Consumer Banking: Statistics and Trends

Banks have long played a major part in our financial lives. They help consumers build wealth for the long term and provide credit for major purchases and projects. However, new technology is driving substantial change in the way people interact with the banking industry. We've compiled a statistical reference to help you better understand the current trends and conditions in consumer banking.

U.S. Consumer Banking: Quick Facts

As a quick reference, we've compiled a set of statistics that answer some of the most commonly-asked questions about consumer banking. Each of these figures are discussed in greater detail in the sections below.

Question | Figure |

|---|---|

| What is the median savings account balance in the U.S.? | $7,000.00 |

| What is the median checking account balance in the U.S.? | $3,400.00 |

| What percentage of bank customers regularly use online and mobile banking? | 71% online, 43% mobile [1] |

| How often does the average U.S. consumer use a debit card? | 22.8 times a month [2] |

| Which bank operates the most branch locations in the U.S.? | Wells Fargo (6,087 branch offices) [3] |

| What percentage of Americans do not have bank accounts? | 7.0% [4] |

Average Bank Balances, Rates and Fees

The account products, interest rates and fees that banks offer tend to change gradually over time. We looked at consumer bank balances, deposit rate trends and fee policies at dozens of major banks to get a snapshot of the current state of banking in the U.S.

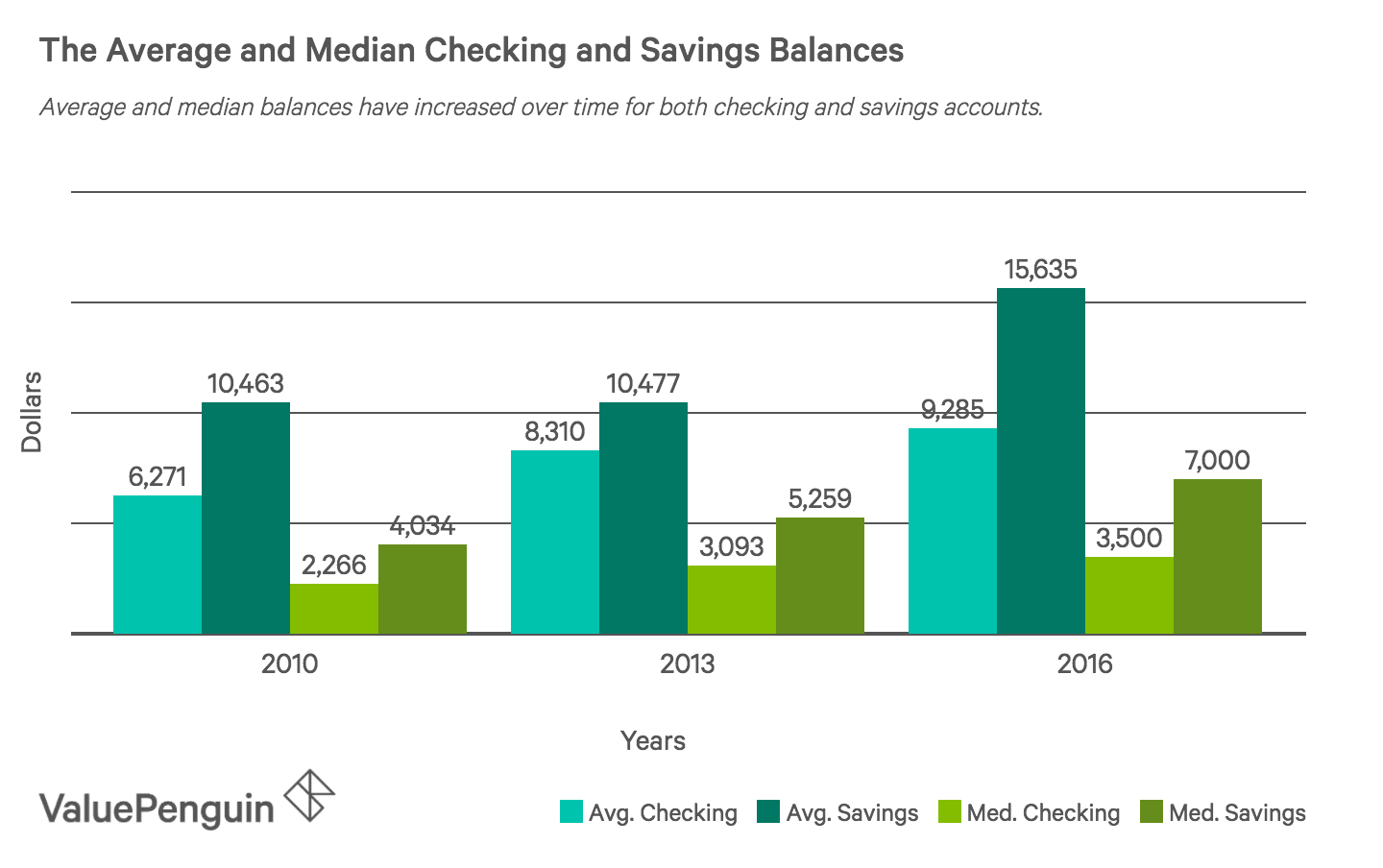

Average and Median Bank Balances

According to the Fed's latest available data, the average checking account balance was $9,284.92, a much higher figure than the median balance of $3,400. The current average savings account balance is $15,634.67, which is also higher than the median savings balance of $7,000.

Current Bank Interest Rates

Contrary to the continual interest rate hikes that we saw in 2018, the Federal Reserve has left its benchmark interest rate unchanged since entering 2019. The federal funds rate grew from a range of 1.25%-1.50% in Jan 2018 to a range of 2.00%-2.25% by Dec 2018. As of right now, the rate sits at a target range of 2.25%-2.50%. Further increases this year are unexpected despite strong domestic economic data as various global events such as the uncertainty of Brexit and the trade war with China remain unresolved.

