Health Insurance

41% of Americans Have Donated to a Crowdfunding Campaign for Medical Bills, With Younger Generations Helping Lead Charge

Medical crowdfunding isn’t a new concept. Yet many of the primary ways people seek donations for these campaigns have changed over the years.

Years ago, it was common to see donation jars in local businesses seeking contributions for individuals who needed help raising funds for large medical expenses. Today, you’re more likely to come across a GoFundMe page or similar online campaign when someone needs financial assistance with medical bills.

The latest ValuePenguin survey addresses all things medical crowdfunding to find out what Americans think of the practice. No matter your feelings on crowdfunding for medical bills, one thing is certain — it’s effective. The vast majority of donors (85%) say the last crowdfunding campaign they contributed to reached its campaign goal.

On this page

Key findings

- Americans aren’t strangers to crowdfunding for medical bills. 41% of Americans say they’ve donated to a medical crowdfunding campaign, averaging $253 on their most recent contribution. Younger generations are more generous, as 48% of Gen Zers and 47% of millennials say they’ve donated to a crowdfunding campaign, averaging $306 and $339, respectively, the most recent time. When asked what urged them to donate most recently, more Americans said it was for someone with a life-threatening illness.

- While some may have mixed feelings about asking for donations, it’s effective. A third of Americans agree donating is the right thing to do to help, while 18% say they have medical expenses they don’t expect others to pay for. However, 85% of donors say the last crowdfunding campaign they contributed to reached the goal, and 61% of donors have given money to someone they didn’t know personally.

- Some worry about the legitimacy of these campaigns. 19% aren’t confident in the authenticity of medical bill crowdfunding, including 30% of baby boomers and 23% of Gen Xers. In fact, 14% of Americans say they’ve been scammed by someone seeking donations for medical care, including 30% of Gen Zers and 20% of millennials, who were also most likely to donate. This may contribute to why 42% of Americans call for more regulations governing medical crowdfunding.

- When asked why they crowdfunded, most pointed to medical costs not covered by insurance. Among the 18% of Americans who’ve crowdfunded themselves, 34% say insurance wouldn’t have covered their expenses and 43% say the out-of-pocket expenses were too high. Roughly three-quarters (74%) of those who solicited crowdfunding said they met their goal. Overall, when asked if they think crowdfunding is more accessible for people facing medical emergencies than traditional financial assistance, 43% of Americans agreed.

2 in 5 Americans have donated to a medical crowdfunding campaign — here’s what they gave most recently

Many Americans — 41% to be precise — say they’ve donated money to a medical crowdfunding campaign. A fifth (20%) of respondents say they’ve given money to a single medical crowdfunding campaign, while nearly the same percentage — 21% — say they’ve donated money to support multiple causes.

Among those who donated, there were various motivations. Below are some of the top reasons donors were inspired to give money to medical crowdfunding campaigns:

- Relationship to the person seeking donations (37%)

- Moved by the story of the crowdfunder (20%)

- Familiarity with the medical condition (15%)

- Made the donor feel good to contribute (13%)

- Believed their donation could make a difference (11%)

The average donor gave $253 to assist others with medical bills in their most recent crowdfunding campaign contribution. However, average donation amounts among men ($286) and women ($213) varied. It’s also worth noting that people with children younger than 18 ($334) or older children ($201) donated more, on average, than those without children ($194).

Medical crowdfunding campaigns can be used to raise money for various causes. Donors noted that some of the primary reasons the fundraisers they contributed to were launched included someone seeking financial help for a life-threatening illness (38%), ongoing medical expenses (34%), everyday expenses (13%) or gender-affirming surgery (10%).

Of course, a medical crowdfunding campaign must also do a good job of getting the word out to potential contributors to be successful. When thinking back to the most recent crowdfunding campaign they saw, respondents said they heard about it through the following methods:

- Social media (43%)

- Word of mouth (9%)

- Family or friends (9%)

- Local news station (7%)

- Article or story (5%)

- Other (3%)

- Church or community organization (3%)

Meanwhile, 22% say they’ve never seen a crowdfunding campaign.

