This high rating reflects the company's good reputation for service and plan quality.

Find Cheap Health Insurance Quotes in Michigan

Best-rated health insurance companies in Michigan

Company |

ACA rating

|

VP rating

|

|---|---|---|

| BCBS of Michigan | ||

| Priority Health | ||

| Ambetter | ||

| UnitedHealthcare |

Blue Care Network of Michigan is a different company from Blue Cross Blue Shield of Michigan. However, both companies are part of the Blue Cross Blue Shield network.

Blue Care Network of Michigan only sells HMO plans, which restrict you to a network of doctors unless you need emergency medical care. If you want the freedom to choose your own doctor and still have some coverage, consider Blue Cross Blue Shield of Michigan. It's the only company in Michigan to offer more flexible PPO (preferred provider organization) plans on the state health exchange. But it's important to remember you'll pay more for these plans than you would for an HMO.

Best health insurance plans in MI for flexible coverage: Blue Cross Blue Shield of Michigan

Blue Cross Blue Shield of Michigan is the only option for PPO (preferred provider organization) plans in Michigan. These give you the flexibility to visit a specialist without getting a referral first, and you can visit doctors outside your network for a higher cost.

You also don't need to choose a primary care doctor. However, PPOs tend to cost more than HMOs (health maintenance organizations), which are less flexible. Consider a PPO if you want the freedom to choose your doctors more than getting the cheapest quotes on your health insurance.

Blue Cross Blue Shield (BCBS) of MI is the most popular health insurance company in the state. BCBS of MI sells roughly 59% of all private health plans in Michigan. The company has a high-quality rating from HealthCare.gov. BCBS of MI also sells the only health plans in Michigan that let you go outside your network of doctors, called PPO plans.

Blue Cross Blue Shield has the largest network of doctors of any health insurance company nationwide.

However, BCBS of MI is more expensive than many of its competitors. The cheapest BCBS of Michigan individual Silver plan option costs $686 per month, on average. That's $301 per month more than the cheapest health insurance in Michigan, the Ambetter from Meridian Clear Silver plan.

How much is health insurance in Michigan?

