Best and cheapest health insurance in CT

Cheapest health insurance companies in Connecticut

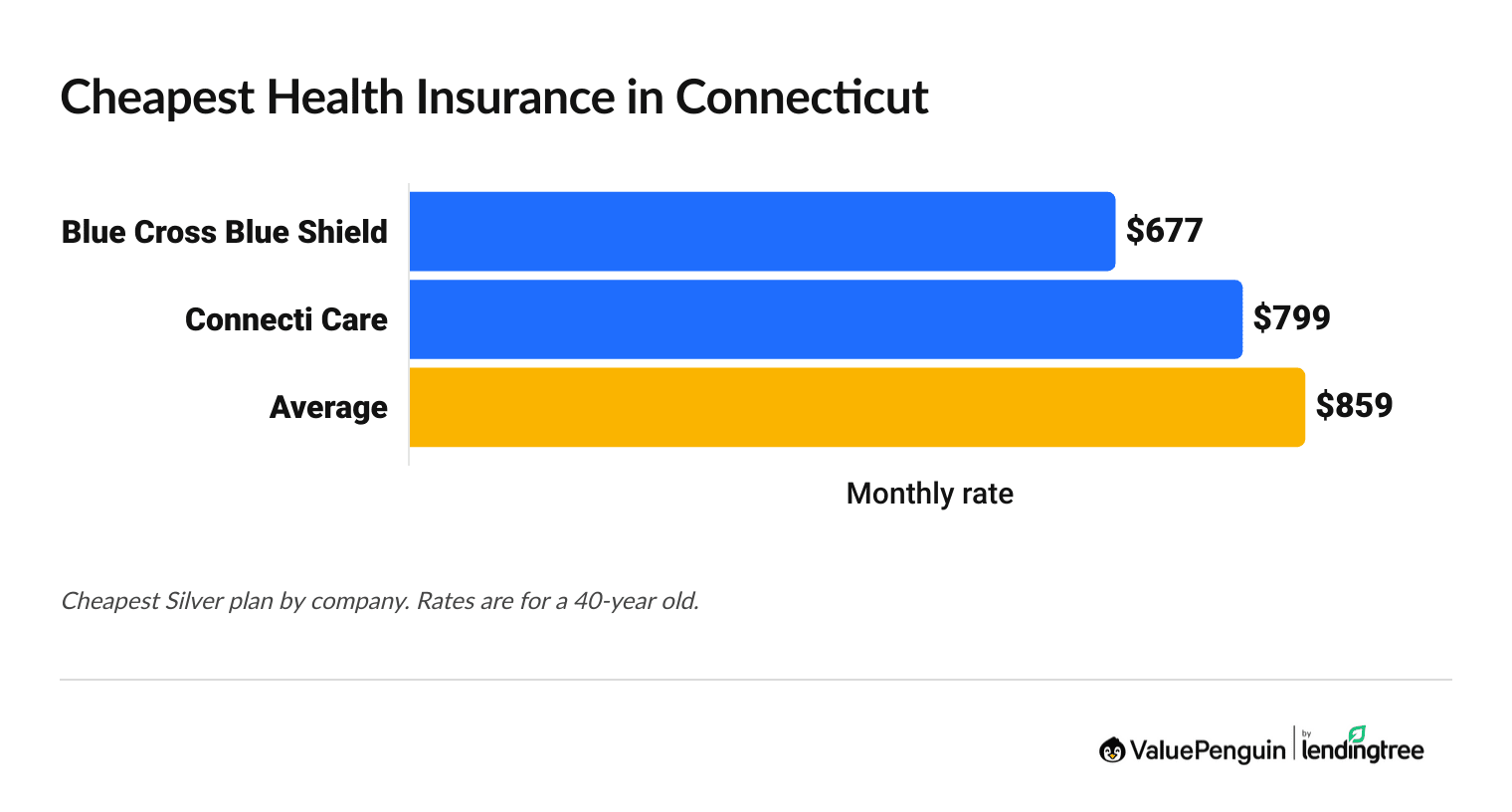

Of the two companies in Connecticut, Anthem Blue Cross and Blue Shield (BCBS) is cheapest, followed by ConnectiCare, with rates starting at $677 per month before discounts.

Find Cheap Health Insurance Quotes in Connecticut

Cheap health insurance plans in CT

Company |

Cost

| |

|---|---|---|

| Anthem | $677-$827 | |

| ConnectiCare | $799-$1,039 | |

- Anthem BCBS has the most affordable health insurance in every part of Connecticut. The company also gives customers access to the largest network of doctors in the nation.