Due to expectations that the federal funds rate will remain the same, consumers are seeing marginally lower rates in a wide range of financial products, including mortgages, loans, and consumer deposit accounts. Lastly, the battle for consumer and business deposits to fortify their balance sheet remains intense as regional banks lose deposit share and online banks gain deposit share. Below is a table of current average, low, and high savings, money market, and interest checking APYs.[5]

Account Type | Low | Avg. | High |

|---|---|---|---|

| Savings | 0.01% | 0.15% | 2.40% |

| Money Market | 0.01% | 0.34% | 3.50% |

| Interest Checking | 0.01% | 0.11% | 1.36% |

Typical Bank Fees

When opening an account, you should always take notice of the bank's service fees. The most common charges include monthly maintenance, ATM withdrawals, wire transfers and overdrafts. Such fees earn banks billions of dollars in annual revenue.

Standard Account Fees at 10 Largest U.S. Banks

Fee Type | Checking | Savings | Money Market |

|---|---|---|---|

| Monthly Maintenance Fees | $12-$25 | $0-$20 | $0-$12 |

| ATM Fees | $2.50-$5.00 | $2.50-$5.00 | $2.50-$3.00 |

| Overdraft Fees | $34-$36 | - | - |

| Wire Transfer Fees | $15-$50 | $15-$50 | $15-$50 |

Large banks provide a wide range of products and services for people of all financial situations. As a result, there are several tiers of bank accounts with different features, benefits and fees. For example, some higher tier checking accounts offer benefits like waived ATM fees, product discounts and the potential to earn interest, but charge higher monthly fees that have higher waiver requirements. The monthly fee and waiver requirements vary from bank to bank and state to state.

Online banks largely function in the same manner and have the same consumers as those with physical branches; however, they do not have the brick-and-mortar locations to maintain. The lack of physical locations means less expenses for the banks and can mean better-priced services and products for the consumer. As a result, most online banks don't charge a monthly account fee, charge less for other services such as overdraft fees and offer higher interest rates.

Consumer Banking Preferences

The ways consumers bank and pay for purchases have changed immensely since the Federal Reserve started to conduct a triennial survey almost 20 years ago.