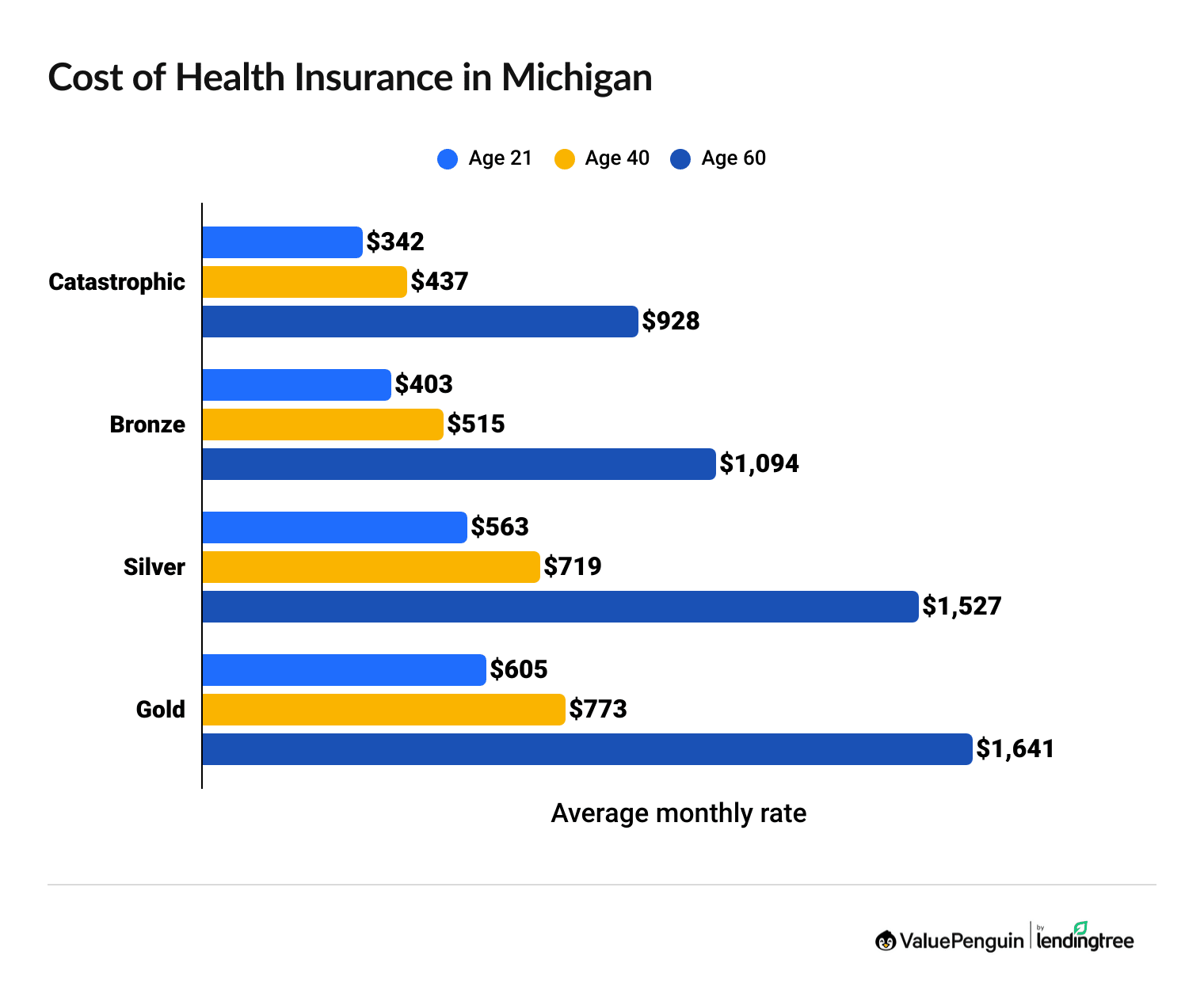

Health insurance in MI costs an average of $719 per month at full price or could possible be about $199 per month for people who qualify for discounts based on how much money they make.

Find Cheap Health Insurance Quotes in Michigan

Higher plan tiers have expensive monthly rates, but they cover a large portion of your doctor's bill. Lower plan tiers have cheap rates, but you pay more for medical care.

It's also important to remember that your age has a big impact on how much you pay for insurance. A 40-year-old in Michigan will pay roughly one-quarter more for the same Silver health plan as a 21-year-old, on average, and a 60-year-old will pay more than double what a 40-year-old pays for the same level of coverage.

Health insurance discount changes in Michigan for 2026

Medical insurance costs $719 in Michigan, or could be around $199 per month, on average, if you're eligible for discounts.

The cost of discounted health insurance is projected to go from about $96 per month in 2025 to $199 per month in 2026. That's because discounts are getting smaller in 2026. Between 2021 and 2025, you could get larger discounts, called "expanded subsidies," if you bought coverage through HealthCare.gov.

These extra discounts won't be available after 2025. Keep in mind, you can still get discounted health insurance in 2026. But the discount will be smaller than in the past few years.

Health insurance rates in Michigan after subsidies (2025 vs. 2026)

Income | 2025 rate | 2026 rate | Difference |

|---|---|---|---|

| $30,000 | $49 | $155 | 216% |

| $40,000 | $154 | $287 | 86% |

| $50,000 | $283 | $415 | 47% |

| $60,000 | $404 | $498 | 23% |

| $70,000+ | $404 | $523 | 29% |

Average cost after subsidies for a single 40-year-old with a Benchmark Silver plan.

- Who can get subsidies? To get subsidies, you have to earn between $15,650 and $62,600 as an individual ($32,150 and $128,600 for a family of four). The less you make, the higher your subsidy.

- How do subsidies work? When shopping for coverage on HealthCare.gov, you can use your subsidy to buy any Bronze, Silver or Gold plan. You can choose to apply your subsidy directly to your monthly rate, or you can get it as a lump sum on your tax return. You can't get subsidies with Catastrophic plans.

- How much do you save? Use ValuePenguin's subsidy calculator to get an idea of how much you'll pay for medical insurance in Michigan after discounts.

Cheap Michigan health insurance plans by city

Blue Care Network of Michigan has the cheapest medical insurance quotes in Detroit, at $508 per month for a Silver plan.

Oscar has the most affordable Silver health plan in Grand Rapids, at $471 per year.