- But it's important to compare plans to make sure you get the right fit. Anthem sells two Silver plans in every county in CT. It's worthwhile to compare them to see which is better for you.

Best health insurance companies in Connecticut

Anthem is the best health insurance company in Connecticut.

Anthem Blue Cross and Blue Shield's PPO plans have an excellent 5-out-of-5-star rating for member experience from HealthCare.gov. That means Anthem customers with PPO plans have an easy time scheduling appointments and getting the care they need.

Find Cheap Health Insurance Quotes in Connecticut

Best-rated health insurance companies in Connecticut

Company |

ACA rating

|

VP rating

|

|---|---|---|

| Anthem | ||

| ConnectiCare |

It's a good idea to choose a company with a strong customer service reputation because you may have an easier time using your insurance and filing a claim down the road.

- Anthem is a Blue Cross Blue Shield company. That means Anthem customers have access to the Blue Cross Blue Shield network, which has more than 2 million doctors and hospitals nationwide.

- ConnectiCare is run by Molina Healthcare. Molina bought ConnectiCare from EmblemHealth in February 2025.

Second cheapest insurance in Connecticut: ConnectiCare

ConnectiCare isn't a good medical insurance choice for most people in Connecticut.

ConnectiCare's plans are more expensive than Anthem's, and it has some bad customer reviews. ConnectiCare gets more than triple the number of complaints expected for a company its size.

ConnectiCare also sells only one type of health care plan in Connecticut, which limits your choices. In contrast, Anthem offers HMO and PPO plans, so you can compare options and find one that works for you.

How much is health insurance in Connecticut?

