Best Cheap Health Insurance in Wyoming (2026)

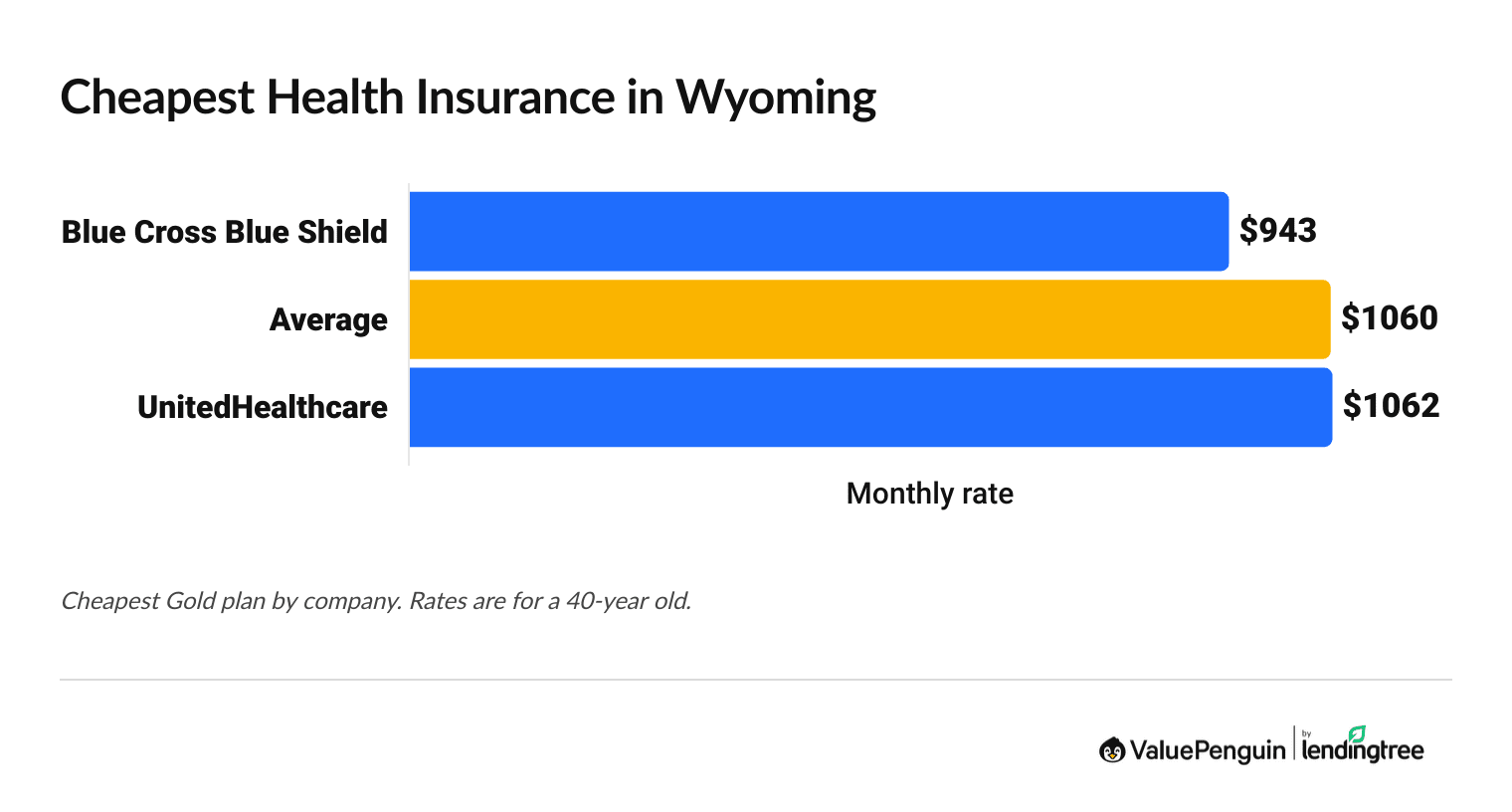

Blue Cross Blue Shield (BCBS) has the best and cheapest health insurance in Wyoming. Gold plans from BCBS start at $943 per month before discounts.

Find Cheap Health Insurance Quotes in Wyoming

Best and cheapest health insurance in Wyoming

Cheapest health insurance companies in Wyoming

Blue Cross Blue Shield sells the cheapest health insurance plans in Wyoming, followed by UnitedHealthcare, with Gold rates as low as $943 per month before discounts.

