Review of AARP Auto Insurance from The Hartford

Great coverage options for seniors at a below average cost.

Find Cheap Auto Insurance Quotes in Your Area

The Hartford provides auto insurance to AARP members over the age of 50 and offers special policy features to best accommodate senior lifestyles that may not be found elsewhere.

AARP's car insurance rates from The Hartford are cheaper than average compared to major competitors. Combined with coverage offerings, AARP and The Hartford are a good option for seniors.

Pros and cons

Pros

Special coverage options for seniors

Personalized customer service

Cheaper-than-average rates

Cons

Must work with an agent

AARP insurance from The Hartford review: Our thoughts

Bottom line: AARP's excellent reputation for servicing the needs of older adults makes it a worthwhile option to consider for those over the age of 50. The added protections for seniors don't make Hartford policies through the AARP more expensive than other large insurers, so AARP auto coverage from The Hartford is a strong option for older drivers. However, if you prefer not to work with an agent, this company will not be a good fit for you.

AARP has a longstanding history of serving older Americans as they age, and auto insurance partnership with The Hartford is no exception. The company's offerings are tailored to senior lifestyles, and both third-party and customer reviews state that AARP policies from The Hartford provide satisfactory service and claims-processing experiences.

In particular, AARP auto insurance from The Hartford includes extra accommodations for seniors such as its RecoverCare coverage.

AARP's special protections will cost drivers less than some major insurers, making the company well worth looking at for coverage.

Compare AARP to other top auto insurance companies | |

|---|---|

| |

| Read review |

| Read review |

| Read review |

| Read review |

The Hartford (AARP) auto insurance: Coverages, quotes and discounts

AARP auto insurance policies from The Hartford include standard coverages, several unique features geared toward elderly drivers and a few potential discounts.