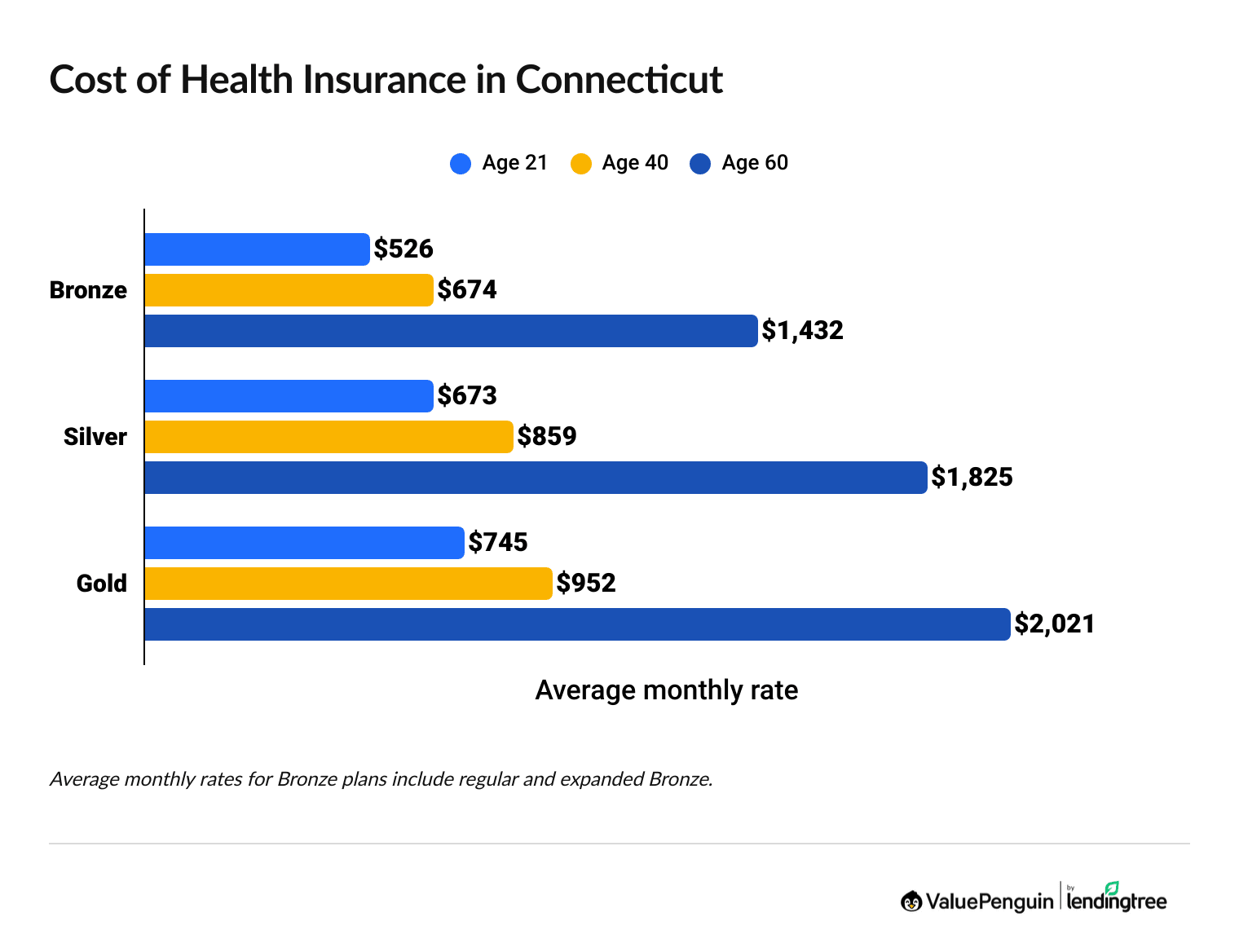

With no discounts, Connecticut health insurance costs $859 per month, on average, for a Silver plan. Residents who qualify for discounts could pay about $310 per month for coverage.

That's $549 per month cheaper than the Connecticut state average.

Find Cheap Health Insurance Quotes in Connecticut

- Gold plans have expensive monthly rates but low costs when you visit the doctor. Bronze plans have cheap rates, but you'll pay more for medical care. Silver plans offer a balance between the two.

- Health insurance quotes increase as you get older. Costs go up slowly in your 20s and 30s before rising dramatically in middle age.

- What you pay for a medical insurance plan depends on the amount of money you make. Typically, you'll pay less if you earn less.

Health insurance discount changes in Connecticut for 2026

Health insurance costs $859 in the Constitution State, or possibly $310 per month, on average, if you get discounts based on your income.

For people who can get subsidies, rates will increase from about $182 in 2025 to $310. That's because Congress hasn’t extended Biden-era health insurance discounts for 2026.

But Connecticutans who qualify for help can get no-cost healthcare with a program called CoveredCT.

Health insurance rates in Connecticut after subsidies (2025 vs. 2026)

Income | 2025 rate | 2026 rate | Difference |

|---|---|---|---|

| $30,000 | $49 | $155 | 216% |

| $40,000 | $154 | $287 | 86% |

| $50,000 | $283 | $415 | 47% |

| $60,000 | $423 | $498 | 18% |

| $70,000 | $496 | $870 | 75% |

Average cost after subsidies for a single 40-year-old with a Benchmark Silver plan.

- Who can get subsidies? To qualify for subsidies, you need to earn between $15,650 and $62,600 per year as an individual (between $32,150 and $128,600 for a family of four).

- How do subsidies work? You can use your subsidy toward any Bronze, Silver or Gold plan through Access Health Connecticut. But if you can get Medicaid or a Catastrophic plan, you won't be able to get subsidies.

- How much do you save? You can use ValuePenguin's subsidy calculator to find out how much a subsidy will lower your health insurance rate.

Cheap health insurance plans in Connecticut by city

Anthem has the cheapest health insurance everywhere in Connecticut, with Silver plans starting at $677 per month before discounts.

But just because a plan is affordable doesn't mean it's the best option for you. It's still a good idea to compare all your options to find the right coverage for your needs.

Cheapest health insurance plans by CT county

County | Cheapest plan | Monthly rates |

|---|---|---|

| Fairfield | Anthem Silver Standard Pathway | $827 |

| Hartford | Anthem Silver Standard Pathway | $707 |

| Litchfield | Anthem Silver Standard Pathway | $730 |

| Middlesex | Anthem Silver Standard Pathway | $752 |

| New Haven | Anthem Silver Standard Pathway | $752 |

Cheapest Silver plan with rates for a 40-year-old

Find Cheap Health Insurance Quotes in Connecticut

Best health insurance by plan tier

The best plan tier for you depends on the amount of care you think you'll need in the coming year and your financial situation.

Gold plans are best for people who have ongoing health problems. These plans have expensive rates, but you'll pay less when you go to the doctor.

Silver plans are the best option if you usually see the doctor only a few times a year. These plans balance reasonable quotes with middle-of-the-road costs you're responsible for when you go to the hospital.

Bronze plans are a fine choice if you're in good health and can easily afford to pay an unexpected medical bill from your savings. These plans have affordable monthly rates, but you pay a lot more when you go to the doctor.

