Insurance Fraud Statistics

The insurance industry lost around $308.6 billion due to fraud in 2022, according to estimates from the Coalition Against Insurance Fraud.

Insurance fraud affects all types of insurance, including car, home, life and health insurance.

Insurance fraud statistics

- There is an estimated $45 billion in property and casualty insurance fraud per year, according to Colorado State University Global’s White Collar Crime Research Task Force (WCCRTF). This includes home, auto and business insurance.

- Life insurance fraud is the most widespread type of insurance fraud, costing companies $74.7 billion each year.

- Between 10% and 20% of insurance claims are fraudulent.

- Policyholders commit $35.1 billion in fraud that lowers their rates each year by lying on their insurance applications to get a better rate.

- American families pay an additional $400 to $700 per year in insurance premiums to help cover the cost of insurance fraud, according to the FBI.

Table of contents

Find Cheap Homeowners Insurance Quotes in Your Area

What is insurance fraud?

Insurance fraud occurs when a person or company misrepresents information when submitting a claim or applying for insurance to make a profit or save money on insurance.

Policyholders aren't the only people that commit insurance fraud — contractors, people who make claims and insurance agents are responsible for fraud, too.

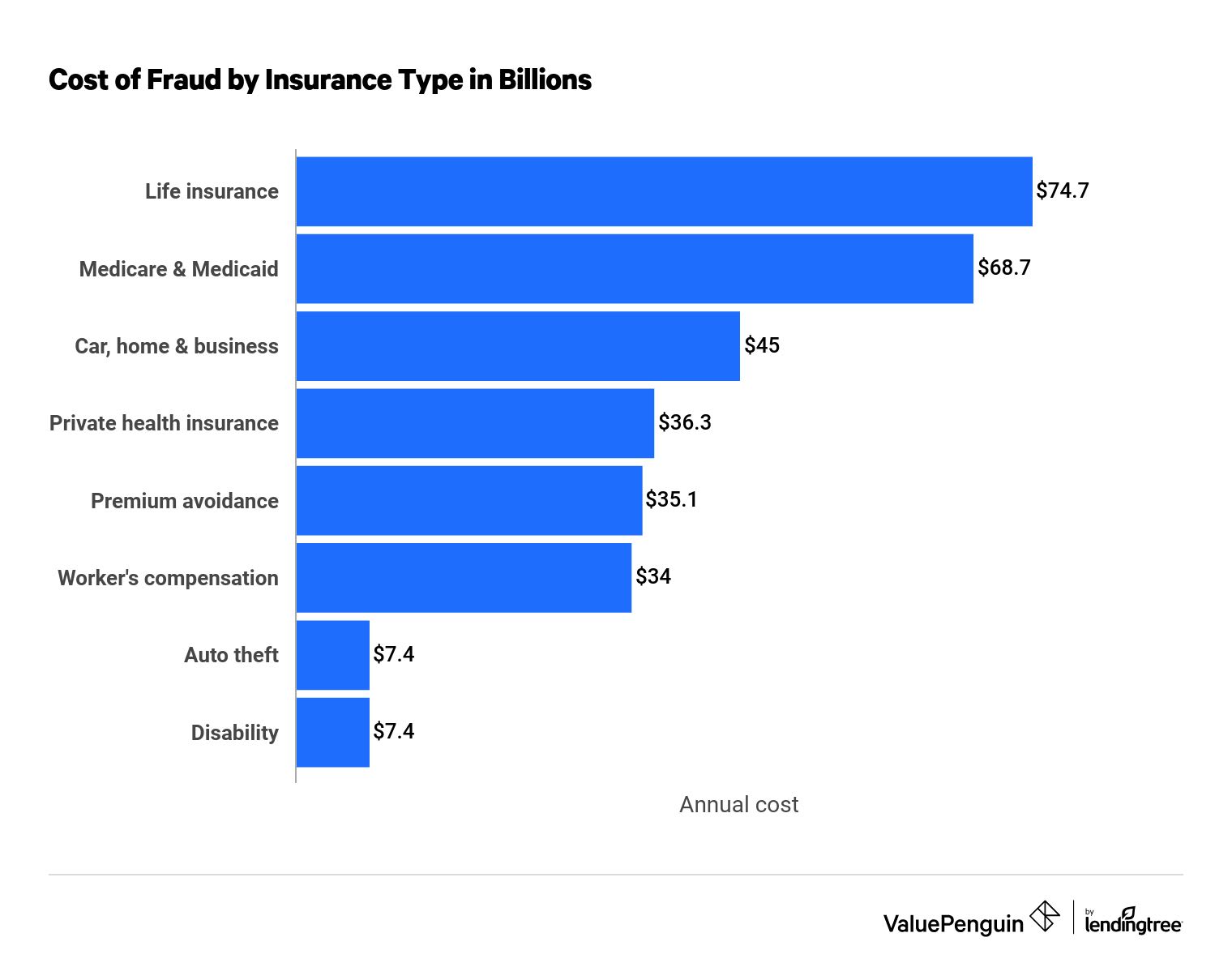

Annual cost of fraud by insurance type

Type of insurance | Billions ($) of fraud |

|---|---|

| Total | $308.6 |

| Life | $74.7 |

| Medicare and Medicaid | $68.7 |

| Car, home & business | $45.0 |

| Health care | $36.3 |

Types of insurance fraud

There are two types of insurance fraud, usually called soft fraud and hard fraud.

Auto insurance fraud

Auto insurance companies lose billions of dollars per year due to insurance fraud. Applicants, policyholders, mechanics and accident victims all participate in car insurance fraud.

The majority of these losses are due to lost premiums. This happens when applicants lie on their insurance application to get a better rate.

Car insurance companies lose $29 billion per year because of this, according to a 2017 study by Verisk.

Cost of lost premiums by fraud type

- Not including a driver in your household on your car insurance policy: $10.3 billion

- Underestimating the number of miles you drive: $5.4 billion

- Not telling your insurance company about past tickets or accidents: $3.4 billion

- Telling your insurance company that your car is garaged at a false address: $2.9 billion

Lost premiums affect car insurance customers, too. Up to 14% of what you pay for car insurance premiums goes toward covering your insurance company's lost premiums.

