Are Dermatologists Covered by Insurance?

Health insurance usually covers medical dermatology, including treatments for acne and skin cancer. Cosmetic dermatology, like facials and... Read More

Compare life insurance quotes and find the best rates for a policy.

Life insurance can help protect your family financially if anything happens to you, but it’s important to make sure you’re not overpaying for the coverage you need.

Life insurance is a planning tool that provides financial protection for your dependents.

The asset provides a tax-free lump sum of money which is paid to your dependent after your death. Typically, life insurance is bought so that your dependents would be able to sustain payments for bills, college tuition or other after-life expenses.

Key components of life insurance policies are:

Every individual has a different financial situation and therefore will require different life insurance needs.

When calculating your needs you should consider what the life insurance will be used for and why you may need life insurance in general.

If you are young and do not have any dependents then buying life insurance may not be a necessary purchase at this point in your life. On the other hand, if you are starting a family in which the financial livelihood of the family relies on your salary, then you may want to consider purchasing some life insurance coverage and calculate your future needs.

When beginning to calculate how much life insurance you need, you should start by adding up your current and future financial obligations. This can include obligations such as:

After you have figured out your obligations, you can add up your current assets such as savings and college funds. Finally, by subtracting your current assets from the obligations you will arrive at a target amount for how much life insurance you will need. It is important to note that this is a rough estimate for coverage and it may be useful to purchase slightly more life insurance to compensate for unexpected financial situations that your dependents might face.

Life insurance companies will typically offer two different types of life insurance: term life insurance and permanent life insurance.

A term policy will last for a set period of time before expiring while permanent plans stay in effect for your entire life. Furthermore, some permanent life insurance policies will have a cash value component that will grow as you make premium payments.

Term life insurance | Permanent life insurance | |

|---|---|---|

| Period of coverage | Specified term, usually one to 30 years | Lifelong |

| Cash value | No | Yes |

| Average monthly premium | Cheap | Expensive |

Depending on your situation and what the purpose of your life insurance is, the type of life insurance that you need will change.

For example, if you are looking for a cheap policy to cover future financial obligations like college tuition, then choosing a term life insurance policy with a death benefit that matches the total tuition may be the best option. On the other hand, say you have Type 1 diabetes and have had problems with getting approved for life insurance. In this case, a permanent policy like guaranteed acceptance life insurance may be a better option for coverage.

