Life Insurance for People with Overweight or Obesity

Life insurance rates may be higher if you have overweight or obesity, because companies take your weight and height into account when setting premiums. This is because having overweight or obesity can put you at higher risk of developing potentially life-shortening conditions, such as heart disease or diabetes.

Find Cheap Life Insurance Quotes in Your Area

However, unless you have severe weight-related health issues, such as limited mobility due to morbid obesity, you're unlikely to be rejected for coverage. If you're an athlete or have a high BMI but low body fat percentage, you'll likely be able to receive credits from an insurance company to qualify for the best life insurance ratings.

How your weight affects your life insurance rating

Insurance companies determine your rating category and the price you pay. They base it in part on a build chart that's similar to a BMI (body mass index) calculation. Typically, the rating categories are:

- Preferred Plus: People in excellent health with no history of medical issues. If you're over the ideal weight for your height by more than a few pounds, you're unlikely to receive this rating.

- Preferred: If you have had a minor medical issue or a family history of moderate conditions, but are otherwise in great health, you'll likely qualify for a Preferred rating. There's often a Preferred category for smokers who would qualify for the best rates, except for their tobacco usage.

- Standard Plus: Typically includes people in good health who have a negative family history or a single condition that exempts them from qualifying for a Preferred rating

- Standard: People of average health who may have a couple of common but manageable issues, such as high cholesterol or blood pressure. There's also a Standard rating for smokers. If you have overweight, and particularly if you have obesity, you'll likely receive a Standard rating.

- Table Ratings: High-risk applicants. Unless you have a very high BMI, it's unlikely you'd receive a Table Rating for life insurance based on your weight alone.

For each rating category, life insurance companies have minimum and maximum weight limits for a given height. Your age and sex may also be taken into account. Some companies, such as Allstate, Mutual of Omaha and Prudential, use a unisex weight chart, which is favorable to women that may be a few pounds over their ideal weight, since the range of acceptable height-to-weight ratios is higher for men.

To give you a sense of how life insurance companies assess your weight, below are sample acceptable height and weight limits for MetLife coverage. As you can see, even if you have a nonoptimal BMI, you may qualify for the best rating category.

A 6-foot man who weighs 195 pounds, for instance, would be considered as having overweight, according to a standard BMI calculation. But he would qualify for a Preferred Plus life insurance rating (or Elite Plus, as MetLife refers to the category). If he weighed 225 pounds, his BMI would be considered obese, but he would still qualify for better-than-Standard rates.

Having overweight alone doesn't typically disqualify you from a low life insurance rate. But other health factors related to your weight might.

Height | Sex | Preferred Plus weight limit | Preferred weight limit | Standard Plus weight limit | Standard weight limit |

|---|---|---|---|---|---|

| 5'0" | Male | 144 | 150 | 164 | 204 |

| Female | 139 | 144 | 157 | 204 | |

| 5'3" | Male | 156 | 162 | 180 | 218 |

| Female | 151 | 157 | 169 | 218 | |

| 5'6" | Male | 170 | 175 | 197 | 236 |

| Female | 164 | 170 | 185 | 236 | |

| 5'9" | Male | 182 | 188 | 215 | 256 |

| Female | 178 | 183 | 199 | 256 | |

| 6'0" | Male | 199 | 204 | 232 | 278 |

| Female | 194 | 199 | 216 | 278 | |

| 6'3" | Male | 215 | 220 | 249 | 302 |

| Female | 211 | 215 | 234 | 302 |

Height and weight limits in this chart are based on the underwriting guidelines for Metropolitan Life. The company's build table is unisex for Standard ratings, which is why the weight limit is the same for both sexes. Weight limits assume the applicant is at least 18, as the range changes based on age.