Crowdfunding can be effective, even if people have mixed feelings

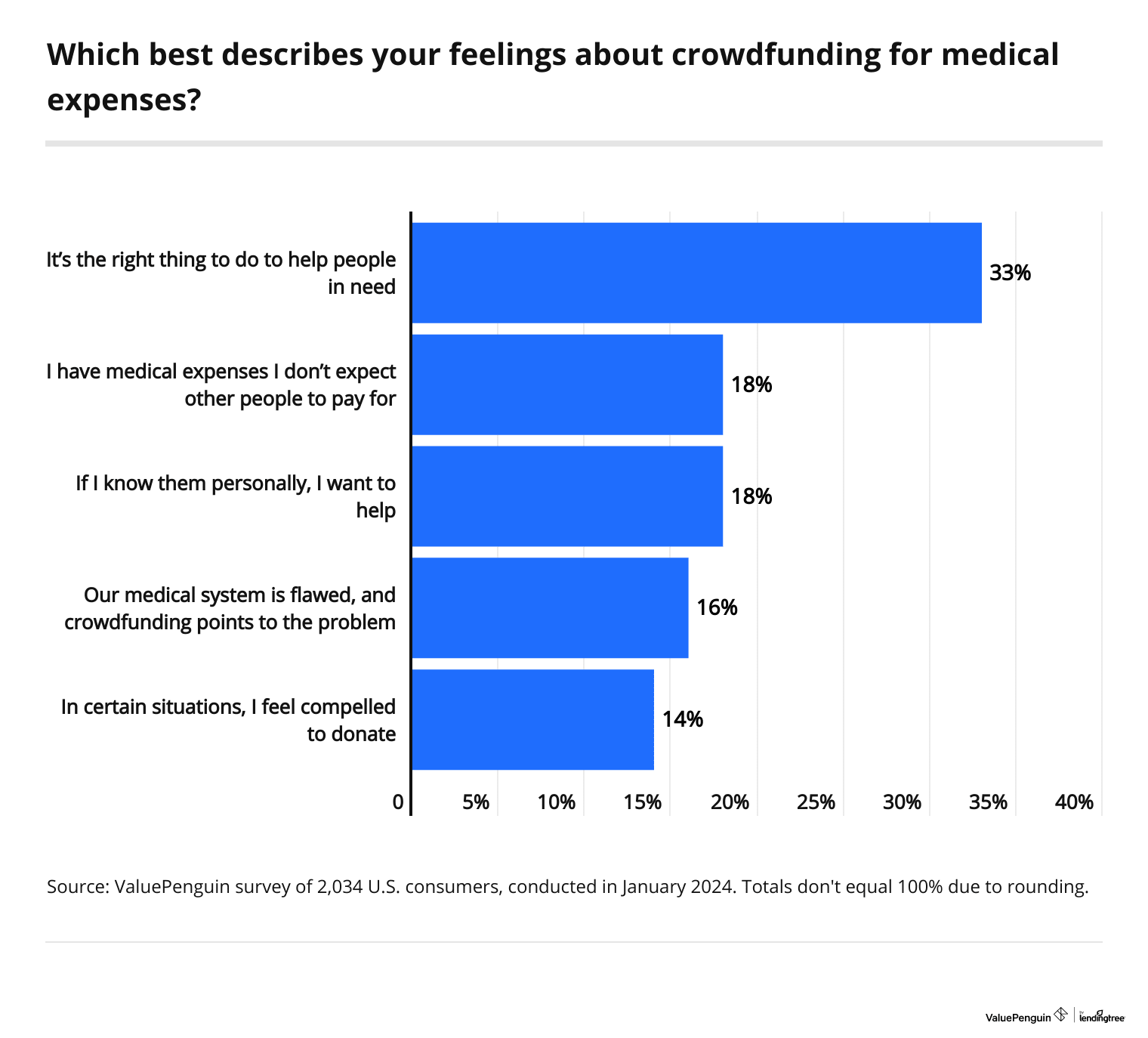

People have mixed feelings about whether crowdfunding campaigns are an appropriate way to pay for medical expenses. Although 33% of Americans believe contributing to one is the right thing to do when someone is in need, 18% say they have their own medical expenses and don’t expect others to pay for them.

Below is a deeper look at how Americans feel about crowdfunding for medical expenses:

No matter your personal feelings on medical crowdfunding, the campaigns have shown to be effective. When looking back at the most recent crowdfunding campaign to which they donated, 85% of respondents said the person collecting met their goal.

It’s also worth pointing out that those who donate aren’t just giving money to people they know personally. The majority of donors (61%) who’ve given money to a medical crowdfunding campaign have contributed to someone with whom they had no personal connection.