Growth in Mobile Banking Usage

Mobile banking provides convenient features that are increasingly sophisticated and capable of replacing brick-and-mortar service. As consumers become more familiar and confident in mobile technology, the use of apps and web tools for banking will increase. In addition, surveys suggest that the growing number of smartphone users increasingly rely on their smartphones to help make financial decisions. [5]

Among survey respondents that primarily used mobile banking over the past 12 months, major uses included checking an account balance or recent transactions (94% of respondents), transferring money between bank accounts (58% of respondents), receiving an alert (56% of respondents), depositing a check using mobile camera (48%), paying a bill (47% of respondents) and locating the closest in-network ATM or branch for their bank (36% of respondents).

Debit card use has risen sharply, while check usage has declined sharply, and credit cards and ACH transfers have seen moderate increases. Mobile wallets, online payments and P2P money transfers have all grown immensely since 2012, but only constitute a small portion of total payments. While this number is small for now, it can change remarkably quickly as seen in China, where mobile payments grew from $11 billion to $17 trillion in just five years.

Changing Habits: Debit Cards vs. Mobile Banking

Mobile banking is gaining in popularity across all age, race or income-based groups. However, a closer look at the demographics suggests that mobile technology is seeing faster adoption among certain consumer groups. Meanwhile, the number of debit card users appears to be trending down—even as the number of cards in circulation grows.

There have been slight variations between race and ownership trends: 90% of Hispanics own mobile phones, while 88% and 83% of whites and blacks own phones, respectively. Hispanic mobile phone users are more likely to own a smartphone than whites or blacks. [5]

Although more households have debit cards (84% of households have a debit card), and debit card use per household has actually increased over time, fewer households (58% of households) are actually using them.[5]

Debit cards are often associated with accessing ATMs or for cashless purchases, but with mobile and online banking, tasks like checking an account balance or transferring money can now be done without ATMs. As credit card rewards improve in value, the number of households using credit cards is also climbing (50.9% of households in 2013 vs. 64.3% in 2018). [5]

Households using prepaid debit cards have grown from 7.9% to 9.8% from 2013 to 2015. These cards were most common among unbanked households, where an estimated 27.1% of unbanked households had a prepaid debit card, compared to 15.4% and 6.9% in underbanked households and fully banked households, respectively. Prepaid debit cards were most popular among households that were younger and lower-income. [5]

Unbanked and Underbanked Statistics

Financial inclusion is one of the hallmarks of a developed country, but there is always a consistent proportion of consumers who manage their money outside of traditional banking. Below are some statistics and trends relating to the unbanked and underbanked in the United States.