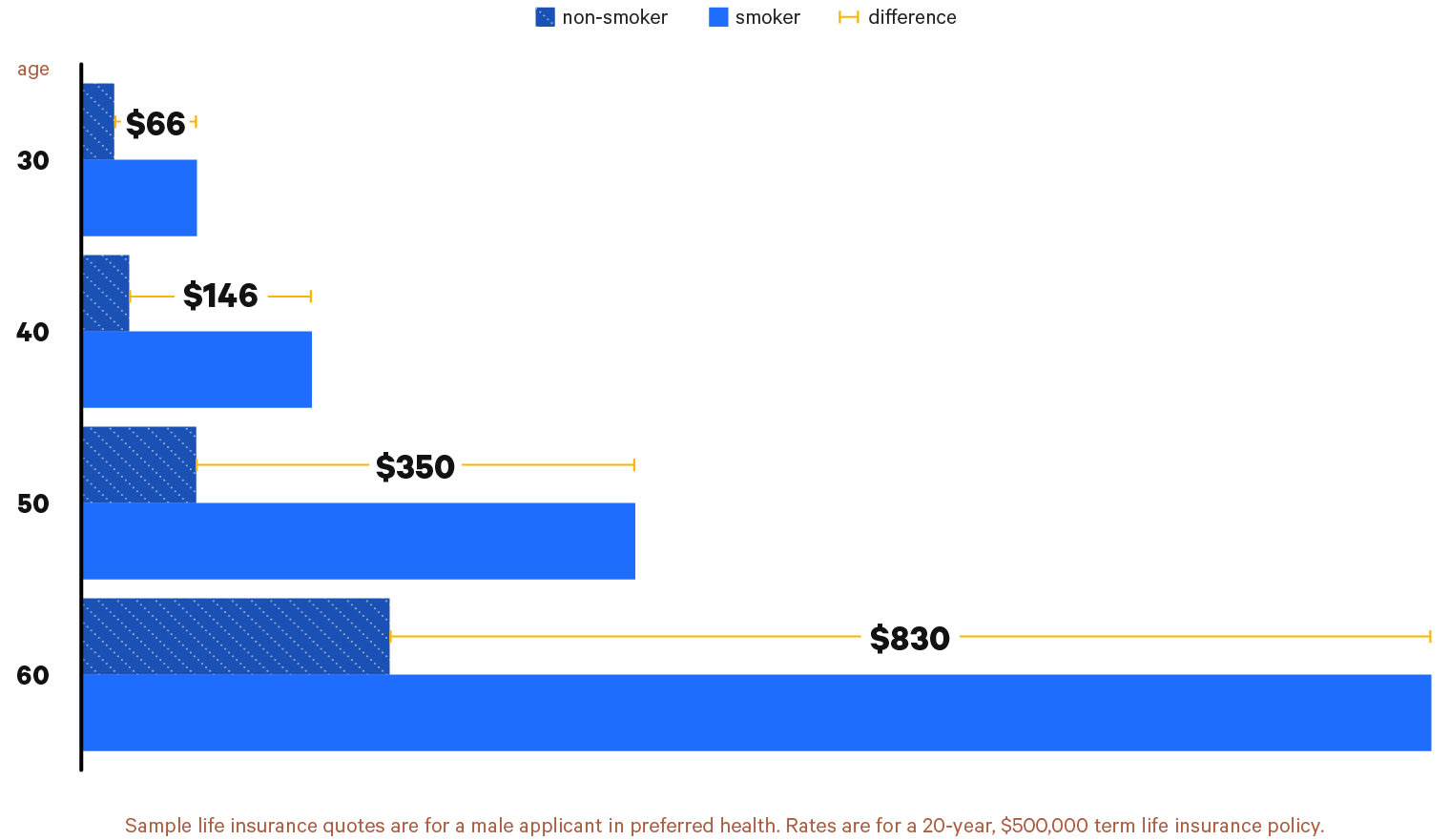

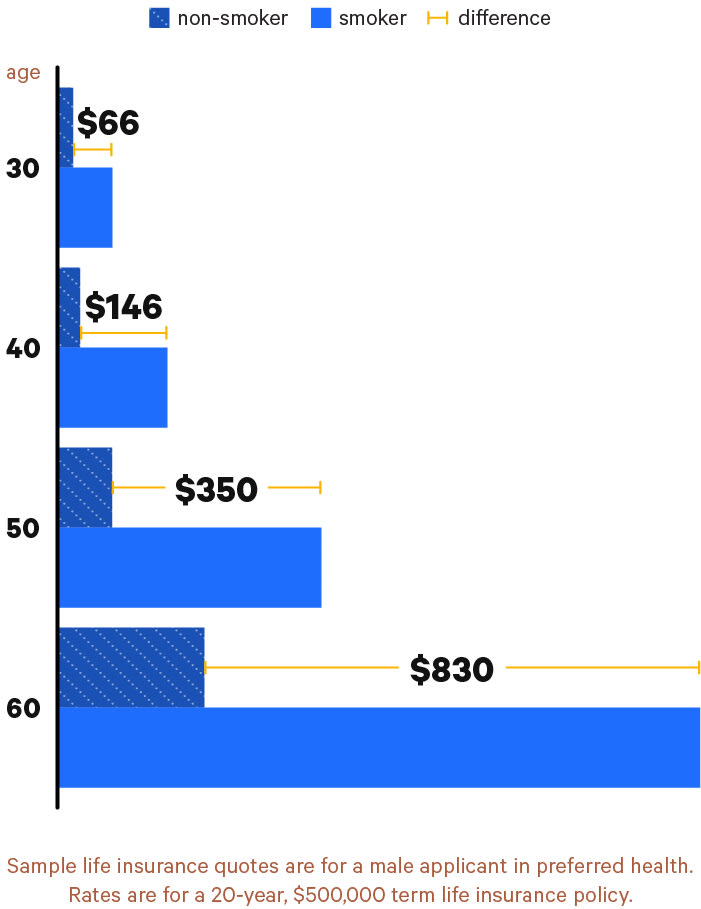

The cost of your life insurance policy will be dependent on a variety of factors including your health, age, occupation and if you smoke. However, the largest determinant will be if you are a smoker.

Smokers will have an average cost of life insurance that is 306% higher when compared to a nonsmoker.

Find Cheap Life Insurance Quotes in Your Area

When searching for the best cheap life insurance we would recommend getting life insurance quotes from as many insurers as possible. To aid you in this process we have provided detailed reviews of some of the best life insurance companies in the industry.

You will notice that many life insurance providers will have favorable underwriting requirements for certain individuals. For example, if you smoke you may find that Northwestern Mutual will have some of the best smoker life insurance rates available. Additionally, some insurers will specialize in certain products such as Mutual of Omaha which has one of the cheapest guaranteed whole life insurance products in the industry.

Health insurance usually covers medical dermatology, including treatments for acne and skin cancer. Cosmetic dermatology, like facials and... Read More

Blood work usually costs between $30 and $120. You will probably pay less if you have insurance, but the cost will change depending on the... Read More

A high-deductible health plan makes you pay for more of your health care costs before your coverage kicks in. These plans can be good if... Read More

Recent legislation has the potential to cut costs for residents of the Empire State, but you can still save on prescriptions regardless of... Read More

The Qualified Medicare Beneficiary program helps people who earn a low income pay for Medicare. Income and asset requirements vary by... Read More

Preexisting conditions are health problems you have before you buy health insurance. Health insurance companies can't consider preexisting... Read More

If you own a Kia or Hyundai, you may be even more of a... Read More

When asked what they’re researching, weight loss (50%), exercise (48%) and diet and nutrition (48%) were the most common responses among... Read More

Nearly a quarter of adults experiencing shortages suffer related negative health consequences. Here's a closer look nationally and by... Read More

Geico sells roughly a quarter of auto insurance policies in New Jersey, making it the most popular company in the Garden State. The 10... Read More

Among those struggling, 67% partially blame societal or cultural expectations and 49% say they don’t believe others acknowledge their... Read More

About 3 in 4 policyholders believe their car insurance rates will rise in... Read More