In addition, fraudulent bodily injury claims cost car insurance companies between $6.8 and $9.3 billion per year. These claims tend to involve neck or back pain, which doesn't generally involve a trip to the hospital, and they are hard to dispute.

In some cases, drivers involved in an accident commit fraud by inflating the severity of an otherwise legitimate claim. Known as "buildup," this type of fraud takes place in 21% of bodily injury claims, which pay for injuries to the other driver or passenger in an accident you cause, and 18% of personal injury protection claims, which pay for your own medical bills after an accident, regardless of fault.

Car insurance fraud examples

Some of the most common types of auto insurance fraud are:

- Lying on your insurance application to get a lower rate

- Faking or exaggerating an injury

- Filing multiple claims for the same accident

- Filing a claim for an accident that never happened

- Causing an accident on purpose to file a claim with another driver's insurance

- Filing a claim for a stolen vehicle that doesn't exist or is still in your possession

- Inflating the cost or extent of repairs needed to get more money from the insurance company

Home insurance fraud

Home insurance fraud is most commonly committed by policyholders doing damage to their own property to file a false insurance claim.

A classic example would be a failing restaurant owner who burns down their own business to get money from the insurance company.

Other types of dishonest claims are more subtle. Homeowners may make a claim for a burglary that didn't happen. Or the burglary may be legitimate, but the homeowner lies about the value of the belongings lost.

Another form of home insurance fraud is homeowners working with dishonest contractors in order to have construction or renovation work covered by an insurance claim. For example, a roofing contractor may tell the insurance company that your roof was damaged by a recent hail storm and needs to be replaced, when the damage is really due to regular wear and tear.

Find Cheap Homeowners Insurance Quotes in Your Area

Examples of home insurance fraud

- Lying about the damage to your home or belongings

- Inflating the value of stolen items after a burglary

- Faking a burglary or causing damage in order to make a claim

- Lying about the intended use of your property on an insurance application

- Having your contractor increase their repair estimate to cover your deductible

Home insurance tends to see an increase in fraud schemes after a natural disaster. Homeowners and contractors take advantage of damage after hurricanes or other major weather events.