Find Cheap Health Insurance Quotes in Wyoming

Affordable health insurance in Wyoming

Company |

Cost

| |

|---|---|---|

| Blue Cross Blue Shield | $943-$1,050 | |

| UnitedHealthcare | $1,062-$1,199 | |

- Blue Cross Blue Shield sells the cheapest Gold plans, no matter where you live in Wyoming, with rates starting at $943 per month. It's also the best health insurance company in Wyoming.

- Gold plans are generally cheaper than Silver plans in Wyoming. Gold plans in the Cowboy State cost $59 less than Silver plans on average. They also cover more of your medical bills, making them the best option for most people in WY.

- UnitedHealthcare has a lower average out-of-pocket maximum, but its high monthly rates mean that it’s still cheaper on average to get a BCBS plan.

Best health insurance companies in Wyoming

Blue Cross Blue Shield (BCBS) sells the best health insurance plans in Wyoming.

Blue Cross Blue Shield gets a good 4-star rating from HealthCare.gov for plan administration, despite having a low 2-star rating overall. This means that Blue Cross Blue Shield tends to have good customer service. Additionally, the company gets fewer complaints than expected. Picking a company with good service might make things easier if you have questions or problems with your plan.

Best-rated health insurance companies in Wyoming

Company |

ACA rating

|

VP rating

|

|---|---|---|

| Blue Cross Blue Shield of Wyoming | ||

| UnitedHealthcare | N/A |

You can use a BCBS plan at most doctor offices and hospitals. This makes it easier to get medical care, especially in rural areas. Plus, Blue Cross Blue Shield has the cheapest rates for Gold plans in Wyoming.

Only two health insurance companies sell plans on HealthCare.gov in Wyoming. Although a smaller number of companies means fewer plan choices, it can also make it easier to compare all the options and choose the right company and plan for you.

Blue Cross Blue Shield earned relatively low overall scores from HealthCare.gov. It has a rating of 2 out of 5 stars. And UnitedHealthcare doesn't yet have a rating in Wyoming.

However, both companies have fewer complaints than expected for their size, according to the National Association of Insurance Commissioners. To pick the best company for you, it could be helpful to talk to current customers about their experiences.

How much does health insurance cost in Wyoming?