Cheapest individual health insurance by MI county

County | Cheapest plan | Monthly rates |

|---|---|---|

| Alcona | Blue Care Network Preferred HMO Silver Saver | $645 |

| Alger | Blue Care Network Preferred HMO Silver Saver | $769 |

| Allegan | Ambetter Clear Silver | $471 |

| Alpena | Blue Care Network Preferred HMO Silver Saver | $645 |

| Antrim | Blue Care Network Preferred HMO Silver Saver | $592 |

Cheapest Silver plan with rates for a 40-year-old

Find Cheap Health Insurance Quotes in Michigan

Blue Care Network of MI has the cheapest rates for more than half of the population of Michigan, including the Detroit metro area.

Ambetter has the cheapest health insurance in Michigan for about 30% of the state's population and about one-third of Michigan's counties.

Best health insurance plans by level of coverage

Silver health plans offer the best combination of cheap rates and affordable costs when you visit the doctor.

It's important to remember that the best plan tier for you will depend on your medical needs and whether you qualify for discounts because of your income.

Gold plans: Best if you have ongoing or expensive medical needs

| Gold plans pay for about 80% of your medical care. |

Gold plans cost $773 per month in Michigan, on average.

That's $54 per month more than an average Silver plan.

A Gold plan makes sense if you think you'll have to spend a lot of money on medical care in the coming year. That's because you'll typically have a lower deductible, and lower copays and coinsurance.

Silver plans: Best for most people

| Silver plans pay for about 70% of your medical care. |

In Michigan, Silver health plans cost $719 per month, on average, with no discounts.

Silver plans offer a middle ground with moderate monthly rates and affordable costs that you're responsible for paying when you visit the doctor.

Average deductible by plan tier in Michigan

- Catastrophic: $10,600

- Bronze: $8,421

- Silver: $4,938

- Gold: $1,625

With a Silver health plan, you'll typically pay higher costs for most types of medical care. On average, you'll pay thousands of dollars more before your coverage starts with a Silver plan than you would with a Gold plan in Michigan.

Bronze plans: Best for affordable coverage

| Bronze plans pay for about 60% of your medical care. |

Michigan residents pay $515 per month for Bronze plans, on average.

That is a savings of $204 per month compared to an average Silver health plan.

A Bronze plan may be a good option if you're in good health and rarely visit the doctor. However, you'll pay more when you visit the doctor with a Bronze plan. In Michigan, Bronze health plans have deductibles that are $3,483 higher than those of Silver plans, on average.

Catastrophic plans: Best to prevent financial disaster

Catastrophic plans cost an average of $437 per month in Michigan.

You can only buy a Catastrophic health plan if you're under 30 years old or you qualify for a special hardship exemption.

Consider a Catastrophic plan if you only need protection for expensive emergencies and you have a large amount of money in your savings account.

Catastrophic plans have lower rates than Bronze plans. However, you'll have to pay $10,600 before your coverage begins for most medical care. It's important to remember that you can't qualify for subsidies with a Catastrophic plan.

Catastrophic plans are rarely worth it if you earn a low income and qualify for discounts.

Best health insurance for Michigan residents who earn low incomes

Michigan residents who struggle to afford medical insurance should consider Medicaid or a Silver health plan with discounts and cost-sharing reductions (CSRs).

Depending on your income, you may qualify for heavily discounted or free health insurance from the government.

Silver plans: Best if you earn a low income but can't get Medicaid

| Silver plans will pay 73% to 94% of your medical costs if you have a low income. |

You can qualify for extra financial help from the government called cost-sharing reductions with a Silver health plan. Other plan tiers don't have this option.

To get cost-sharing reductions in Michigan, you need to earn less than roughly $39,000 per year as an individual or $80,000 per year as a family of four.

Cost-sharing reductions help you pay for the costs you're responsible for when you visit the doctor, such as medical costs before you reach your deductible, copays and coinsurance.

Medicaid: Free health insurance for Michigan residents

Medicaid is free government health insurance for people who earn a low income.

Medicaid is the best health insurance option if you qualify. In Michigan, you can go on Medicaid if you make about $22,000 per year or less as a single person or $44,000 per year or less for a family of four. Pregnant women can qualify for Medicaid with an income of about $31,000 or less, and children younger than 18 are eligible if they have a family income of roughly $70,000.

Are health insurance rates going up in Michigan?

Health insurance rates rose by 26%, on average, in Michigan from 2025 to 2026. Silver health plans got 28% more expensive, on average. Gold plans increased by an average of 27%, and Catastrophic and Bronze plans got 25% and 24% more expensive, on average, respectively. The cost of a Silver plan rose by 75% between 2022 and 2026.