Gold plans: Best if you have frequent medical issues

| Gold plans pay for about 80% of your medical care. |

In Connecticut, Gold plans cost an average of $952 per month and have an average deductible of $1,633.

Gold plans have high monthly rates but lower costs per visit when you get care. That makes Gold plans a good option if you expect to need a lot of medical care in the coming year. But Gold plans don't make financial sense if you have normal health needs.

Silver plans: Best for average medical needs

| Silver plans pay for about 70% of your medical care. |

In Connecticut, Silver plans cost an average of $859 per month and have an average $5,000 deductible.

Silver health plans have moderate rates and average costs that you're responsible for paying when you go to the doctor. Consider a Silver plan if you have average medical needs and expect to see the doctor no more than a few times in the coming year.

You may qualify for if you earn a low income.

Bronze plans: Best if you're healthy and you have savings

| Bronze plans pay for about 60% of your medical care. |

In Connecticut, Bronze plans cost an average of $674 per month and have an average $6,750 deductible.

Bronze plans have affordable quotes, but you have to pay a lot of money before most coverage starts.

Consider a Bronze plan if you're in good health and you can easily afford to pay a large medical bill from your savings.

More discounts and free health insurance plans in CT

Connecticut residents who earn a low income may qualify for free coverage or extra discounts.

HUSKY health insurance (Medicaid): Best for free coverage

If you live in Connecticut and make about $22,000 per year or less ($44,000 per year or less for a family of four), you can get free medical insurance, called Medicaid or HUSKY health insurance. Pregnant women and families with children under the age of 19 may qualify with higher household incomes.

CoveredCT program: Best if you don’t qualify for Medicaid but have low income

Health insurance subsidies are being reduced because Congress voted against them. But you could get free health insurance in Connecticut if you qualify for the program called CoveredCT.

You can apply for CoveredCT at any time; you aren’t limited to applying only during open enrollment or a qualifying life event. But you must meet eligibility requirements:

- You are a Connecticut resident between the ages of 19 and 64.

- You earn too much to qualify for HUSKY health insurance.

- You make 175% of the Federal Poverty Level or less.

- You enroll in a Silver health plan on Access Health CT.

Silver plans with cost-sharing reductions: Best for discounted coverage

| Silver plans will pay 73% to 94% of your medical costs if you have a low income. |

If you don’t qualify for HUSKY health insurance or CoveredCT, you may still qualify for extra discounts called cost-sharing reductions if you earn between $15,650 and $39,125 per year as an individual and you have a Silver plan.

Cost-sharing reductions aren't available if you have a Gold or Bronze plan.

While this type of discount isn’t as big in 2026, it could still lower your costs, such as your deductible, copays and coinsurance.

Are health insurance rates going up in CT?

Health insurance rates increased by 13% from 2025 to 2026 in Connecticut, on average. Silver plans had the highest jump, at 21%. Bronze and Gold plans went up by 10% and 7%, respectively. Since 2022, costs for both Gold and Silver plans rose over 50%.

Bronze

Silver

Gold

Year | Cost | Change |

|---|---|---|

| 2022 | $413 | – |

| 2023 | $536 | 30% |

| 2024 | $583 | 9% |

| 2025 | $615 | 6% |

| 2026 | $674 | 10% |

Monthly costs are for a 40-year-old. Expanded Bronze plans are included in 2024, 2025 and 2026 averages, when they're offered.

Why is health insurance expensive in Connecticut for 2026?

Rising health care costs, more expensive prescription drugs and expiring government subsidies are driving up the cost of health insurance in Connecticut.

Three of the main reasons for this sudden price jump include rising prescription drug costs, more expensive medical services and greater demand for health care. Expiring COVID-19-era federal subsidies have also pushed up the cost of medical insurance in Connecticut.

Tips for getting cheaper Connecticut health insurance in 2026

- Healthy individuals should consider a plan tier with a lower average rate, such as a Bronze or Silver plan.

- Don't forget to compare quotes from the companies in your area on Access Health CT, the state health insurance marketplace.

- Consider a high-deductible health plan (HDHP) for cheaper quotes.

- If you have a high-deductible plan, you can open a health savings account (HSA), which offers generous tax benefits.

- Don't forget to check if you're eligible for free government health insurance, called Medicaid.

Essential health coverage in CT

Plans from the Connecticut health insurance marketplace have to cover certain benefits, called minimum essential coverage. That includes care for pregnant women and newborns, mental health services and prescription drug coverage.