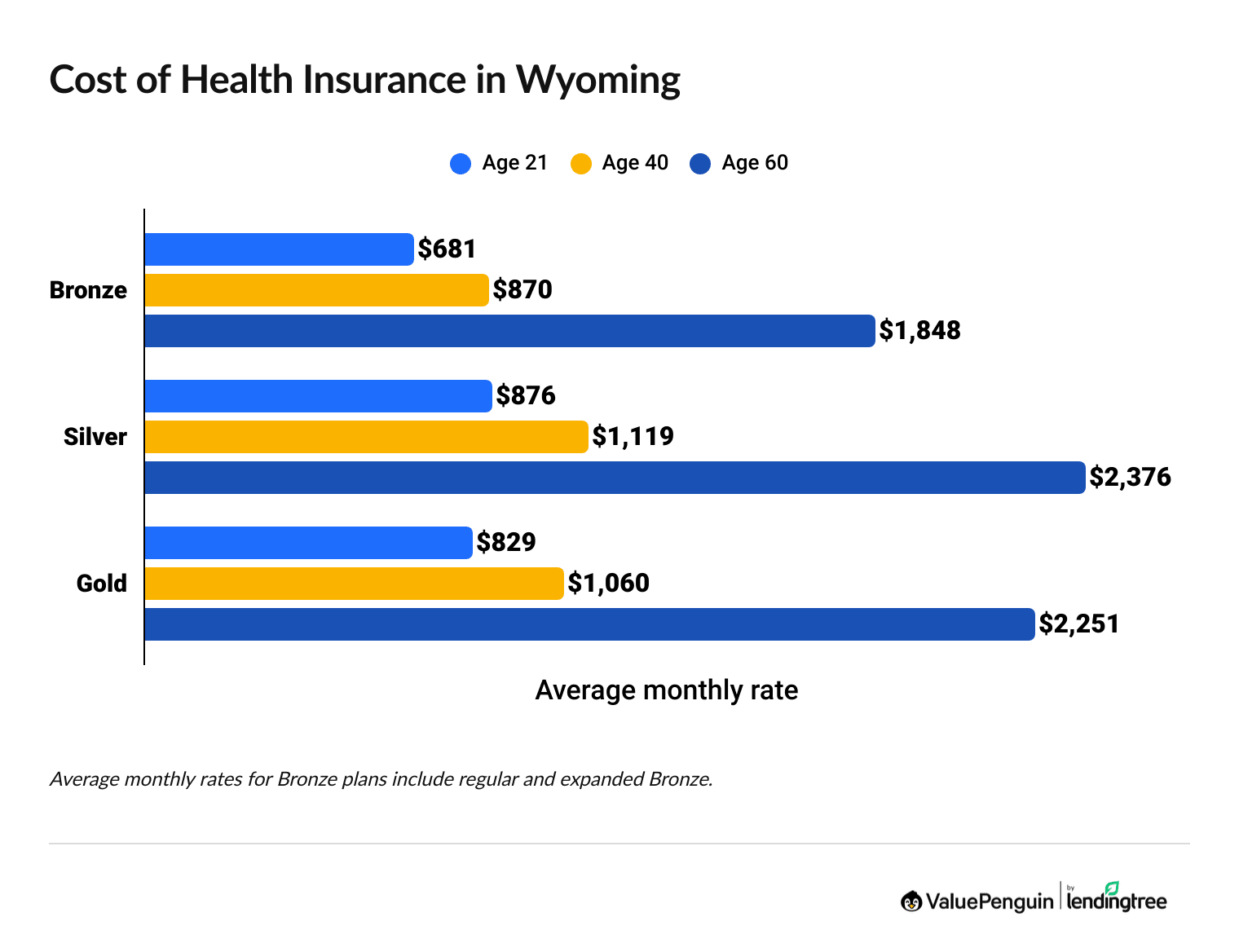

A Silver health insurance plan in Wyoming costs an average of $1,119 per month, but you may be able to get discounts based on your income, lowering your average cost to around $378 per month.

Find Cheap Health Insurance Quotes in Wyoming

- Gold plans are cheaper, on average, than Silver plans in Wyoming. Because they have more coverage than Silver plans and are $59 a month cheaper, Gold plans are the most common plan tier in Wyoming.

- Your rate will change based on your age, how many people you insure on your plan, where you live in Wyoming, what company you pick, and whether you smoke or use tobacco.

A UnitedHealthcare plan isn’t good for most people

For a UHC Gold plan, you’ll pay about $120 to $150 more each month, on average. This is so pricey that any savings you’d get from a smaller average deductible or a lower out-of-pocket maximum wouldn’t matter: You’d end up paying more overall.

A UHC plan might be good only if the doctors you want aren’t in network for BCBS. However, BCBS has the largest doctor network in the country.

Health insurance discount changes in Wyoming for 2026

You could pay about $378 per month, for health insurance in Wyoming if you qualify for discounts based on your income.

For people who can get subsidies, rates could rise from about $182 in 2025 to $378 in 2026. That's because the bigger discounts called "expanded subsidies" aren’t likely to be renewed for 2026.

While you may still be able to pay less than full price for health insurance based on your income, you’ll very likely pay more than last year.

Health insurance rates in Wyoming after subsidies (2025 vs. 2026)

Income | 2025 rate | 2026 rate | Difference |

|---|---|---|---|

$30,000 | $49 | $155 | 216% |

| $40,000 | $154 | $287 | 86% |

| $50,000 | $283 | $415 | 47% |

| $60,000 | $423 | $498 | 18% |

| $70,000 | $496 | $1,090 | 120% |

Average cost after subsidies for a single 40-year-old with a Benchmark Silver plan.

- How can you get subsidies? You have to make between $15,650 and $62,600 as a single person or between $32,150 and $128,600 as a family of four. Subsidies are meant to help people who have too much income to qualify for Medicaid be able to afford health insurance.

- How do subsidies work? You can use subsidies to get a cheaper Bronze, Silver or Gold plan from any health insurance company in Wyoming. But you have to buy a plan on HealthCare.gov to get subsidies. If you get a plan directly from an insurance company, you won't be able to get the discount.

- How much do you save? ValuePenguin's subsidy calculator can help you see how much a subsidy will lower your health insurance rate.

Cheap Wyoming health insurance plans by city

Blue Cross Blue Shield has the cheapest health insurance in Cheyenne.

In fact, no matter where you live in Wyoming, Blue Cross Blue Shield sells the cheapest Gold, Silver and Bronze health plans.

But just because a plan is cheap doesn't mean it's the best plan for you. Review all your options and pick the plan that most closely matches your monthly budget and your medical needs.