Baby boomers not confident about campaigns’ reliability

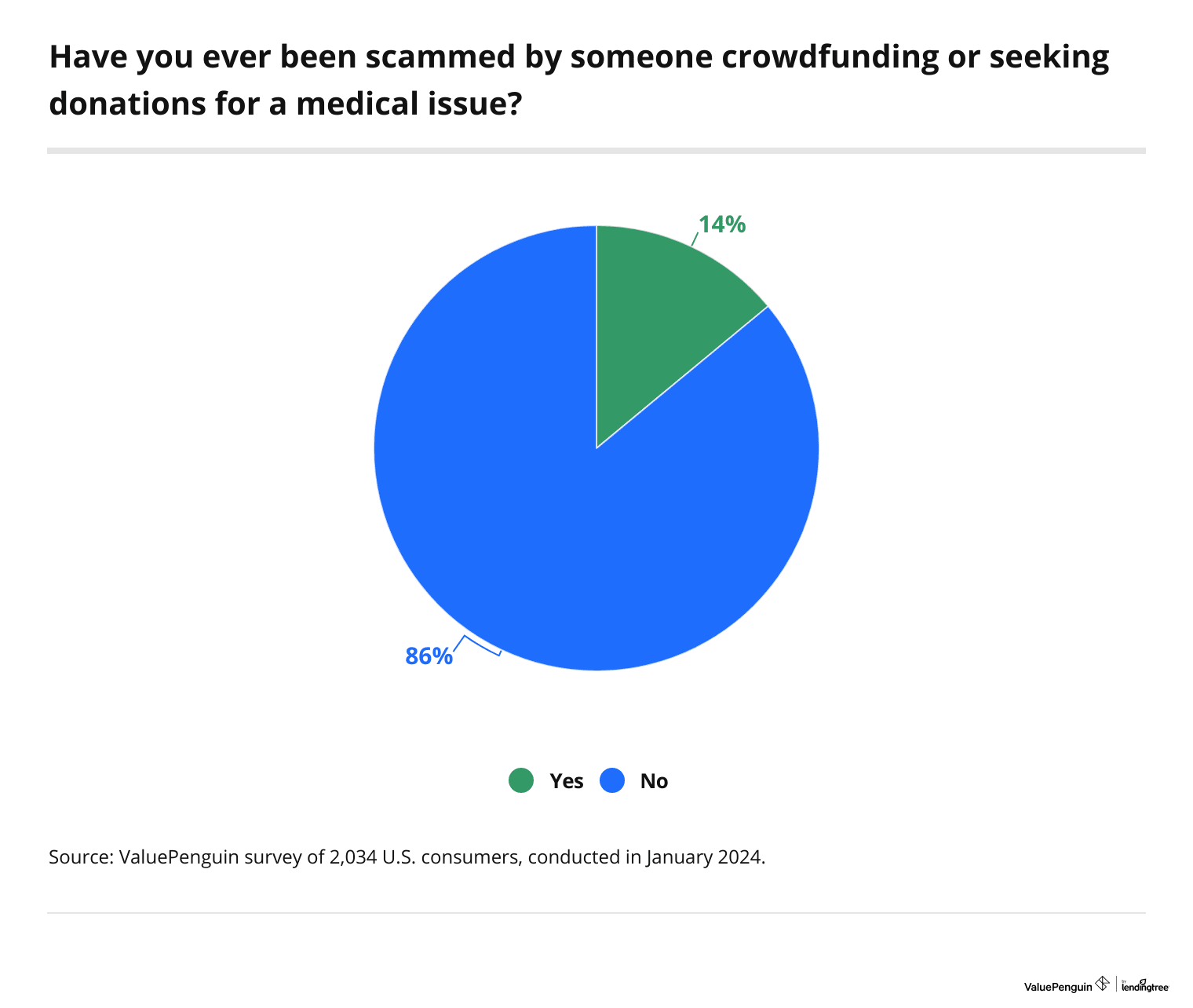

Despite many feeling compelled to donate money to others in need, there are concerns about the legitimacy of some medical crowdfunding campaigns. Overall, 19% of respondents worry some fundraisers may not be reliable.