Are health insurance rates going up in MI in 2026?

Catastrophic

Bronze

Silver

Gold

Year | Cost | Change |

|---|---|---|

| 2022 | $295 | – |

| 2023 | $309 | 5% |

| 2024 | $328 | 6% |

| 2025 | $351 | 7% |

| 2026 | $437 | 25% |

Monthly costs are for a 40-year-old.

It's important to compare health insurance quotes every year. The cheapest health insurance in Michigan this year won't necessarily be the best choice next year.

Why is health insurance expensive in MI for 2026?

Health insurance in Michigan is getting more expensive for 2026 because of higher prescription drug prices and more doctor visits by enrollees.

Other factors driving up the cost of health insurance in Michigan are expiring tax credits, higher health care costs and inflation.

How to save money on medical insurance in 2026

- High-deductible health plans (HDHPs) typically have cheaper quotes than regular insurance plans.

- If you have an HDHP, open a health savings account (HSA) for significant tax benefits.

- Compare quotes to save on your monthly rate without sacrificing coverage or service quality.

- If you earn a low income, you may be eligible for free government health insurance, called Medicaid.

ACA essential health benefits

In Michigan, Obamacare plans bought through HealthCare.gov are required by law to cover 10 essential benefits regardless of the plan tier you choose.

- Outpatient care

- Emergency services

- Hospital care

- Care for pregnant women and newborns

- Services for mental health and substance use disorders

- Prescription drugs

- Rehabilitation services and devices

- Laboratory services

- Preventive, wellness and ongoing disease services

- Coverage for babies (pediatrics)

In addition, companies can't deny you coverage or charge you higher rates based on your health. All plans also have maximum annual limits on how much you'll spend for medical care, called out-of-pocket maximums.

Cost of Michigan health insurance by family size

How much you pay for health insurance will depend on the size of your family.

You'll pay an average of $430 per month for every child under 15 that you add to your plan. In Michigan, a family of four with two 40-year-old adults and two children under 15 will pay $2,299 per month before discounts for a Silver health plan.

Family size | Average monthly cost |

|---|---|

| Individual | $719 |

| Individual and child | $1,149 |

| Couple | $1,438 |

| Family of three | $1,868 |

| Family of four | $2,299 |

Averages based on a Silver plan for 40-year-old adults and children who are under age 15.

Short-term health insurance plans in Michigan

In January 2025, the Trump administration rolled back a rule that limits the length of short-term health policies to three months. That means you can get short-term health insurance in Michigan for up to 185 days.

You can buy short-term health insurance at any time of the year, not just during open enrollment. In addition, these plans tend to cost less than regular health insurance. But they typically offer worse coverage than marketplace plans.

Pros of short-term health insurance plans in MI

Cons of short-term health insurance plans in MI

Health insurance enrollment by income level in Michigan

Changes to Affordable Care Act (ACA) health insurance discounts will most affect people who earn a low income.

That's because those people are more likely to get coverage from HealthCare.gov than other groups. About 7 in 10 Michiganders with marketplace coverage in 2025 made under roughly $38,000.

Enrollment by income

Income | % of total enrollment |

|---|---|

| Less than $15,060 | 1% |

| $15,060 to $20,783 | 8% |

| $20,784 to $22,590 | 29% |

| $22,591 to $30,120 | 20% |

| $30,121 to $37,650 | 13% |

Enrollment in 2025 marketplace plans made during the 2024-2025 open enrollment period. Total may not be 100% due to rounding.

Frequently asked questions

Is $200 a month expensive for health insurance in Michigan?

No, $200 per month for medical insurance in Michigan is much cheaper than the state average for all plan tiers. Keep in mind, you can get even more affordable quotes by taking advantage of discounts, called subsidies.

Why are insurance rates going up in Michigan?

Health insurance rates in Michigan are going up in 2026 because of expiring marketplace discounts, more expensive prescription drugs, higher health care costs and inflation. Full-priced marketplace plans are getting 26% more expensive year on year, and the average cost of health insurance after subsidies is more than doubling.

What is the most affordable health insurance in Michigan?

Blue Care Network of Michigan has the cheapest Silver medical insurance for most Michigan residents, including those in the Detroit area. However, Oscar offers the most affordable quotes in Grand Rapids, and Ambetter has the cheapest coverage in Ann Arbor.