Cheapest health insurance plans by WY county

County | Cheapest plan | Monthly rates |

|---|---|---|

| Albany | BCBS BlueSelect Gold Core | $1,013 |

| Big Horn | BCBS BlueSelect Gold Core | $1,013 |

| Campbell | BCBS BlueSelect Gold Core | $1,013 |

| Carbon | BCBS BlueSelect Gold Core | $1,013 |

| Converse | BCBS BlueSelect Gold Core | $1,013 |

Cheapest Gold plan with rates for a 40-year-old

Find Cheap Health Insurance Quotes in Wyoming

Best health insurance by level of coverage

The best health insurance plan for you is one that fits into your budget and gives you medical coverage that matches your needs.

A good guideline is to buy a higher-tier plan, like Gold, if you have more expensive or complex medical needs because these plans pay for more of your health care bills. And in Wyoming, Gold plans are a good option because they have lower rates than Silver plans.

Gold plans: Best for most people

| Gold plans pay for about 80% of your medical care. |

Gold plans cost an average of $1,060 per month in Wyoming.

Gold plans pay for the largest portion of your medical bills. In Wyoming, they're cheaper than Silver plans, which is uncommon, and they give you more coverage. Gold is the most popular plan level in Wyoming and the best option for most people.

In other states, Gold plans are usually a good idea if you have a chronic or complex medical condition, need expensive treatment or take prescription medications.

Silver plans: Best if you have a low income

| Silver plans pay for about 70% of your medical care. |

Silver plans cost $1,119 per month, on average, in Wyoming.

Silver plans give you less coverage than a Gold plan. In Wyoming, they're more expensive than Gold plans, which means they're not the best option for most people.

But if you have a low income, Silver plans can be a good option. That's because you might get an extra discount that lets you pay less when you go to the doctor. This discount can make your Silver plan even better than a Gold plan and cheaper overall.

Bronze plans: Best for young, generally healthy people

| Bronze plans pay for about 60% of your medical care. |

In Wyoming, Bronze plans cost $870 per month, on average.

Bronze plans have the cheapest monthly rates, but you have to pay a larger share of your medical bills. If you're young and healthy, these plans can be a good choice. Just make sure you have the money in the bank to pay the high out-of-pocket maximum if you need medical care.

Blue Cross Blue Shield sells what are called PPO plans. These plans typically cost more than other plan types, but in Wyoming, they’re slightly cheaper. With a PPO, you have more control over your medical care. You can see any doctor you want and still have some coverage, although you'll pay less when you see a doctor who's in the network. You also don't need a referral to see a specialist with a PPO, which can make it faster to get medical care.

You can get a PPO with a Bronze, Silver or Gold plan in Wyoming.

Cheap or free health insurance in Wyoming if you have a low income

Medicaid is a good option for coverage if you can't afford to buy a plan. And if you can't get Medicaid, a Silver plan can be a good idea. You might be able to get a few discounts that make your rate and medical bills cheaper.

Medicaid in Wyoming

Medicaid is a good option for low-cost or free health insurance if you have a low income.

But it's difficult to get Medicaid in Wyoming because the state hasn't expanded its program like most other states. You only qualify if you meet the income requirements and fit into another category. For example, adults who have a low income but don't have any other qualifications can't get Medicaid.

Wyoming has Medicaid programs for several groups.

- Children

- Pregnant women

- People who are blind

- People with disabilities

- Seniors

- Parent or caretaker of a child

- Immigrants

- People who get Supplemental Security Income

- People with breast or cervical cancer

- People with tuberculosis

The income limits vary depending on why you qualify for Medicaid. For example, a person with breast or cervical cancer can qualify for Medicaid if they earn less than $3,260 per month. But a single pregnant person can only qualify for Medicaid if they make less than about $2,009 per month.

Use cost-sharing reductions for cheaper medical care

If you can't get Medicaid, a Silver plan can be a good option. Silver plans have an extra discount for people with low incomes. They're called cost-sharing reductions, and they let you spend less when you go to the doctor. If you qualify, your Silver plan might even pay for more of your medical bills than a Gold plan.

You must make between $15,650 and $39,125 as an individual, $21,150 and $52,875 as a couple or $32,150 and $80,375 as a family of four to qualify for this type of discount.

Even though Silver plans are the most expensive plan tier in Wyoming, you can use subsidies to lower your monthly rate.

Are health insurance rates going up in WY in 2026?

In 2026, health insurance in Wyoming costs 26% more, on average, than in 2025.