Baby boomers ages 60 to 78 are especially concerned about the authenticity of medical bill crowdfunding, with 30% expressing doubts regarding the legitimacy of campaigns. Meanwhile, 23% of Gen Xers ages 44 to 59, 12% of millennials ages 28 to 43 and 12% of Gen Zers ages 18 to 27 express similar concerns.

Unfortunately, there are reasons potential donors should exercise caution. Not everyone who seeks donations for medical crowdfunding campaigns is honest. About 1 in 7 (14%) Americans say they’ve been scammed by someone seeking donations for medical expenses.

This potential for abuse is perhaps why many Americans believe there should be more government oversight regarding medical crowdfunding. Four in 10 (42%) respondents would welcome additional government regulation.

Why people crowdfund themselves

Nearly 1 in 5 (18%) Americans have turned to crowdfunding at least once in their lives to help cover the cost of medical expenses. At 24%, men are more likely to seek donations through a crowdfunding campaign than women (13%).

It’s also worth noting that medical crowdfunding is more common among younger generations. Only 5% of baby boomers have ever crowdfunded for their own medical bills. By comparison, 34% of Gen Zers and 28% of millennials say they’ve done so.

Those who asked for donations say they did so because they needed money to pay for various medical (or medical-related) expenses, including:

- A major lifesaving surgery (28%)

- Another type of surgery (22%)

- Everyday living expenses made difficult to manage due to medical issues (16%)

- Ongoing medical treatment, like chemotherapy (14%)

- Gender-affirming surgery (9%)

- Other (8%)

- Cosmetic surgery, like fixing broken teeth (4%)