For example, the government spent $80 billion on reconstruction after Hurricane Katrina in 2005. Around 9% of that money, or $6 billion, was spent on fraudulent claims.

Common disaster fraud schemes

Homeowners

- Filing false claims or exaggerating the amount of damage

- Submitting claims for damage that happened prior to the storm

- Filing a wind or theft claim for items damaged by flooding, which is not typically covered by home insurance.

Contractors

- Inflating the cost of repairs to get more money from insurance

- Requiring payment up front but not repairing damage

- Increasing the claim amount by including damage that wasn't caused by the storm

Life insurance fraud

Life insurance fraud costs insurance companies $74.7 billion each year.

This type of fraud accounts for 24% of all insurance fraud. That makes life insurance fraud the most common type of insurance fraud.

Life insurance fraud can be committed by those applying for policies, policyholders, beneficiaries and people working in the life insurance industry.

Life insurance fraud examples

- Lying on a life insurance application. Applicants might lie about their age or income, or fail to disclose important information about medical conditions and current medications.

- Fraudulently changing a beneficiary. This can happen when someone forges a document to make themselves the beneficiary of a policy.

- Faking someone's death. Beneficiaries may try to collect a life insurance payout for someone who's still alive or who never existed in the first place.

- Insurance agents or industry workers stealing premiums instead of sending them to the life insurance company.

- Scammers selling fake policies and keeping the premiums.

- Murdering the policyholder.

Health insurance fraud

Private health insurance companies lose $36.3 billion per year because of insurance fraud.

In addition, the government is the victim of $68.7 billion of insurance fraud each year through Medicare and Medicaid. Combined, that makes up 34% of all insurance fraud.

Medicare and Medicaid recipients are more likely to experience fraud than people with private health insurance. There are a number of reasons for this, including the fact that they are often older or disabled. Both of these groups are more susceptible to fraud because they may be less involved in their health care decisions or have difficulty understanding complex bills.

In addition, people insured through Medicaid have little to no cost for medical care, so they're less likely to notice when they're charged for extra treatments.

Common health insurance scams

Health insurance fraud can be committed by both providers and patients.

Health care providers, like hospitals, pharmacies, home health services and long-term care facilities commit the majority of private health insurance, Medicare and Medicaid fraud by:

- Billing patients for services that were never provided.

- Upcoding, or submitting a claim for a service that is more expensive or complex than what was provided. This also includes billing for higher-quality medication or supplies.

- Unbundling, or billing for a handful of services individually instead of using a single billing code that would cost the insurance company less money.

- Making up false diagnoses or feigning medical necessity in order to give patients unnecessary, expensive treatments.

Patients can also commit health insurance fraud by:

- Stealing someone's identity to use their health benefits.

- Sharing their health insurance benefits with friends or family members.

Insurance fraud punishment

Insurance fraud is against the law in every state in the country.

In most cases, states classify insurance fraud as a felony that can result in expensive fines and years of jail time. Most of those states also have a government agency devoted to rooting out fraud.

Insurance companies have become experts at detecting fraud and creating systems to reduce the issue. This includes the use of artificial intelligence and machine learning to discover fraud attempts.

Sources

Senior Writer

Lindsay Bishop is a Senior Writer at ValuePenguin, where she educates readers about home, auto, renters, flood and motorcycle insurance.

Lindsay began her career in the insurance and financial industry in 2010. She was a licensed auto, home, life and health insurance agent and held Series 6 and 63 financial licenses.

After a hiatus from the financial sector, Lindsay returned to the industry as a content writer for ValuePenguin in 2021. She enjoys having the opportunity to help readers make smart decisions about their insurance so they can be prepared for anything life throws their way.

When Lindsay isn't writing about insurance, you can find her spending time with family, enjoying the outdoors on Sunday long runs or riding her Peloton.

How insurance helped Lindsay

As a homeowner for 15 years located in South Carolina, Lindsay has plenty of experience navigating the coastal insurance market and managing the claims process. That includes successfully negotiating a full roof replacement claim.

Expertise

- Home insurance

- Car insurance

- Flood insurance

- Renters insurance

- Motorcycle insurance

Referenced by

- CNBC

- Yahoo Finance

- Miami Herald

Education

- BS/BA Economics, University of Nevada Las Vegas

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.