Unbanked Households by Age and Income Group

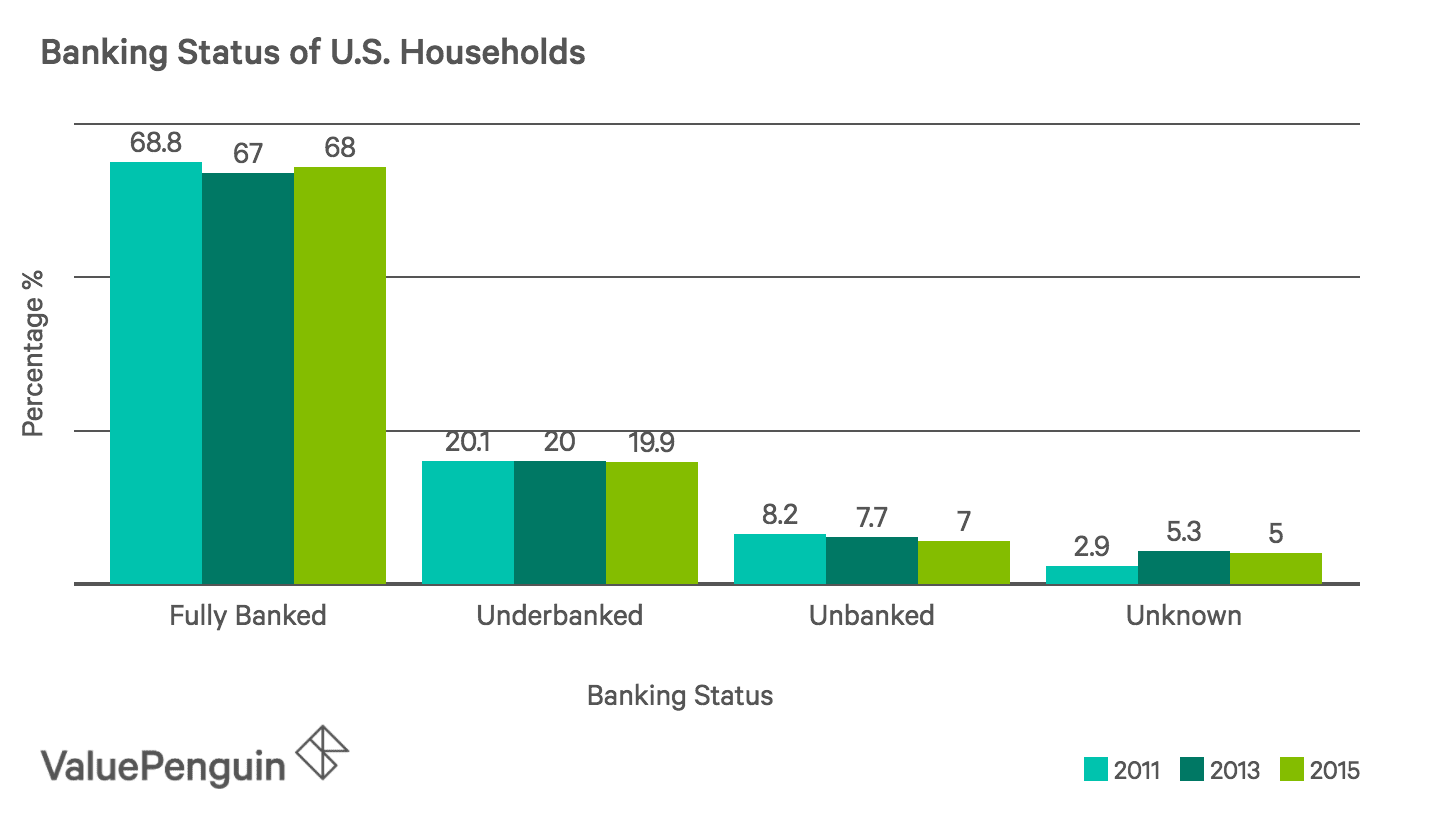

An unbanked household is one in which no person owns a checking or savings account. Unbanked households constitute 7% of all American households. An underbanked household has at least one person with an account at a federally insured institution, but also uses alternative financial services and products. These can include payday loans, money orders, check cashing services and pawn shop loans. Underbanked households make up 19.9% of U.S. households.

As with prepaid debit cards, government data showed a higher incidence of unbanked and underbanked households among younger and lower-income Americans. The data showed similar trends for households that reported lower levels of educational attainment.

Unbanked and Underbanked Households by State

Nationwide, the portion of unbanked and underbanked households has declined by 0.7% and 0.1% respectively since 2013.

However, this trend is for the nation as a whole, and certain states have actually seen an increase in the percentage of households that are unbanked/underbanked.

2013 | 2015 | % Change | ||||

|---|---|---|---|---|---|---|

State | % Unbanked | % Underbanked | % Unbanked | % Underbanked | % Unbanked | % Underbanked |