Silver and Bronze plans went up by about 25% for 2026. Gold plans, the most popular level of health plan in the state, went up the most: 27%. Over five years, the cost for a Gold plan has increased by 63%.

Bronze

Silver

Gold

Year | Cost | Change |

|---|---|---|

| 2022 | $413 | – |

| 2023 | $622 | 51% |

| 2024 | $631 | 1% |

| 2025 | $695 | 10% |

| 2026 | $870 | 25% |

Monthly costs are for a 40-year-old. Expanded Bronze plans are included in 2024, 2025 and 2026 averages, when they're offered.

Why is health insurance expensive in WY in 2026?

Higher health care costs are the main reason why health insurance rates are higher in 2026.

When health care gets more expensive, medical insurance companies pay more every time you go to the doctor or get a prescription. The extra costs add up when they're multiplied over hundreds of thousands or even millions of customers. To make up for it, companies raise rates for everyone. In Wyoming, health insurance companies are raising rates by about 26% on average.

That means they cost health insurance companies a lot of money. Rates go up for everyone to balance out the cost of these medications.

Health insurance rates are higher in 2026 because insurance discounts are changing. Since 2021, people with low incomes have benefited from bigger discounts called "enhanced subsidies." However, Congress hasn’t renewed them. That means the discounts in 2026 are smaller, which translates to higher rates.

What to do if your rate goes up in 2026

- Get quotes and shop around. Each medical insurance company has different rates, so getting quotes can help you find a cheaper plan. Before you commit to a plan, though, make sure your doctors are in the network.

- Consider a lower-tier plan. Dropping to a lower-tier plan, like Bronze, can help you get a cheaper rate each month. However, you do have to pay more when you go to the doctor, so make sure you have the savings to afford medical care if something serious happens.

- Open an HSA. In 2026, you can open a health savings account (HSA) with a Bronze plan because Bronze plans are now considered high-deductible health plans. HSAs let you set aside pretax money to use for medical care.

- See if you get discounts. Even though the discounts in 2026 might not be as big as they have been for the last five years, you should still check to see if you qualify. If you can get discounts, they're an easy way to save.

- Check if you can get Medicaid. It's hard to get Medicaid in Wyoming. But if you have a low income, it's worth it to check to see if you qualify. If you can get Medicaid, most of your medical care will likely be free or very cheap.

In Wyoming, you can buy an Affordable Care Act (ACA) plan, sometimes called an "Obamacare" plan, on HealthCare.gov between Nov. 1 and Jan. 15.

No matter what plan tier you buy, your plan has to cover at least 10 health situations.

- Doctor visits

- Prescription medicines

- Emergency services

- Laboratory services

- Hospital stays

- Pregnancy and newborn care

- Mental health care

- Rehab services and devices

- Wellness and chronic disease care

- Pediatric services

The difference in the plans is how much of your bills are covered. For example, both a Bronze plan and a Gold plan will pay for you to go to the emergency room. But a Bronze plan might only pay for about 60% of the bill, while a Gold plan might pay for about 80%.

Average cost of health insurance by family size in Wyoming

A family of four pays an average of $3,389 per month for a Gold plan in Wyoming, assuming the children are both under age 15. Children under 15 are charged a flat rate of about $634 per month. Age doesn't start to affect rates until a child turns 15. After that, their medical insurance rate will be higher each year.

Family size | Average monthly cost |

|---|---|

| Individual | $1,060 |

| Individual and child | $1,694 |

| Couple | $2,120 |

| Family of three | $2,754 |

| Family of four | $3,389 |

Averages based on a Gold plan for 40-year-old adults and children who are under age 15.

Short-term health insurance in Wyoming

Wyoming currently follows a Biden-era rule that caps short-term health policies at four months total in a 12-month period, including renewals. In January, the Trump administration rolled back this rule, so Wyoming may change how long short-term policies last in the future. Other states allow short-term health insurance to last up to 364 days at a time.

A short-term health insurance plan can be a good idea if you only need coverage for a short time period, like between jobs. But you can usually get better coverage with a plan from HealthCare.gov.

Pros of short-term health insurance in Wyoming

Cons of short-term health insurance in Wyoming

Health insurance enrollment by income level in Wyoming

People with low incomes are the most affected by the changes in health insurance discounts.

The expanded health care subsidies were made to help people with smaller incomes afford insurance. In Wyoming in 2025, over half of people with a marketplace plan made less than $37,651 in a year. Without those expanded discounts, health insurance rates may be unaffordable to some in the Cowboy State.