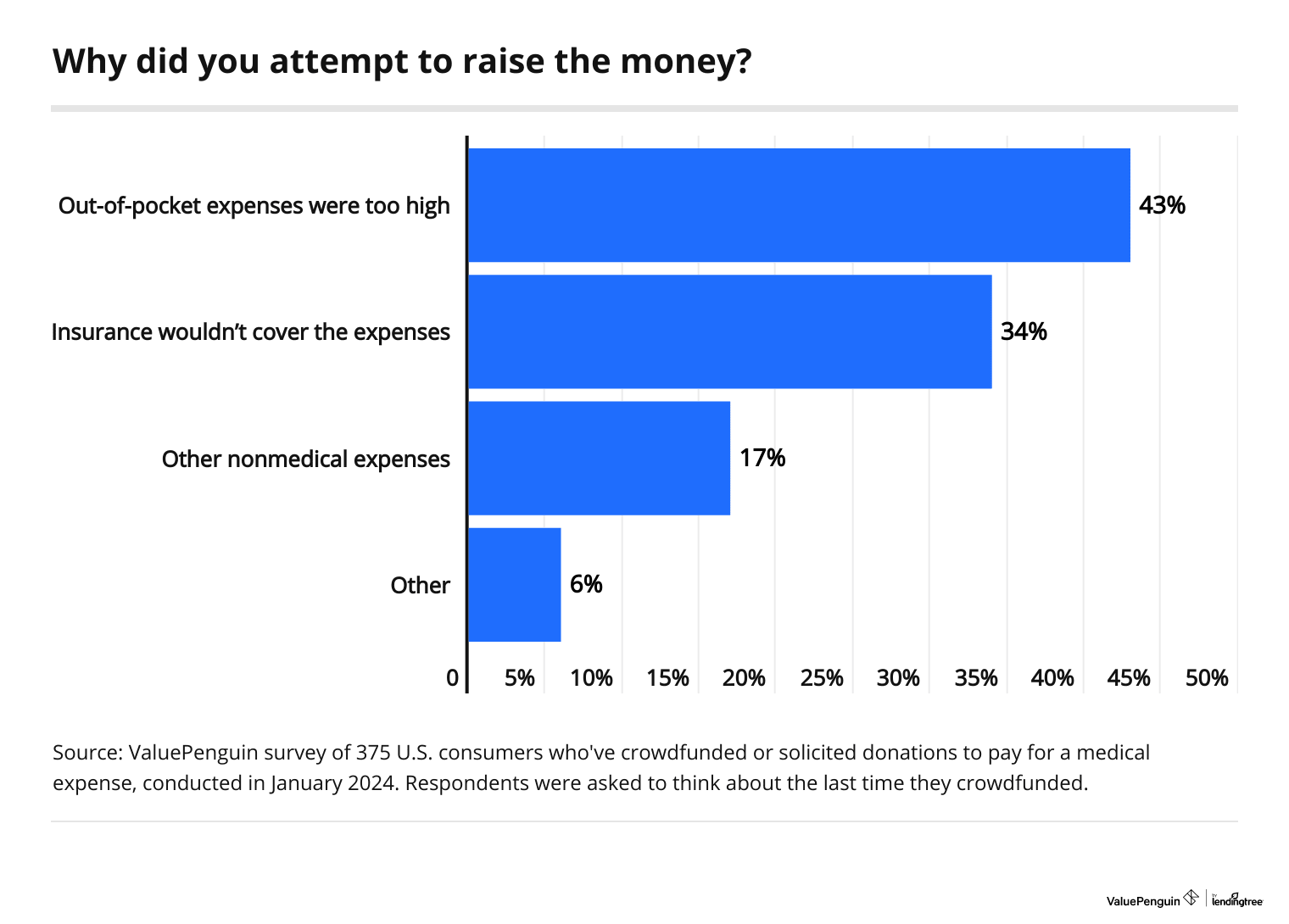

Among people who crowdfunded for medical expenses, many had health insurance coverage. Yet despite the costs of health insurance, the coverage wasn’t always sufficient to pay for what people needed.

Four in 10 (43%) who crowdfunded did so because out-of-pocket expenses were too high to cover alone. And 34% say insurance wouldn’t cover the cost of their medical expenses. Below is a look at other reasons why people felt the need to turn to medical crowdfunding to raise money:

On a positive note, people who used fundraisers to help make ends meet were largely successful in their efforts. About three-fourths (74%) of crowdfunders say they met their fundraising goals. Further, 43% of Americans believe crowdfunding to be a more accessible option than traditional financing for people facing medical emergencies.

4 tips for overcoming financial hurdles brought on by medical bills

Medical bills and the extra expenses that accompany them often create financial burdens that can be difficult to overcome. The tips below may be helpful if you’re looking for ways to cover these costs.

1. Review your insurance coverage

"It’s generally not a good idea to set and forget your health insurance coverage," says Divya Sangameshwar, ValuePenguin health insurance expert. Your premiums may adjust annually. Further, your coverage may also change — medications, doctors and hospitals allowable on your former plan might not be included anymore.

"Reviewing your current plan and making sure you’re protected in the year ahead should become an annual routine when open enrollment comes around," Sangameshwar says.

2. Invest in a health savings account (HSA)

Another strategy to consider, before medical expenses arise, is the idea of enrolling in a health savings account (HSA). This special type of account can help you reduce your taxable income and save money for health care expenses at the same time.

"Enrolling in an HSA and contributing pretax or tax-deductible dollars will give you a solid nest egg to pay for qualified medical expenses — both now and in the future," Sangameshwar says. "An HSA will come in handy to pay for your deductible or out-of-pocket expenses your insurer won’t cover."

3. Negotiate expenses

It’s wise to get your insurance coverage and an HSA before medical bills arise. But that doesn’t mean you can’t try to negotiate with medical providers after the fact.

Once you receive a bill from a doctor or hospital, it’s a good idea to go through the statement line by line and look at each charge. If anything looks too high or incorrect, you should bring it to the attention of the billing department. And you may be able to ask for discounts in other situations, such as if you’re paying cash or experiencing a financial hardship.

"Be persistent in following up with customer service representatives to get an explanation for charges or to negotiate amounts down to more reasonable levels," Sangameshwar says. "If you have a medical bill in collections, you can try to negotiate down the amount of money you owe. Debt collectors generally buy debts for pennies on the dollar, and that gives you leverage to negotiate to pay less than owed."

4. Consider a crowdfunding campaign

In addition to the steps above, you also could consider starting a medical crowdfunding campaign to raise additional cash for your situation. Of course, not every crowdfunding campaign is a success. If you choose to try this approach, it’s wise to research the best ways to structure your campaign before you launch it.

Many people who donated to a medical crowdfunding campaign did so because they felt moved by the recipient’s story (20%). Therefore, sharing your experience in a compelling way could improve your chances of a successful outcome.

Photos or videos can be effective tools for sharing your story. And frequent updates may help keep donors informed as well.

Methodology

ValuePenguin commissioned QuestionPro to conduct an online survey of 2,034 U.S. consumers ages 18 to 78 from Jan. 17 to 19, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78