AARP auto insurance quote comparison

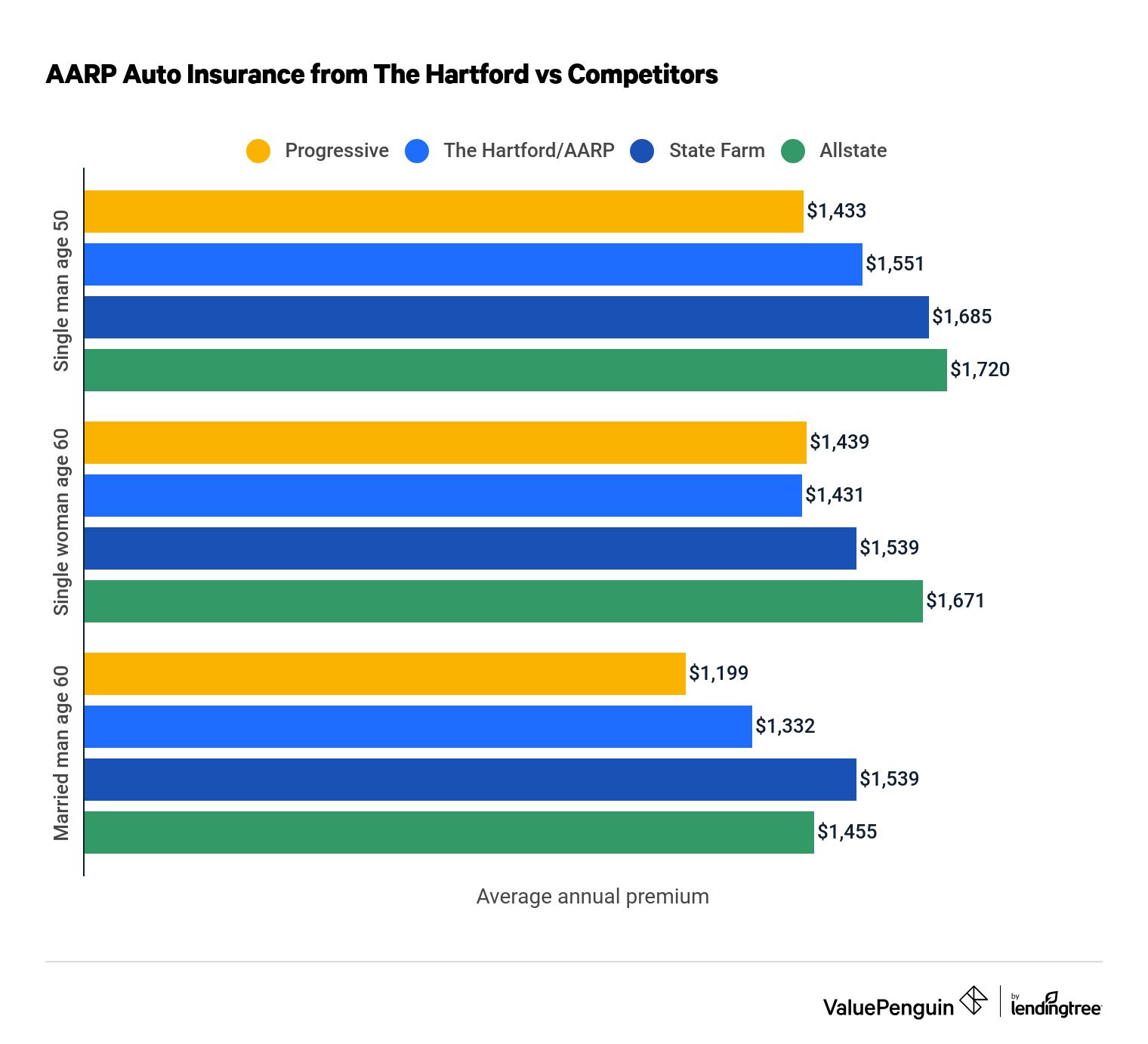

Quotes from AARP through The Hartford are cheaper than rates offered by Allstate and State Farm, which are some of the most popular auto insurance companies in the United States. Across three driver profiles, AARP was typically more expensive than Progressive, though cheaper than average, overall.

Find Cheap Auto Insurance Quotes in Your Area

AARP car insurance costs by driver profile vs. competitors

Insurer | Single man age 50 | Single woman age 60 | Married man age 60 |

|---|---|---|---|

| Progressive | $1,433 | $1,439 | $1,199 |

| The Hartford/AARP | $1,551 | $1,431 | $1,332 |

| State Farm | $1,685 | $1,539 | $1,539 |

| Allstate | $1,720 | $1,671 | $1,455 |

If you're 50 or older, we suggest giving The Hartford a strong look. A number of useful features, including RecoverCare, will benefit seniors.

Nevertheless, we always suggest getting multiple quotes to understand who is able to provide the cheapest rate in your area. Enter your ZIP code to among the top insurers in the United States, and click through to get a quote.

AARP coverage options

AARP car insurance from The Hartford provides all the typical car insurance coverages seen at large, national insurers, including liability, uninsured/underinsured motorist, personal injury protection and comprehensive and collision coverage.

Yet AARP's policies also has other standard policy features that may be attractive to senior drivers, especially RecoverCare, a benefit that considers the needs of older adults. After a car accident, daily chores or tasks can become even more difficult for seniors. RecoverCare helps lighten that burden by temporarily covering necessary home services after a covered accident. These include transportation, food preparation, cleaning, lawn mowing and dog walking.

While availability and benefit levels can vary by state, customers could get up to $2,500 covered for six months. This can offer a lot of peace of mind for seniors, caretakers and their families.

Other notable coverage options and features include:

New car replacement coverage

If you total a new car within the first 15 months after you buy it or within 15,000 miles, this protection helps replace it with a new vehicle of the same make and model.

Accident forgiveness

If all drivers on a policy have a clean driving record for five consecutive years, you qualify for accident forgiveness and won't see your rates increase after their first car accident.