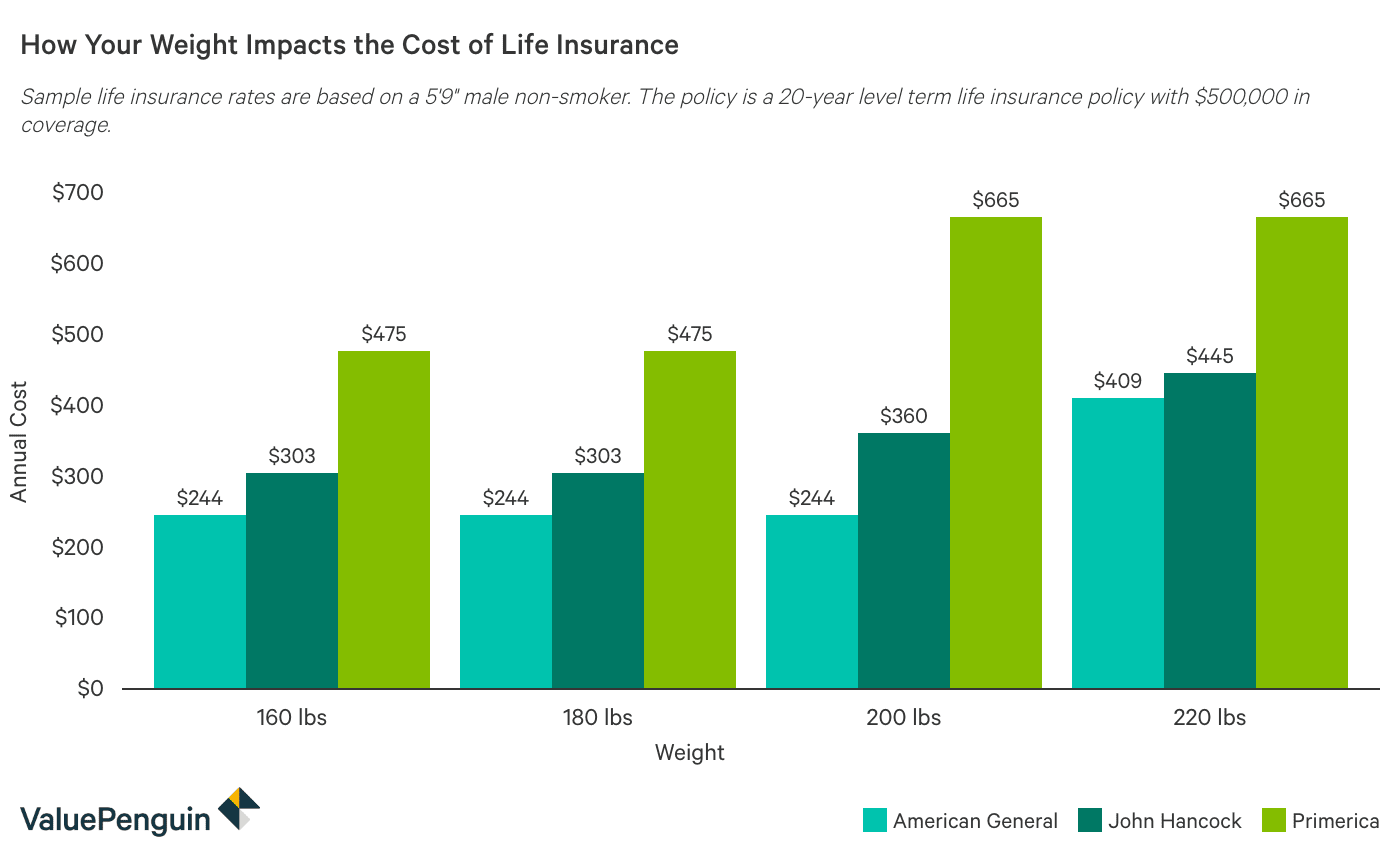

In general, the higher your body weight and BMI, the more your term life insurance is going to cost, regardless of the company. However, the cutoff point and other factors for each rating category are different between companies. For example, a 200-pound man who is considered to have overweight might get a Preferred rating from John Hancock but a Standard rating from Primerica. And a 220-pound man with no other medical issues but obesity could receive a Standard Plus rating from American General and favorable premiums for term life insurance.

Insurance companies may make exceptions to their weight and BMI guidelines for athletes or fit people with a high chest-to-waist ratio. The weight tables are approximate guidelines, because companies don't want to exclude people who are very fit despite having a high BMI. If there's a healthy reason your BMI is outside the expected range, notify the company when applying, so they can confirm whether you qualify for a Preferred rating.

Why do life insurance companies have BMI requirements?

Life insurance companies set rates based on how risky they determine you to be or how likely you are to die during the policy's term. Many conditions linked to obesity increase your mortality risk, such as:

- Heart disease

- Stroke

- High cholesterol

- Diabetes

- High blood pressure

- Sleep apnea

- Osteoarthritis

- Fatty liver disease

- Kidney disease

Even if you don't currently have one of these conditions, the company may not offer you a Preferred rating if you fall outside their recommended weight limits, because a high BMI increases your risk of a serious medical issue later. Once a life insurance policy is purchased, the company can't change your premiums, so they must determine future risk based on your current information.

How to get the best life insurance rates if you have overweight

Find Cheap Life Insurance Quotes in Your Area

When applying for life insurance, you'll be asked about your health and lifestyle, which the company will check against any medical records and exams. You should always be honest, and one of the simplest ways to ensure you get the best life insurance ratings is to include all relevant health information. If you follow a healthy diet and a consistent exercise program, are monitored by your doctor on a regular basis and have had no weight-related health issues, you'll likely qualify for a good life insurance rating.

Often, if you have overweight but no other issues, you'll still qualify for the best life insurance ratings. Even applicants with a high BMI who are categorized as having obesity but are otherwise healthy can get a good rating. Remember, it's usually weight-related complications, such as diabetes, or even a family history of heart attacks that will result in a worse rating.