Enrollment by income

Income | % of total enrollment |

|---|---|

| Less than $15,060 | 1% |

| $15,060 to $20,783 | 15% |

| $20,784 to $22,590 | 5% |

| $22,591 to $30,120 | 16% |

| $30,121 to $37,650 | 17% |

Enrollment in 2025 marketplace plans made during the 2024-2025 open enrollment period. Total may not be 100% due to rounding.

Frequently asked questions

Does Wyoming have Blue Cross Blue Shield?

Yes, Wyoming does have a Blue Cross Blue Shield company. Blue Cross Blue Shield of Wyoming sells the cheapest Gold plans in the state. It's also the best health insurance company in Wyoming because of its good customer service and large network of doctors.

What is the average cost of health insurance in Wyoming?

A Gold plan costs an average of $1,060 per month for a 40-year-old in Wyoming. Typically, Silver plans are a good tier to use for average rates, but in Wyoming, Gold plans are cheaper. A Silver plan costs $1,119 per month on average, which is $59 more than a Gold plan.

Is health insurance mandatory in Wyoming?

Health insurance is technically required in Wyoming because it's required nationally. But you won't pay a fee anymore if you don't have a policy. Only a few states have fees for not having health insurance, and Wyoming isn't one of them.

Is $200 a month a lot for health insurance in WY?

No, $200 per month is cheap for Wyoming health insurance. You could get a plan for $200 or less if you have a low income and you get discounts called subsidies. Otherwise, health insurance costs an average of $829 per month for a 21-year-old with a Gold plan. A 40-year-old pays an average of $1,060 per month for the same coverage. In Wyoming, Gold plans are cheaper than Silver plans, on average.

Methodology

Wyoming health insurance rate data for 2026 is from the Centers for Medicare & Medicaid Services (CMS) website. ValuePenguin used the CMS public use files to find average rates for different plan tiers, geographic locations and family sizes.

Rates

Rates are based on a 40-year-old with a Gold plan, unless otherwise noted. Rates for Bronze plans include regular and Expanded Bronze plans for 2024, 2025 and 2026, when the plans are available. Your costs and plan options will vary; plans aren't always available in all parts of a state or county.

Subsidies

Rates after subsidies are estimates for a 40-year-old with a Benchmark Silver plan and are based on how subsidies were structured before 2021. Prices are calculated using KFF's rates for full-price Benchmark plans, federal poverty levels (FPLs), IRS rules about premium tax credits and Congressional reports about expanded tax credits. The total cost in the state uses rates calculated by income, which are weighted using CMS data on the incomes of those who purchased plans during 2024-2025 open enrollment. The median was used for each income range. Unknown incomes were excluded from the calculations. Incomes of 100% of the federal poverty line and 500% of the federal poverty line were assumed for enrollees who earn less than 100% FPL and more than 500% FPL, respectively. Information about state subsidies, when available, was sourced from state marketplaces.

Ratings

ValuePenguin's experts rank companies based on cost, coverage options, customer satisfaction and unique value. Ratings are out of 100 possible points. ACA ratings show how the company performs in Wyoming for medical care, member experience and plan administration. The 2026 plan quality data from CMS is based on data from the previous year. Ratings are not available for new plans or plans with low enrollment.

More sources

Enrollment trends, including plan selections by tier and enrollment by income, are from CMS data for the 2024-2025 open enrollment period. Info about the most popular plan level in Wyoming is from KFF. Other sources include the National Association of Insurance Commissioners (NAIC) and S&P Global Capital IQ.

About the Author

Senior Writer

Jenn Jones is a Senior Writer at LendingTree where she covers auto, home, renters and motorcycle insurance topics.

Previously an editor for USA TODAY Blueprint and a finance manager at World Car dealerships, she has more than a decade of experience in the world of personal finance and a deep interest in sharing knowledge that empowers others. She’s also served as a freelance translator, copy editor, writer and researcher. She graduated from the University of Virginia with a B.S. in commerce and a B.A. in Chinese language and literature.

How insurance helped Jenn

Jenn first came to appreciate pet insurance when annual checkups for her cat and dog totaled more than $700.

Expertise

- Auto insurance

- Renters insurance

- Condo insurance

- Home insurance

Referenced by

- USA TODAY

- MSN

- F&I Magazine

- Automotive News

Education

- BS, Commerce, University of Virginia

- BA, Chinese Language and Literature, University of Virginia

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.