| Alabama | 9.2% | 26.4% | 12.5% | 23.9% | +3.3% | -2.5% |

| Alaska | 1.9% | 19.3% | 3.5% | 26.1% | +1.6% | +6.8% |

| Arizona | 12.8% | 17.6% | 8.5% | 18.5% | -4.3% | +0.9% |

| Arkansas | 12.3% | 25.7% | 9.7% | 22.6% | -2.6% | -3.1% |

| California | 8.0% | 17.0% | 6.2% | 19.1% | -1.8% | +2.1% |

| Colorado | 6.4% | 17.3% | 4.4% | 19.1% | -2.0% | +1.8% |

| Connecticut | 5.6% | 14.4% | 6.2% | 14.8% | +0.6% | +0.4% |

| Delaware | 6.1% | 18.5% | 4.8% | 15.4% | -1.3% | -3.1% |

| District of Columbia | 11.8% | 24.8% | 10.8% | 25.4% | -1.0% | +0.6% |

| Florida | 6.2% | 19.1% | 5.9% | 17.7% | -0.3% | -1.4% |

| Georgia | 10.9% | 26.9% | 11.9% | 14.6% | +1.0% | -12.3% |

Reasons Why Unbanked Households Avoid Banks

There are many reasons people go without a bank account or bank services, but the top five causes cited by unbanked and underbanked survey respondents were:

Reason Cited | % of Respondents |

|---|---|

| Not enough money to keep in account | 57.4% |

| Avoiding bank gives more privacy | 28.5% |

| Don't trust banks | 28.0% |

| Account fees too high | 27.7% |

| Account fees unpredictable | 24.0% |

Another major reason for the number of unbanked and underbanked households is income volatility. The survey asked households whether their month-to-month income varied "somewhat", "a lot", or "not much".

Income Varied… | Unbanked | Underbanked |

|---|---|---|

| A lot | 12.9% | 30.9% |

| Somewhat | 8.7% | 26.6% |

| Not much | 5.7% | 19.1% |

As the table shows, the rate of unbanked and underbanked households increases at greater reported levels of income volatility. This positive correlation held true at every income level, but was less pronounced among households with higher overall incomes.

Top 10 Largest U.S. Banks

We looked at the top 10 banks by number of branches and recorded some quick stats like number of branches, total deposits and total assets. Data are from the FDIC and companies' quarterly reports and accurate as of Q1 2018.

Bank | Total Deposits | # of Branches | Change in Branches from 2017 | States Covered |

|---|---|---|---|---|

| 1. Wells Fargo | $1,297,178M | 6,087 | -2.0% | 41 |

| 2. J.P. Morgan Chase | $1,297,178M | 5,284 | -2.4% | 23 |

| 3. Bank of America | $1,328,664M | 4,603 | -3.2% | 33 |

| 4. U.S. Bank | $344,5284M | 3,222 | -1.5% | 28 |

| 5. PNC | $264,704M | 2,561 | -4.7% | 19 |

| 6. BB&T* | $158,196M | 2,192 | -2.8% | 15 |

| 7. Regions Bank | $96,990M | 1,492 | -7.2% | 15 |

| 8. Suntrust Bank* | $162,379M | 1,311 | -8.0% | 11 |

| 9. TD Bank | $832,824M | 1,278 | -0.6% | 15 |

| 10. KeyBank | $104,751M | 1,039 | +8.1% | 13 |

BB&T and SunTrust are currently in the process of a merger to become Truist, the 6th largest bank in America.

The United States has the most banks in the world, with over 4,800 different banks. Compared to other nations, the U.S. has a very fragmented banking sector—Canada, for instance, has just 28 active banks. This diversity stems from the complicated regulatory environment, which can differ from state to state. As a result, regulators find it more challenging to exercise rigorous oversight, and banks can thus take riskier positions than in more concentrated markets.

Sources

- 1. Federal Reserve Bank Mobile Financial Services Survey

- 2. Federal Reserve Bank Payments Survey

- 3. FDIC Deposit Market Share Reports

- 4. FDIC Unbanked Household Survey 2015

- 5. S&P Market Intelligence

About the Author

Banking Analyst

Richard is a former research analyst who recently graduated from New York University's Stern School of Business with a B.S. in Finance and Sustainable business. During his time at school, he enjoyed learning how business and society intersects. Since graduating, he has enjoyed traveling, cooking, and learning about retirement accounts.

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.