Disappearing deductible

If you have a clean driving record, your collision deductible is reduced year after year with the potential to hit $0.

Some of these coverage options are available only in certain states. Be sure to check online or with an agent to confirm eligibility.

AARP auto insurance discounts

For the most part, AARP car insurance discounts through The Hartford are typical compared to the policies offered by major insurers in the United States. One unique feature AARP offers is its own defensive driving program, the AARP Smart Driver course. Drivers can take this class online within 60 days and may get rate discounts for 36 months.

While these discounts aren't remarkably unique overall, they will help you save on AARP/The Hartford's already below-average rates.

Discount type | Max discount amount |

|---|---|

| Airbag installation | 10%–20% |

| Anti-theft devices | 5%–15% |

| Anti-lock braking system | 5% |

| Hybrid vehicle | N/A |

| Multi-vehicle policy | 20% |

| Multi-policy credit | 7%–16% |

| New vehicle | N/A |

| Persistency credit | 2%–8% |

The specific discounts offered by AARP and The Hartford can vary depending on your driver profile, vehicle and location.

AARP auto insurance from The Hartford customer service and ratings

AARP customers can expect solid customer service from The Hartford. In both service experience and claims satisfaction, The Hartford has better-than-average customer reviews.

Indeed, in J.D. Power's 2021 U.S. Auto Claims Satisfaction Study, The Hartford was first among more than 19 insurance companies included in the study. Customers rated insurers for their claims servicing, first notice of loss, estimation process, repairs, rental experience and settlement.

According to the National Association of Insurance Commissioners, The Hartford, which provides AARP's coverage, has a Complaint Index of 1.70 for personal auto insurance, indicating a low degree of customer satisfaction with the service experience. The Complaint Index suggests that The Hartford gets 70% more complaints than expected for a company of its size.

Customers should also not worry about whether AARP and The Hartford will have enough money to pay out insurance claims. The Hartford has has an "A+" Financial Strength Rating from A.M. Best, which is among the highest possible ratings for an insurance company and shows solid financial stability.

About AARP Auto Insurance from The Hartford

The AARP, formerly the American Association of Retired Persons, offers a multitude of insurance products through its insurance partner, The Hartford Group. AARP's roots date back to 1958, when a former professor from California established the company as a nonprofit membership organization for people who are 50 and older. Today, there are nearly 38 million AARP members throughout the country.

The Hartford/AARP's customer service line is open from 8 a.m. – 9 p.m. EST on weekdays and 8 a.m. – 6 p.m. on weekends.

Phone number: 800-423-6789

To speak to a person: Press 0 for customer service.

Frequently asked questions

Is The Hartford/AARP a good car insurance company?

The Hartford is a good company for car insurance. It offers solid coverage options at a below-average price. Insurance from AARP is managed by The Hartford.

Is AARP car insurance cheap?

AARP insurance from The Hartford is cheaper than average. Quotes from AARP are cheaper than Allstate and State Farm but not Progressive for sample drivers.

Are AARP insurance and The Hartford insurance the same?

The Hartford is an insurance company that partners with AARP to sell car insurance to people over 50.

Who can buy car insurance from AARP?

Only people over 50 years old can buy insurance from The Hartford and AARP. AARP members will get a discount, but you don't need to be a member to buy a policy.

Methodology

ValuePenguin gathered thousands of quotes from every ZIP Code in California for three drivers: a 50-year-old single man, a 60-year-old single woman and a 60-year-old married man. Each driver owns a 2015 Honda Civic and has a clean driving record with the same coverage limits.

Coverage | Limits |

|---|---|

| Bodily injury liability | $50,000 per person/$100,000 per accident |

| Personal injury protection | $10,000 |

| Property damage liability | $25,000 per accident |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

Rate data was compiled using Quadrant Information Services. Rates should be used for comparative purposes only, and your own quotes may be different. They are sourced from public insurer filings.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.