Weight-related life insurance application questions

- Current weight and height: Be honest about your build, but make sure you include any other relevant information. For instance, if you have a high BMI but particularly low body fat percentage, the company may give you credits and improve your rating.

- Weight changes in the past year: A crash diet is unlikely to help you get the best life insurance rating. Companies get concerned about sudden changes in weight, so you'll only be credited with half of any recent weight loss. But if you've begun an exercise or diet regimen that has helped you start to lose weight, make sure you disclose this in your application, even if the company doesn't specifically ask about it.

- Whether you smoke: Smokers pay higher life insurance rates, particularly if you have overweight and wouldn't qualify for a Preferred tobacco rating.

- Your last doctor's appointment: Not being under the regular care of a doctor could hurt your chances of receiving the best ratings, because obesity is linked to other health issues. Life insurance companies want to know you're regularly monitored for complications that could arise.

- Health or mobility issues related to your weight: If you have trouble with mobility or medical issues related to having obesity, you likely won't qualify for the best life insurance ratings.

A simple way to improve your health rating is by preparing for the life insurance medical exam. Schedule your exam for first thing in the morning, when you've fasted, to get the best rating. Your weight can fluctuate by several pounds throughout the day as you eat and drink, so scheduling the exam early removes some of the variability.

Finally, ask your insurance company if you can get a new medical exam a couple of years after you've bought the policy. If you've lost weight, you may be able to qualify for a better rating and lower premiums by being reassessed and showing that you're keeping the weight off. You might also compare quotes from other companies to see if you'd qualify for a cheaper policy somewhere else.

The impact of weight loss on life insurance rates

If you intentionally lose weight (through nonsurgical methods) in the 12 months before applying for a policy, you'll get better life insurance rates, but you'll probably only receive credit for half of the weight you've lost. Insurance companies want to know that your weight loss is sustained and you won't simply gain it back, so they focus on your longer weight trends, as opposed to a single snapshot.

Say you're 5'6" and used to weigh 205 pounds, which would have qualified you for a Standard rating from Mutual of Omaha. If you began a diet and exercise program or used weight loss drugs to help you lose 30 pounds, you would qualify for a Preferred Plus rating, as long as you've kept that weight off for at least a year. However, if the 30 pounds of weight loss happened within the past 12 months, you would only be credited with having lost 15 pounds, which would get you a Preferred rating instead.

Similarly, if you lose weight in the prior 12 months through surgical methods, you'll be credited with losing weight but receive a worse rating overall due to the recent surgery.

On the other hand, unintentionally losing a large amount of weight — over 10 pounds — is a point of concern for companies, and you will either receive a worse rating or be rejected for coverage.

Sudden weight loss that's not on purpose could mean you have an underlying medical condition. The life insurance company would want to know what's causing the change in weight and how the condition is being managed before you'd qualify for a good rating.

What if you're denied life insurance due to your weight?

In most cases, you won't be denied life insurance coverage solely due to a high BMI. Even if one company refuses to cover you, another would likely offer you a policy. Failing to qualify for life insurance with multiple companies usually only happens if you have morbid obesity and other health conditions.

If, for some reason, you can't get a standard term or permanent life insurance policy due to issues linked to your BMI, try losing weight and then reapplying for coverage. Even though life insurance companies will only give you partial credit for major weight loss in the previous 12 months, you're more likely to qualify for the policy of your choice.

But, if you need coverage immediately and are unable to qualify elsewhere, you may want to consider a guaranteed acceptance life insurance policy. As the name suggests, these policies guarantee acceptance, no matter your weight. However, there are a few downsides:

- They provide very limited coverage — usually no more than $25,000.

- Guaranteed acceptance policies cost more than standard life insurance policies per dollar of coverage.

- If you die in the first two to three years after buying the policy, your beneficiaries would only receive a partial payout, unless the death was accidental. For instance, if you have a heart attack one year after buying coverage, your family would not receive the full death benefit.

Lying about your weight on a life insurance application

Even if you buy a policy that doesn't require a medical exam, your insurance company may have other ways of confirming your build, such as medical records. That is why you shouldn't lie about your weight on a life insurance application. If the company ever determines that you misrepresented your weight, it could be considered fraud, and they could cancel your policy or deny your beneficiaries's claim. So, while lying about your weight may help you initially get a policy or a better rate, it's not worth the risk of losing the benefits of coverage after you've paid the premiums.

Senior Insurance Analyst

Maxime Croll, a former director for ValuePenguin, has spent nearly a decade helping consumers understand complex insurance topics.

Before joining ValuePenguin, she helped launch NerdWallet's personal insurance business and was Director of Product Marketing at CoverWallet. Her insurance insights and analysis have appeared in Forbes, USA Today, The Hill and many other publications.

Maxime's insurance win

Maxime's first car insurance agent took the time to run through what to do if an accident happened. She’s always appreciated it.

Expertise

- Car insurance

- Home insurance

- Renters insurance

- Health insurance

Referenced by

- Forbes

- USA Today

- The Hill

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.