What is the average monthly cost of health insurance in Michigan?

The average monthly cost of health insurance in Michigan is $719 per month before discounts. Those who qualify for discounts could possibly pay around $199 per month, on average.

How do I get health insurance in Michigan?

If you don't have workplace coverage, the best way to get medical insurance in Michigan is by shopping through the state health exchange. Michigan's health marketplace lets you easily compare quotes and find out what discounts you're eligible for.

What is the best health insurance in Michigan?

Blue Care Network of Michigan offers the best health insurance in Michigan because of its good customer service reputation and affordable quotes. If you want more flexibility when it comes to choosing your doctor, consider getting a PPO plan from Blue Cross Blue Shield of Michigan.

Despite their similar names, Blue Care Network of Michigan and Blue Cross Blue Shield of Michigan are two different companies.

How do I get free health insurance in Michigan?

In Michigan, you may qualify for free government health insurance, called Medicaid, if you make around $22,000 per year ($44,000 for a family of four) or less. If you earn a low income but don't qualify for Medicaid, you may qualify for financial assistance from the government, called subsidies and cost-sharing reductions (CSRs).

Methodology

Michigan health insurance rate data for 2026 is from the Centers for Medicare & Medicaid Services (CMS) website. ValuePenguin used the CMS public use files (PUFs) to find average rates for different plan tiers, geographic locations and family sizes.

Rates

Rates are based on a 40-year-old with a Silver plan, unless otherwise noted. Rates for Bronze plans include regular and Expanded Bronze plans for 2024, 2025 and 2026, when the plans are available. Your costs and plan options will vary; plans aren't always available in all parts of a state or county.

Subsidies

Rates after subsidies are estimates for a 40-year-old with a Benchmark Silver plan and are based on how subsidies were structured before 2021. Prices are calculated using KFF's rates for full-price Benchmark plans, federal poverty levels (FPLs), IRS rules about premium tax credits and Congressional reports about expanded tax credits. The total cost in the state uses calculated rates by income, which are weighted using CMS data on the incomes of those who purchased plans during 2024-2025 open enrollment. The median was used for each income range. Unknown incomes were excluded from the calculations. Incomes of 100% of the federal poverty line and 500% of the federal poverty line were assumed for enrollees who earn less than 100% FPL and more than 500% FPL, respectively. Information about state subsidies, when available, was sourced from state marketplaces.

Ratings

ValuePenguin's experts rank companies based on cost, coverage options, customer satisfaction and unique value. Ratings are out of 100 possible points. ACA ratings show how the company performs in Michigan for medical care, member experience and plan administration. This 2026 plan quality data from CMS is based on data from the previous year. Ratings are not available for new plans or plans with low enrollment.

More sources

Enrollment trends, including plan selections by tier and enrollment by income, are from CMS data for the 2024-2025 open enrollment period.

Other sources include S&P Global Capital IQ and the National Association of Insurance Commissioners (NAIC).

About the Author

Senior Writer

Talon Abernathy is a ValuePenguin Senior Writer who specializes in health insurance, Medicare and Medicaid. He's also contributed to other insurance verticals including home, renters, auto, motorcycle and flood insurance.

Talon came to ValuePenguin in 2023. Since his arrival, he's helped to expand the site's health insurance-related content offerings. He enjoys helping readers understand the ins and outs of America's all too complicated health insurance landscape.

Before coming to ValuePenguin, Talon worked as a freelance writer. His prior work has touched on a broad range of personal finance-related topics including credit-building strategies, small business incorporation tactics and creative ways to save for retirement.

Insurance tip

In many parts of the country, you can qualify for a free Silver health insurance plan if you meet certain income requirements. Government subsidies in the form of premium tax credits and cost-sharing reductions may mean you'll pay nothing for coverage.

Expertise

- Health insurance

- Medicare and Medicaid

- Flood insurance

- Homeowners insurance

- Renters insurance

- Auto and motorcycle insurance

Referenced by

- The Miami Herald

- Money.com

- MSN

- Nasdaq

- The Sacramento Bee

- Yahoo! Finance

Education

- BA, University of Washington

- Certificate in Copyediting, UC San Diego

Credentials

- Licensed Life & Disability Insurance Agent

- Licensed Property & Casualty Insurance Agent

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.