Marketplace plans also offer important protections, such as a cap on how much you'll spend each year for medical care, called an out-of-pocket maximum. Additionally, companies can't consider your health history when setting rates or approving coverage if you buy insurance through the state marketplace.

Short-term health insurance plans in Connecticut

Short-term health insurance isn't available in Connecticut because of strict state-level rules.

If you need to get coverage outside Nov. 1 through Jan. 15, called open enrollment, , see if you qualify for the CoveredCT program or a special enrollment period.

A special enrollment period is given when you move to a new state, get married, get divorced or lose your existing coverage. COBRA is also an option if you recently lost your job. However, COBRA tends to cost more than a regular marketplace plan.

Frequently asked questions

Is $200 a month expensive for health insurance in Connecticut?

No, $200 per month for health insurance in Connecticut is not expensive. That's significantly cheaper than the statewide average. Keep in mind, you'll pay far more for medical insurance in CT than you will in most other states.

What is the average cost of a health insurance plan in Connecticut?

The average cost of health insurance in Connecticut is $859 per month for a 40-year-old individual with a Silver health plan. Those eligible for discounts, called subsidies, pay an average of $310 per month for coverage.

Who has the best cheap health insurance in Connecticut?

Anthem Blue Cross and Blue Shield has the best affordable health insurance in Connecticut. Its Silver plans start at $677 per month before discounts, the cheapest of any company in Connecticut.

How do you get health insurance in CT?

You can buy health insurance in Connecticut through the state marketplace, called Access Health Connecticut. You may qualify for discounted coverage if you earn a low income.

What is the most popular health insurance in Connecticut?

Anthem sells the most individual and group plans of any company in Connecticut, with about 57% of all medical insurance plans in the state. Molina, which owns ConnectiCare, sells 52% of individual plans.

Methodology

Connecticut health insurance rate data for 2026 is from the Centers for Medicare & Medicaid Services and Access Health CT, Connecticut's state health insurance marketplace. ValuePenguin used the CMS public use files and state marketplace data to find average rates for different plan tiers, geographic locations and family sizes.

Rates

Rates are based on a 40-year-old with a Silver plan, unless otherwise noted. Rates for Bronze plans include regular and Expanded Bronze plans for 2024, 2025 and 2026, when the plans are available. Your costs and plan options will vary; plans aren't always available in all parts of a state or county.

Subsidies

Rates after subsidies are estimates for a 40-year-old with a Benchmark Silver plan and are based on how subsidies were structured before 2021. Prices are calculated using KFF's rates for full-price Benchmark plans, federal poverty levels (FPLs), IRS rules about premium tax credits and Congressional reports about expanded tax credits. The total cost in the state uses rates calculated by income, which are weighted using CMS data on the incomes of those who purchased plans during last year's open enrollment. The median was used for each income range. Unknown incomes were excluded from the calculations. Incomes of 100% of the federal poverty line and 500% of the federal poverty line were assumed for enrollees who earn less than 100% FPL and more than 500% FPL, respectively. Information about state subsidies, when available, was sourced from state marketplaces.

Ratings

ValuePenguin's experts rank companies based on cost, coverage options, customer satisfaction and unique value. Ratings are out of 100 possible points. ACA ratings show how the company performs in Connecticut for medical care, member experience and plan administration. This 2026 plan quality data from CMS is based on data from last year. Ratings are not available for new plans or plans with low enrollment.

More sources

Enrollment trends, including plan selections by tier and enrollment by income, are from CMS data for the 2025 open enrollment period.

Other sources include HUSKY Health Connecticut, CT Mirror, S&P Global Capital IQ and the National Association of Insurance Commissioners.

About the Author

Senior Writer

Jenn Jones is a Senior Writer at LendingTree where she covers auto, home, renters and motorcycle insurance topics.

Previously an editor for USA TODAY Blueprint and a finance manager at World Car dealerships, she has more than a decade of experience in the world of personal finance and a deep interest in sharing knowledge that empowers others. She’s also served as a freelance translator, copy editor, writer and researcher. She graduated from the University of Virginia with a B.S. in commerce and a B.A. in Chinese language and literature.

How insurance helped Jenn

Jenn first came to appreciate pet insurance when annual checkups for her cat and dog totaled more than $700.

Expertise

- Auto insurance

- Renters insurance

- Condo insurance

- Home insurance

Referenced by

- USA TODAY

- MSN

- F&I Magazine

- Automotive News

Education

- BS, Commerce, University of Virginia

- BA, Chinese Language and Literature, University of Virginia

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.